Is it time to say goodbye to your Nidhi Company? Closing a Nidhi Company is a significant decision that involves several essential steps. The decision to close a Nidhi company, a unique form of non-banking financial institution in India, is never taken lightly. Various factors, such as financial instability, lack of profitability, non-compliance, or changing market dynamics, may prompt the need for closure. However, regardless of the reasons, the process of closing a Nidhi company must be carried out with meticulous attention to legal and regulatory requirements. In this article, we will discuss the closing of Nidhi Company.

| Table of Contents |

What do you mean by Nidhi Company?

A Nidhi company is a specific type of non-banking financial company (NBFC) that operates as a mutual benefit society. The term “Nidhi” is derived from the Sanskrit word for “treasure” or “fund,” and these companies are primarily established to promote the habit of thrift and savings among their members. Nidhi companies are unique to India and are governed by the Ministry of Corporate Affairs (MCA) and the Nidhi Rules, 2014.

The primary objective of Nidhi companies is to inculcate the habit of saving and provide access to credit facilities to their members, especially those belonging to the lower and middle-income groups.

Features of Nidhi Company

The features of Nidhi Company are as follows-

- Membership: Nidhi companies only accept members who are individuals and not entities. Each member must contribute a nominal share of the capital as part of their membership.

- Minimum members and capital: A Nidhi Company must have at least 200 members within one year of its incorporation. Additionally, it should maintain a minimum net-owned fund (NOF) of Rs. 10 lakhs or higher, as prescribed by the MCA.

- Limited activities: Nidhi companies do not engage in any activity other than borrowing and lending to its members. They cannot conduct chit-fund, leasing, hire-purchase, or insurance-related transactions.

- Fund utilization: Nidhi companies primarily raise funds through fixed and recurring deposits from their members. These funds are then utilized to offer various financial services to the members, including loans and advances.

Reasons for Closure of Nidhi Company

The reasons for the Nidhi Company strike-off are as follows-

- Non-Compliance: Non-compliance with the regulations and guidelines set forth by the Ministry of Corporate Affairs (MCA) can lead to legal issues and penalties. If a Nidhi company repeatedly fails to comply with the regulatory requirements, it may face closure.

- Lack of Profitability: If a Nidhi company faces consistent losses and is unable to generate sufficient revenue to cover its expenses, it may decide to close down voluntarily.

- Changing Business Environment: Changes in the economic or business environment, such as shifts in customer preferences or technological advancements, may render the business model of Nidhi Company less relevant or viable.

- Dissolution by Members: The members of a Nidhi company may also collectively decide to dissolve the company if they believe it is no longer serving its purpose or if they wish to exit the association.

- Legal or Regulatory Issues: Legal disputes, litigations, or adverse regulatory actions can create significant challenges for a Nidhi company. In severe cases, these issues may lead to the company’s closure.

Documents required for the closing of Nidhi Company

Below are the mandatory documents required for closing a Nidhi Company-

- Indemnity bond notarized by directors (STK 3);

- Latest bank statement;

- Statement of Accounts detailing the company’s assets and liabilities audited by a Chartered Accountant;

- STK 4 form attached to the affidavit statement at each company;

- Special resolution or consent of 75% of members;

- PAN card of the company (if any);

- Certificate of bank account closure (if any).

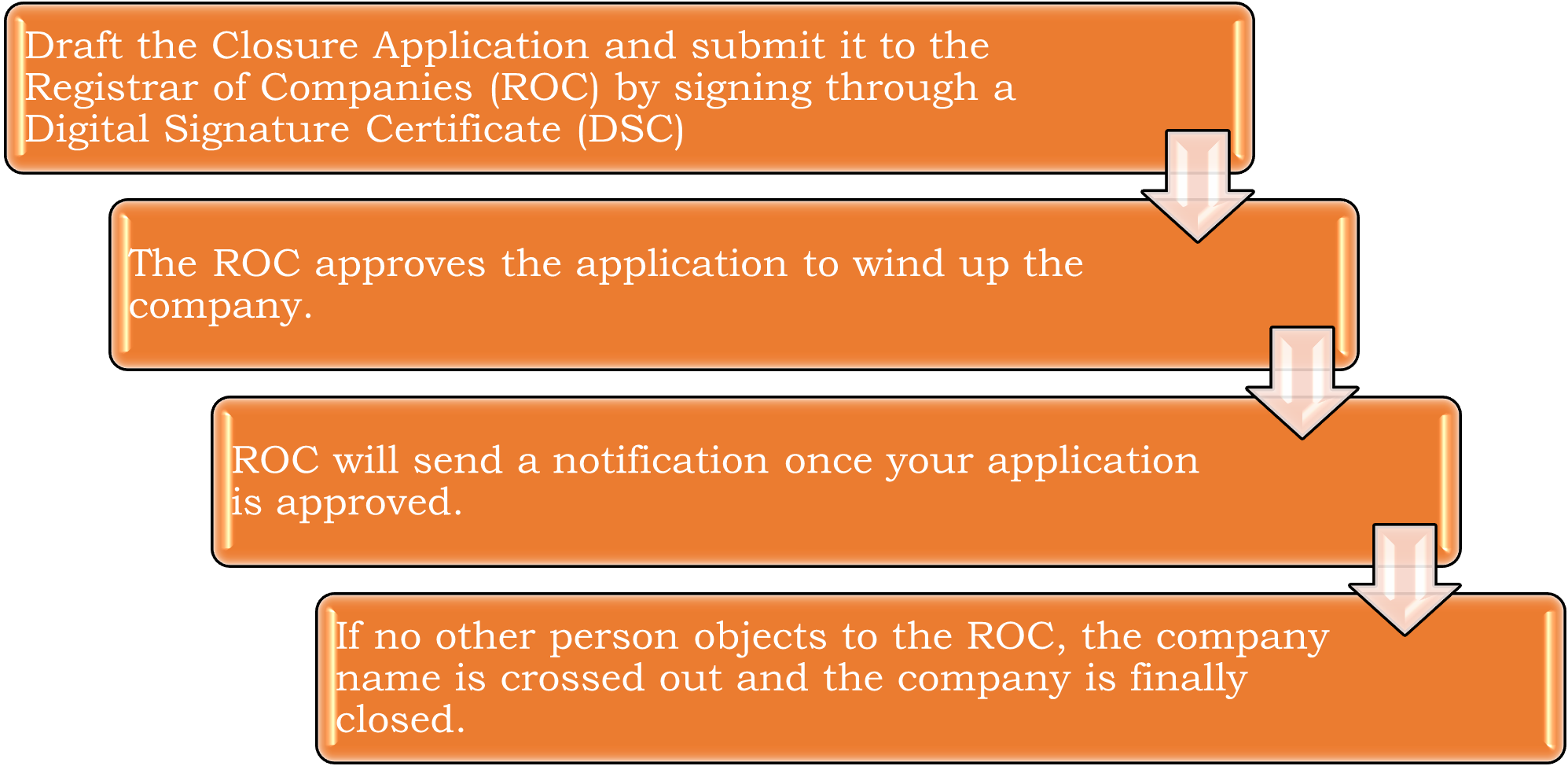

How to Strike off Nidhi Company?

If you wish closure of Nidhi Company, please follow the steps below-

Note: The whole process usually takes 20-25 working days, but it can also vary depending on the processing time of different governments of states.

Wrapping Up

The process of closing of Nidhi Company involves careful planning, compliance with legal requirements, and meticulous handling of financial affairs. Nidhi Companies must follow the prescribed procedure while winding up ensuring transparency, protecting the interests of creditors and shareholders, and complying with regulatory obligations. It is essential to seek professional advice and guidance throughout the process to ensure a smooth and lawful closure of the Nidhi Company.

In case of any query regarding the closing of Nidhi Company, a team of expert advisors from Legal Window is here to assist you at every step. Feel free to reach us at admin@legalwindow.in.

CS Urvashi Jain is an associate member of the Institute of Company Secretaries of India. Her expertise, inter-alia, is in regulatory approvals, licenses, registrations for any organization set up in India. She posse’s good exposure to compliance management system, legal due diligence, drafting and vetting of various legal agreements. She has good command in drafting manuals, blogs, guides, interpretations and providing opinions on the different core areas of companies act, intellectual properties and taxation.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (90)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (119)

- Hallmark Registration (1)

- Income Tax (201)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (21)

- Startup/ Registration (130)

- Trademark Registration/IPR (40)

Recent Posts

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.