Revival of Strike off Companies

Get the Revival of strike off companies starting from ₹ 25,000/-

Petition with NCLT

Active Status of Company

Simple & Secure Online Process

Dedicated Professional

Expert Lawyer/CS Advice

Get the revival in 2-3 months

Introduction of Revival of strike off companies

Whenever any company fails to fulfill the following statutory requirements of the Act is struck off by the Registrar of Companies:-

- either fails to commence its business within a period of one year of date of its incorporation or;

- who have not been carrying of any business or operations for a period of two financial years or;

- who fails to submit the yearly returns.

The Striking Off of the Company simply means removing the name from the Register of Companies as maintained by the Registrar of Companies. With the striking off a Company will not be considered in existence and cannot perform any of its operations thereafter.

Though there is a slight difference between the striking off of a Company and winding off a Company, as the former means temporary closure which allows the company to restore itself in future while winding off means permanent closure where there are no chances of revival.

Revival of a Company is done to make the status of Company active again as per the process enumerated under the law.

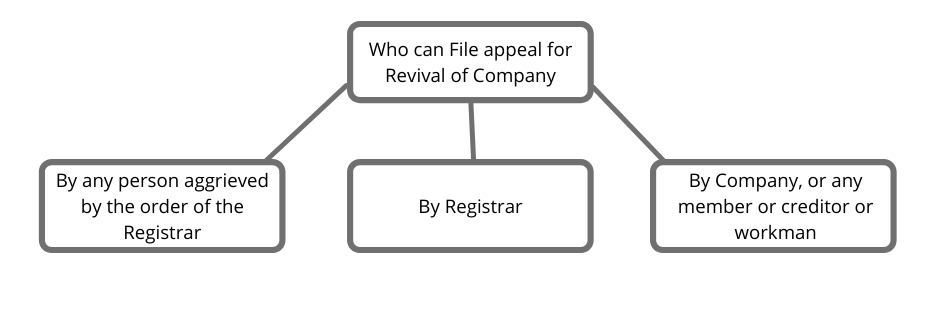

For revival of a Company an appeal / petition / application can be filed by a person who is affected by such strike off of the company to the National Company Law Tribunal (NCLT) within a period of 3 years from the respective date of order by the registrar for striking off of the name of the Company and the onus lies on the person applying for the said revival upon the satisfaction of NCLT with the justifications given by the concerned person and is of the opinion may order the restoration of the name of the company in the register of companies.

Legal Window can help you with the revival of your Company Name in the Registers of Registrar of Companies just by following certain steps by providing the best assistance, timely delivery and guaranteeing the highest customer satisfaction You may get in touch with our team on 072407-51000 or email admin@legalwindow.in .

Documents Required for Revival of strike off companies

Copy of the Notice of striking off of Companies along with list of companies

Copy of the Incorporation documents such as Certificate of Incorporation, Memorandum and Articles of Association

Copies of the Current Bank Account Statement of the Company

Copy of the letter received from the respective Bank regarding the freezing of the Current Bank Account of the Company

Copy of the Income Tax Returns filed by the Company since incorporation

Copy of the Audited Financial Statements since incorporation

Who can Apply for Revival of strike off companies

Grounds of Restoration of the Company

In the cases as mentioned below the NCLT may allow the restoration of the struck off company:

- Where there are some pending litigations on the Company.

- Where the assets of the company have high monetary value.

- Any other reason as the NCLT may allow.

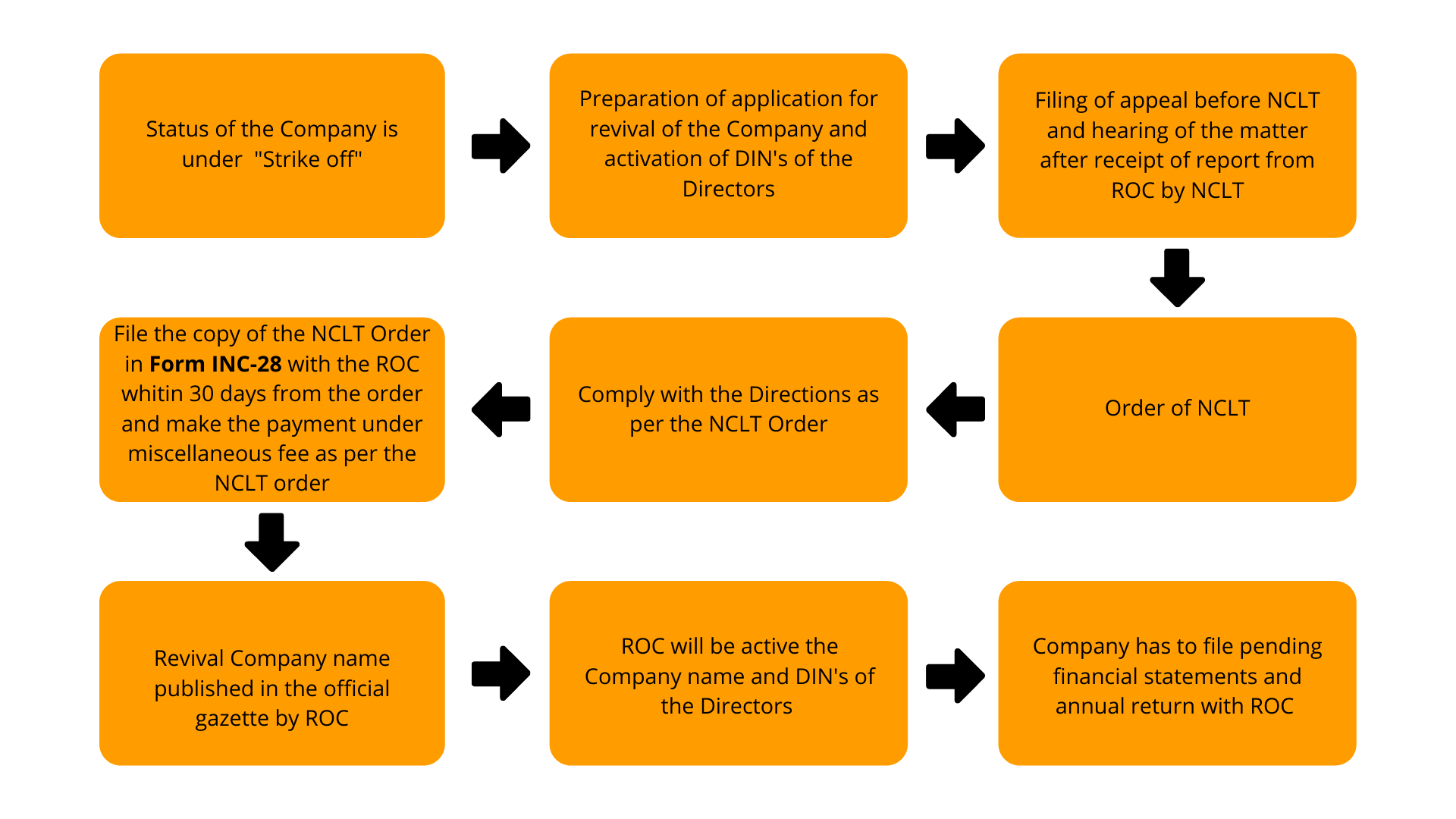

Procedure for revival of strike off companies by NCLT

Process of Revival of strike off companies

1. Complete the Application Form

You are requested to first fill the simple questionnaire provided by our expert team which will enable us to know the case of revival of the Company.

2. Document Processing

At the second step you will be required to produce the documents in accordance with the questionnaire filled based upon which case will be dealt so that we can arrange them as per the requirement and for further processing.

3. Drafting of Application and serving the same to ROC

This step consists of drafting of Application after the deep understanding of the case by our expert team for restoration of the Company name in accordance with the law to be filed with NCLT. A Copy of the same shall also be served to the ROC via Registered Post or by hand.

4. Conducting of Hearing by the Tribunal

In case any objections are raised the NCLT may call for a hearing in order to resolve the objections if any raised.

5. Receiving of Order

On hearing the NCLT may order for revival and will pass an order for revival of the Company, after receiving we will file the said order with ROC and the required fees if any is to be paid by the Company as directed by the NCLT.

6. Publication in the Official Gazette

Lastly, upon publication of the Order in the official gazette by ROC the Company will be revived and can function normally.

Revive the status of strike off company starting from ₹ 25,000/-

Professional Consultation

Drafting of Documents

Filing of E-Forms with ROC

Preparation of Application

Filing of Application with NCLT

Regular Follow ups with the concerned authorities

Related Posts

FAQ's on Revival of Stike Off Companies

The Notice of strike off can be obtained from the official website of the government i.e. Ministry of Corporate Affairs

The applicant shall have to deliver a certified copy of the order of NCLT to the ROC within a period of 30 days from the date of order.

The statutory fees of Rs. 1000/- shall be paid for applying for restoration.

The petition or an appeal for the revival of struck off company can be made by the company/ members/ woekmen/ creditors before the expiry of 20 years from the date of publication in the Official Gazette of the notice of the striking-off.

No, the petition or appeal for the revival of the struck off companies has to be made in person in NCLT and cannot be filed online.

Yes, NCLT issues the order on the basis of many grounds and if order has been passed to file the pending financial statements and annual return, then the company has to file by paying all the penalties.