What is PAN Card Importance and use? How to apply for PAN in India?

- February 25, 2022

- Miscellaneous

You’ll need one thing for each of these activities, whether you’re trying to buy a car or a house, participate in the stock market, or convert your Indian rupees to foreign currency. You may wonder how these two have a connection. The PAN card is the solution. Let us discuss briefly PAN Card Importance and use. The Income Tax Department’s Permanent Account Number (PAN) card is one of the most crucial documents in today’s world.

| Table of Content |

PAN Card Importance and use- What is PAN Card?

PAN is a computerised system that records all of a person’s or company’s tax-related information under a single PAN number. This serves as the primary key for data storage and is used by everyone in the country. As a result, no two tax-paying entities can share a PAN.

PAN Card Importance and use- Types of PAN

- The person

- Hindu Undivided Family (HUF)

- Firms/Partnerships

- Company

- Trust

- The social environment

- Foreigner

Documents required for PAN Card

There are two sorts of documentation required for PAN. Proof of Address (POA) and Proof of Identity (POI) are two different types of proof (POI). Any two of the documents listed below should fit the requirements.

- Individual Applicant: Aadhaar, Passport, Voter ID, and Driver’s License (POI/ POA).

- Hindu Undivided Family: A HUF affidavit signed by the HUF’s head, together with POI/POA information.

- The Registrar of Companies issues a Certificate of Registration to a company that is registered in India.

- Firms/ Limited Liability Partnerships (LLP): Registrar of Firms/ Limited Liability Partnerships Certificate of Registration and Partnership Deed

- Trust: A copy of the Trust Deed or Charity Commissioner’s Certificate of Registration Number copy.

- Registrar of Co-operative Societies or Charity Commissioner: Certificate of Registration Number.

- Passport PIO/ OCI card issued by the Indian government Bank statement from the country of residence In India, a copy of an NRE bank statement

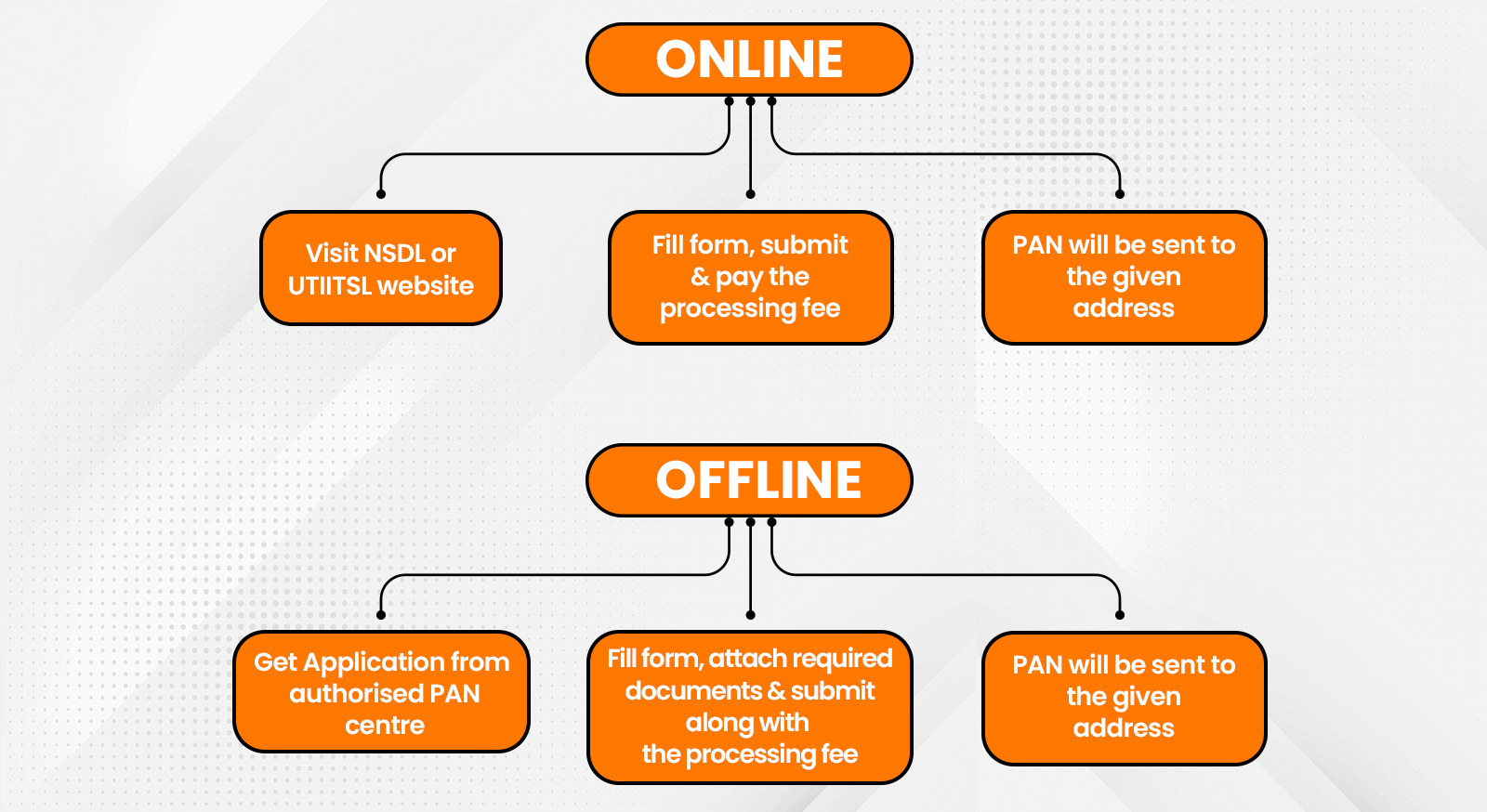

How to Apply for PAN Card

You can fill out the form and submit the needed papers by going to the official PAN – NSDL/UTIITSL website. In addition, if you pay the processing charge, your PAN will be sent to you within 15 days.

Points to Ponder

- Only capital letters must be use to fill out the form.

- Complete all of the fields that require update.

- For any updates to take place, You require mobile number.

- Complete the form in both English and the local language that you should use at the time of enrolment.

- Double-check that the form contains only current and relevant information.

- No salutations such as Mr./ Mrs./ Ms./ Dr. are permitted.

- Please fill the address correctly.

- When self-attesting supporting documents, include your name, signature, and thumbprints.

- Only attach papers that are relevant to the desired update.

- Income Tax Department will application reject due to incorrect information and a lack of supporting documentation.

Uses of PAN Card

- Filing of IT Returns: All persons and companies that are subject to income tax are require to file IT returns.

- A PAN card is also uses for the filing of IT returns, and it is for this reason that both people and businesses apply for one.

- Opening a bank account: To open a new bank account, whether it’s a savings or a current account, you’ll need a PAN card.

- To open a bank account, all banks, whether public, private, or cooperative, require the provision of a PAN card.

- Buying or selling a car: If you want to buy or sell a car worth more than Rs. 5,00,000, you must provide your PAN card information.

- Applying for a credit or debit card: Regulations require you to provide your PAN card details when applying for a debit or credit card at any bank or financial institution.

- Purchase of jewellery: If you want to buy any type of jewellery that costs more than Rs. 5,00,000, you must present your PAN card information at the time of purchase.

- If you’re thinking about investing in securities, you’ll need to provide your PAN number for any transactions over Rs. 50,000.

- Proof of Identity: A PAN card is a valid proof of identity throughout the country, as well as proof of age.

- Foreign Exchange: If you are travelling outside of India and need to exchange your Indian currency for a foreign currency, you must present your PAN number to the money exchange bureau/bank/institution where you are converting the money.

- Property: PAN card documentation is now require when buying, selling, or renting property in India. For a property purchase the buyer’s and seller’s PAN numbers must be on the sales deed and any other relevant papers.

- Loans: If you need a loan, all loan providers, including banks and other lending institutions, require you to submit details of your PAN when you apply for one.

Some more Benefits of PAN Cards.

- The bank will deduct TDS (Tax Deductible at Source) on the FD interest amount.

- Cash Deposits: If you make a cash deposit of more than Rs. 50, 000 at a time, you must also provide your PAN information.

- This complies with the RBI’s directive, which requires banks to notify any substantial cash deposits to the central bank in order to combat money laundering.

- Telephone Connections: If you want to get a new phone or mobile phone connection, you must supply your PAN number, as private cellular companies will not connect you without it.

- Insurance Payments: When making an insurance payment of more than Rs. 50, 000 per year, the Income Tax Department requires PAN card information.

Takeaway

It can be concluded that PAN card is most important document issued by the Income Tax Department of India.

By taking a cognizance into PAN Card Importance and use we can easily come to the point that it is as significant document as any other because where the transactions above certain limits takes place, the individual is required present his/her PAN Card.

For more information about this topic kindly connect to our experts.

Neelansh Gupta is a dedicated Lawyer and professional having flair for reading & writing to keep himself updated with the latest economical developments. In a short span of 2 years as a professional he has worked on projects related to Drafting, IPR & Corporate laws which have given him diversity in work and a chance to blend his subject knowledge with its real time implementation, thus enhancing his skills.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (147)

- Compliance (88)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (116)

- Hallmark Registration (1)

- Income Tax (199)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (20)

- Startup/ Registration (126)

- Trademark Registration/IPR (40)

Recent Posts

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.