Have you ever wondered how companies reveal their financial secrets to the world? The answer lies in the process of filing financial statements with the registrar. Filing of Financial Statements with the Registrar is an important process where companies submit their financial reports to a government authority or regulatory body. These statements include information about a company’s earnings, expenses, assets, and debts, providing a clear picture of its financial health. By filing these statements, businesses comply with legal requirements and offer transparency to stakeholders, such as investors, creditors, and the public, ensuring they have access to essential financial information for making informed decisions.

In this article, we will discuss the financial statement to be filed with registrar.

| Table of Contents |

What are Financial Statements?

Financial statements are the formal documents representing the financial activities and position of an organization or a business. They provide a summary of the company’s financial performance, financial position, and cash flows over a specific period, typically one year. These statements are essential tools for assessing the financial health and stability of a company and are used by various stakeholders, including investors, creditors, management, regulatory authorities, and the public.

Section 129 of the Companies Act of 2013 provides for the preparation of financial statements. It stipulates that the financial statements give a true and fair view of the current state of the company. It also states that the reports must comply with the accounting standards set out in the newly inserted section 133.

Necessity of Financial Statements

Financial statements, holding company accounts and consolidated balance sheet, income statement, cash flow statement, and statement of changes in equity, present a snapshot of a company’s financial status and performance over a specific period. These statements enable stakeholders to assess the financial health of an organization, its profitability, liquidity, and solvency. Furthermore, financial statements provide critical insights into a company’s operational efficiency, investment potential, and ability to meet its financial obligations. Accurate and timely financial reporting is crucial for maintaining trust, attracting investment, securing loans, and facilitating decision-making.

Also read our article on: Voluntary Revision of Financial Statement

Benefits of Filing Financial Statements with Registrar

The benefits of filing a financial statement with the registrar include-

- Stakeholder Confidence: Accurate and timely financial reporting through filing financial statements enhances stakeholder confidence. Investors, creditors, and potential business partners gain insights into a company’s financial health, enabling them to make informed decisions and evaluate investment opportunities.

- Access to Capital: Filing financial statements is often a prerequisite for accessing capital through bank loans, lines of credit, or equity investments. Lenders and investors rely on these statements to assess a company’s creditworthiness, growth potential, and risk profile.

- Legal Compliance: Compliance with regulatory requirements is crucial for avoiding penalties, fines, or legal disputes. By filing financial statements with the registrar, businesses demonstrate their commitment to fulfilling legal obligations and operating within the bounds of the law.

- Business Analysis and Planning: Financial statements serve as a valuable tool for internal analysis and strategic planning. By reviewing past performance and financial metrics, businesses can identify areas for improvement, make informed business decisions, and set realistic goals for the future.

Process of Filing Financial Statements with Registrar

The process of filing financial statements with the registrar generally involves the following steps:

- Financial Statement Preparation: The Company’s finance and accounting team prepares the financial statements by the applicable accounting standards, such as GAAP or IFRS.

- External Audit (if required): In some jurisdictions or for specific types of companies, an external audit of the financial statements is mandatory. An independent auditing firm is engaged to examine financial records, transactions, and accounting practices to ensure compliance and accuracy.

- Finalization and Approval: Once the financial statements are prepared and audited (if required), the audited financial statements are reviewed by the management and the board of directors for finalization and approval.

- Submission to the Registrar: The finalized financial statements, along with any other required documents, are submitted to the registrar or relevant regulatory authority within the specified timeframe. The submission can be done online or through physical documentation, depending on the regulations of the country or jurisdiction.

- Public Accessibility: In many cases, filed financial statements become publicly accessible through the registrar’s website or other designated platforms. This availability allows stakeholders and the general public to access the information and gain insights into the company’s financial health.

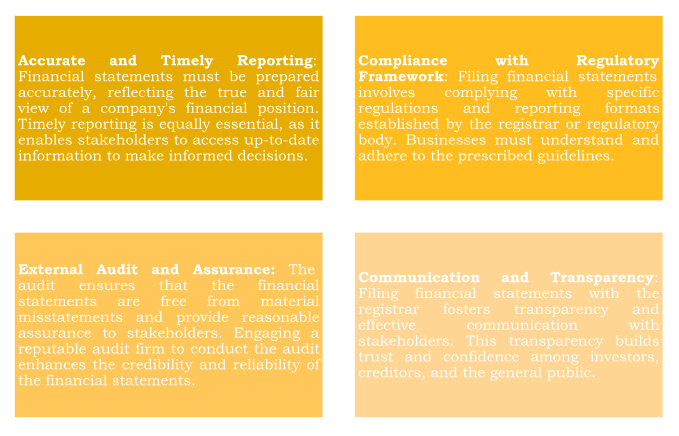

Key Considerations in Filing Financial Statements

Final words

Filing financial statements with the registrar is a critical step for businesses in ensuring compliance with regulatory requirements, fostering transparency, and building stakeholder confidence. Accurate and timely financial reporting, compliance with regulatory frameworks, external audits, and effective communication contribute to the overall success and credibility of an organization. By fulfilling their obligations and providing essential financial information, businesses can enhance their reputation, attract investment, and lay the foundation for sustainable growth in today’s dynamic business landscape.

In case of any query regarding the financial statement to be filed with registrar, a team of expert advisors from Legal Window is here to assist you at every step. Feel free to reach us at admin@legalwindow.in.

CS Urvashi Jain is an associate member of the Institute of Company Secretaries of India. Her expertise, inter-alia, is in regulatory approvals, licenses, registrations for any organization set up in India. She posse’s good exposure to compliance management system, legal due diligence, drafting and vetting of various legal agreements. She has good command in drafting manuals, blogs, guides, interpretations and providing opinions on the different core areas of companies act, intellectual properties and taxation.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (89)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (118)

- Hallmark Registration (1)

- Income Tax (199)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (21)

- Startup/ Registration (128)

- Trademark Registration/IPR (40)

Recent Posts

- Startup’s Guide to Employee Stock Ownership Plans April 29, 2024

- Master Secretarial Audit: A Complete Compliance Guide April 27, 2024

- Farmer Producer Companies-Major provisions under Companies Act April 26, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.