Registrar and Share Transfer Agent

Transfer your shares with our Registrar and Share Transfer Agent starting from ₹ 1500/-

Execution of Share Transfer Deed

Stamp Duty on Share Transfer

Simple & Secure Online Process

Dedicated Professional

Expert CS Advice

Get the Shares Transferred in 7-10 days

Introduction of Registrar and Share Transfer Agent

Transfer of shares is a process in which the existing shares as issued by the Company are transferred from one person whether natural or artificial to another either by way of sale or gift. Shares are considered as a movable property, post reviewing the Articles of Association of the Company. As in case of Private limited companies the shares cannot be freely transferable while in case of Public Companies they can be transferred in the market easily.

In case of Public Companies or Listed Companies the shares are transferred electronically with the help of clearing house i.e. NSE and BSE. Further, the private limited companies who have not dematerialized shares, the shares are transferred in physical form only. Here we will discuss transfer of shares in a physical form.

Legal Window can help you with the transfer of shares just by following certain steps by providing the best assistance, timely delivery and guaranteeing the highest customer satisfaction You may get in touch with our team on 072407-51000 or email admin@legalwindow.in

Documents Required for Company Share Transfer in Jaipur

PAN Card of both transferor and transferee

Certificate of Incorporation in case of Company

Proof of Address of transferee

Common Seal of the Company; if any

Details of shares to be transferred

Share Certificates of the shares to be transferred

Process followed by Registrar and Share Transfer

1. Complete the Application Form

You are requested to first fill the simple questionnaire provided by our expert team which will enable us to know the case of transfer of shares of the Company.

2. Document Processing

At the second step you will be required to produce the documents in accordance with the questionnaire filled based upon which case will be dealt so that we can arrange them as per the requirement and for further processing.

3. Drafting of Documents for Share Transfer

After arranging the documents we will begin with the drafting of Board Resolution (if not passed ) for Transfer of shares of the Company and to execute the share transfer deed in SH-4 (a prescribed format given under Companies Act, 2013 ) by the transferor and transferee and the stamp duty to be paid in accordance with Indian Stamp Act of the respective state.

4. Conducting the Board Meeting and passing of Board Resolution for register of transfer of shares

Again a Board Meeting will be conducted to register the transfer of shares if the documentation with regard to the transfer of shares is in order.

5. Entry in Share Certificate and Register of Members

After approval in the Board Meeting, entry for share transfer will be recorded on the Share Certificates and Register of Members.

Additional Information on Registrar and Share Transfer Agent

Transfer of Shares

For initiating the process for transfer of shares of a Private Limited Company one must review the Articles of Association of the Company as a Private Limited Company is restricted to freely transfer its shares. This restriction could be:-

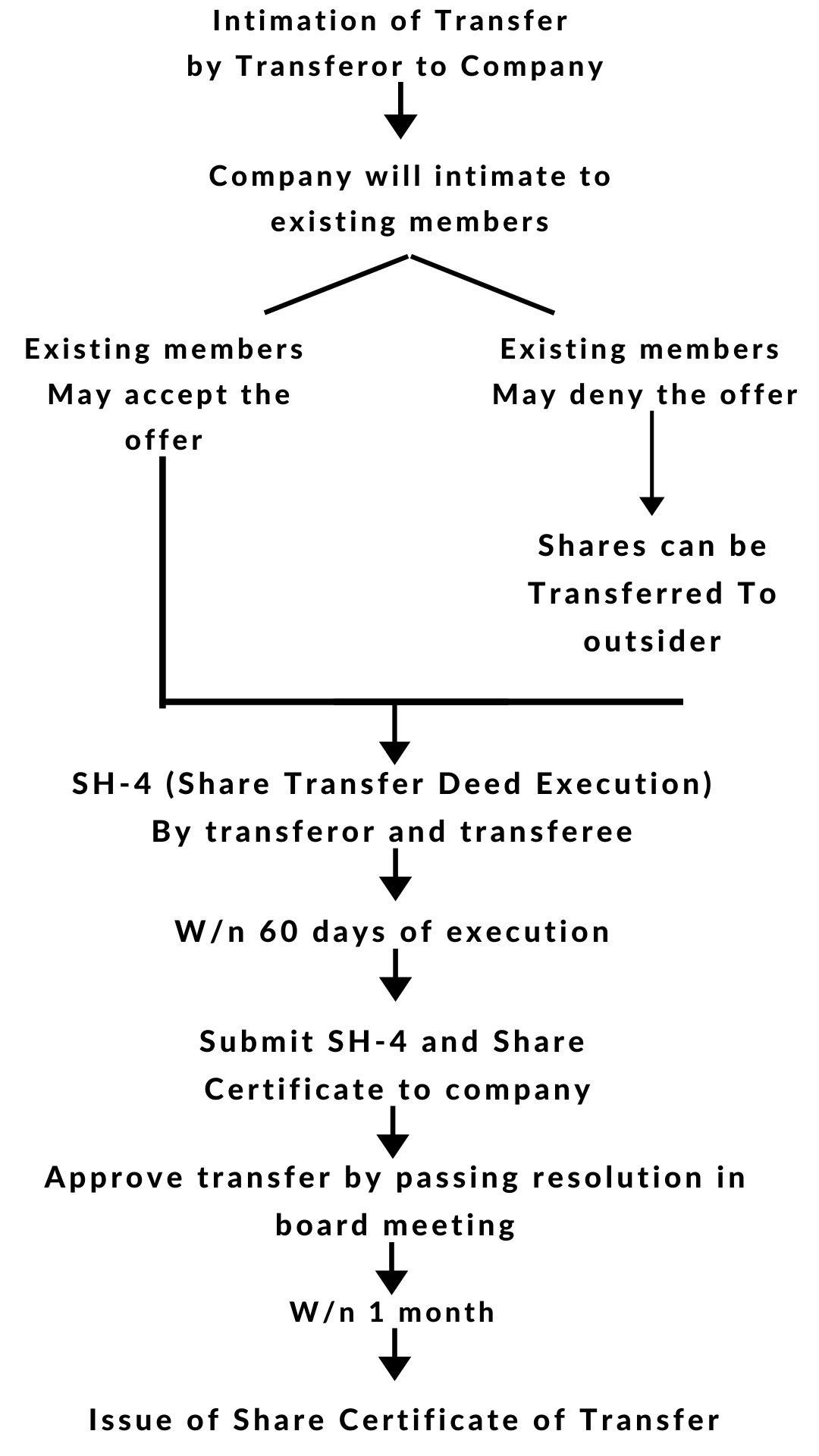

- Rights of pre-emption: Right of pre-emption means whenever the shareholder wishes to transfer all or some part of his/her shares then they must be first offered to the existing members of the company in accordance with the price determined by the Directors or the Auditor of the Company. The value of such shares can be decided based upon the formula / method mentioned in the Articles of Association. If the existing shareholders are not interested in buying then such shares can be freely offered to outsiders.

- Powers of Directors to refuse: In case any stringent provisions have been prescribed in the Articles of Association of the Company then the Directors may have the powers to refuse registration of transfer of shares.

SH-4 : Share Transfer Deed

The execution of share transfer is done through a share transfer deed SH-4 which has to be executed by the transferor and transferee by filling all the details of the company, no of shares transferred, value of shares, details of transferor and transferee and should be stamped as per the stamp duty levied in the respective state. The stamp duty has to be paid by the seller in this case. The executed deed has to be submitted within 2 months of the date of execution.

Share Transfer In case of Non Resident

For transferring the shares from resident to non-resident or vice versa a Form FC-TRS shall also be filed by the Indian Resident with the Reserve Bank of India within 60 days from the date of remittance or transfer whichever is earlier.

Flowchart for Share Transfer

Related Posts

FAQ's on Registrar and Share Transfer Agent

- Transferor

- Transferee

- Subscriber to the Memorandum of Association

- Company itself

- Legal Representative if any

Yes, stamp duty is to be paid in accordance with Stamp Act for respective state which is born by the transferor or seller.

No, as it the internal process which is recorded in minutes, and no further filing with ROC is required. Any such change is submitted while filing the annual return of the company in MGT-7.

A Minimum fee of Rs. 25,000/- is charged which can be extended to Rs. 5,00,000/- and the officer in default can be penalized with minimum of Rs.10,000/- to maximum Rs. 1,00,000/-.

If the share certificate is lost, then the letter of allotment may be provided as a proof along with share transfer deed.

The instrument shall be registered within 60 days from the date of execution.

In case of Listed Company they are available on the stock exchange whereas in case of other companies it is generally determined on the basis of the average market value of shares at the time of transfer or agreed price between the transferor and the transferee of the shares, whichever is high.

The Company shall register & issue the share certificate in the name of the transferee within one month of the receipt of the duly executed & stamped share transfer instrument along with the original certificate of the shares being transferred.

The share transfers if any shall be approved by passing a board resolution and shall be recorded in Register of Members electronically or physically.

In case you want to transfer the shares partly, first ask the company to split your share certificates in the numbers you want. In this case the original share certificate is cancelled and new splitted certificates are issued.

Ex: Suppose you have 5000 shares and you wish to transfer only 2000 shares. In this case the company will split the certificate in two parts i.e. one of 2000 and one of 3000 with a footnote that these certificates are issued in lieu of the original certificates.