Filing your income tax returns (ITR) every year is really important. You have to be careful and follow some rules. It is critical to file your income tax returns (ITR) every year. You must use caution and adhere to certain guidelines. It can be difficult to keep up with all of the current changes, but you must in order to avoid making mistakes and getting into trouble. To execute it correctly, you must first comprehend a few key concepts. Here’s a short 4-point checklist for income tax return filing to help you arrange your money and follow the requirements so you can file your ITR more easily.

| Table of Content |

What is Income Tax Returns?

The Government of India creates Income Tax Laws. Individuals, Hindu Undivided Families (HUFs), corporations, firms, LLP, associations of persons, bodies of individuals, municipal authorities, and any other artificial legal person are subject to taxation. The imposition of tax on a person is determined by these laws based on his residency status. Every person who qualifies as an Indian resident must pay tax on his or her international income. Each fiscal year, taxpayers must comply with specific standards while completing their Income Tax Returns (ITRs).

An ITR, also known as an income tax return, is a document used to record your income and taxes to the Income Tax Department. Your wages determine the amount of tax you owe. If the form indicates that you have overpaid taxes, you may be eligible for a refund from the Income Tax Department.

Importance of accurate ITR filing

The significance of timely Income Tax Return (ITR) filing cannot be emphasized, as it is a critical method for individuals and businesses to preserve financial transparency and regulatory compliance. Taxpayers who file accurate ITRs meet their legal obligations, avoiding potential legal consequences and penalties. Furthermore, it helps the development of a legitimate financial history, which can be useful in obtaining loans, investments, or even specific job chances. Furthermore, accurate ITR files help to maintain the general integrity of the tax system, establishing confidence and accountability within the economic framework.

Understanding the 4-Point Checklist

The uncertainty about where to begin frequently cause us to put off the task until the last minute. But don’t worry, because aid is on the way. Simply have the following checklist for income tax return filing on hand to ensure a seamless and error-free ITR filing:

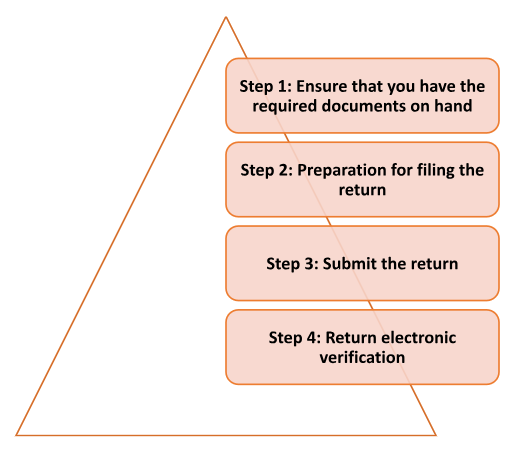

Step 1: Ensure that you have the required documents on hand

- Permanent Account Number (PAN) (your PAN serves as your user ID while using the income tax website).

- Aadhaar card.

- A copy of your tax return from the previous year.

- Bank statements, omitting bank accounts that have been inactive for at least two years.

- A Form 16 from your employer.

- A summary of all the interest income collected on the balances in your savings accounts during the fiscal year.

Step 2: Preparation for filing the return

- Register on the IT Department’s tax filing.

- Ensure that you have a valid email address and cell phone number to confirm your profile.

- You must enter your Aadhaar number and validate your Aadhaar details in the form.

- Choose the appropriate form for your situation. For the majority of people, it is ITR 1- SAHAJ.

- SAHAJ is for individuals with salaries, one-house property, and income from other sources such as dividends, interest income, winnings, and so on.

Step 3: Submit the return

- You can fill out the form online (save your details as a draft with each update to avoid losing data).

- Alternatively, under the left hand tab, select the downloads link and download the Java or Excel Utility (ideally Java). You can work on your IT Return while offline with its assistance.

- When you are connected, select the Prefill option in the Java Utility. Your personal information will be collected automatically.

- It is recommended that you get Form 26AS. This form contains information about your tax credit. It displays the entire amount of tax deducted and already paid on your behalf.

- If salary is your only source of income, your IT return should resemble the Form 16 given by your company.

- Check that the deductions you claim in your return are in accordance with Form 16.

- Make careful to include all other sources of income.

- Also, confirm that you have added all of the interest money collected on the balances in all of your savings accounts during the fiscal year. Section 80TTA allows you to claim a deduction of up to Rs. 10,000.

Step 4: Return electronic verification

- Unless you validate the return, it will not be considered genuine.

- You can either choose physical verification or e-verify your return (e-verification can be done in a variety of ways).

- Print the acknowledgment of ITR-V, sign it in blue ink, and send it to the Centralized Processing Centre (Bangalore) within 120 days after filing your return for physical verification.

Avoiding penalties and legal complications

Maintain correct and timely compliance with all relevant rules and regulations to prevent penalties and legal issues. Keep precise records, meet filing dates, and meet tax responsibilities. Seek expert advice when necessary, and stay current on changing legal needs. Implement sound internal controls and risk management procedures. Develop an organizational culture of transparency and ethical behavior. Conduct compliance audits on a regular basis to detect and correct any potential non-compliance concerns. To reduce risks and build long-term stability, prioritize a proactive approach to legal compliance. When e-filing your income tax return, make sure to keep a copy of your proof of income tax e-filing for your records

Conclusion

Finally, maintaining a smooth tax filing process is critical. You can avoid unnecessary penalties and legal issues by following the Complete checklist for income tax return filing. Maintain organization, gather all required documentation, and file your tax return accurately and on time. Seek expert help if necessary, and stay up to date on the latest tax regulations. You can effectively manage the difficulties of tax filing and prepare the path for a trouble-free financial journey by being vigilant and responsible.

CA Pulkit Goyal, is a fellow member of the Institute of Chartered Accountants of India (ICAI) having 10 years of experience in the profession of Chartered Accountancy and thorough understanding of the corporate as well as non-corporate entities taxation system. His core area of practice is foreign company taxation which has given him an edge in analytical thinking & executing assignments with a unique perspective. He has worked as a consultant with professionally managed corporates. He has experience of writing in different areas and keep at pace with the latest changes and analyze the different implications of various provisions of the act.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (90)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (118)

- Hallmark Registration (1)

- Income Tax (200)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (21)

- Startup/ Registration (130)

- Trademark Registration/IPR (40)

Recent Posts

- NGO Darpan Registration in Jaipur May 2, 2024

- Registration of Charges with ROC May 1, 2024

- Post incorporation compliances for companies in India April 30, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.