What is GST Number, How to Apply for GSTIN Online, and Documents Required

- October 12, 2023

- GST

GST is an indirect tax system introduced in India in 2017 to streamline the country’s taxation structure. All businesses involved in the supply of goods or services are required to register for a unique GSTIN (GST Identification Number) as per GST rules. This article deals with How to Apply for GSTIN Online, how to apply for them online, and what are the documents required for registration.

| Table of Contents |

Understanding GST Number

The GST number, also known as the GSTIN, is a unique 15-digit identification number assigned to each registered taxpayer. The first two digits indicate the taxpayer’s state code, followed by their PAN or TAN number. The next ten digits comprise the entity’s alphanumeric code, while the 14th digit represents the business entity’s default registration code (1 for regular taxpayers and 2 for non-resident taxpayers). Finally, the last digit is the checksum digit for error detection. After all, how to get GSTIN is a process that can be done by an individual online.

How to Apply GSTIN Online?

As an online GST registration process, getting a GSTI Number has also a simplified application procedure. The following steps outline the process to get GSTIN or apply for a GST Number.

- Open the GST Online Portal and login.

- Go to the ‘Services’ page, select ‘Registration’ > New Registration, and finally click.

- You will be directed to the Registration form after selecting this option, where you must enter your information, including your name, PAN, contact information, email address, state, and the entity type that best describes you (either a non-resident service provider or a non-resident deductor, payer, or collector of taxes).

- When you provide these details, the portal will confirm them by sending you an OTP to the specified email address and mobile number.

- You will receive an Application Reference Number (ARN) on your mobile device and email if you enter the right OTP.

- You must then enter your ARN to finish Part B of the application process. After entering this, you will be prompted to upload the application’s supporting documents.

- The GST officer will review your information once you submit Part B of the application within 3 working days and let you know if any additional information is needed. This has to be delivered in seven business days.

- The authority can accept or reject the application for the reasons specified in Form GST-REG-05 when all the information and paperwork have been received and approved.

Also, read: GSTIN – Meaning, Structure and How to Apply and Applicable Fees

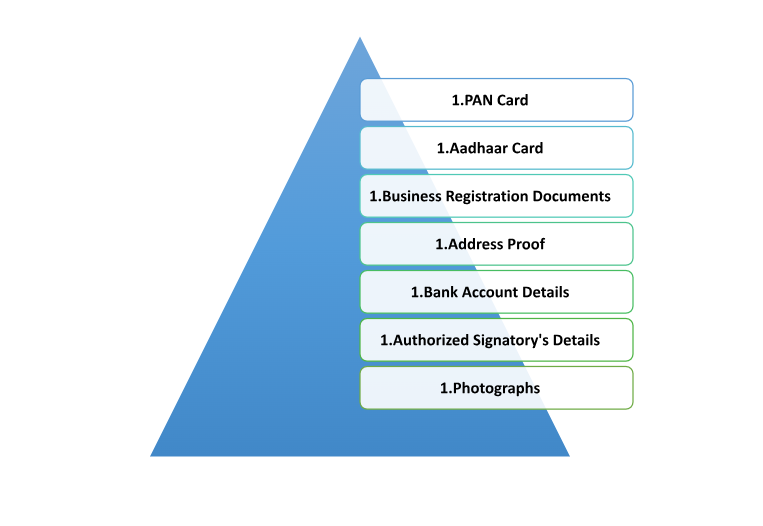

Documents Required to Get GSTI Number

The registration process requires various documents to establish the authenticity and legality of the business. The following documents are required to get GSTIN or GST Number Online.

- PAN Card: The Permanent Account Number (PAN) of the applicant or organization to validate its existence.

- Aadhaar Card: The Aadhaar card acts as proof of identity and residential address for individual applicants.

- Business Registration Documents: For a company, partnership, or LLP, registration documents like the Certificate of Incorporation, Partnership Deed, or LLP Agreement are required.

- Address Proof: Documents such as a utility bill, lease/rent agreement, or ownership document of the principal place of business must be submitted.

- Bank Account Details: Bank account statements, cancelled cheques, or an extract of the first page of the bank passbook indicating the name, address, and GSTIN must be provided.

- Authorized Signatory’s Details: PAN card, address proof, and photograph of the authorized signatory, along with their letter of authorization, if applicable.

- Photographs: Recent passport-sized photographs of the applicant, partners, directors, or authorized representatives.

Final Note

Getting a GSTIN is an essential step for any business involved in the supply of goods or services. How to get GSTIN is an online process that has a simplified application procedure, ensuring that businesses can easily comply with their tax obligations. By providing accurate details and the required documents during the registration process, businesses can swiftly obtain their unique GSTIN. Remember, prompt GST registration not only helps maintain compliance but opens doors to various benefits under the GST framework.

In case of any query regarding GST Number or how to Apply for GSTIN Online, feel free to connect with our legal experts at Legal Window at 72407-51000.

CA Pulkit Goyal, is a fellow member of the Institute of Chartered Accountants of India (ICAI) having 10 years of experience in the profession of Chartered Accountancy and thorough understanding of the corporate as well as non-corporate entities taxation system. His core area of practice is foreign company taxation which has given him an edge in analytical thinking & executing assignments with a unique perspective. He has worked as a consultant with professionally managed corporates. He has experience of writing in different areas and keep at pace with the latest changes and analyze the different implications of various provisions of the act.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (90)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (120)

- Hallmark Registration (1)

- Income Tax (202)

- Latest News (34)

- Miscellaneous (165)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (21)

- Startup/ Registration (130)

- Trademark Registration/IPR (40)

Recent Posts

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.