Income Tax Return Last Date – Reasons You Need to File ITR on Time

- September 14, 2023

- Income Tax

Do you know the importance of filing Income Tax Return (ITR) on time? Reasons you need to file ITR on time offers numerous benefits; including reducing the likelihood of errors, avoiding late filing penalties and ensuring faster tax refunds. In addition, early filing gives taxpayers more time to correct errors and deal with any audit or notice from the Income Tax Department. In this article, we will discuss ITR filing last date FY 2023-24.

| Table of Contents |

What is Income Tax Return (ITR)?

A person must submit an Income Tax Return (ITR) form to the Income Tax Department. It includes details about a person’s income and the taxes that must be paid on it each year. The information included in the ITR should be specific to a certain fiscal year, which runs from April 1 through March 31 of the following year. Salary, corporate earnings, rental income from real estate, dividends, capital gains, interest, and other types of revenue are all examples of sources of income. Taxpayers must typically file their ITR annually and include information about their income and other pertinent financial facts for a given time period.

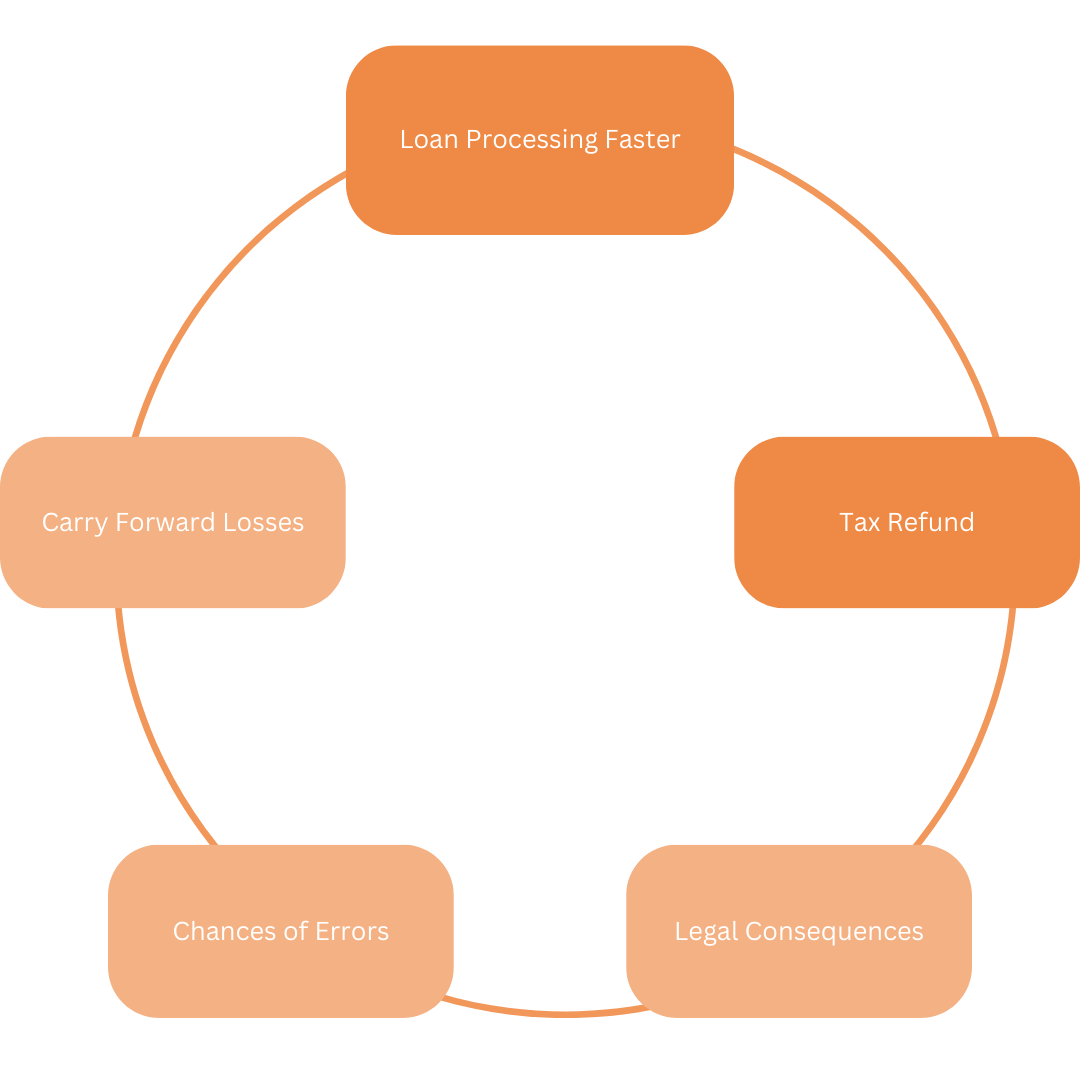

Reasons You Need to File ITR on Time

Filing your income tax return is an annual responsibility for every taxpayer. Below are few reasons to file ITR on time-

- Loan processing faster: The ITR provides a detailed picture of your total income, investments and tax liabilities. The financial institution will check your ITR to determine your eligibility before approving the loan. Consistently late reporting can portray you as irresponsible and reduce the bank’s confidence in your ability to make payments on time.

Hence, it is important not only to pay all taxes on time but also to keep detailed copies of all your ITRs. Regular and well-kept records help to process loans and loans from financial institutions faster and more efficiently. - Tax Refund: There are certain investments that involve Tax Deducted at Source (TDS), i.e. the provider deducts relevant taxes from your income/earnings before paying you the amount. However, if your total income falls under the tax-exempt bracket, you have to claim refund of the TDS paid.

- Chances of Errors : Rushing to file your ITR at the last minute can open up the possibility of errors and mistakes that can lead to your returns being rejected by the department. Timely filing of ITR was considered as one of the mistakes that could lead to error.

- Legal Consequences: If you fail to file ITR on time, you will be liable to pay certain amount as penalty to the department.

- Carry forward losses: According to income tax rules, taxpayers can carry forward losses to the next accounting period if they file their income tax return before the deadline. This helps taxpayers to reduce their tax liability on future income.

Document Requirements for Filing of Income Tax Return

Some key documents are necessary to fill ITR such as:

- Aadhar card

- Bank statement

- Form-16

- Form- 26AS

- Any investment documents

- Lease agreement, deed of sale or dividend guarantees (if any).

How to file Income Tax Returns?

The ITR can be filed online by following these steps-

- Visit the official income tax website.

- After logging in to the portal, click on the ‘e-file’ tab and then click on ‘File Income Tax Return’.

- Select the ‘Assessment Year’ and ‘Filing Mode’ and click ‘Continue’.

- Select the suitable category as to whether you want to file Income Tax Return as an Individual, Hindu Undivided Family (HUF) or others. Select ‘Individual’. Then click ‘Continue’.

- Now select the Income Tax Return you want to file.

- In the next step, you will be asked for the reason for submitting a return above the basic exempt limit or for the reason for the seventh provision of Section 139 sub-section 1.

- If you have already provided your bank account information, verify it beforehand or fill it.

- Now you will be redirected to a new page for filing your ITR. Check the pre-filled information provided is correct.

- Lastly verify your returns and send the hard copy to the Income Tax Department. The verification process is mandatory.

ITR filing last date FY 2023-24

Here’s a table summarizing the due dates for tax filing for ITR filing last date FY 2023-24–

| Category of Taxpayer | Due Date for Filing Tax (2023-24) |

| Individual / HUF/ AOP/ BOI (no audit required) | 31st July 2024 |

| Businesses (Requiring Audit) | 31st October 2024 |

| Businesses requiring transfer pricing reports | 31st November 2024 |

| Revised return | 31st December 2024 |

| Late return | 31st December 2024 |

Also read- Filling Income Tax Return (ITR) Online: A Comprehensive Step by Step Guide for Assessment Year 2023-24

What is the Interest and Penalty for Late Filing of Returns?

The consequences of late ITR filing include-

| Particulars | Penalty an Interest |

| Penalty for late submission of income tax return |

|

| Penalty for Late Filing of TDS Return |

|

Final Words

Acknowledging the numerous benefits associated with filing ITR, it is essential to navigate the process efficiently. Start by determining the appropriate income tax return form tailored to your specific financial situation. Remember to complete the form carefully, ensure accuracy and completeness, and meet the submission deadline. You shouldn’t ignore errors on your tax return so correct them immediately by filing a corrected return.

In case of any query regarding ITR filing last date FY 2023-24, a team of expert advisors from Legal Window is here to assist you at every step. Feel free to reach us at admin@legalwindow.in.

CA Pulkit Goyal, is a fellow member of the Institute of Chartered Accountants of India (ICAI) having 10 years of experience in the profession of Chartered Accountancy and thorough understanding of the corporate as well as non-corporate entities taxation system. His core area of practice is foreign company taxation which has given him an edge in analytical thinking & executing assignments with a unique perspective. He has worked as a consultant with professionally managed corporates. He has experience of writing in different areas and keep at pace with the latest changes and analyze the different implications of various provisions of the act.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (90)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (118)

- Hallmark Registration (1)

- Income Tax (200)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (21)

- Startup/ Registration (128)

- Trademark Registration/IPR (40)

Recent Posts

- Post incorporation compliances for companies in India April 30, 2024

- Startup’s Guide to Employee Stock Ownership Plans April 29, 2024

- Master Secretarial Audit: A Complete Compliance Guide April 27, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.