Exploring ELSS Tax Saving Investment Plan in India: What is ELSS and How to Invest in It?

- September 28, 2023

- Finance Company

In India, ELSS (Equity Linked Saving Scheme) mutual funds have become a popular choice for tax-advantaged investments. ELSS combines the benefits of tax savings under Section 80C of the Income Tax Act, 1961 with the potential for long-term wealth creation through equity investments. This article aims to provide a detailed overview of ELSS Tax Saving Investment Plan in India , including its definition, benefits, interest rates, and how investors can start investing in ELSS.

| Contents |

Understanding ELSS

Definition

ELSS is a type of mutual fund scheme that primarily invests in equity and is considered an equity-linked saving scheme. It offers tax benefits under Section 80C, where investments up to INR 1.5 lakh can be claimed as deductions from taxable income in a financial year.

Key Features and Benefits

- Investment Horizon: ELSS funds have a lock-in period of three years, which is the shortest compared to other tax-saving options.

- Equity Exposure :ELSS funds invest a significant portion (at least 80%) of their assets in equity and equity-related securities.

- Tax Benefits:-Investments in ELSS funds qualify for deductions under Section 80C, minimizing the investor’s tax liability.

- Potential for Higher Returns:-As ELSS funds predominantly invest in equities, they have the potential to generate higher returns over the long term, assuming a well-managed portfolio.

Also, read: Exploring Tax saving options other than Section 80C of the Income Tax Act, 1961

Best ELSS Funds to Invest in 2023

- Criteria for Selection

When choosing the best ELSS funds, the following factors should be considered:

- Past Performance:-Assess the fund’s historical performance over different market cycles.

- Fund Management:-Evaluate the expertise and track record of the fund manager.

- Consistency:-Look for funds that have shown consistent returns over a reasonable period.

- Expense Ratio:-Consider the fund’s expense ratio, as lower expenses can boost returns.

ELSS Interest Rates

- ELSS and Interest Rates:-Unlike traditional savings accounts or fixed deposits, ELSS does not offer fixed interest rates. The returns from ELSS are market-driven and dependent on the performance of the underlying equity investments.

- Historical Returns:-ELSS funds have historically performed well, providing an average annualized return of around 12-15% over the long term. However, past performance should not be considered a guarantee of future returns.

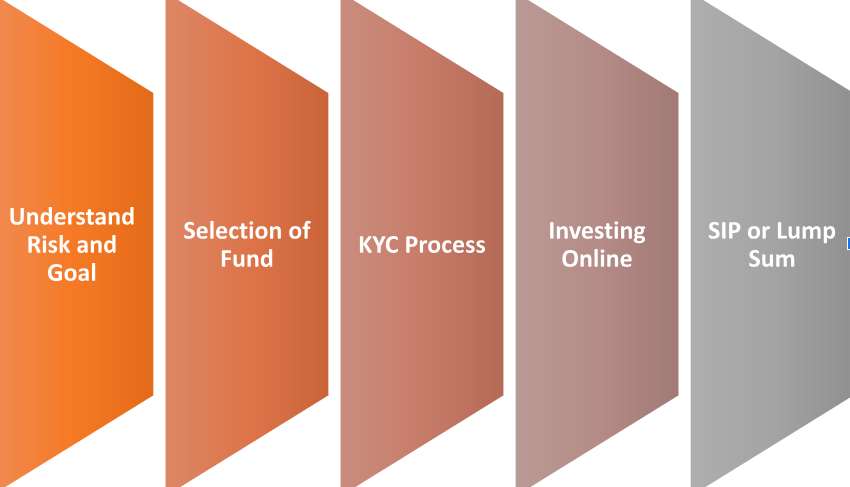

How to Invest in ELSS?

- Understand Risk and Goal:-Investors should assess their risk appetite and investment goals before choosing ELSS funds. ELSS has exposure to equities and can be subject to market fluctuations, which implies a higher risk compared to debt-based investments.

- Selection of Fund:-Identify the desired ELSS fund(s) based on the investment criteria discussed earlier. It is advisable to diversify investments across different funds to mitigate risk and optimize potential returns.

- KYC Process:-Complete the Know Your Customer (KYC) process by submitting relevant documents like proof of identity, address, and PAN details to a registered intermediary.

- Investing Online:-Investors can invest in ELSS funds online through the fund house’s website, intermediaries, or online investment platforms. Provide the necessary details, select the desired fund(s), and follow the instructions for investment.

- SIP or Lump Sum:-Investors can choose to invest through a lump sum or opt for Systematic Investment Plans (SIPs) for regular investments. SIPs allow investors to invest a fixed amount at periodic intervals, reducing the impact of market volatility.

Winding Up Note

ELSS tax-saving investment plans in India offer investors the dual benefits of tax deductions and potential long-term wealth creation through equity investments. They provide an ideal investment avenue for individuals seeking tax efficiency with a higher return potential. By understanding ELSS, exploring interest rates, and following the investment process, investors can make informed decisions to capitalize on the benefits afforded by ELSS funds.

In case of any query regarding the ELSS Tax Saving Investment Plan in India, feel free to connect with our legal experts at Legal Window at 72407-51000.

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost. Our team offers expertise solutions in various fields that include Corporate Laws, Direct Taxations, GST Matters, IP Registrations and other Legal Affairs.

Categories

- Agreement Drafting (23)

- Annual Compliance (12)

- Change in Business (37)

- Company Law (149)

- Compliance (90)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (9)

- FSSAI License/Registration (14)

- GST (122)

- Hallmark Registration (1)

- Income Tax (207)

- Latest News (34)

- Miscellaneous (169)

- NBFC Registration (8)

- NGO (18)

- SEBI Registration (6)

- Section 8 Company (10)

- Start and manage a business (26)

- Startup/ Registration (133)

- Trademark Registration/IPR (48)

Recent Posts

- NGO Registration in West Bengal July 29, 2024

- Trademark Registration In Jodhpur July 22, 2024

- Trademark Registration in Agra July 15, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.