In India, individuals are focusing on the best tax-saving options or best tax-saving schemes. Tax-saving investments play an important role in the financial planning of individuals. An individual can utilize this opportunity and reduce tax liability. This article deals with Exploring the Best Tax Saving Investment options to Save Tax under 80C of the IT Act, 1961, how can an individual save 100% income tax, hidden ways to save tax, and how much investment is needed to save tax.

Contents |

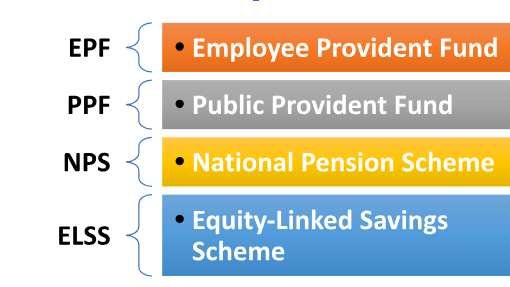

Best Tax Saving Options

- EPF: EPF is a retirement savings plan by the government that helps employees give a portion of their salary to their EPF account. Under section 80C of IT Act, 1961 the contributions to an Employee Provident Fund are tax deductible.

- PPF: The long-term investment option to save tax that provides individuals with tax benefits is PPF. Contributions made towards the Public Provident Fund are eligible for tax deductions under Section 80C, and the interest earned as well as the maturity amount are tax-free.

- NPS: NPS is a voluntary retirement savings scheme that offers tax advantages. Contributions made towards NPS are eligible for tax deductions under Section 80C, 80CCD(1), and 80CCD(2). Additionally, investing in the National Pension Scheme Tier II account for a minimum of three years qualifies for additional tax deductions under Section 80C.

- ELSS (Equity-Linked Savings Scheme): ELSS is a type of mutual fund that invests predominantly in equities, offering higher returns in the long run. Under Section 80C, of the IT Act, 1961 the contributions in ELSS are eligible for tax deductions up to a maximum of Rs. 1.5 lakhs per financial year.

Also, read: Employees Provident Fund: Understanding How EPF helps you save on Tax in India.

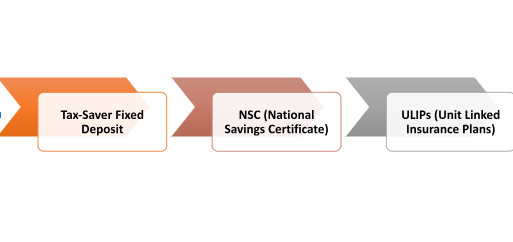

Best Tax Saving Schemes

- Tax-Saver Fixed Deposit: Several banks offer tax-saving fixed deposits (FDs) that come with a lock-in period of 5 years. Investments in tax-saver FDs are eligible for tax deductions under Section 80C.

- NSC (National Savings Certificate): NSC is a government-backed scheme that offers fixed returns over a predetermined period. Investments made in NSC are eligible for tax deductions under Section 80C, up to a maximum of Rs. 1.5 lakhs.

- ULIPs (Unit Linked Insurance Plans): ULIPs are insurance-cum-investment products that offer dual benefits of life coverage and market-linked returns. Premiums paid towards ULIPs are eligible for tax deductions under Section 80C, subject to certain conditions.

Hidden Options to Save Tax

- Health Insurance Premium: Premiums paid towards health insurance policies for self, spouse, children, and parents are eligible for tax deductions under Section 80D. Additionally, premiums paid towards health check-ups can be claimed as deductions.

- Donations: Contributions to charity institutions are tax deductible under Section 80G of IT Act, 1961.

- Home Loan: The repayment of the principal amount of a home loan is eligible for tax exemptions under Section 80C.

Also, read: Best Tax Saving Investments: A Crucial Guide for Your Tax Management

Strategies to Save 100% Income Tax

Saving 100% income tax may not be feasible due to the progressive tax structure. However, individuals can maximize their tax savings by efficiently leveraging various investment options to save tax and optimizing deductions available under different sections of the Income Tax Act.

How Much Investment is Needed to Save Tax?

The required investment to save tax varies based on an individual’s taxable income and tax slab. To save tax under Section 80C alone, an investment of up to Rs. 1.5 lakhs is necessary. However, taxpayers should carefully analyze their overall financial situation and consult professionals to determine the appropriate investment amount suited for their tax-saving goals.

Closing Remark

Saving tax is an essential aspect of financial planning, and the Indian tax structure provides numerous investment options to save tax. By considering the best tax-saving options, schemes, and hidden ways to save tax, and strategizing accordingly, individuals can significantly reduce their tax liability and secure their financial future. It is vital to conduct thorough research, consult professionals, and stay updated with changing tax laws to make informed investment decisions.

In case of any query regarding the Best Investment Options to Help Save Tax, feel free to connect with our legal experts at Legal Window at 72407-51000.

CA Pulkit Goyal, is a fellow member of the Institute of Chartered Accountants of India (ICAI) having 10 years of experience in the profession of Chartered Accountancy and thorough understanding of the corporate as well as non-corporate entities taxation system. His core area of practice is foreign company taxation which has given him an edge in analytical thinking & executing assignments with a unique perspective. He has worked as a consultant with professionally managed corporates. He has experience of writing in different areas and keep at pace with the latest changes and analyze the different implications of various provisions of the act.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (90)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (118)

- Hallmark Registration (1)

- Income Tax (200)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (21)

- Startup/ Registration (128)

- Trademark Registration/IPR (40)

Recent Posts

- Post incorporation compliances for companies in India April 30, 2024

- Startup’s Guide to Employee Stock Ownership Plans April 29, 2024

- Master Secretarial Audit: A Complete Compliance Guide April 27, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.