Understanding the main metrics to include in a pitch deck is critical for entrepreneurs seeking investment for their new ventures. A pitch deck is a presentation that comprises important information about your company and is intended to impress potential investors and secure money. You may have heard the term ‘pitch deck’ in entrepreneur groups or conventions as a new entrepreneur. If you’re putting together a pitch deck, this article will help you grasp the key metrics that will make your presentation stand out and attract potential investors to back your company.

| Table of Content |

What is a Pitch Deck?

A pitch deck, also known as a startup pitch deck, is a brief but important presentation that offers investors with important information about your company, service, or product, as well as your fundraising requirements. Key variables like as target market, valuation, financial goals, and projections are included. The finest pitch decks are visually pleasing, with simple, instructive software-generated slides. A pitch deck is a concise presentation that provides an overview of a business or startup. A well-crafted pitch deck seeks to provoke interest and support for the company, resulting in additional discussions or prospective investment opportunities.

Key elements of Pitch Deck

The following are the key elements of a pitch deck:

- Cover Slide: An enticing title and a captivating image that define your company.

- Problem Statement: Clearly explain the issue that your product or service is attempting to solve.

- Solution: Describe your solution and how it tackles the specified problem in a unique way.

- Market Opportunity: Describe the size of the market, its potential growth, and your target audience.

- Traction and Milestones: To indicate momentum, highlight any progress, successes, or major milestones.

- Business Model: Describe how your company functions, earns income, and survives.

- Marketing Strategy: Describe how you want to reach and acquire clients.

- Competitive Analysis: Identify and explain your competitors’ distinct value propositions.

- Introduce the important members of your team, their areas of expertise, and their roles in the company.

- Present your revenue model, sales estimate, and financial projections.

- Funding Requirements: Clearly indicate how much money you need and how it will be used.

- Use of cash: Describe how you intend to use the requested cash to propel growth and meet milestones.

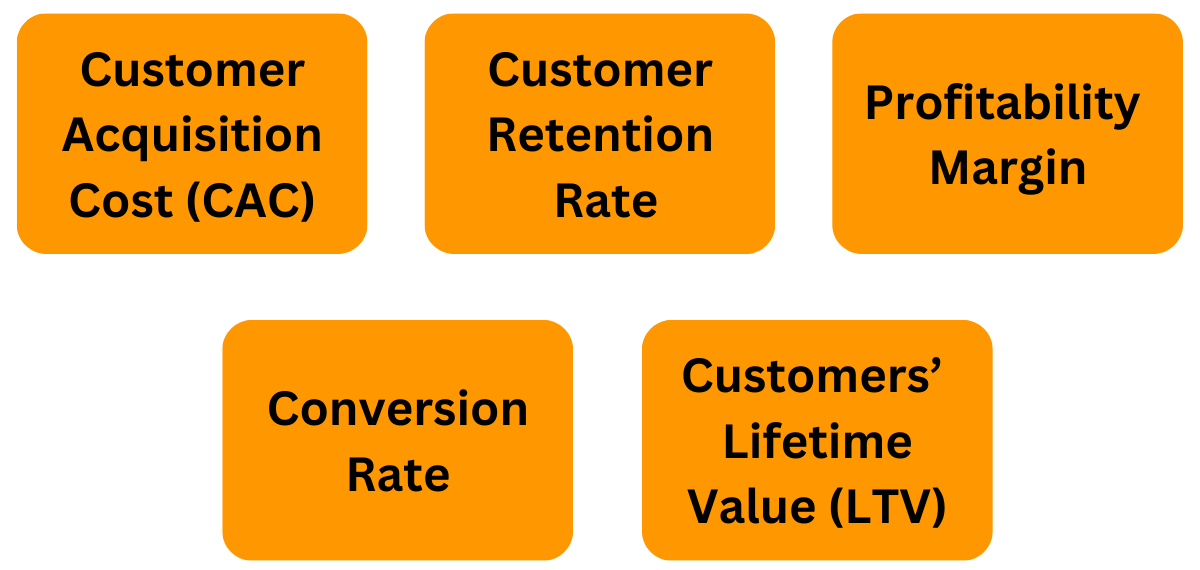

5 Key Metrics to incorporate in your Pitch Deck

Customer Acquisition Cost (CAC): How many marketing initiatives did you carry out in the previous fiscal year to increase your market share? These strategies made a major difference in your client acquisition and retention efforts. In essence, your company’s Customer Acquisition Cost (CAC) includes a variety of sales and marketing charges, such as monetary incentives, loyalty programs, promotional campaigns, and marketing spend. Investors are typically drawn to organizations with a moderate to low CAC when checking how to evaluate a pitch deck. It is critical to present thorough data illustrating the breakdown of your CAC via a strong business intelligence platform, providing a clear picture of your client acquisition techniques and associated costs.

Customer Retention Rate: While 44% of organizations prioritize customer acquisition, only 18% prioritize customer retention. Customer Retention Rate (CRR) is a vital indicator that defines how well your company performs in terms of maintaining and keeping customers active. This measure is heavily influenced by revenue analysis of repeat customers, QoQ analysis of repeat purchases, net promoter score (NPS) of your consumers, and other factors. A 5% increase in CRR can enhance a company’s profitability by up to 95%. As a result, all investors look at this indicator and want deep-dive analytics on it.

Profitability Margin: It goes without saying that any investor will look at your company’s profits before investing. What more can you do to improve your profit margin? You can work with several reports, such as Year-on-Year (YoY) analysis, compounded growth rate, product profitability matrix, and so on, to assist you break down your firm and make it more transparent to possible investors. With this level of transparency, you can easily appeal to a larger number of investors and entice them to invest in your company.

Conversion Rate: In a pitch deck, it’s critical to emphasize the conversion rate as a critical indicator for a company’s success. This rate reflects the company’s ability to sell its products and services. While the conversion rate is influenced by elements such as the company’s revenue and client cohorts, the predictive analysis of a business intelligence platform can forecast possible revenue growth and the evolution of the conversion rate over time. This data-driven research, based on past data, enables firms to make educated decisions and has the potential to attract the attention of interested investors. What to include in your pitch deck is important to understand as these insights regarding your company’s capacity to convert prospects into customers when creating a pitch deck, since they highlight the company’s growth potential and attractiveness to potential investors.

Customers’ Lifetime Value (LTV): Did your previous investor inquire about your customers’ Lifetime Value (LTV)? If this concept surprised you, you should know that investors evaluate a company’s capacity to grow the LTV of its consumers. 76% of firms think that LTV is a significant concept and use various enablers such as loyalty programs to incentivize customers with each purchase, upselling programs via coupons and promo codes, cross-branding campaigns, and so on. With a business intelligence platform, you can perform interesting analytics on the LTV and perform a cost-benefit analysis to demonstrate how long-term sustainable your firm will be.

Conclusion

Finally, a well-structured pitch deck is critical in presenting your company’s value proposition and development to potential investors. In summary, what a good pitch deck includes is important for all of the necessary materials to make a compelling argument for your company. With a well-crafted pitch deck, you increase your chances of capturing the attention and interest of potential investors, bringing you one step closer to turning your entrepreneurial dreams into reality. Experts at Legal Window may assists you regarding the understanding of components of a Pitch Deck for your Company. Contact our Experts at 072407-51000 or by email at admin@legalwindow.in.

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost. Our team offers expertise solutions in various fields that include Corporate Laws, Direct Taxations, GST Matters, IP Registrations and other Legal Affairs.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (90)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (120)

- Hallmark Registration (1)

- Income Tax (202)

- Latest News (34)

- Miscellaneous (165)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (21)

- Startup/ Registration (130)

- Trademark Registration/IPR (40)

Recent Posts

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.