The ITR-4 Form, also called Sugam, is a simple tax return form made for people and families in India who earn money from businesses or professions. It’s meant for those with a straightforward financial life, making tax filing easier. This form lets you report your business or job income, along with other earnings like salary and house property. It’s made to be easy to use, helping small taxpayers with their taxes in a smooth and simple way.

| Table of Content |

What is ITR-4 Form (Sugam)?

The ITR-4 Form, also known as Sugam, is an income tax return form in India designed for individuals and Hindu Undivided Families (HUFs) who have opted for the presumptive income scheme under Section 44AD, Section 44ADA, or Section 44AE of the Income Tax Act. It is intended for taxpayers with income from a business or profession, including small businesses and professionals with relatively straightforward financial activities. The form allows eligible persons to declare their business or profession revenue, as well as income from other sources such as wages, real estate, and other interests. It simplifies tax filing, making it easier for small taxpayers to meet their responsibilities.

Who is it for: Eligibility Criteria and Target Audience

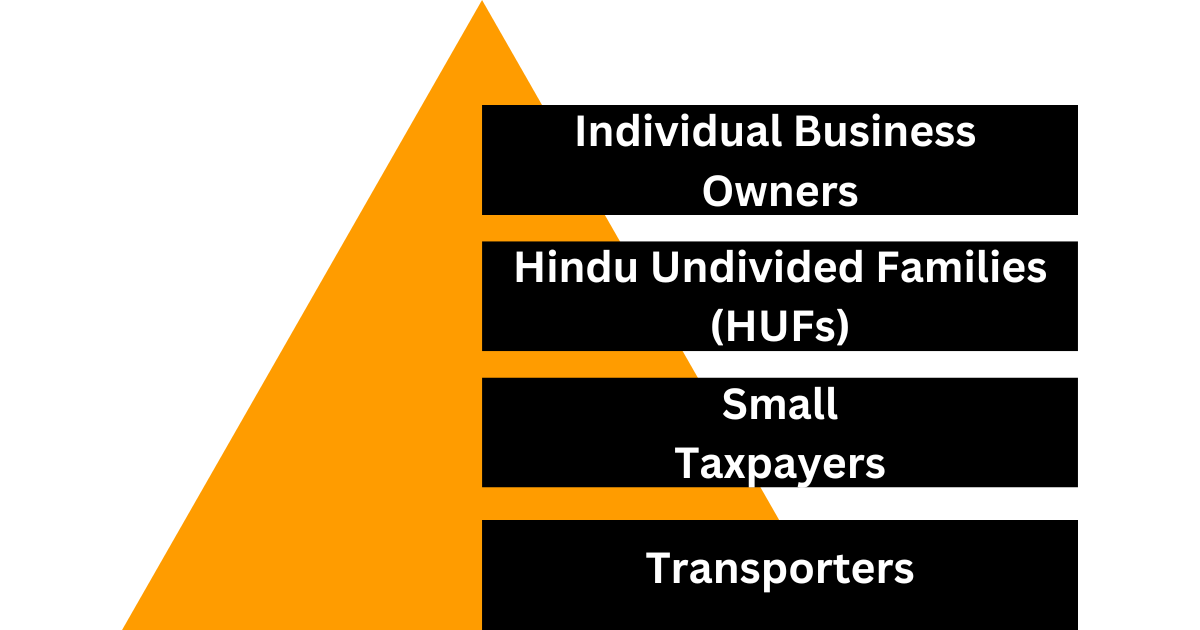

The ITR-4 Form (Sugam) in India is primarily designed for the following eligible categories of taxpayers:

- Individual Business Owners: This form is suitable for individuals who are engaged in any form of business, trade, profession, or freelance work.

- Hindu Undivided Families (HUFs): HUFs that generate income from business or profession are eligible to use ITR-4.

- Small Taxpayers: ITR-4 is especially beneficial for small taxpayers who opt for the presumptive income scheme as per Sections 44AD, 44ADA, or 44AE of the Income Tax Act. Professionals: Individuals with professions like doctors, lawyers, consultants, and other service providers who receive professional fees can use ITR-4 to report their income.

- Transporters: Those engaged in the business of plying, hiring, or leasing of goods carriages are also eligible to use ITR-4 under certain conditions.

Key Features of ITR-4 Form (Sugam)

- Simplified Tax Filing: ITR-4 Form provides a simplified approach for small taxpayers to report their income from business or profession, along with income from other sources, reducing the complexity of the tax filing process.

- Presumptive Taxation: The form allows eligible taxpayers to opt for the presumptive income scheme under Sections 44AD, 44ADA, or 44AE, simplifying the income computation process by offering a predetermined income rate without the need for extensive accounting.

- Complete Income Reporting: ITR-4 allows individuals and HUFs to disclose a variety of sources of income, such as income from a business or profession, salary, house property, and other interests, offering a complete platform for taxpayers to accurately declare their earnings.

- Designed for Small enterprises and Professionals: The form is designed to satisfy the special needs of small enterprises, professionals, and freelancers, providing them with a convenient tool to effectively meet their tax obligations.

- Ease of Compliance: With clear section-wise instructions and guidelines, ITR-4 Form ensures ease of compliance for taxpayers, minimizing the possibility of errors and facilitating a smooth and hassle-free tax filing experience.

- Flexibility and Accessibility: The form is easily accessible online and through offline modes, allowing taxpayers to choose a filing method that best suits their preferences and convenience, further enhancing the accessibility of the tax filing process.

Step-by-Step Guide to Filling ITR-4 Form

Certainly, here’s a step-by-step guide to filing ITR-4 (Sugam) online:

- Registration: Visit the official income tax e-filing portal and register yourself using your Permanent Account Number (PAN).

- Download Form: Download the latest ITR-4 (Sugam) form and the corresponding utilities from the portal.

- Gather Documents: Collect all necessary documents, including bank statements, TDS certificates, and any other relevant financial records.

- Fill in Personal Details: Begin by entering your personal details, such as name, PAN, and contact information, in the designated sections of the form.

- Report Income Details: Provide accurate details of your income from business or profession, salary, house property, and other sources as required in the form.

- Utilize Presumptive Scheme: If applicable, take advantage of the presumptive income scheme under Sections 44AD, 44ADA, or 44AE, and fill in the relevant sections accordingly.

- Claim Deductions: Make use of eligible deductions under various sections of the Income Tax Act to reduce your taxable income and compute the total tax payable accordingly.

- Verify Information: Ensure all information provided is accurate and double-check the form for any errors or discrepancies.

- File ITR-4 (Sugam) Online: After verifying the details, proceed to the e-filing portal and select the option to upload the filled ITR-4 form. Follow the instructions to complete the submission process.

- Complete Verification: Complete the verification process using the Electronic Verification Code (EVC), Aadhaar OTP, or Digital Signature Certificate (DSC) to authenticate the filing.

- Acknowledgment: Upon successful submission, download and save the acknowledgment receipt for future reference and record-keeping purposes.

By following these steps, you can easily file ITR-4 (Sugam) online and ensure a smooth and efficient tax filing experience. In case of any query regarding Income Tax Return (ITR) Forms, feel free to connect with our legal experts at Legal Window at 72407-51000.

Tips for Optimizing Tax Returns Using ITR-4 Form

Certainly, here are some tips for optimizing tax returns using the ITR-4 Form (Sugam):

- Maximizing Deductions: Take advantage of all available deductions under various sections of the Income Tax Act, such as Section 80C, 80D, and 80G, to minimize your taxable income and maximize tax savings.

- Maintain Accurate Records: Keep detailed and accurate records of all your business expenses, receipts, and invoices to ensure that you can claim legitimate deductions and comply with tax regulations effectively.

- Leverage Presumptive Scheme: Understand the provisions of the presumptive income scheme thoroughly and assess whether opting for it would be beneficial for your business, as it can simplify the income computation process and reduce the burden of maintaining detailed accounts.

- Timely Compliance: Adhere to all tax filing deadlines and comply with the necessary tax regulations to avoid penalties and interest charges, ensuring timely submission of your ITR-4 Form to the income tax department.

- Seek Professional Guidance: Consult a tax advisor or a chartered accountant to gain insights into effective tax planning strategies and to ensure that you are maximizing your tax benefits within the legal framework.

- Maintain Separate Bank Accounts: Maintain separate bank accounts for personal and business finances to facilitate accurate tracking of business income and expenses, thereby simplifying the process of reporting income in the ITR-4 Form.

By implementing these tips, you can optimize your tax returns effectively using the ITR-4 Form, ensuring that you take full advantage of available deductions and provisions while complying with the tax laws in India.

Conclusion

Finally, the ITR-4 Form (Sugam) is a useful tool for small business owners, professionals, and Hindu Undivided Families (HUFs) in India, simplifying the procedure of filing income tax returns. Its simplified approach, along with provisions for presumptive income and comprehensive income reporting, provides taxpayers with a straightforward and effective way to meet their tax obligations. Individuals can optimize their tax returns and ensure a smooth and hassle-free tax filing experience by leveraging the form’s key features and following to best practices such as accurate record-keeping and timely compliance. This contributes to effective financial planning and compliance with tax regulations.

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost. Our team offers expertise solutions in various fields that include Corporate Laws, Direct Taxations, GST Matters, IP Registrations and other Legal Affairs.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (90)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (118)

- Hallmark Registration (1)

- Income Tax (200)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (21)

- Startup/ Registration (128)

- Trademark Registration/IPR (40)

Recent Posts

- Post incorporation compliances for companies in India April 30, 2024

- Startup’s Guide to Employee Stock Ownership Plans April 29, 2024

- Master Secretarial Audit: A Complete Compliance Guide April 27, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.