Section 80C of the IT Act, 1961 gives taxpayers a variety of deductions to reduce their taxable income. This article aims to provide an understanding of Section 80C, its legal applications, provisions, and the various investments and expenses that qualify for tax deductions under this section. It also highlights the maximum deduction limit, the 80C exemption list, and the potential tax savings under 80C that can be achieved by utilizing these provisions effectively. In this blog we’ll discuss about Section 80C Deduction Under Income Tax

Contents

Section 80C of the IT Act, 1961

Section 80C of the IT Act, 1961, helps taxpayers to claim deductions from their gross taxable income up to a maximum limit of Rs. 1.5 lakhs (as of the financial year 2021-22). It focuses on encouraging individuals to make investments in specified financial instruments and expenses that promote long-term savings.

The deduction under section 80C applies to individuals and Hindu Undivided Families (HUFs) and is subject to meeting specific conditions and investment limits.

80C Deduction Limit and Eligible Investments

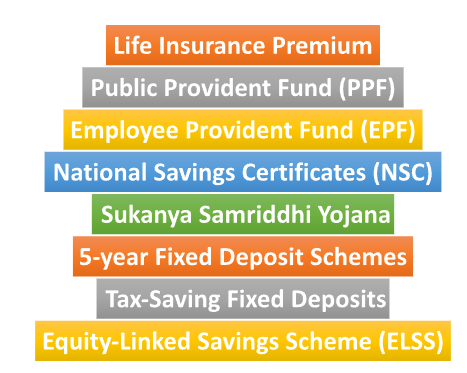

The provision of section 80C offers a wide range of eligible investments, allowing taxpayers to choose based on their financial goals, risk appetite, and desired investment tenure. The following are some of the popular 80C deduction lists and are considered investments under 80C:

- Life Insurance Premium: Premiums paid towards life insurance policies, involving those issued by LIC (Life Insurance Corporation) or other private insurers, are eligible for deductions under section 80C of the IT Act, 1961.

- Public Provident Fund (PPF): Under section 80C of the IT Act, 1961 PPF is a long-term government-backed savings scheme that allows individuals to get tax benefits. Individuals can contribute to their PPF accounts and claim deductions on the amount invested, subject to the maximum 80C limit.

- Employee Provident Fund (EPF): Contributions made by employees towards their EPF accounts are eligible for deductions under section 80C. This includes both the employee’s contribution and the employer’s contribution.

- National Savings Certificates (NSC): Investments made in NSCs, issued by the government, qualify for 80C deductions. The interest accrued on NSCs is taxable, but the investment amount and interest for the initial five years are eligible for deductions.

- Sukanya Samriddhi Yojana: Investments made under this Sukanya Samridhi Yojana specifically designed for the girl child can also be claimed for deductions under section 80C.

- 5-year Fixed Deposit Schemes: Some banks offer special fixed deposit schemes with a lock-in period of five years that provide tax benefits under section 80C.

- Tax-Saving Fixed Deposits: Certain banks offer fixed deposit schemes specifically designed for tax savings under 80C, and investment up to the maximum 80C limit is eligible for deductions.

- Equity-Linked Savings Scheme (ELSS): ELSS is a type of mutual fund that predominantly invests in equities. Investments made in ELSS qualify for deductions under section 80C.

Also, read: Exploring Tax Saving Options Other than Section 80C of the Income Tax Act, 1961

80C Exemption List and Other Eligible Expenses

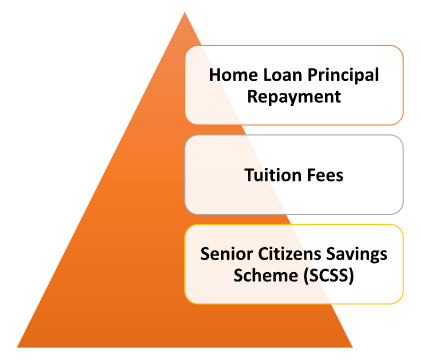

Apart from the aforementioned investment avenues, certain eligible expenses also qualify for exemptions under section 80C. These include:

- Home Loan Principal Repayment: The principal component of Equated Monthly Installment (EMI) paid towards a home loan is eligible for exemptions under Section 80C.

- Tuition Fees: Payments made towards the education of up to two children for full-time courses in recognized educational institutions can be claimed under section 80C.

- Senior Citizens Savings Scheme (SCSS): Investments made in the SCSS, designed for senior citizens, also provide deductions under section 80C.

Maximizing Tax Savings under Section 80C

To maximize Section 80C tax deduction, individuals are advised to analyze their financial goals, risk appetite, and investment horizon carefully. Diversification across various eligible investments helps to balance risk and optimize returns, ensuring tax efficiency.

Also, read: Income Tax Deduction under section 80CCC in India

Winding Up Note

Section 80C of the Income Tax Act provides taxpayers with a substantial opportunity to reduce their tax liability through a multitude of eligible investments and expenses. By carefully selecting from the 80C deduction list and making informed investment decisions, individuals can maximize tax savings and secure their long-term financial future.

In case of any query regarding Section 80C Deduction Under the Income Tax Act, 1961, feel free to connect with our legal experts at Legal Window at 72407-51000.

CA Pulkit Goyal, is a fellow member of the Institute of Chartered Accountants of India (ICAI) having 10 years of experience in the profession of Chartered Accountancy and thorough understanding of the corporate as well as non-corporate entities taxation system. His core area of practice is foreign company taxation which has given him an edge in analytical thinking & executing assignments with a unique perspective. He has worked as a consultant with professionally managed corporates. He has experience of writing in different areas and keep at pace with the latest changes and analyze the different implications of various provisions of the act.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (89)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (118)

- Hallmark Registration (1)

- Income Tax (199)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (21)

- Startup/ Registration (128)

- Trademark Registration/IPR (40)

Recent Posts

- Startup’s Guide to Employee Stock Ownership Plans April 29, 2024

- Master Secretarial Audit: A Complete Compliance Guide April 27, 2024

- Farmer Producer Companies-Major provisions under Companies Act April 26, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.