The Income Tax for NRI: A Comprehensive Guide Act, of 1961, a cornerstone of India’s tax legislation, governs the taxation of individuals and entities within the country. One distinct category of taxpayers covered by this Act is Non-Resident Indians (NRIs). NRIs are individuals who reside abroad but have financial ties to India, such as income sources, investments, and assets. The taxation of NRIs is subject to specific provisions outlined in the Act, ensuring a fair and efficient system that both promotes investment and generates revenue for the Indian government. In this article, we will discuss Income Tax for NRI: A Comprehensive Guide in India and we will into the NRI Tax Slab, prevailing in the country.

Let us first have some basic understanding regarding the Non-Resident Indian or NRI and their residential status as per prevailing statutes in the country. Before we move on to discuss Income Tax for NRIs: A Comprehensive Guidein India.

Non Resident Indian or NRI

Under FEMA and the Income Tax Act, of 1961, every person residing outside of India is classified as an NRI. If a person spends more than 182 days in India in a fiscal year, he or she is deemed a resident. In contrast, an NRI is someone who:

Has been gone from India or will be absent from India for the following reasons:

- Work in a country other than India

- Operating a business or pursuing a career outside of India

- Circumstances indicating the individual’s wish to remain outside of India indefinitely

In any case, a person who has immigrated to or lives in India who is not:

- India Job Opportunities

- Having a business or profession in India

- Factors indicating the individual’s willingness to remain in India indefinitely.

Other Factors:

- Individuals or companies formed or registered in India.

- A person residing outside of India owns or controls an office, agency, or branch in India.

- A person residing in India owns or controls an office, agency, or branch located outside of India.

- In this case, a person who has been to or remained in India.

Although FEMA defines the term as any number of days above 182, the Income Tax Act, of 1961 specifies that the absence must be for at least 182 days to qualify as an NRI.

Income Tax for NRI in India

Both citizens and non-residents of India are subject to the country’s income tax rules. Income Tax for NRI: A Comprehensive Guide (Non-Resident Indians) is based on their residency status, or whether they are regarded as residents or non-residents for income tax reasons.

An NRI is required to pay income tax in India if their total income, which includes money generated both in and outside of India, is greater than the basic exemption ceiling of INR 2.5 lakh (for the financial year 2022-23). NRIs are only subject to taxation on income generated or received in India, nevertheless. Even if it is sent to India, income generated outside of India is not subject to taxation there.

NRIs pay the same amount in taxes as residents do. However, there are distinct guidelines for determining an NRI’s taxable income. Deductions under Section 80C (for investments in specific instruments like PPF, NSC, etc.) or Section 80D (for payment of medical insurance premiums), for example, are not accessible to NRIs but are to residents.

Eligibility for Income Tax for NRI

An NRI must file an income tax return if their taxable income in India for the year exceeded the basic exemption limit or if they realized short- or long-term capital gains from the sale of any investments or assets located there, even if the gains were below the basic exemption limit. If the tax withheld at source exceeds the amount of the actual tax burden, he or she may also submit a tax return to request a refund.

Additionally, the person can be qualified for a refund if they sustain a capital loss that can be adjusted against capital gains. It should be highlighted that only locals—not NRIs—are subject to the higher exemption limit for women and senior people.

Do All NRIs Need to File Taxes before the Income tax due date?

NRIs must file an income tax return in India if they have taxable income there. An NRI who owns a home in India and receives rental income, for instance, would be required to file an income tax return if the rental income exceeded the exemption threshold. Taxes are due by NRIs on the following types of income: Income Tax for NRI: A Comprehensive Guide.

- Any income produced from or earned in India

- Any revenue deemed to have accrued or originated in India is also included.

- Additionally, any income earned in India

- Any revenue said to have originated from India

Furthermore, only if a return of income for the year of the loss is submitted may losses from one fiscal year be carried forward and offset against revenue from succeeding fiscal years. Last but not least, late returns are subject to a 1% monthly penalty interest charge on the tax payable. Additionally, a Rs 5,000 fine may be applied if the return is not submitted within a year of the appropriate fiscal year’s end. NRIs must thus submit their Income Tax Returns on time.

Benefits of Filing NRI Income Tax Return as per Income Tax Act, 1961

The following are the benefits of filing of Income Tax Return that NRI could get as per the Income Tax Act, of 1961:

- Legal Compliance: The most apparent advantage of filing NRI income tax returns is adhering to the law. The Income Tax Act, of 1961 mandates that NRIs should file their tax returns if their total income in India exceeds the threshold limit. Complying with this legal obligation ensures that NRIs are on the right side of the law and helps avoid any unnecessary legal complications.

- Claiming Refunds: NRIs may have tax deductions or withholding taxes on their income sources in India, such as interest on savings, fixed deposits, or rental income. Filing income tax returns allows them to claim refunds on excess taxes withheld or paid, which can be substantial. This can help NRIs optimize their tax liability and maximize their financial returns.

- Avoiding Penalties: Failure to file income tax returns within the stipulated time frame can lead to penalties and fines. By filing their tax returns on time, NRIs can avoid these penalties and maintain a clean financial record.

- Establishing Financial Identity: Regularly filing income tax returns establishes a credible financial identity for NRIs in India. This can be beneficial when applying for loans, credit cards, or other financial services. A consistent tax filing history can enhance an NRI’s financial reputation and credibility.

- Proof of Income: NRI income tax returns serve as documentary proof of income earned in India. This documentation can be valuable for various purposes, such as visa applications, loan approvals, property purchases, and more. Having an official record of income can simplify these processes and provide transparency to the authorities.

- Compliance with Double Taxation Avoidance Agreements (DTAA): India has signed Double Taxation Avoidance Agreements with several countries to prevent the double taxation of income earned by NRIs. Filing Income Tax for NRI: A Comprehensive Guide income tax returns is often a requirement to avail the benefits of these agreements, which can significantly reduce the tax liability of NRIs.

NRI Tax Slab in India as per Income Tax Act, 1961

NRIs are subject to a different tax slab compared to residents. Here is an overview of the NRI Tax Slab for the assessment year 2023- 24:

| Income Tax Slab | Tax Rate |

| Below 2.5 Lakhs | No Tax |

| 2.5 Lakhs – 5.0 Lakhs | 5% |

| 5.0 Lakhs – 7.5 Lakhs | 10% |

| 7.5 Lakhs – 10.0 Lakhs | 15% |

| 10.0 Lakhs – 12.5 Lakhs | 20% |

| 12.5 Lakhs – 15.0 Lakhs | 25% |

| Above 15 Lakhs | 30% |

Income tax rules for NRI : Deductions and Exemptions Available to NRI’s in India

The following are Deductions and Exemptions Available to Income Tax for NRI: A Comprehensive Guide NRIs in India as per the Income Tax Act, of 1961:

Exemptions Available to NRIs

The following are the Exemptions:

- Income Not Liable to Tax: NRIs enjoy exemptions on certain types of income earned abroad. Income like foreign dividends, interest, long-term capital gains from the sale of specified assets, and gifts received from relatives are generally not taxable for NRIs.

- Double Taxation Relief: India has Double Taxation Avoidance Agreements (DTAAs) with many countries. These agreements ensure that an NRI does not end up paying taxes on the same income in both India and their resident country. NRIs can claim relief under the DTAA provisions.

Deductions Available to NRIs

The following are the Deductions:

- Section 80C: NRIs can claim deductions under this section for investments made in specified instruments such as Public Provident Fund (PPF), National Savings Certificates (NSC), Tax-saving Fixed Deposits, and Equity-Linked Savings Schemes (ELSS), subject to an overall limit of ₹1.5 lakh.

- Section 80D: NRIs can avail deductions for health insurance premiums paid for themselves, spouse, children, and parents. The deduction limit varies based on the age of the insured and the coverage taken.

- Section 80E: NRIs can claim deductions for the interest paid on education loans for higher studies, including those taken for themselves, their spouse, children, or a student for whom they are a legal guardian.

- Section 24(b): NRIs can claim a deduction of up to ₹2 lakh on the interest paid on a housing loan for a property situated in India, provided the loan is used for purchase, construction, repair, or reconstruction of the property.

- Section 10(14): NRIs can avail certain exemptions on allowances such as house rent allowance (HRA) received from an Indian employer, subject to conditions.

NRIs and Capital Gains Tax

NRIs need to be aware of the tax implications related to the sale of assets in India. Long-term capital gains on the sale of specified assets like equity shares and equity-oriented mutual funds are exempt from tax. However, short-term capital gains are taxed at a flat rate of 15%.

TDS (Tax Deducted at Source) for NRIs

TDS is a mechanism to collect tax at the source of income. NRIs must be mindful of TDS provisions on various income streams such as rent, interest, and capital gains. They can avail the benefit of lower or nil TDS rates under DTAA.

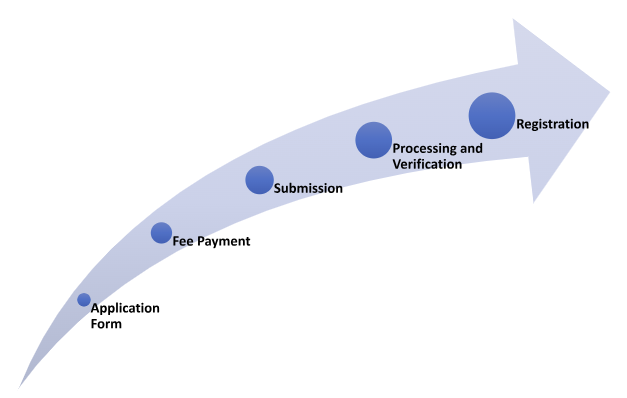

Procedure for NRI ITR Filing in India as per Income Tax Act, 1961

The following is the procedure to file an NRI Income Tax Return:

- Determine Residential Status: Before proceeding with filing the income tax return, an NRI must determine their residential status for the financial year. The Act categorizes individuals as resident, non-resident, or resident but not ordinarily resident based on the number of days spent in India during the financial year and preceding years. NRIs need to be aware of this classification as it impacts their tax liability in India.

- Select the Appropriate ITR Form: NRIs need to choose the correct Income Tax Return (ITR) form based on their sources of income. The forms are categorized according to the nature of income, such as salary, house property, business/profession, capital gains, and others. The Central Board of Direct Taxes (CBDT) typically releases these forms before the beginning of each assessment year.

- Report Income from Various Sources: NRIs are required to report all income earned or received in India, such as rent from property, interest income, capital gains from asset sales, and any other taxable income. However, income earned outside India is generally not taxable in India for NRIs. Income that is subject to Tax Deducted at Source (TDS) should be reconciled with Form 26AS, which is a consolidated statement of TDS.

- Claim Deductions and Exemptions: NRIs can claim deductions and exemptions as per the Income Tax Act, similar to resident Indians. Deductions under sections like 80C (investment in specified instruments), 80D (health insurance premium), and 10(14) (house rent allowance) can help reduce taxable income.

- Taxation of Investment Gains: NRIs need to be aware of the tax implications on various investments, including equity shares, mutual funds, and real estate. Capital gains earned from the sale of assets may attract tax, and different rates apply depending on the holding period and type of asset.

- File the Income Tax Return: Once all the necessary information is gathered and computations are made, NRIs can proceed to file their income tax returns. The returns can be filed electronically through the official Income Tax Department website or via authorized intermediaries. It’s essential to keep all relevant documents, such as Form 16/16A (TDS certificates), bank statements, and investment proofs, handy during the filing process.

- Verify and Authenticate: After filing the return, it needs to be verified. NRIs can choose to e-verify the return using methods such as net banking, Aadhaar OTP, or a physical signed copy sent to the Centralized Processing Center (CPC) in Bengaluru, India.

- Addressing Refunds: In cases where excess tax has been deducted at source, NRIs can claim a refund by filing the income tax return. The refund can be credited directly to their bank account, or they can opt for a physical refund check.

- Compliance with Double Taxation Avoidance Agreements (DTAA): NRIs residing in countries that have a DTAA with India can take advantage of provisions in the agreement to avoid double taxation. They can claim tax relief or exemption based on the specific terms of the agreement.

- Maintain Proper Documentation: NRIs should maintain thorough documentation of all financial transactions, income sources, and tax-related documents. This documentation is crucial in case of any future audits or assessments by the tax authorities.

Way Forward

Navigating the complexities of non-resident Indian income tax returns requires a solid understanding of the rules, regulations, and benefits available. Compliance with tax obligations not only ensures adherence to the law but also enables NRIs to manage their finances effectively. As the global economy continues to evolve, NRIs play an integral role in contributing to India’s growth while maintaining their connections across borders. Therefore, staying informed about income tax regulations is crucial for NRIs to make informed financial decisions and achieve their goals.

CA Pulkit Goyal, is a fellow member of the Institute of Chartered Accountants of India (ICAI) having 10 years of experience in the profession of Chartered Accountancy and thorough understanding of the corporate as well as non-corporate entities taxation system. His core area of practice is foreign company taxation which has given him an edge in analytical thinking & executing assignments with a unique perspective. He has worked as a consultant with professionally managed corporates. He has experience of writing in different areas and keep at pace with the latest changes and analyze the different implications of various provisions of the act.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (90)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (118)

- Hallmark Registration (1)

- Income Tax (200)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (21)

- Startup/ Registration (130)

- Trademark Registration/IPR (40)

Recent Posts

- NGO Darpan Registration in Jaipur May 2, 2024

- Registration of Charges with ROC May 1, 2024

- Post incorporation compliances for companies in India April 30, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.