If you are an entrepreneur seeking a chance to expand your business globally, you are in the right place. IEC Code is key to a world of opportunity having so much to offer. An Importer-Exporter Code or an IEC is a unique identification number issued by the government to enable seamless import and export transactions. With an IEC code, you can break into international markets, gain access to global suppliers, and helps to reach your products worldwide. If any business wishes to start its import or export business in India will require an Import Export Code (IEC). Importers will not be able to import commodities unless they have an Import Export Code, and exporters will not be able to apply for export benefits from the Director General of Foreign Trade. In this article, we will discuss the benefits of the IEC Code.

| Table of Contents |

What is an Import Export Code?

Importer Exporter Code (IEC) is obtained by a business entity for the import of goods into India or the export of goods from India for business. IEC code registration is used under the Foreign Trade (Development and Regulation) Act of 1992. It is issued by the authority of the Directorate General of Foreign Trade (DGFT) as a 10-digit unique number. The IEC certificate is the primary document for the trade of import and export nature.

Any business entity including natural persons can apply for registration for import or export from India. The IEC is granted lifetime validity i.e. till the existence of the business. Application for IEC code registration is submitted IEC code online at DGFT along with the necessary documents.

What are the benefits of the IEC Code?

Now one must be wondering about the benefits of the IEC Code has to offer. Below are the points to help you understand the benefits of the IEC code.

- Easy registration process: The Directorate General of Foreign Trade (DGFT) has started the IEC code online registration process. Organizations that are both registered and unregistered can apply for a permit and receive a code within 10 working days. If you have registered for GST, you don’t need to worry about another IEC code.

- Enables access to government schemes: Benefits in the form of subsidies or otherwise declared by the agencies would be available to business organizations having IEC Code. Exporters can carry out tax-free exports after registering a written undertaking under GST. If taxes are paid on the export, the exporter is entitled to a refund of the amount paid in taxes.

- Facilitates Import and Export Transactions: The IEC Code streamlines import and export processes, ensuring smooth customs clearance and compliance with legal requirements. It simplifies documentation and reduces bureaucratic hurdles, making international trade more efficient.

- Access to global markets: IEC Code allows you to reach a wider range of countries and expand your global reach. It will also significantly speed up your growth. It opens up a world of possibilities for both your company and you.

- No annual maintenance requirement: There are no monthly or annual maintenance costs after obtaining import and export codes. Registration is non-transferable and valid for the entire life of your company. As a result, there is no need to set any reminders for submitting and renewing the IEC Code.

- PAN-based registration: The code is generated using the permanent account number of the business organization. As a result, registration is not required based on the location of the business; rather, one business organization can register only once. Registration is canceled or surrendered upon dissolution of the enterprise.

- Builds Credibility and Trust: Possessing an IEC Code enhances a business’s credibility and trustworthiness in the eyes of international partners, suppliers, and customers. It demonstrates the company’s commitment to adhere to legal and regulatory norms, fostering confidence, and fostering fruitful business relationships.

Need for Import Export Code

Below are the situations in which importers and exporters will require an import and export code:

- When importers have to clear their shipments through customs, the customs authorities will ask the importer for an import and export code.

- When funds are sent overseas through banks, the bank asks the importer for an Import Export Code.

- When exporters have to ship their shipments, the customs port will ask the exporter for an import and export code.

- When exporters are paid in foreign currency and the money is transferred directly to the exporter’s bank account, the bank asks the exporter for an Import Export Code.

Documents required for IEC Registration

To register an import export code, you will need the following documents:

- Copy of PAN card of company or firm or owner.

- A copy of the passport or Aadhaar card or voter ID card of the individual.

- A copy of the canceled check of the current bank account of the firm or company or owner.

- Copy of electricity bill or rental agreement.

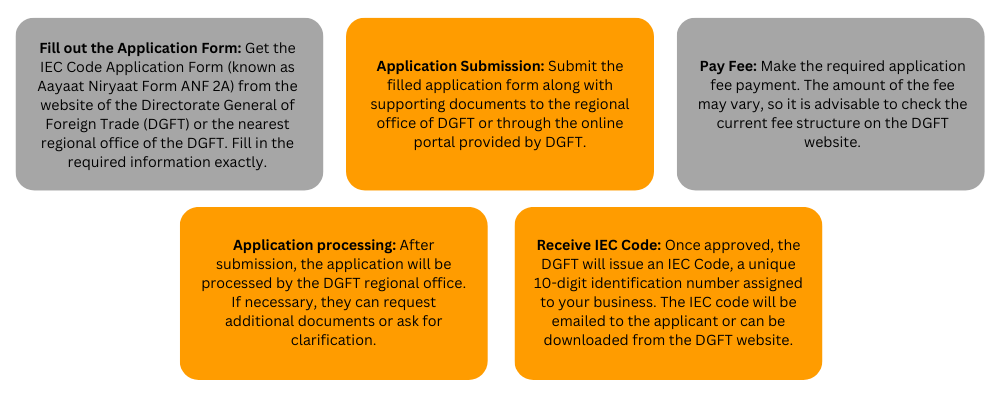

Application Process to Obtain IEC Code

When is it not mandatory to have an Import and Export Code?

The Government of India has recently issued a circular making import and export codes not mandatory for GST (Goods and Services Tax) registered traders. If the trader is registered under GST, his PAN number will be used as his new import and export code for import and export purposes. An Import Export Code will not be required if the goods being imported or exported are not for commercial purposes but for personal purposes. Imports or exports carried out by Government of India Ministries and Departments or notified charitable institutions will not require an Import Export Code.

Business owners who want to expand their business to global markets can register with Import Export Code and gain access to a wider audience.

Final words

The Importer-Exporter Code (IEC) is an indispensable tool for entrepreneurs aiming to expand their businesses globally. It unlocks the potential of international markets, grants access to global suppliers, and enables businesses to showcase their products worldwide. By obtaining and maintaining an IEC Code, entrepreneurs can navigate the complexities of international trade with ease and position their businesses for success on the global stage. So, if you aspire to take your business to new heights, embrace the IEC Code and embark on a journey of international growth.

In case of any query regarding the IEC Code, a team of expert advisors from Legal Window is here to assist you at every step. Feel free to reach us at admin@legalwindow.in.

CS Urvashi Jain is an associate member of the Institute of Company Secretaries of India. Her expertise, inter-alia, is in regulatory approvals, licenses, registrations for any organization set up in India. She posse’s good exposure to compliance management system, legal due diligence, drafting and vetting of various legal agreements. She has good command in drafting manuals, blogs, guides, interpretations and providing opinions on the different core areas of companies act, intellectual properties and taxation.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (90)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (119)

- Hallmark Registration (1)

- Income Tax (201)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (21)

- Startup/ Registration (130)

- Trademark Registration/IPR (40)

Recent Posts

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.