Are you a business owner and want to know How To File GSTR 3B Don’t worry; we are here to help! Filling out GSTR 3B is a basic task for every registered business in India. It is a simple process that allows you to report a monthly summary of sales and purchases to the Goods and Services Tax (GST) department. By filing GSTR 3B accurately and on time, you will stay compliant with GST regulations. So, let’s explore How To File GSTR 3B easily and efficiently!

| Table of Content |

Overview

The introduction of the GST regime has successfully removed the cascading effect of taxation and simplified the overall process. Since its introduction, several GST return forms have been introduced for specific purposes. GSTR-3B is one such vital return form and knowing how to file GSTR 3B is also very vital and crucial.

To benefit from the same and avoid the related consequences, taxpayers need to know more about how to file GSTR 3B and other important aspects.

What is GSTR -3B?

GSTR-3B is filled out by registered corporations as a monthly self-declaration alongside GSTR 1 and GSTR 2 forms. It is a consolidated summary of inward and outward supplies introduced by the Government of India to provide relief to businesses that have switched to the GST regime.

In other words, knowing how to file GSTR -3B helps to declare the total of GST liabilities for a given tax period. It should be noted that GSTR-3B cannot be changed, and sellers have to file a separate GSTR-3B for each of their GSTINs. They must take care to pay the tax liability of GSTR-3B by the last date for filing GSTR-3B for the same month.

Contents of a GSTR-3B

Following are the tabs of GSTR-3B which contains various information:

- Tab 1: Tax on incoming supplies and transfer of tax liability: Details of outbound supplies (sales) of regular taxable sales, zero-rated sales, and exempt sales should be given. In this tab, external supplies outside of GST and incoming supplies (purchases) that are subject to the transfer of tax obligations should also be reported.

- Tab 2: Interstate deliveries: Interstate supplies to unregistered persons and composition dealers must be reported.

- Tab 3: Eligible ITC

ITC Availed: ITC on import of goods, import of services, ITC under the reverse charge mechanism, general ITC on taxable purchases

ITC Reversed: Any ineligible claim or payment must be reported, and the same will be deducted to arrive at the net eligible ITC. - Tab 4: Exempt, nil, and non-GST inbound supplies: Non-GST, nil-GST, or GST-exempt domestic and interstate purchases are reported separately.

- Tab 5: Interest and late fees: Any delay in filing your return or failure to pay GST in previous months will result in interest and late fees being paid; these are auto-populated details.

- Tab 6: Tax payment: This is the most fundamental part, where all the data given in all the previous cards will be combined to calculate the actual tax liability of the taxpayer. Initial ITC, current month’s ITC, and tax liability are all calculated, and the tax amount is paid in this tab.

Prerequisites on how to file a GSTR -3B

- Any corporation liable to file the monthly returns GSTR-1, GSTR-2, and GSTR-3 should submit Form GSTR-3B.

- Form GSTR-3B can be easily filled out online through the GSTN portal. The tax due can be paid through challans in banks or through online payment.

- You either need an OTP from your registered phone to verify your return using an EVC (Electronic Verification Code) or a Digital Signature Certificate (Class 2 or higher). You can also file your GST return using an Aadhar-based e-sign.

How to file GSTR-3B in GST portal?

To file GSTR-3B, you need to do the following steps:

- Login to the GST Portal: Visit the official Goods and Services Tax (GST) portal and login using your credentials (GSTIN, username, and password).

- Access to Form GSTR-3B: Once you log in, you will find the ‘Services’ tab in your dashboard. Click on it and select “Return”. Select the Returned Items Panel from the drop-down menu.

- Select Tax Period: On the Return Panel page, select the relevant tax period for which you want to file GSTR-3B. Click the “Prepare Online” button.

- Fill in the details: On the GSTR-3B form, you have to provide various details related to your business transactions and tax liability.

Some of the key sections include:

- Part I: Basic Details: Verify your business name, GSTIN, and the period for which you are filing the return.

- Part II: Details of outbound supplies and inward supplies subject to remittance: Provide details of outbound supplies, including taxable supplies, exports, exempt supplies, and non-GST supplies. Also list the incoming supplies subject to the transfer of tax liability.

- Part III: Details of the Input Tax Credit (ITC): Provide details of eligible ITCs for inbound supplies, including imports and inbound supplies subject to remittance.

- Part IV: Payment of Tax: Calculate the tax liability and enter the details of the tax payable along with the tax already paid in cash or through ITC.

- Part V: Credit of TDS/TCS: Provide details of the credit for tax deducted at source (TDS) and tax collected at source (TCS), if applicable.

- Preview and save the form: Once you have filled in all the relevant information, click the “Preview” button to check the form. If you find any errors, correct them before continuing.

- Form Submission: After checking the form, click on the “Submit” button to file the GSTR-3B return. After submission, you will receive a confirmation with a unique reference number.

- Pay your tax: After submitting, you will be redirected to the payment page. Pay your tax liability using available payment options like internet banking, debit cards, credit cards, or over-the-counter payment modes.

- File your return using DSC or EVC: After successful payment, you can choose to file your return using a digital signature certificate (DSC) or an electronic verification code (EVC). Select the appropriate option and complete the submission process.

- Confirmation and Filling: After filing the return, you will receive confirmation of the successful filing of GSTR-3B. It is recommended to download and save the receipt for future reference.

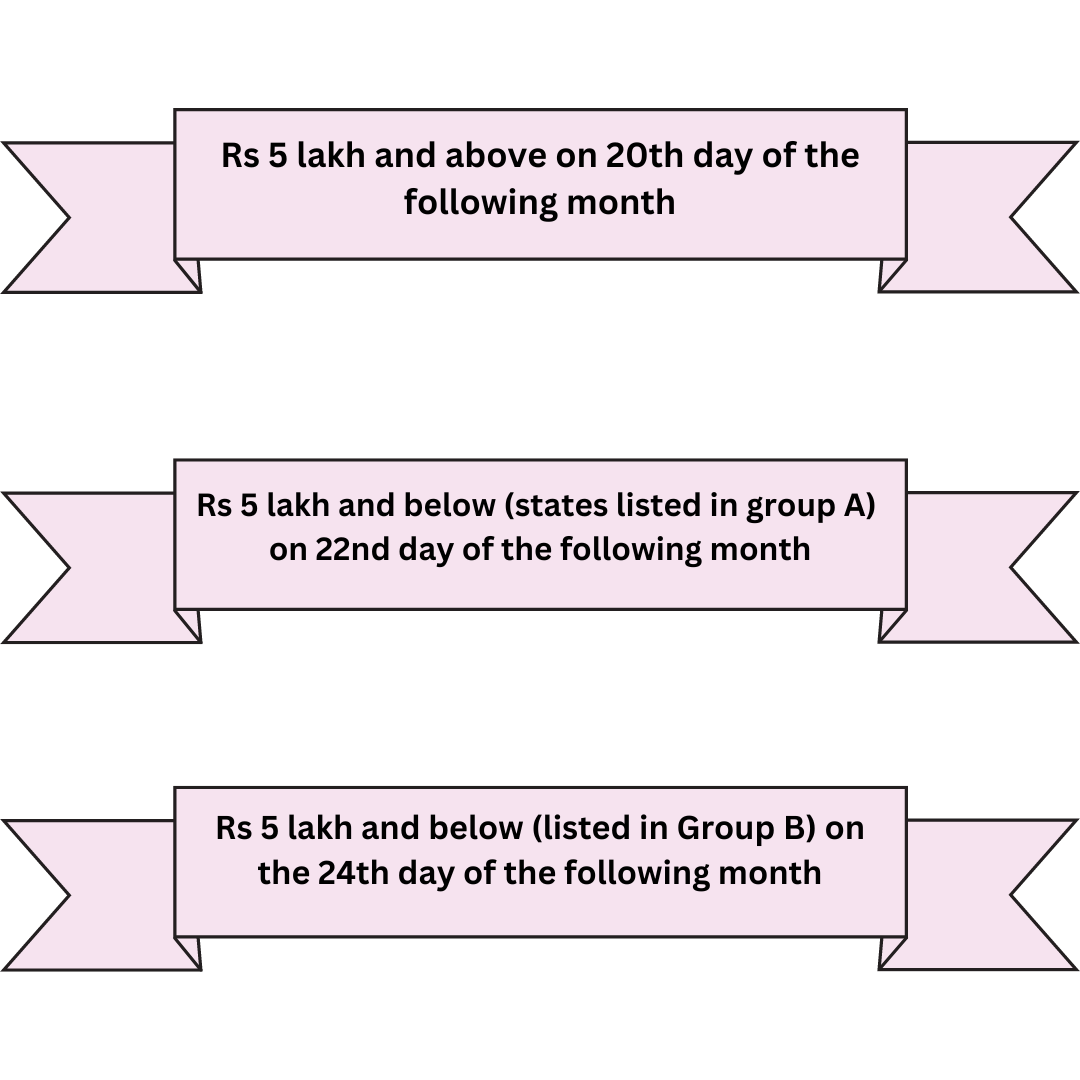

Last date for filling GSTR-3B

The filing date of the GSTR 3B return is notified as the 20th day of the month following the relevant month. Considering the difficulties of the taxpayers, the GST Council has introduced the due dates below:

For businesses without turnover:

GSTR-3B late fee and penalties per day

The applicable late fees and interest for late payment of GSTR-3B are as follows:

- You will have to pay 20 per day of delay for zero tax liability.

- If you are liable to pay tax, the applicable late fee will be 50 per day of delay.

- If there is any amount of tax owed, penalty interest of 18% p.a. will be charged on the amount of tax owed.

Conclusion

Taxpayer must report all necessary ITC of the current tax period as well as any unused ITC of previous month. Any ITC that occasionally appears in GSTR-2B but is not shown in the books of account must be kept on file by the company. Under the previous indirect tax system, the state tax cannot be adjusted against the central tax credit or vice versa. So we can conclude that the interstate transactions were not eligible for ITC. In addition, the cascading effect drove up the prices of products and services.

Feel free to connect to you experts at Legal Window regarding any time of query related to how to file a GSTR-3B.

CA Pulkit Goyal, is a fellow member of the Institute of Chartered Accountants of India (ICAI) having 10 years of experience in the profession of Chartered Accountancy and thorough understanding of the corporate as well as non-corporate entities taxation system. His core area of practice is foreign company taxation which has given him an edge in analytical thinking & executing assignments with a unique perspective. He has worked as a consultant with professionally managed corporates. He has experience of writing in different areas and keep at pace with the latest changes and analyze the different implications of various provisions of the act.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (90)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (120)

- Hallmark Registration (1)

- Income Tax (202)

- Latest News (34)

- Miscellaneous (165)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (21)

- Startup/ Registration (130)

- Trademark Registration/IPR (40)

Recent Posts

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.