How to Effectively Improve Cash Flow Management in Business?

- August 1, 2023

- Start and manage a business

Want to improve your business’s financial performance and ensure long-term success? The secret lies in effective cash flow management. By implementing strategies that streamline incoming payments, optimize outgoing expenses, cash flow control inventory, and accurately predict cash flow, you can achieve a healthy and stable financial position. Take charge of your business’s financial future, seize opportunities, and lay the groundwork for sustainable growth. It’s time to unlock the potential of your business and pave the way to financial success. In this article, we will discuss cash flow management in business.

| Table of Contents |

What is Cash Flow Management in Business?

Cash flow management tracks and controls how much money is coming in and going out of the business to accurately predict cash flow needs. It is a daily process of tracking, analyzing, and optimizing the net amount of cash income minus expenses. It’s all about managing your business finances responsibly so you have enough cash to grow. Managing cash flow management strategies predict how much cash will be available to cover debt, payroll, and supplier invoices.

Significance of Cash Flow Management in Business

Managing Cash flow plays a pivotal role in the financial health and sustainability of a business for the following reasons:

- Meeting Financial Obligations: Positive cash flow ensures that a business can meet its financial obligations, such as paying suppliers, employees, and creditors on It helps maintain trust and credibility with stakeholders.

- Capitalizing on Opportunities: A healthy cash flow position enables businesses to seize growth opportunities, invest in new projects, expand Operations, or pursue strategic initiatives. It provides the necessary funds to fuel innovation and stay competitive.

- Managing Expenses and Liabilities: Effective cash flow management helps control expenses and By understanding cash flow patterns, businesses can identify areas of excessive spending, negotiate better deals with suppliers, and avoid unnecessary debt.

- Planning and Budgeting: Cash flow management facilitates effective financial planning and budgeting. It allows businesses to forecast future cash inflows and outflows, set realistic financial goals, and allocate resources

- Financial Stability: A consistent positive cash flow position enhances a business’s financial stability. It provides a cushion during economic downturns, unforeseen circumstances, or seasonal fluctuations, ensuring the company can weather challenging times without.

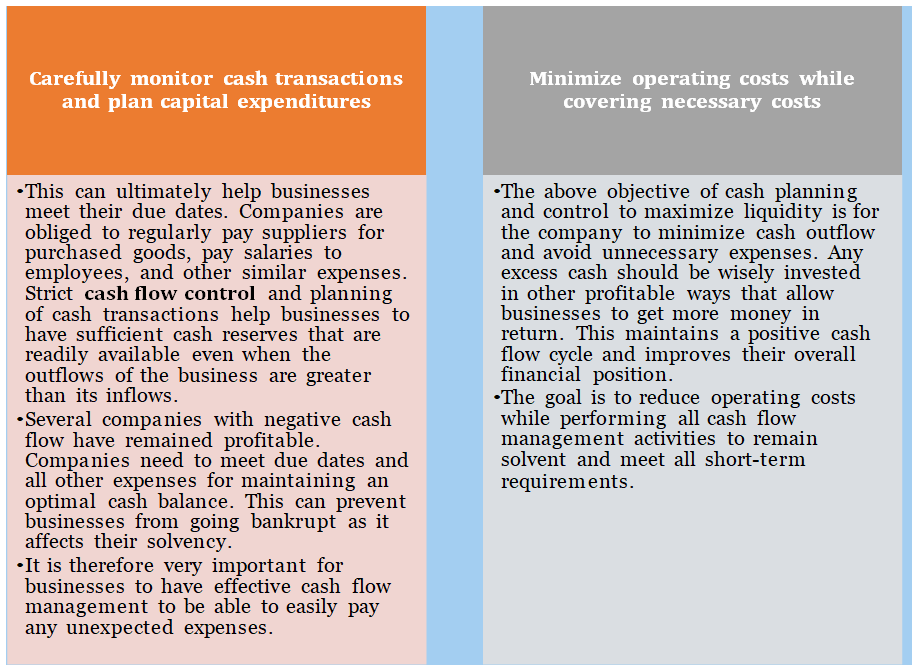

Objectives of Cash Flow Management in Business

Cash flow management in business has two main objectives-

Categories of Cash Flow in Business

Cash can flow from and through several parts of an organization such as:

- Cash Flows from Operations (CFO)

Cash Flow Operations describe the cash flows from normal operations such as the production and sale of goods. This is a number that determines whether the company has enough funds to pay its bills and operating expenses. To ensure long-term viability, there must be more cash flow from operations (CFO) than outflows.

- Cash Flows from Investing (CFI)

Cash Flow Investing (CFI) is a figure that represents how much money has been generated or spent from investment-related activities over some time.

- Cash Flows from Financing (CFF)

Cash Flow Financing (CFF) demonstrates the net cash flows that are used to finance the business and its working capital. Activities may include transactions that involve the issuance of debt securities or shares and the payment of dividends. CFF provides investors with insight into an organization’s cash position and how well the capital structure is managed.

Also, read our Article on: What are the Basic Financial Statements?

Key Strategies for Effective Cash Flow Management in Business

The strategies for effective cash flow management in business are-

- Accurate Cash Flow Forecasting: Develop a comprehensive cash flow forecast by analyzing historical data, market trends, and future projections. Anticipate cash flow gaps and surpluses, allowing you to make informed decisions and take proactive measures to bridge any

- Monitor and Control Receivables: Implement effective accounts receivable practices to ensure timely payment collection. Communicate payment terms to customers, send accurate and timely invoices, and promptly follow up on overdue

- Streamline Payables: Optimize accounts payable by negotiating favorable payment terms with suppliers, avoiding unnecessary expenses, and strategically managing vendor Regularly review and analyze expenses to identify cost-saving opportunities and eliminate non-essential expenditures.

- Inventory Management: Control inventory levels to minimize excess stock and associated holding Analyze demand patterns, optimize reorder points, and implement just-in-time inventory practices. Efficient inventory management reduces the risk of obsolete inventory and frees up cash for other business needs.

- Cash Flow Monitoring Tools: Utilize accounting software or dedicated cash flow monitoring for inflows and These tools provide real-time visibility into your financial position, help identify potential cash flow bottlenecks, and facilitate informed decision-making.

- Emergency Funds: Establish a contingency fund to prepare for unexpected expenses or periods of reduced cash Set aside a portion of profits or allocate a specific amount regularly to build a financial safety net. Emergency funds provide stability during challenging times and reduce reliance on external financing.

- Financing Options: Explore financing alternatives, such as lines of credit, short-term loans, or invoice financing, to bridge temporary cash flow Carefully evaluate the terms, interest rates, and repayment terms to ensure compatibility with your business’s financial objectives.

- Regular Financial Analysis: Conduct regular financial analysis, including cash flow statements, income statements, and balance Identify trends, areas of improvement, and potential risks. This analysis provides valuable insights for informed decision-making and strategic planning.

Final words

Effective cash flow management in business is essential for the success and sustainability of any business. By implementing key strategies such as accurate cash flow monitoring receivables and payables, forecasting, optimizing inventory levels, utilizing cash flow monitoring tools, establishing emergency funds, exploring financing options, and conducting regular financial analysis, businesses can improve cash flow management. Maintaining a healthy cash flow position allows companies to meet financial obligations, capitalize on opportunities, and navigate challenges, ensuring long-term growth and stability.

In case of any query regarding cash flow management in business, a team of expert advisors from Legal Window is here to assist you at every step. Feel free to reach us at admin@legalwindow.in.

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost. Our team offers expertise solutions in various fields that include Corporate Laws, Direct Taxations, GST Matters, IP Registrations and other Legal Affairs.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (90)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (120)

- Hallmark Registration (1)

- Income Tax (202)

- Latest News (34)

- Miscellaneous (165)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (21)

- Startup/ Registration (130)

- Trademark Registration/IPR (40)

Recent Posts

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.