A business organization held by a small group of people is known as a Private Limited Company. It’s owned by a group of members called shareholders. Startups and businesses with high growth aspirations popularly choose the private company as the appropriate business structure. The business entity is recognized as a company through registration under the Companies Act of 2013 in India. Ministry of Corporate Affairs is the governing body, widely known as the MCA. In this article, we will discuss the taxation criteria for a Private Limited Company in India.

What is Taxation for Private Limited Company?

A tax authority or government levies or imposes a tax on private limited companies. We apply income tax to Good and Services Tax (GST) to all levels.

State and central governments play an important role in determining taxes. To streamline the taxation process and ascertain transparency in the country, the state and central governments have introduced several policy reforms over the years. One such change was the Goods and Services Tax (GST), which simplified the tax regime on the sale and distribution of goods and services in the country. Taxation of governments or authorities has been a mainstay of civilization since ancient times.

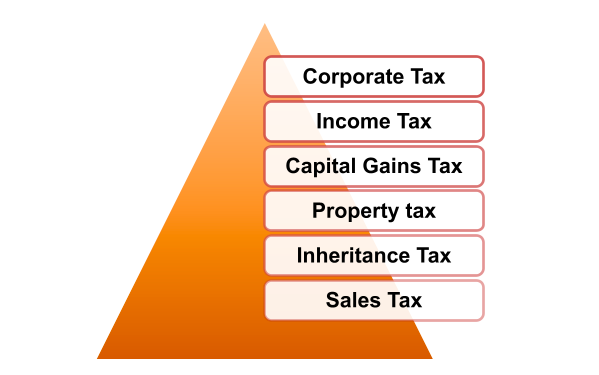

How many types of Taxation for Private Limited Company?

- Corporate Tax: It is a tax imposed on the profit of a business.

- Income Tax: It is that tax which is imposed by Governments on financial income produce by all entities within their jurisdiction, including individuals and businesses.

- Capital Gains Tax: These are imposed on capital gains made by businesses from the sale of particular assets including stocks, agreements.

- Property Tax: It is paid by the owner of the property. This is calculated as per the value of the land.

- Inheritance Tax: It is paid by the owner of the property. This is calculated as per the value of the land.

- Sales Tax: This is a consumption tax imposed by the government on the sale of goods and services. It can take in the form of a Value Added Tax (VAT) and Goods and Services Tax (GST), a state sales tax, or an excise tax.

What is the Income of a company?

Let us discuss types of income before understanding the rates of taxes:

- Profits earned from Private Limited Company

- Capital Gains

- Income from renting the property

- Income from other sources like interest, dividend, etc.

What is the Tax Rate for Private Limited Company for Assessment Year 2022-23?

- Tax rate for Domestic Company if Turnover > Rs. 400 Crore.

| Income Slab | % of Tax | Surcharge |

| Upto 1 Crore | 30% | Nil |

| Above 1 Crore but upto 10 Crore | 3,00,000 + 30% | 7% |

| Above 10 Crore | 3,00,00,000 + 30% | 12% |

Health & Education Cess is fixed @4% on all income slab.

- Tax rate for Domestic Company if Turnover < Rs. 400 Crore.

| Income Slab | % of Tax | Surcharge |

| Upto 1 Crore | 25% | Nil |

| Above 1 Crore but upto 10 Crore | 2,50,000 + 25% | 7% |

| Above 10 Crore | 2,50,00,000 + 30% | 12% |

Health & Education Cess is fixed @4% on all income slab.

Tax rate for Foreign Company is @ 40% fixed and Cess @ 4% on total income tax + surcharge.

Tax Benefits for Private Limited Company in India

- Salary to founder or directors: For any person who is the founder or director of the company then the motive of that person is to earn maximum profit. Profit amount is to be taken by the founder of directors in the profit-sharing ratio which is pre-decided as a dividend.

For the purpose of saving tax, directors can receive profit as salary instead of dividend. Salary to founder or directors is an expense of the private limited company.

- Sitting fees to the director: A company may pay fees to the director for attending meetings on the board. Director’s sitting fees should not more than Rs. 1,00,000/- and it is decided by BOD.

It may be claimed as the expense and in hands of the director, it is exempted to the limit provided.

- Preliminary expenses: These are incorporation expenses that are raised before and after the incorporation of the private limited company. These are to be paid by the founder or director of the company in the form of professional charges for the creation of AOA and MOA, fees paid to the registrar, stamp duty, etc.

We can save tax with these expenses if we have proper documentation.

- Rent expenses: The registered address of the company is on rent on the name of the director or name of a relative then this rent may be booked in the books.

So, we can book rent expenses and can take tax benefits freely.

- Capitalizing capital asset and depreciation: If a assets purchase for the company and it’s going to give benefits in creating revenue for more than a year. It is showing as an expense instead of capitalized. After all, it must be shown in the balance sheet instead of the profit & loss statement.

Asset showing in the balance sheet should be depreciated due to its useful life. Hence we can take tax benefits to the ultimate years.

- Salary of family members: Family members or relatives help in doing business works free of cost. As a good tax planner, such expenses must be recorded in the books of the company.

Indirectly the gain has gone into your hands with the exemption of that expense from the taxable income of the company.

- Entertainment expenses: These are general and exciting expenses incurred in celebrating business success with family or partners.

It must be recorded properly in the books of accounts to get a flat 30% discount and save tax at the same rate.

- Director’s vehicle expense: The vehicle is used in the business for traveling and meetings. Not only fuel but also repair and maintenance of the vehicle is charges as business expenses.

For tax benefits required proper documentation and planning then we can save tax 22% to 30%.

Which Income Tax Return form is applicable for Private Limited Company?

On or before 30th October every year is the due date of filing income tax return of companies including foreign companies. If the company came into existence until the same financial year, it would have to file an income tax return for that period on or before 31 October. ITR 6 tax returns to be filed by the companies.

Takeaway

A Private Limited Company is formed lawfully with limited liability or legal protection for its shareholders but that places restrictions on its ownership. Company is an artificial person created by law. It is clothed with many rights, obligations, powers and duties prescribed by law.

Among many obligations, paying tax in Private Limited Company is one of the main obligations of a company. That is true that we cannot and must not avoid tax payments, but yes certain tax planning steps can be taken with an objective of getting some extra monetary benefits.

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost. Our team offers expertise solutions in various fields that include Corporate Laws, Direct Taxations, GST Matters, IP Registrations and other Legal Affairs.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (89)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (118)

- Hallmark Registration (1)

- Income Tax (199)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (20)

- Startup/ Registration (127)

- Trademark Registration/IPR (40)

Recent Posts

- Farmer Producer Companies-Major provisions under Companies Act April 26, 2024

- Detailed Analysis of Section 179 of the Companies Act, 2013 April 24, 2024

- Maximise Your Tax Savings: Power of Form 12BB April 23, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.