Companies rely on funds to manage the affairs of their business successfully. Shareholders in a company play a vital role in raising funds, and in that process, they become its stakeholders. They exercise control over the share of profits in proportion to the money they invest. Dividend is known as the share of profit by shareholders. Shareholders are also considered the owners of the company; therefore, they are entitled to get a dividend. There is not an exact definition of the dividend in the Companies Act, 2013. Under section 2(35), it merely mentions dividends as “any interim dividend.” With a view to distribute the profit among the shareholders of the company, the Declaration and Payment of Dividend under the Companies Act were enacted. In this article, we shall cover various provisions related to the Declaration and Payment of Dividend under the Companies Act, 2013.

Meaning of “Dividend”

Dividend refers to the reward a corporation offers to its shareholders, in cash or otherwise. Dividends can be given in various ways, such as cash payment, inventory, or some other form. It is determined by its Management Board and requires the approval of the shareholders. A dividend is the distribution of a portion of the company’s earnings, decided and managed by the company’s board of directors, and paid to a class of its shareholders.

Understanding Dividend as per Companies Act 2013

Dividend is defined under Section 2(35) of the Companies’ act, 2013 includes any interim dividend:

- Dividends are sum of money to be paid to the members of the company out of the profits made by the Company.

- It is a share of profits of the company.

- It may be noted that dividend is paid to shareholders in proportion to the amount paid-up on the share held by them.

- Preference shareholders re always paid the dividend in preference to the equity shareholders.

Sources of Dividend

The basic principle of a declaration of dividend is that it shall be paid out of profit only. As per the Companies Act, it can be paid out of the following sources:

- From the current year’s profit

- Accumulated profit from the previous year

- Out of the money provided by the Central or State Government for the payment of dividends in pursuance of guarantee given

Who can declare Dividend?

As per the provisions contained in the Companies Act, 2013, all companies can declare dividends except for those who are registered under section 8.

Dividend is to be declared by the company at its Annual General meeting on such rate as may be recommended by board, and it has no power to declare dividend exceeding the amount recommended by the board. Once declared, it becomes debt payable by the company to its shareholders, who can sue the company for the non-payment of the dividend.

A company cannot pass a resolution for the declaration of dividend, without passing a resolution for the adoption of accounts. Hence, a company shall adopt its books of accounts first and then only, entitled to declare the dividend.

Types of dividend

There are following types of dividend:

- Interim dividend; and

- Final dividend

- Preference share Dividend

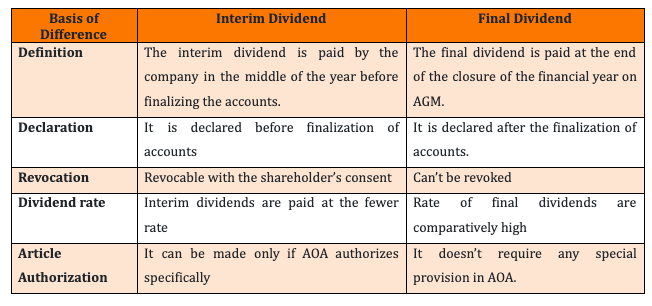

Interim Dividend vs. Final Dividend

As per Section 2(35) of the Companies Act 2013, an Interim Dividend will be declared by the board any time before the closure of the fiscal year by the Private Limited Company. Following is the difference between interim and final dividend:

Mandatory Conditions for Dividend Declaration

Declaring dividend out of current year’s profit

Company has to meet the following requirements for declaring dividend out of its profit:

- Depreciation: Depreciation shall be provided on all depreciable assets as per the prescribed rate or its useful life before declaring the dividend.

- Reserve: Company cannot declare or pay a dividend unless it transfers a certain percentage of profit to reserve.

- Set off previous year loss: Company must set off the carried forwarded previous year’s loss from the current year’s profit before declaring the dividend.

- Free Reserve: Company shall not declare its dividend out of any reserve other than Free Reserve.

Declaring Dividend out of Surplus Reserves in case of insufficient current year’s profit

The company can declare the dividend out of surplus reserve in case of insufficient current year’s profit subject to the following conditions:

- Rate of Dividend: The dividend rate shall not exceed the average of the declared dividend of three immediately preceding years.

- Withdrawal amount: The total amount of withdrawal from accumulated reserve shall not exceed 1/10th of the paid-up share capital and free reserves as per the latest audited financial statement.

- Utilization of money withdrawn: Such withdrawn money from accumulated reserve shall be first used to set off the previous year’s loss before declaring a dividend for the current year.

- Balance: Balance of surplus reserve after withdrawal shall not fall below 15% of its paid-up share capital as per its latest financial statement.

Circumstances under which dividend is not required to be paid

- In case dividend cannot be paid due to operation of law;

- In case members have given directions to the company which cannot be complied with;

- In the event of dispute regarding the payment of dividend;

- In case company has adjusted dividend against amount due from the shareholders;

- In case the company has made any default in compliance with the provisions of section 73 and section 74, dividend cannot be paid.

Provisions relating to Payment of Dividend

The provisions under the Companies Act, 2013 provides that no dividend shall be paid except through cash and where the dividend is payable in cash, it can be paid by way of cheque, warrant or by any electronic mode to the shareholder who is eligible to receive the dividend. However, it may be kept in mind that a company, who has defaulted in compliance with respect to the provisions of section 73 and section 74 comprising of prohibition of acceptance of deposits from public and repayment of deposits, shall be barred to declare dividend.

The amount of the dividend (Including the interim dividend) must be deposited in the bank in a separate account in five days from the date such declaration of dividend is made. The dividend shall be payable to the eligible shareholder by way of cash.

Procedure to be followed for dividends declaration:

- Issuance of 7 days’ advance notice period under Section 173 of the Companies act, 2013 for an annual financial meeting of the board of directors

- Advance 2 days’ notice to the stock exchange where company’s securities are places in case of a listed company

- The resolution needs to be passed in an annual board meeting for dividend division and issuance

- Prepare a statement of dividend

- To ensure that annual dividend tax is paid to the concerned authority

- Open a separate bank account for dividend division

- Transfer dividend to shareholders as per their shareholding pattern

Punishment for Failure to Distribute Dividend as per Companies Act 2013 (Section 127)

Where a dividend has been declared by a company but has not been paid or the warrant in respect thereof has not been posted within thirty days from the date of declaration to any shareholder entitled to the payment of the dividend, every director of the company shall, if he is knowingly a party to the default, be punishable with imprisonment which may extend to 2 years and with fine which shall not be less than 1000 rupees for every day during which such default continues and the company shall be liable to pay simple interest at the rate of eighteen per cent per annum during the period for which such default continues.

Wrapping Up

Although, distribution of dividends acts as a booster to the shareholders and indicates that the company is doing well and has generated good profits, but considering the COVID-19 pandemic, the dividend pay-outs by various companies in the ongoing financial year will witness a dip as compared to previous years, as many companies are starving and are looking to conserve the cash to tide over the current COVID -19 situation.

Possible decline in free cash flow because of fall in net profit, additional expenses due to the COVID-19 pandemic, and cash conservation for prospective acquisitions are seen as key factors for this likely scenario.

It is also contemplated that dividend policy will have to undergo a change this financial year. This is mainly because companies are expected to keep cash for acquisitions to generate growth to beat the negative growth that the industry is likely to clock on organic basis and also to support the economy and absorb losses.

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost. Our team offers expertise solutions in various fields that include Corporate Laws, Direct Taxations, GST Matters, IP Registrations and other Legal Affairs.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (89)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (118)

- Hallmark Registration (1)

- Income Tax (199)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (20)

- Startup/ Registration (127)

- Trademark Registration/IPR (40)

Recent Posts

- Farmer Producer Companies-Major provisions under Companies Act April 26, 2024

- Detailed Analysis of Section 179 of the Companies Act, 2013 April 24, 2024

- Maximise Your Tax Savings: Power of Form 12BB April 23, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.