Food plays an essential role in our lives. It gives us the required energy and nutrients that facilitate healthy development and helps one to stay active. However, one must ensure that the food consumed is safe. Food Safety and Standards Authority of India certifies that the food is acceptable for human consumption. It provides an assurance regarding the safety of food and the process used in manufacturing it. The authority scrutinizes the food quality from its preparation to the final packaging. Unhealthy food can cause various diseases like food poisoning, stomach aches, etc. Considering the importance of food safety there is a need to enact these standards and rules to confirm the safety. In this article, we will discuss the complete procedure for filing of the FSSAI Annual Return.

The Food Safety and Standards Act, 2006 was established to regulate the food industry and for framing the laws relating to food manufacturing, storage, distribution, sale and import. Thereby, it developed a Food Safety and Standards Authority of India (FSSAI).

What is Food Safety Annual Returns?

All the License Holders declare certain facts like per day production capacity of the entity, the SKU details of the entity, etc., while the process of obtaining the License is going on in the food licensing department. To validate the facts declared by the Food Business Operators (FBO) with the actual facts, the Food Safety and Standard Authority of India mandates the filing of FSSAI Annual Return by the Food Business Operators (FBO) for the lapsed financial year.

Hence, it can be said that obtaining the Food License is not enough for the Food Business Operator (FBO). It is equally essential to comply with FSSAI compliances and file for the FSSAI Annual Return. The Annual Return should be filed within the prescribed time, or penalties will be faced by the Food Business Operator (FBO).

Benefits of FSSAI annual Compliance

- Reputation: Annual Compliance by an entity which is registered as per the requirements of the FSSAI would increase the overall reputation of the company or entity. The public will trust an entity that complies with the requirements related to annual compliance.

- Increase in Brand Value: A company that has FSSAI license would be more reputed in the eyes of consumers. Apart from this, the value derived by the entity would be more.

- More Government Support: Another benefit from this form of annual compliance is more government support for the entities that comply with the requirements.

Who should file the FSSAI Annual Returns?

The following entities are required to file the annual returns:

- Every food manufacturer, importer, exporter, seller, etc., except the manufacturers of milk and milk products (they have to file a half-yearly return);

- Every FBO with the business turnover equal to or exceeding Rs. 12 lakhs.

Entities exempted from filing FSSAI Annual Returns

Following entities are exempted from filing FSSAI annual return:

- Restaurants

- Fast food joints

- Canteens

- Grocery stores

Essentials to Keep in Mind While filing Annual Returns

Every FBO must provide the following information in the form at the time of filing FSSAI annual return:

- Name of the food product manufactured/handled/sol/imported/exported

- Quantity in Metric Tons

- Size of bottle/can/any other package (like PP) or bulk package

- Value

- The selling price of per kg or per unit of packing

- The quantity exported or imported in kg

- Rate per kg or per unit of packing CIF/ FOB

- Information of countries or ports where they are exported

What essentials things the Food Authority should confirm for every Food Article?

The Food Authority should confirm the following things for every Food Article before issuing a License to the Food Business Operator (FBO):

- The use of any food additive or any food processing aid should be as per the FSSAI Act rules and regulations;

- There should not be any insecticides or pesticides contained in the food article;

- The labelling and marking of food article should be done as per FSSAI guidelines;

- Is there a presence of any contaminated, toxic substance or any impurities in the food article that may cause harm to human health?

The FSSAI is required to monitor the system control. The Food Commissioner appointed by the State Government is responsible for doing the effective implementation of food safety and standards.

What are the Kinds of Annual Return?

The kinds of FSSAI Annual Return laid down under the FSSAI Act are:

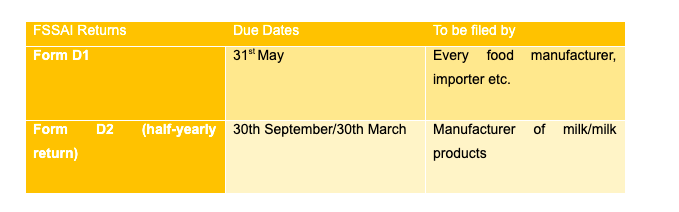

FSSAI Form D1

Food business units involved in manufacturing, importing, labelling, packing, re-labelling, and re-packing needs to file FSSAI Form D1 which is mandatory for them. The form is prescribed by the Food Safety Commissioner and is a mandatory for the FBOs irrespective of the production they are involved in.

The FSSAI annual Return-Form D1 should be filed on or before 31st May of every fiscal year. The form is filed with the Licensing Authority depending upon the type of food products sold by the FBO in the preceding financial year.

FSSAI Form D2

Form D2 is filed half-yearly and not every food business operator is eligible to file Form D2. Instead, FSSAI license holders who are involved in the manufacturing and distribution of milk or milk products can file Form D2. Form D2 is filled from 1st April to 30th September and from 1st October to 31st March of every financial year.

Procedure for filing FSSAI Annual Return

The procedure for filing Annual FSSAI Return is as follows:

- Download the form based upon the kind of business of Food Business Operator (FBO);

- Fill the necessary details as prescribed in the form.

- Collect all the details from the finance team of entity

- Fill the details in the form as applicable to the kind of business of entity and products manufactured in the entity;

- After filling the details in the form, review all the details. The details filled in Return Form should be in corroboration of the facts mentioned and declared in the Food License. In case of any dissimilarity with the details mentioned in the food license, necessary modifications should be made in the Food License.

- After the details are finalized in the form, the Food Business Operator can send the form via registered post or through email to the concerned food licensing authority in the respective jurisdiction.

Penalty for Delay Filing of Annual Returns

Section 2.1.13 (3) of FSS (Licensing and Registration) Regulations, 2011[1], says that if the company fails to file for the annual return within the stipulated time frame then a fine of Rs100 will be imposed on them every day and it will keep on increasing till the date they don’t file annual return.

Conclusion

FSSAI License is an assurance for consumers that the food business is running as per the guidelines prescribed by FSSAI. FSSAI License is the security of one’s safety and well-being. Hence, it becomes mandatory for the Food Business Operators (FBO) to file the Annual FSSAI Return with the concerned food authorities. Sometimes the filing of FSSAI Annual Return can be tiresome and time-consuming. We at Legal Window have experienced professionals who can help you with the process of filing the Annual FSSAI Return. Our professionals will help and assist you with the process of FSSAI Annual Return and will ensure the successful completion of your work.

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost. Our team offers expertise solutions in various fields that include Corporate Laws, Direct Taxations, GST Matters, IP Registrations and other Legal Affairs.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (89)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (118)

- Hallmark Registration (1)

- Income Tax (199)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (20)

- Startup/ Registration (126)

- Trademark Registration/IPR (40)

Recent Posts

- Detailed Analysis of Section 179 of the Companies Act, 2013 April 24, 2024

- Maximise Your Tax Savings: Power of Form 12BB April 23, 2024

- Cryptocurrency startups and Regulatory compliance April 22, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.