In order to reduce the compliance burden on the corporate sector, the Ministry of Corporate Affairs (MCA) has announced that the companies whose financial year has ended in December 2019, would be allowed to hold their first Annual General Meeting (AGMs) within the first nine months of their current fiscal or September 30 without it being considered a violation of the Companies Act.

The above relaxation comes in account of the coronavirus pandemic (COVID-19) as many companies requested for leniency on the AGM rules owing to the social distancing norms and the nationwide lockdown that was in force till May, 2020 by PM Narendra Modi.

Provisions of Holding AGM (Annual General Meeting) as per Companies Act, 2013

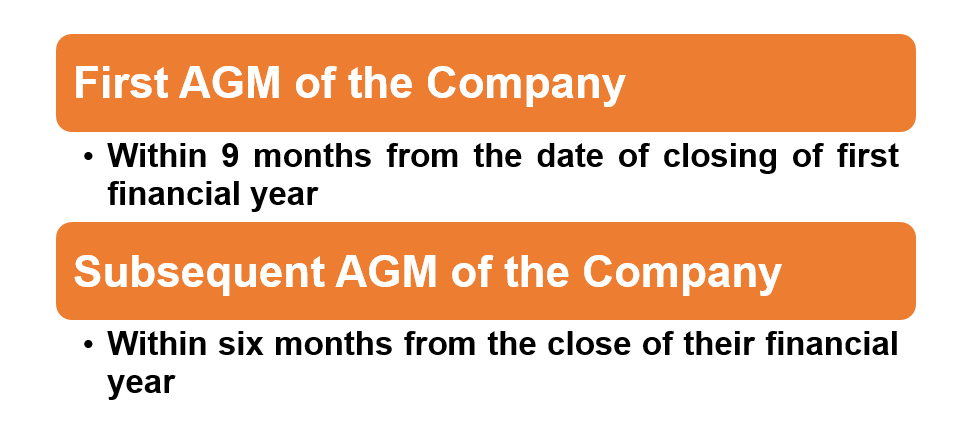

According to Section 96 of the Companies Act, 2013, an Annual General Meeting is hold by the Company every year in a following below mentioned intervals:

The AGM of any company is held by giving 21 days advance notice to all the members and not more than 15 months should be elapsed between two AGMs.

The main purpose of holding Annual General Meeting is to obtain approval of financial statements from the members of the company. Other than this, ordinary as well as special business also transacted at the Annual General Meeting. As per the Companies Act, 2013, all companies, other than One Person Company (OPC), must hold a general meeting each year apart from other meetings as the AGM.

Applicability and scope of the MCA Circular

The AGM Circular applies to all the AGMs to be called by companies within the calendar year 2020. In simple words, all the companies will call their AGM for the financial year 2019-2020 in the calendar year 2020 only. Therefore, one may conclude that this AGM Circular can be availed by all the companies without any exception.

Condition for companies laid down by MCA in circular

- MCA has mentioned a specific condition for companies that they cannot provide e-voting facility, to call their AGMs under this relaxation

- Further, Companies can conduct their AGM through VC (Video Conferencing) only if the company has in its record, the email-ids of at least half of its total number of members, who:

- in case of a Nidhi Company, hold shares of more than one thousand rupees in face value or more than one per cent. of the total paid-up share capital, whichever is less;

- in case of other companies having share capital, who represent not less than seventy-five per cent. of such part of the paid-up share capital of the company as gives a right to vote at the meeting;

- in case of companies not having share capital, who have the right to exercise not less than seventy-five per cent. of the total voting power exercisable at the meeting

- Entities like public sector banks will not be covered under this circular.

Advantages of conducting AGM through VC mode

- Helps in maintaining social distancing

- Less time consuming process;

- Operating convenience;

- Saving in Cost

- Environment friendly;

- Sooner getting the advantage of last audited accounts;

Provision of extension of AGM

As per Section 96(1) of the Companies, Act, 2013, the Registrar of Companies (ROC) may extend the time limit of holding AGM up to maximum period of three months; however extension doesn’t apply on first AGM. In order to apply for extension, an application needs to be submitted in e-form GNL-1.

Penal Provisions – Defaulting in Convening AGM

Penalty provisions regarding the default made in holding AGM are defined under Section 99 of the Companies Act, 2013, as per which every office officer in default shall be punishable with fine which may extend to Rs. 1,00,000/- while in case of continuing default it will go up to Rs. 5,000/- per day.

Takeaway

The circular issued on 21st April 2020 notifies that companies whose financial year (other than first financial year) ended on 31st December, 2019, can convene their AGM within nine months from the closure of the financial year (i.e. by 30th September, 2020), and it shall not be viewed as a violation. From the above discussion, we can say that it is a welcome move by the MCA keeping in mind the difficulty faced by stakeholders due to COVID-19 and following social distancing norms and consequential restrictions.

For more information on the above extension, contact Legal Window now.

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost. Our team offers expertise solutions in various fields that include Corporate Laws, Direct Taxations, GST Matters, IP Registrations and other Legal Affairs.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (89)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (118)

- Hallmark Registration (1)

- Income Tax (199)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (20)

- Startup/ Registration (127)

- Trademark Registration/IPR (40)

Recent Posts

- Farmer Producer Companies-Major provisions under Companies Act April 26, 2024

- Detailed Analysis of Section 179 of the Companies Act, 2013 April 24, 2024

- Maximise Your Tax Savings: Power of Form 12BB April 23, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.