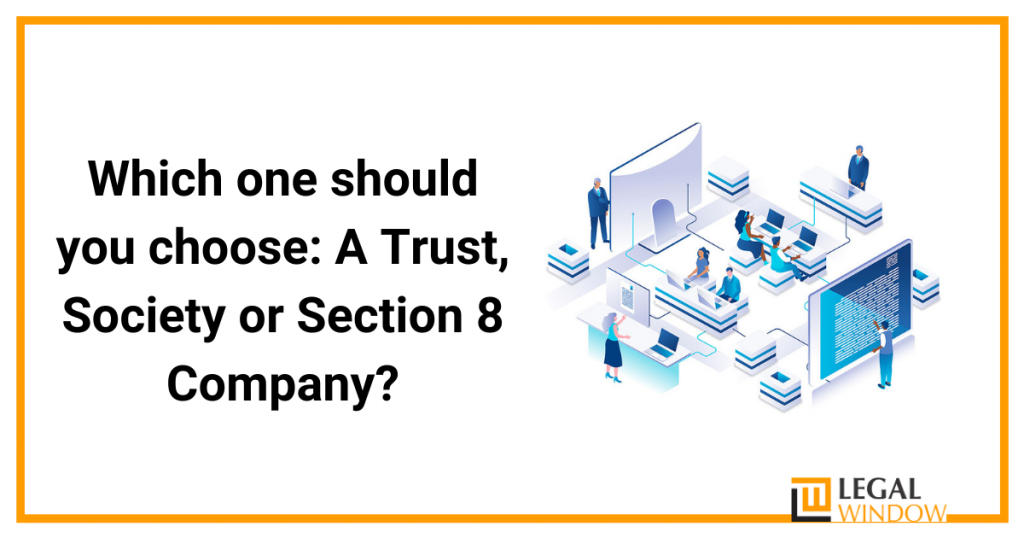

In this article, we will discuss about three types of organizations including three different aspects of forming an NGO i.e a Society, Trust and a Section 8 Company. These organisations are generally formed to promote social welfare, social development and other charitable purposes. However, you need to understand that all the above three does not serve the same purpose, then which one you should choose? Lets try to find out.

Before we proceed, let’s try to understand them one by one.

What is Trust Registration?

A Trust is an arrangement where owner or trust or of Trust transfers the property to a trustee. Such transfer of property is done for the benefit of a third party. The property is transferred to the trustee by the trust or along with a proclamation that the property should be held by the trustee for the beneficiaries of the trust.

The Indian Trust Act 1882, provides for the provisions related to Trust in India. The Trust Registration is advisable in India for obtaining the benefits. Trust is of two types:

- Public Trust:

A Public Trust is the one whose beneficiaries include the common public at large. Furthermore, a Public Trust in India can be further subdivided into Public Religious Trust and Public Charitable Trust.

- Private Trust:

In India, a Private Trust is the one whose beneficiaries include individuals or families.

What is Society Registration?

An entity or group of people working together not for profits but for the welfare of the general public with an agenda of helping the community has an option of Society registration to gain a legal status. A non-commercial organization with seven or more persons coming together for any scientific, literary or charitable purposes or for purposes as mentioned under section 20 of the Society Registration Act, 1860, may get Society Registration by subscribing their names to a Memorandum of Association and filing the same with the registrar. There are following features of Society registration:

- For Society Registration, there is a requirement of a minimum of seven or more members.

- In case of people, companies or societies registered outside India are interested in starting a society in India then they would have to subscribe to the Memorandum of a society in India.

- In India, it is not obligatory to register a society however with society registration they get legal protection and become eligible for the advantages offered by the government.

What is Section 8 Company Registration?

An NGO can be registered as a Section 8 company under the Companies Act 2013. Section 8 Company Registration is the process of incorporation of an NGO under the Companies Act 2013.

A section 8 Company can be registered for promoting Art, Science, Commerce, Technology, Sports, Education, Social Research, Social Welfare, Religion, Charity and Protection of Environment etc. A Section 8 Company can work anywhere in India after succesful completion of the registration process. he Government grants them an exclusive license under Section 8 Company. There are three conditions for this.

- The company should form for a charitable trust

- Income and profits should be applied toward these objects

- It should not pay any dividend to its members

- It can be formed with only two members may be Indian or foreigner it should have at least two directors, who need not be m a member.

Which one is better Trust or Society or Section 8 NGO?

Each form has its own advantages and all are related to non-profit work

- Trust is easy to form and run –but unwieldy when it comes to changing objects or setting disputes You can choose a trust if you are dedicating your own property to public good.

- In India, a nonprofit organization for a charitable purpose can be registered under the different Authorities. It could be registered as a trust, society and section 8 company. A charitable purpose is defined under Section 2 (15) of Income-tax act “Charitable purpose “includes relief of the poor, education, Yoga, medical assistance, Preservation of environment (Incl. watersheds, forests, and wildlife) and preservation of monuments or places or objects of artistic or historical.

- Interest and the advancement of any other object of general public utility “Charitable purpose do not include the purpose that relates exclusively to religious teaching or worship. While selecting the form in which it should be registered non-profit making, the entity must evaluate the objects and the area of operation, persons involved in its constitution and the sources of income to achieve its purpose. To facilitate the decision making a comparative analysis of a different form of registration available for non-profit making entities i.e. Trust, Society & section 8 Company.

- Income tax act gives equal treatment for exempting their income and granting an 80G certificate, whereby donors to nonprofit organizations may claim a rebate against donations made. Foreign contribution to non-profits is governed by FC(R) regulations and the Home Ministry.

- CAF would like to clarify that this material and the provides only broad guidelines and it is recommended that legal and or financial experts be consulted before taking any important legal or financial decision or arriving at any conclusion.

Comparison between Trust, Society and Section Non-Profit Organization:

| SR. NO | TITLE | SECTION 8 COMPANY | TRUST | SOCIETY |

| 1 | Minimum members required | 2 –Two | 2 –Two | 7-Seven |

| 2 | Ownership | Shareholders | Trustee | Members |

| 3 | Transfer of Ownership | Transfer of shares | Not permissible | Member Resolution |

| 4 | Liabilities | Limited | Unlimited | Limited |

| 5 | Stamp Duty | Not applicable | Non-Judicial Stamp | Not applicable |

| 6 | Reliability | High | Low | Moderate |

| 7 | Time for formation | 60-70 days | 15-20 days | 15-20 days |

| 8 | Payments to members and directors | Only for Actual Work | Allowed | Allowed |

| 9 | Management | Director | Trustee | Allowed |

| 10 | Post Formation and directors | Strict guidelines & compliances | No major statutory compliances | Moderate compliances |

For more information contact us or send us an email at admin@legalwindow.in.

CA Pulkit Goyal, is a fellow member of the Institute of Chartered Accountants of India (ICAI) having 10 years of experience in the profession of Chartered Accountancy and thorough understanding of the corporate as well as non-corporate entities taxation system. His core area of practice is foreign company taxation which has given him an edge in analytical thinking & executing assignments with a unique perspective. He has worked as a consultant with professionally managed corporates. He has experience of writing in different areas and keep at pace with the latest changes and analyze the different implications of various provisions of the act.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (146)

- Compliance (88)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (115)

- Hallmark Registration (1)

- Income Tax (199)

- Latest News (34)

- Miscellaneous (163)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (20)

- Startup/ Registration (126)

- Trademark Registration/IPR (39)

Recent Posts

- Understanding Trademark Objection under Section 11 April 15, 2024

- Cancellation, suspension and revocation of GST registration April 13, 2024

- Tax Laws for YouTubers and Streamers in India April 12, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.