Step by step process for the Name Change of Company as per Companies Act, 2013

- April 21, 2021

- Company Law

Change is common, and things keep changing all the time. So do you think about sticking to the same business name is a wise decision even if your company is expanding in different new areas? The company name change is not that easy process and must not be taken lightly. Your company’s name must be relevant to the service it is providing. Rectification of a company’s name or change in the name of the company is done to make words correspond to the reality in case it is inappropriate. The Memorandum of Association of the Company (MOA) contains Name Clause, Registered Office Clause, and Object Clause. By the alteration of the name of a company, you can change the name clause.

Concept of Change of Name of the Company

In today’s era, a distinct name not only acts as the building block for a company’s existence but also helps in maintaining the status of a separate legal entity. In a Memorandum of Association (MOA), the first clause deals with the name of the limited company, from which it is recognized in the Public domain.

In the global business market, compromise, arrangements and restructuring play a crucial role in satisfying the changing business needs by mixing the strengths of two or more companies. Therefore, businesses must embrace changes to sustain in the corporate sector; otherwise, they would not only lose the competitive edge but would fail to meet the needs of their loyal customers as well.

The term “change” denotes the change in the company’s name or change in activities. A company needs to obtain the prior consent of its shareholder in the general meeting before undertaking the process of any change.

As per Section 13 of the Companies Act, 2013, a company needs to obtain the prior consent of its shareholders by passing a special resolution in the General Meeting. After that, it needs to alter its MOA (Memorandum of Association) to undergo the process of change of name of the company.

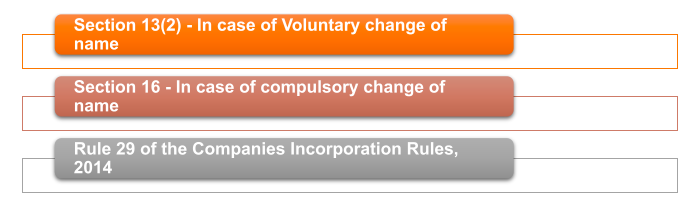

Applicable Section for Name change of Company under the Companies Act 2013

Along with the applicability of the above-mentioned sections, approval of the Central Government is also required in the case of Public Company. The name change results in entire name change or addition/deletion of the word i.e. from Private limited to Public Limited.

Applicability of the Companies (Incorporation) Second Amendment Rules, 2020 on the Change of name of the Company

According to Rule 29 (1) of the Companies (Incorporation) Second Amendments Rules, 2020, a company who has failed to file the Annual Returns and the financial statements with the ROC (Registrar of Companies) is restricted from changing its name. Moreover, a company who has not paid or repaid matured debentures or deposits or interest thereon is not eligible to change its name.

Availability and Determination of the Company’s New Name

It is important to decide the new name of the company as it is the very first stage for the change in the name of the company. While deciding the new name of the Company various factors are required to be kept in mind-

- Availability of name under MCA.

- Consideration of provisions of the Companies Act 2013.

- Conducting the Board meeting and approval of the Board of directors.

Checking name availability

The authorized director or company secretary will apply in form INC-1 to MCA for checking name availability and approving the name. This process is same as the process adopted at the time of initial name approval.

RoC will send a letter stating that the proposed name is available. Please note that this will not be the final approval of company name, it is just a confirmation from RoC that proposed name is available.

The proposed name shouldn’t be similar to another existing company name, and it shouldn’t include the word “state.” Other conditions existing at the time of initial name approval exists in this situation also.

Change of Name of the Company: Obligations on the Listed Companies

In India, as per Regulation 45 of the SEBI (Listing Obligations and Disclosure Requirements) Regulation, 2015, any listed company which has changed its name because of the addition of new business line needs to fulfil the certain obligation as follows:

- It needs to disclose its Net Sales, Income and Expenditure and PAT (Profit After Tax) that belongs to the new business line, separately in the Financial Accounts. Further, it needs to disclose these details for three consecutive years, starting from the date of the change in name, along with all the other compliance that the listed companies need to comply with;

- A company cannot change its name again until a minimum of one has passed from the date of the last name change. Further, the company must have earned at least half of its total revenue in the previous financial year from the new activity endorsed by the new name, or by the investment in the new project, or the project (Fixed Assets + WIP [Work in Progress] + Advances + Inventory + Investments and Trade Receivables + Cash and Cash equivalents) is at least 50% of the company’s assets.

- The term “Advances” shall include only those amounts which has been paid out to the suppliers and contractors for the proper execution of project concerning the new activity as reported in the new name. Besides this, to make sure the company is appropriately adhering to all the compliances, the directors need to submit an auditor’s certificate in the stock exchange.

- The new name of the company shall be notified together with the company’s old name through the official websites of the recognised stock exchanges, where the company has been listed for at least one year from the date of its last change in name;

Documents Required for Change Company Name in India

The essential documents required for Change Company Name in India are as follows:

- Digital Signature Certificate of one of the authorised directors to be provided;

- A copy of the latest amended Memorandum of Association and Articles of Association of the company;

- Certificate of Incorporation of the company to be provided;

- Copy of PAN card of the company should be provided;

- Complete Minutes of the members meeting.

What is the Procedure for Change Company Name in India?

The process of Change Company Name in India is as follows:

Passing of Board Resolution

When all the partners are mutually agreed a Board Meeting should be called for the passing a resolution to change the company name. In the Board Meeting, the Board of Directors will thoroughly discuss and approve the change in the name of the company.

After the approval for the same Director or the CS of the company will be authorised to check name availability with the Ministry of Corporate Affairs. And, also the Director or CS of the company will be authorised to call for an Extra-Ordinary General Meeting for passing the special resolution for a change company name.

Checking Name Availability

The authorized Director or Company Secretary is required to apply in RUN form to the Ministry of Corporate Affairs for checking the availability of name and approving the name of the company. This process is same as the process that is adopted at the time of initial name approval of the company.

Registrar of Companies will be sending a letter stating that the proposed name by the members is available. Please note that this will not be considered as the final approval of the company name, it is simply a confirmation from Registrar of Companies that the proposed name is available.

The name proposed should not be similar to any another existing company name, and it should not include the word “state.” The other basic conditions existing at the time of initial name approval also exists in this situation.

Passing Special Resolution

Once the proposed new name is approved by the Ministry of Corporate Affairs, the company is required to call for an Extra-Ordinary General Meeting. A special resolution should be passed for the changing of name and make the required change in the company’s Memorandum of Association and Articles of Association.

Applying to Registrar

A special resolution is required to be filed with the Registrar of Companies within a time period of 30 days of passing the special resolution. With the passed resolution, Form MGT-14 should also be filed which contains the complete details about the past special resolution in the extraordinary general meeting. Following documents are required to be submitted with MGT-14:

- A certified true copy of the Special Resolution;

- Notice of the Extraordinary General Meeting;

- Explanatory statement to the Extraordinary General Meeting;

- The altered Memorandum of Association;

- The altered Articles of Association;

Once Form MGT-14 is filed, the company is required to file form INC-24 with the Registrar of Companies for taking an approval of the central government for change company name along with the fees prescribed for the same.

Form INC-24 is required to be filed after form MGT-14. Since, form INC-24 specifically asks for the SRN of MGT-14 form filed with Registrar of Companies. SRN of RUN is also required to be mentioned in form INC-24. Along with form INC-24, a copy of the minutes of the Extra-Ordinary General Meeting where a special resolution was passed, also needed to be submitted.

In form INC-24, reasons for the change company name, details about the total number of members who attended the Extraordinary General Meeting, the total number of members voting in favour or against the special resolution, and total percentage of shareholding is also required to be mentioned.

Issuance of Certificate of Incorporation

If the Registrar of Companies is completely satisfied with the documents submitted, he/she will issue a new Certificate of Incorporation to the existing company.

The change company name process will not be considered as completed until the new Certificate of Incorporation is issued by the Registrar of Companies.

Incorporating Company Name in MOA and AOA

Once the new Certificate of Incorporation is received from the Registrar of Companies, the changed company name should be incorporated in all the copies of MOA and AOA.

To Sum Up

A company’s name can be changed at any time after its incorporation. It being an entity regulated by law, it has to follow a specific process provided by the Companies Act, 2013. The process includes conducting board meeting and member’s meeting for their respective consent, which will be followed by name reservation and approval from Central Government for said change. Fresh Certificate of Incorporation will be issued by RoC in new name after updating the Register of Companies. The company name change does not impact the existence of the company, which leaves all the assets and liabilities unaffected.

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost. Our team offers expertise solutions in various fields that include Corporate Laws, Direct Taxations, GST Matters, IP Registrations and other Legal Affairs.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (147)

- Compliance (88)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (116)

- Hallmark Registration (1)

- Income Tax (199)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (20)

- Startup/ Registration (126)

- Trademark Registration/IPR (40)

Recent Posts

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.