Conversion of Private Company to Public Company as per Companies Act, 2013

- August 4, 2023

- Change in Business

In today’s business landscape, companies often need to adapt and transform to meet changing market demands and capitalize on growth opportunities. One such transformation is the Conversion of a Private Company into Public Company. The Companies Act, 2013 in India provides a legal framework for this conversion process, outlining the procedures, requirements, and implications involved. This article will delve into the details of Conversion of a Private Company to Public Company under the Companies Act, 2013.

But before we move on to discuss about the procedure for conversions of private company into public company, let’s move on to understand some basic information about the Private Limited Company and Public Limited Company.

Meaning of Private Limited Company

A Private Limited Company is a distinct legal entity that is governed by the provisions of the Companies Act, 2013 in India. It is a popular choice for entrepreneurs and small businesses due to its flexible structure, limited liability, and ease of operation.

According to Section 2(68) of the Companies Act, 2013, a private company is defined as a company that has the following characteristics:

- Minimum Shareholders: A private company must have a minimum of two shareholders, and the maximum limit is set at two hundred shareholders. This restriction on the number of shareholders distinguishes it from a public company, which can have an unlimited number of shareholders.

- Minimum Directors: A private company must have a minimum of two directors. At least one of these directors should be an Indian resident. Unlike a public company, a private company can have all its directors as shareholders as well.

- Share Transfer: The shares of a private company are not freely transferable. Shareholders have restrictions on transferring their shares to others. These restrictions are usually mentioned in the company’s articles of association and shareholders’ agreement.

- Invitation to Public: A private company cannot invite the public to subscribe to its shares or debentures. It cannot issue a prospectus or solicit funds from the general public for subscription of its securities.

- Statutory Meetings: A private company is not required to hold statutory meetings or follow elaborate procedures like a public company. It provides greater operational flexibility to the company’s management.

Meaning of Public Limited Company

According to the Companies Act, 2013, a Public Limited Company is defined as a company which is not a Private Limited Company and has a minimum paid-up share capital of five lakh rupees or such higher paid-up capital as may be prescribed. The company must also have a minimum number of seven members, and there is no maximum limit on the number of members in a Public Limited Company.

The Public Limited Company has the following characteristic:

- Limited Liability: One of the key characteristics of a public limited company is limited liability. The liability of the shareholders is limited to the amount unpaid on their shares. This means that the personal assets of the shareholders are not at risk in the event of the company’s debts or obligations.

- Share Capital: A Public Limited Company must have a minimum paid-up share capital of five lakh rupees or a higher amount as prescribed. The capital is divided into shares, and these shares can be freely transferred or traded on a stock exchange.

- Number of Members: A public limited company must have a minimum of seven members. There is no maximum limit on the number of members, and the company can have an unlimited number of shareholders.

- Public Offering: Unlike private limited companies, public limited companies have the option to raise funds from the general public by issuing shares to the public through initial public offerings (IPOs). This allows them to raise substantial capital for expansion or other business purposes.

- Listing on Stock Exchange: Public limited companies can apply for listing their shares on recognized stock exchanges, such as the National Stock Exchange (NSE) or the Bombay Stock Exchange (BSE). Listing provides liquidity to the shareholders as they can sell their shares in the open market.

- Statutory Compliance: Public limited companies are subject to various statutory compliance requirements under the Companies Act, 2013. These include filing annual financial statements, holding annual general meetings, maintaining proper books of accounts, appointing auditors, and complying with corporate governance norms.

Conversion of Private Company to Public Company as per Companies Act, 2013

The Companies Act, 2013, enacted by the Indian Parliament, provides a comprehensive legal framework for the functioning and regulation of companies in India. Among the various provisions outlined in the Act, one significant aspect is the process of conversions of private company into public company.

Converting a private company to a public company involves transforming the legal structure of the business to enable public trading of its shares on a recognized stock exchange. This transition brings various benefits such as increased access to capital, enhanced market presence, and improved credibility.

However, the conversion process requires meticulous compliance with legal and regulatory obligations, including drafting and filing necessary documents, obtaining approvals, and adhering to disclosure requirements.

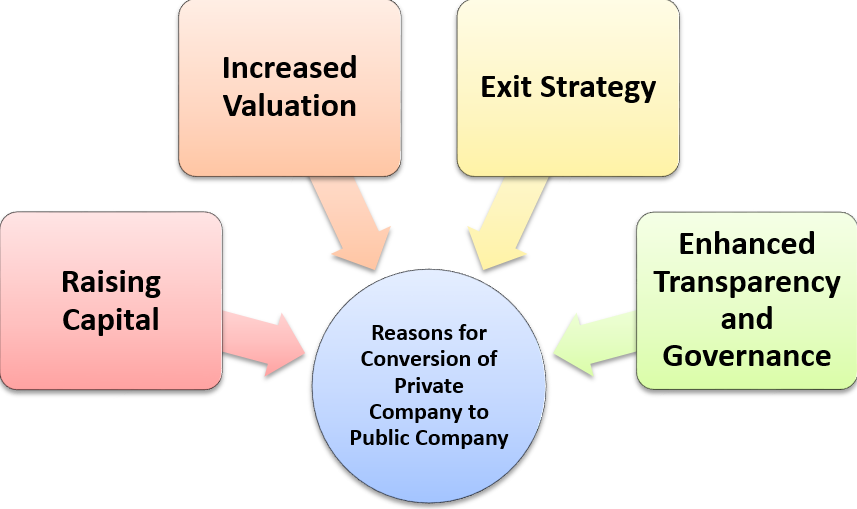

Reasons for Conversion of Private Company to Public Company

Private Companies often choose to convert to Public Companies for several reasons. Some of the common motivations behind such a conversion are:

- Raising Capital

Public Companies have the advantage of accessing a broader pool of investors and raising funds by issuing shares through Initial Public Offerings (IPOs). This influx of capital can be instrumental in expanding the business, funding new projects, or reducing debt.

- Increased Valuation

A Public Company’s valuation is often higher than that of a private company due to the wider market recognition and potential for liquidity. The conversion to a public company can enhance the overall value and attractiveness of the business.

- Exit Strategy

Converting to a Public Company can provide an exit route for existing shareholders, including founders and early investors, who may wish to monetize their investments and unlock value.

- Enhanced Transparency and Governance

Public Companies are subject to greater regulatory scrutiny and are required to comply with stricter corporate governance norms. This can instill investor confidence, attract institutional investors, and foster transparency in operations.

Benefits of Conversion of Private Company to Public Company

Some of the benefits of Conversion of Private Company to Public Company are as follows:

- Access to Capital: One of the primary advantages of converting a private company to a public company is the ability to raise capital from the general public. By issuing shares to the public through an Initial Public Offering (IPO), a company can attract investments from a wider pool of investors, including institutional investors and retail investors. This infusion of capital can provide the necessary funds for expansion, research and development, acquisitions, and other strategic initiatives.

- Enhanced Brand Visibility: Going public can significantly enhances a company’s brand visibility and reputation. Public companies are subject to increased scrutiny and disclosure requirements, which can help build trust among stakeholders, including customers, suppliers, and partners. The status of being a public company can instill confidence in the market, attract new customers, and provide a competitive edge.

- Liquidity for Shareholders: Conversion to a public company can provide an exit strategy for existing shareholders. In a private company, the shares are often illiquid, making it challenging for shareholders to sell their stakes. However, by going public, shareholders can sell their shares on stock exchanges, providing liquidity and the ability to realize their investments. This increased liquidity can make the company’s shares more attractive to potential investors.

- Expansion Opportunities: A public company enjoys better access to growth opportunities. With increased capital resources, a public company can undertake expansion plans, enter new markets, invest in research and development, and execute strategic acquisitions. The ability to tap into public markets allows for greater flexibility in pursuing growth strategies and achieving economies of scale.

- Valuation and Exit Options: Public companies generally have a higher valuation compared to private companies. The market value of a public company’s shares is determined by market forces and investor sentiment. This can provide a benchmark for valuing the company and can be advantageous in scenarios such as mergers and acquisitions or raising further capital through follow-on offerings. Moreover, being a public company offers an exit option for the promoters and early investors who can gradually sell their shares in the market.

- Employee Incentives: Conversion to a public company can open up opportunities for employee stock ownership plans (ESOPs). ESOPs allow employees to become shareholders and benefit from the company’s growth and success. This can be an effective tool for attracting and retaining top talent, as employees have the potential to share in the company’s financial success and align their interests with the long-term goals of the organization.

- Regulatory Compliance and Governance: Public companies are subject to stricter regulatory requirements and corporate governance standards compared to private companies. This can lead to improved transparency, accountability, and investor protection. Compliance with these regulations enhances the company’s credibility and reduces the risk of corporate governance-related issues. Adopting robust governance practices can also attract institutional investors and strengthen the company’s reputation in the market.

Documents required for Conversion of Private Limited to Public Limited Company as per Companies Act, 2013

The following documents are needed for conversion of private limited to public limited company:

- Shareholders’ PAN Card Details

- If the shareholder is a foreign national, a copy of the foreign national’s passport must be submitted.

- PAN, Aadhaar Card, Voter ID are the identification documents required for shareholders and directors.

- Electricity, water, and other utility bills

- NOC (No Objection Certificate) from the registered office owner

- Rental Agreement and other registered office documents

- If the person is a foreign national, all documents must be notarized by the appropriate government.

- The MOA and AOA

- A copy of the company’s Certificate of Incorporation

- Company’s Income Tax Returns

- Company’s most recent Audited Financial Statements

Forms necessary for the conversion of Private Limited Company to Public Limited Company

For the conversion of a private limited company to a public limited company, the following forms are required:

- Form MGT 14: Form MGT 14 must be submitted to the Registrar of Companies. Along with this information, the ROC must receive the notice of the EGM, amended AOA, amended MOA, statements with explanations, and resolutions adopted at the EGM.

- Form INC 27: Form INC 27 must be submitted to the Registrar of Companies. Along with this information, the ROC must receive the notice of the EGM, amended AOA, amended MOA, statements with explanations, and resolutions adopted at the EGM. The minutes of the meeting must also be sent to the ROC.

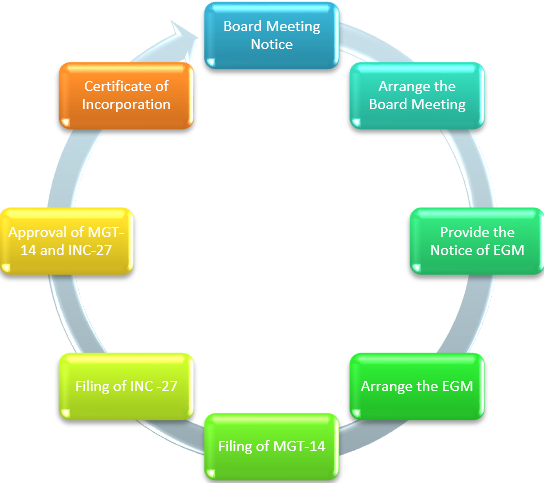

Procedure of Conversion of Private Limited to Public Limited Company

The following is the procedure for Conversion of Private Company to Public Company:

- Board Meeting Notice

To hold a board meeting, the Private Company’s directors must provide notice. The meeting must be announced seven days in advance. This notice must include the meeting’s agenda. The following items must be included on the board meeting agenda:

- Resolution that must be approved at the board meeting

- Time and Conditions for Holding an Extraordinary General Meeting

- The EGM was approved.

After, the passing of the notice the next step is to hold a Board Meeting.

- Arrange the Board Meeting

The next stage is for the company to have a board meeting. The following items must be authorized at the board meeting:

- Prepare a resolution for the conversion of a private limited company to a public limited company.

- Complete the company’s list of creditors.

- Approve the drafts of the Memorandum and Articles of Association.

- Consider setting a date and location for the EGM.

After, the arranging of Board Meeting the next step is to provide notice to hold EGM.

- Provide the Notice of EGM

The directors must then issue notice to all shareholders of the Extraordinary General Meeting (EGM) at least 21 days before the meeting in the following step of the board meeting. A period of 21 clear days notice is required to calculate the timeframe.

- Arrange the EGM

The company must then hold an EGM as the next stage. In this case, a special resolution requiring a majority vote must be considered to be carried. The approved MOA and AOA must also be considered by the meeting’s directors.

- Filing of MGT-14

Within 30 days of the EGM, the directors must file form MGT-14 with the Registrar of Companies (ROC).

- Filing of INC -27

Even the form INC-27 must be sent to the ROC within 15 days following the EGM.

- Approval of MGT-14 and INC-27

The ROC will then evaluate whether the details connected to the MGT and INC were completed in accordance with the provisions of the Companies Act, 2013. If there are no problems, the ROC will approve the forms.

- Certificate of Incorporation

Following the approval procedure, the ROC will issue the newly created company with a Certificate of Incorporation.

Post-Compliance Requirements for Conversion of Private Limited to Public Limited Company

Once the conversion is approved by the Registrar of Companies (ROC), the following post-compliance requirements must be met:

- Alteration of Memorandum and Articles of Association

The company’s Memorandum and Articles of Association must be amended to reflect the change in the status from Private to Public. The alteration should be approved by the shareholders and filed with the ROC.

- Increased Minimum Capital

A Public Limited Company must have a minimum paid-up share capital of INR 5 lakhs or such higher amount as prescribed. The company must ensure compliance with this requirement within a specified time frame.

- Appointment of Independent Directors

A Public Limited Company must have a certain number of independent directors on its board, as mandated by the Act. The company must appoint independent directors within the stipulated timeframe and ensure compliance with their obligations.

- Compliance with Listing Regulations

If the company intends to list its shares on a stock exchange, it must comply with the listing regulations of the respective exchange. This includes fulfilling disclosure requirements, corporate governance norms, and periodic reporting obligations.

- Compliance with Public Company Reporting

A Public Limited Company must comply with additional reporting requirements compared to A Private Limited Company. This includes filing regular financial statements, holding annual general meetings, and maintaining statutory registers.

It is crucial for companies undergoing conversion to ensure compliance with all legal, regulatory, and procedural requirements. Engaging legal and financial professionals with expertise in corporate law can be beneficial to navigate the complexities associated with the conversion process.

Takeaway

Takeaway

The conversion of private company to public company under the Companies Act, 2013 offers various advantages, including access to capital, increased valuation, and enhanced transparency. However, companies must carefully evaluate their objectives and consider the legal, financial, and operational implications before undertaking this conversion. Adhering to the prescribed procedure and complying with regulatory requirements is essential to ensure a smooth and successful transition.

CS Urvashi Jain is an associate member of the Institute of Company Secretaries of India. Her expertise, inter-alia, is in regulatory approvals, licenses, registrations for any organization set up in India. She posse’s good exposure to compliance management system, legal due diligence, drafting and vetting of various legal agreements. She has good command in drafting manuals, blogs, guides, interpretations and providing opinions on the different core areas of companies act, intellectual properties and taxation.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (90)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (119)

- Hallmark Registration (1)

- Income Tax (201)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (21)

- Startup/ Registration (130)

- Trademark Registration/IPR (40)

Recent Posts

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.