The NPS (National Pension Scheme) came into force to provide individuals with a consistent source of income during their retirement years. It is a long-term investment and provides various tax benefits of NPS. Understanding these advantages might assist consumers in making sound decisions about their retirement funds. This article deals with the NPS tier 2 tax benefits, NPS tax saving, exemptions, and NPS employer contributions.

Contents

NPS and Tax Benefits

NPS is a retirement savings scheme sponsored by the government. It gives substantial tax benefits in India. The tax benefit of NPS are governed by an authority called PFRDA (Pension Fund Regulatory & Development Authority). The authority was formed under the PFRDA Act, 2013. Moreover, Section 80CCD(1) and Section 80CCD(2) of the IT Act, 1961 provide tax benefits of NPS to individuals contributing to the NPS.

- NPS Deduction Under Section 80CCD(1)

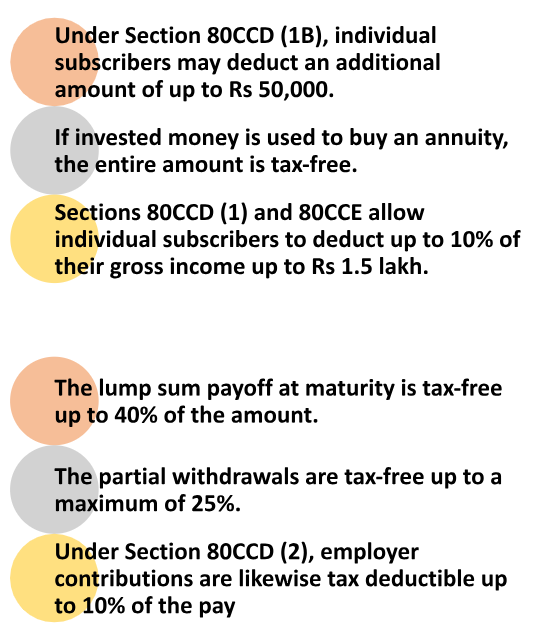

Section 80CCD(1) allows individual taxpayers, including self-employed individuals, to claim NPS deductions of up to 10% of their salary (for salaried employees) or their gross income (for self-employed) towards contributions made to the NPS. A maximum of Rs. 1.5 lakh can be claimed by the individual under this section.

- NPS Deduction Under Section 80CCD(2)

In IT Act, 1961 the salary employees can claim deductions under Section 80CCD(2). It permits employers to contribute up to 10% of an employee’s salary to the National Pension Scheme. This deduction is above the limit of Rs. 1.5 lakh available under Section 80CCD(1). This deduction falls under the overall limit of Section 80C, which includes other investments like EPF, PPF, etc.

- NPS Deduction Under Section 80CCD(1B)

Individuals to claim an additional deduction of up to ₹50,000 on contributions made towards the National Pension System (NPS). It is expressly mentioned in section 80CCD(1B) of the IT Act 1961. This deduction is above the limit of ₹1.5 lakh provided under Section 80C. It encourages taxpayers to invest in NPS and helps them save on income tax while building a secure retirement fund.

Also, read: Difference between EPF, PPF & NPS, and Tax Benefits

NPS Tax Benefit under the Income Tax Act (Section 10)

Apart from the above-mentioned deductions, NPS tax exemption under Section 10 of the Income Tax Act, 1961. This exempts any amount received from NPS upon maturity or partial withdrawal from tax, up to 40% of the maturity corpus.

Additional NPS Tax Benefits for Individuals

Under Section 80CCD(1B), there is an additional tax benefit of NPS. It is a deduction of Rs. 50,000 is available exclusively for NPS contributions through Section 80CCD(1B). This deduction is over and above the limit of Section 80C, providing individuals with an opportunity to save more on their taxable income.

NPS Tax Exemption and Tier 2 Benefits

- NPS Tax Exemption

The NPS tax exemption on the maturity amount received by the individual upon retirement, also known as the National Pension Scheme deduction. As per the PFRDA Act, 2013, this maturity amount is exempt from tax up to 60% of the total corpus. The remaining 40% must be utilized to purchase annuities, which are taxable based on the individual’s earnings under “Income from Other Sources.”

- NPS Tier 2 Tax Benefit

NPS Tier 2 is an additional investment option that allows individuals to make voluntary contributions, unlike the Tier 1 account, which is mandatory. While Tier 2 does not offer tax benefits under Section 80C, contributions made to this account for a minimum of three years are eligible for indexation benefits.

Indexation advantages help individuals to adjust their investments against inflation and it reduces their tax liability on the gains that are made from the appropriate investment. Moreover, withdrawals from the Tier 2 account are subject to short-term and long-term capital gains tax, depending on the investment time lapse.

NPS Tax Benefits in Nutshell

End Note

The tax benefit of NPS to individuals looking to secure their finances. Individuals can claim deductions on their contributions by utilizing the provisions outlined in the Income Tax Act of 1961. The Act specifically included the provisions for salaried employees and employer contributions. Additionally, the NPS Tier 2 account NPS deduction provides flexibility for investments with separate tax treatment. Being aware of the tax benefits available under the NPS scheme can help individuals optimize their tax savings while creating a substantial retirement corpus.

In case of any query regarding Understanding the Tax Benefit of NPS, feel free to connect with our legal experts at Legal Window at 72407-51000.

CA Pulkit Goyal, is a fellow member of the Institute of Chartered Accountants of India (ICAI) having 10 years of experience in the profession of Chartered Accountancy and thorough understanding of the corporate as well as non-corporate entities taxation system. His core area of practice is foreign company taxation which has given him an edge in analytical thinking & executing assignments with a unique perspective. He has worked as a consultant with professionally managed corporates. He has experience of writing in different areas and keep at pace with the latest changes and analyze the different implications of various provisions of the act.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (90)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (118)

- Hallmark Registration (1)

- Income Tax (200)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (21)

- Startup/ Registration (130)

- Trademark Registration/IPR (40)

Recent Posts

- NGO Darpan Registration in Jaipur May 2, 2024

- Registration of Charges with ROC May 1, 2024

- Post incorporation compliances for companies in India April 30, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.