Understanding Section 263 of Income Tax Act, 1961: A Comprehensive Guide

- December 7, 2023

- Income Tax

Section 263 of the Income Tax Act, 1961 serves as a key mechanism to ensure the proper and just administration of tax laws in India. This rule lets the Commissioner change any decision that seems wrong, harms the government’s money, or wasn’t properly checked. It gives the Commissioner power to fix any mistakes or if the law wasn’t used correctly, which could cause less tax or loss to the government. Section 263 is all about making sure things are fair, right, and follow the rules when figuring out taxes. It’s super important for keeping the tax system fair and honest.

| Table of Content |

Overview of Section 263 Income Tax Act

Section 263 of the Income Tax Act grants the Commissioner authority to rectify the orders which have error to prevent revenue loss. This provision empowers the Commissioner to revise orders lacking proper inquiry to revenue interests. It’s crucial in ensuring fair assessments. Numerous Section 263 of Income Tax Act case laws like demonstrate its application, emphasizing rectification of errors, proper scrutiny, and protecting revenue interests. For instance, in the case of CIT v. Max India Ltd., the Commissioner changed a decision because it missed important information, ensuring the right amount of tax was paid. Knowing about these cases helps taxpayers and experts handle assessments better. It shows how important it is to fill out tax forms accurately and follow the rules. This is really important for making sure taxes are fair and everyone plays by the same rules.

Understanding the Commissioner’s Powers

The Commissioner’s powers under Section 263 of the Income Tax Act are pivotal in ensuring accurate and fair tax assessments. These powers empower the Commissioner to review and rectify any erroneous orders passed by subordinate tax officers. The key aspects of these powers include:

- Revision Authority: The Commissioner can review and revise any order if it’s found to be incorrect, prejudicial to the interests of revenue, or lacking proper inquiry.

- Preventing Revenue Loss: This provision aims to prevent revenue loss by correcting mistakes or oversights made during assessments that might lead to under-assessment of taxes.

- Scrutiny for Fairness: It allows the Commissioner to scrutinize orders to ensure they are just and in accordance with the provisions of the Income Tax Act.

- Protection of Revenue Interests: The Commissioner’s powers ensure that tax assessments are accurate, preventing any undue benefit or loss to the government.

- Importance for Taxpayers: Understanding these powers is crucial for taxpayers and tax professionals to navigate assessments accurately, avoid discrepancies, and comply with tax laws.

In essence, these powers grant the Commissioner the authority to intervene when assessments are flawed, ensuring fairness, accuracy, and adherence to legal provisions in the tax assessment process.

Process and Procedure under Section 263

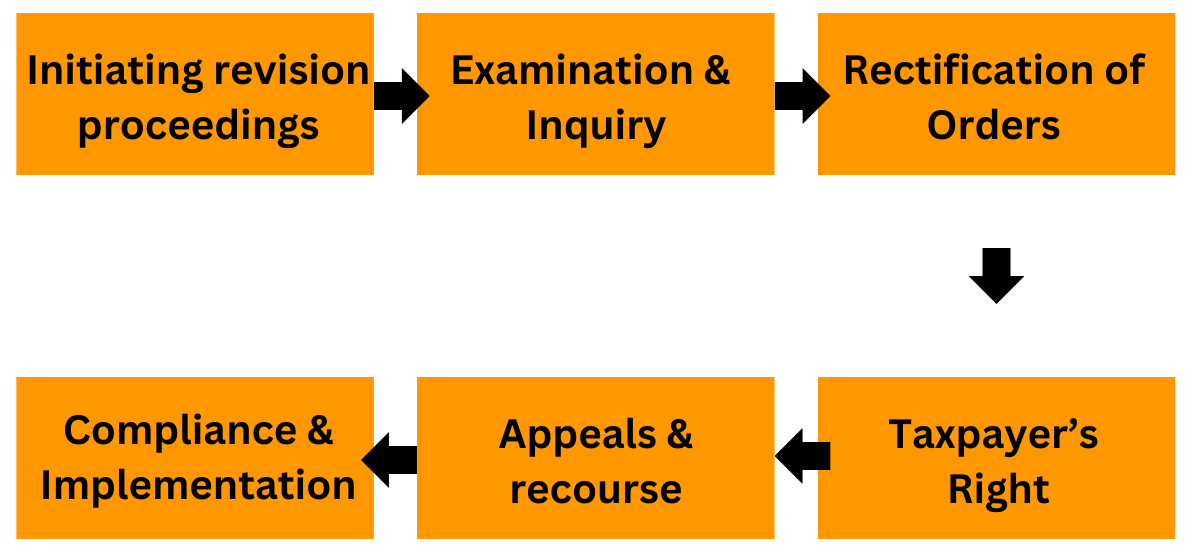

The process and procedure under Section 263 of the Income Tax Act outline how the Commissioner exercises their powers to rectify erroneous orders. Here’s a breakdown:

- Initiating Revision Proceedings: The Commissioner can initiate revision proceedings based on their own knowledge or on receiving information suggesting an order might be erroneous.

- Examination and Inquiry: The Commissioner examines the order and conducts inquiries if necessary to ascertain if it’s erroneous and prejudicial to revenue interests.

- Rectification of Orders: If the Commissioner finds an error, they issue a show-cause notice to the taxpayer, providing an opportunity to present their case. Following this, a revised order correcting the mistake is issued.

- Taxpayer’s Rights: Taxpayers have the right to be heard and present their arguments and evidence against the proposed revision before the Commissioner makes a final decision.

- Appeals and Recourse: If dissatisfied with the Commissioner’s revision, taxpayers can appeal to higher authorities or tribunals for redressal.

- Compliance and Implementation: Once the revised order is finalized, it becomes binding, and taxpayers are required to comply with the new assessment.

Understanding this process is crucial for taxpayers and tax professionals to navigate revision proceedings effectively, ensuring fair representation and compliance with the Income Tax Act.

Compliance and Legal Implications

Compliance and legal implications under Section 263 of the Income Tax Act are significant:

- Adherence to Correct Orders: Taxpayers must comply with revised orders issued by the Commissioner under Section 263. Non-compliance can lead to penalties or further legal actions.

- Legal Obligations: Once the Commissioner revises an order, it holds legal validity and should be followed unless appealed and overturned by higher authorities.

- Impact on Tax Liabilities: Revised assessments can impact tax liabilities. Taxpayers need to understand and fulfill their revised tax obligations based on the rectified order.

- Importance of Documentation: Maintaining proper records and documentation is crucial to substantiate claims and defenses during revision proceedings.

- Appeals and Recourse: If taxpayers disagree with the revised order, they have the right to appeal to appellate authorities or tribunals for reconsideration.

- Professional Advice: Seeking advice from tax professionals or consultants can help navigate compliance issues and understand the legal implications of revised orders.

Compliance with revised orders and understanding the legal consequences is vital to ensure adherence to tax laws and avoid penalties or further legal actions.

Importance for Taxpayers and Tax Consultants

Knowing Section 263 of the Income Tax Act is really important for both regular folks doing taxes and the experts who help them. For regular taxpayers, it means filling out forms right so they don’t get in trouble later or have to fix things and pay fines. And for the experts, it helps them check everything carefully, so their clients don’t make mistakes and follow the rules. This helps everyone deal with taxes fairly and avoid arguing about them later on. This understanding fosters proactive tax planning, optimizing strategies to mitigate revision risks. Overall, familiarity with Section 263 is pivotal for accurate filings, compliance, and fostering a fair tax environment for taxpayers and efficient service delivery by tax consultants.

Conclusion

In summary, Section 263 of the Income Tax Act is like a big tool that helps make sure taxes are fair and right. It lets the Commissioner fix any mistakes in orders to protect the government’s money and make sure everyone follows the tax rules. For regular folks, it’s important to understand this section to fill out tax forms correctly and avoid problems. And for tax experts, knowing about it helps them check things carefully and plan taxes well. So, it’s all about making sure everyone plays by the rules and the tax system is fair for everyone.

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost. Our team offers expertise solutions in various fields that include Corporate Laws, Direct Taxations, GST Matters, IP Registrations and other Legal Affairs.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (90)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (118)

- Hallmark Registration (1)

- Income Tax (200)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (21)

- Startup/ Registration (128)

- Trademark Registration/IPR (40)

Recent Posts

- Post incorporation compliances for companies in India April 30, 2024

- Startup’s Guide to Employee Stock Ownership Plans April 29, 2024

- Master Secretarial Audit: A Complete Compliance Guide April 27, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.