Income Tax Notice in India: Types, Significance, and How Taxpayers should respond to them?

- August 18, 2023

- Income Tax

Income tax is an essential source of revenue for the Indian government, contributing significantly to the nation’s development and welfare. To ensure the proper collection of taxes and adherence to tax regulations, the Income Tax Department issues notices to taxpayers when discrepancies or irregularities are identified in their tax returns or financial transactions. These notices play a essential role in maintaining tax compliance and transparency in the system. In this article, we will provide an overview of income tax notice in India, their types, significance, and how taxpayers should respond to them.

Understanding Income tax notice

An income tax notice is a formal communication issued by the Income Tax Department to inform a taxpayer about specific issues related to their tax return or financial activities. Notices can be sent through both physical mail and electronic means, and they require the taxpayer’s attention and response within a specified timeframe.

Provisions regarding to Income tax notice and its Legal Aspect

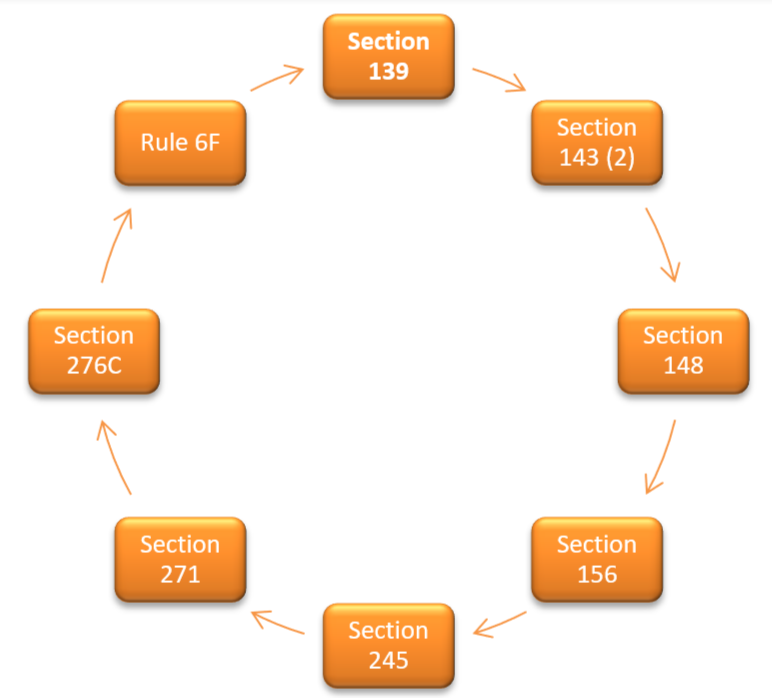

The Indian Income Tax Act, 1961 has several sections about income tax notice and their legal implications. Some of the Acts and Provisions are as follows:

- Section 139: This section deals with the filing of income tax returns. The tax authorities can issue notices under this section if a taxpayer fails to file their return or files an incomplete or inaccurate return.

- Section 143(2): This section pertains to the scrutiny assessment of tax returns. The tax authorities can issue notices under this section to conduct a thorough examination of a taxpayer’s return, seeking additional information or clarifications.

- Section 148: If the assessing officer believes that income has escaped assessment, he can issue a notice under this section to reopen the assessment for a particular assessment year.

- Section 156: This section empowers tax authorities to issue notices for payment of tax, interest, penalty, or any other sum due under the Income Tax Act.

- Section 245: Under this section, the tax authorities can issue a notice to adjust any refund due to the taxpayer against outstanding tax liabilities.

- Section 271: This section deals with penalties for various defaults, and a notice can be issued to impose penalties for non-compliance.

- Section 276C: The intentional attempt to evade the tax is included in this provision. The taxpayer may be informed to pay the penalty and serve time in jail if the income tax agency discovers any deliberate attempts to evade tax.

- Rule 6F: This regulation addresses record-keeping. Every taxpayer is required by this rule to keep specific records and documentation, and if they don’t, the income tax department may give them a warning.

Types of Income Tax Notices

The following are the types of Income Tax Notice in India:

- Intimation under Section 143(1): This is an intimation notice that is generated after the processing of income tax returns. It informs the taxpayer about any adjustments made to their declared income, deductions, or tax liability. If there is a difference between the tax calculated by the taxpayer and the tax computed by the department, the intimation notice will provide details of the adjustments made.

- Notice under Section 139 (9): This notice is issued if there are discrepancies or errors in the tax return filed by the taxpayer. The taxpayer is given an opportunity to rectify these errors within a specified time.

- Notice under Section 143(2): This is a scrutiny notice, indicating that the tax return will be subject to a detailed examination by the tax authorities. The taxpayer may need to provide additional documents, explanations, or clarifications to support the information provided in the return.

- Notice under Section 148: If the Income Tax Department believes that a taxpayer has undisclosed income, they can issue a notice under Section148 to reopen the assessment for a specific assessment year. This notice can be issued within four years from the end of the relevant assessment year.

- Notice under Section 271(1) (c): This notice is issued if the tax authorities believe that the taxpayer has concealed income or furnished inaccurate particulars of income. It may result in the imposition of penalties.

- Notice under Section 245: When a taxpayer has outstanding dues or demands pending with the tax department, and they are expecting a refund for a different assessment year, a notice under Section245 may be issued, intimating the adjustment of the refund against the outstanding demand.

Key Aspects of Income tax notice and Legal Safeguards for Taxpayers

The following are the Key Aspects of Income Tax Notice in India:

- Mode of Issuance: Income tax notices are typically issued in writing and can be served through various means, including physical delivery, registered post, electronic communication, or even through the taxpayer’s e-filing account.

- Time Limit: The Income Tax Act sets specific time limits for issuing different types of notices. For instance, a notice under section 143(2) for scrutiny assessment must be issued within six months from the end of the financial year in which the return is filed.

- Response Time: Taxpayers are usually given a reasonable period to respond to the notice, provide requested information, or attend hearings if required. Failure to respond within the stipulated time can lead to adverse consequences.

- Representation: Taxpayers have the right to present their case and provide necessary documents and explanations during the proceedings initiated by an income tax notice. They can also be represented by authorized representatives, including tax professionals.

While income tax notices are essential tools for tax administration, the Income Tax Act also provides certain safeguards to protect taxpayers’ rights:

- Legal Safeguards for Taxpayers

The following are the Legal Safeguards for Taxpayers:

- Reasons to Believe: Before issuing a notice for reopening assessment under section 148, the assessing officer must have valid reasons to believe that income has escaped assessment. This ensures that the reopening is not arbitrary.

- Opportunity of Hearing: Taxpayers have the right to be heard and present their case before any adverse action is taken based on the notice.

- Appellate Mechanisms: If a taxpayer disagrees with the outcomes of the notice, they can appeal to higher authorities, such as the Commissioner of Income Tax (Appeals) or the Income Tax Appellate Tribunal.

- Limitation Period: There are prescribed time limits for completing various assessment and reassessment procedures to prevent undue delays.

Reasons of an Income Tax Notice

Receiving an income tax notice can be unsettling, but it is essential to understand that it doesn’t necessarily imply wrongdoing. There are several reasons why individuals or businesses might receive an Income Tax Notice in India:

- Discrepancies in Income Declaration: One common reason for receiving an income tax notice is a mismatch between the income declared in the tax return and the information available with the tax department. This could arise due to errors or omissions in the income reported, such as failing to disclose all sources of income, not reporting interest income, or inaccurately reporting deductions.

- High-Value Transactions: The income tax department closely monitors high-value financial transactions. If an individual or entity engages in significant financial activities, such as buying or selling high-value assets like property or vehicles, the tax department may issue a notice to seek clarification on the source of funds and ensure compliance with tax laws.

- Discrepancies in TDS/TCS: Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) are mechanisms to ensure that taxes are deducted or collected at the source of income. If there are discrepancies between the TDS or TCS reported by the taxpayer and that reported by the deductor or collector, it could lead to an income tax notice.

- Non-Disclosure of Foreign Assets: Individuals who hold foreign assets, such as bank accounts, investments, or properties, are required to disclose these assets in their tax returns under the Foreign Account Tax Compliance Act (FATCA) and the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act. Failure to report such assets could result in an income tax notice.

- High Expenditure and Low Income: If an individual’s spending patterns indicate a lifestyle that seems incongruent with their reported income, the income tax department may initiate an inquiry to determine the source of funding for such expenditures.

- Random Scrutiny: The income tax department selects a certain number of tax returns for scrutiny each year. If your return is selected, you may receive a notice asking you to provide supporting documents and explanations for the entries in your return.

- Failure to File Returns: Not filing income tax returns, especially when you are liable to do so, can lead to the issuance of a notice. It is important to remember that filing returns is mandatory for individuals and entities whose income exceeds the specified threshold.

- Underreporting of Income: Deliberately underreporting income or inflating deductions to reduce tax liability is a serious offense. If the tax department suspects such behavior, they may issue a notice to investigate and assess the correct tax liability.

- Non-Disclosure of Gifts or Loans: Gifts received beyond a certain threshold are subject to taxation. Failing to disclose such gifts or loans received from relatives or non-relatives could lead to a notice.

- Tax Evasion or Avoidance: Engaging in activities to evade or avoid taxes, such as creating sham transactions or using illegal means to reduce tax liability, can lead to severe penalties and notices from the income tax department.

It’s important to note that receiving an income tax notice does not automatically imply guilt. In many cases, it might be a routine inquiry to seek clarification or additional information. If you receive an income tax notice in India, it’s advisable to consult a tax professional or a chartered accountant to respond appropriately and provide accurate information to the tax authorities.

What you should do on receiving an Income tax notice from Income Tax Department?

The measures that follow should be taken when you get notice under one of the aforementioned sections:

- To find out why a notice was sent, carefully read it.

- Check the notice’s essential information to see if you are the one it is intended for. Your proper name, PAN number, address, and other details should be included in the notice to guarantee that you receive it. Verify the notice’s stated assessment year as well.

- Find out if there is a mismatch in your income tax return that led to the notification being delivered.

- Please respond to the notice within the allotted period in order to prevent penalties and charges.

- Make sure your response is supported by sufficient data.

- Additionally, confirm that notice you got is reflected in your online income tax account.

Legal Window will offer you the essential services, legal counsel, and assistance with responding to Income tax notice as well as other compliance-related issues. You may reach our staff by calling 072407-51000 or sending an email to admin@legalwindow.in.

Way Forward

Income tax notices are an integral part of the tax administration system and are used by the Income Tax Department to ensure tax compliance and fairness. As taxpayers, it is essential to be aware of our rights and responsibilities, respond diligently to notices, and seek professional help when needed. Timely and accurate responses can help resolve any discrepancies and ensure a smooth tax assessment process. By staying informed and being proactive, taxpayers can avoid unnecessary complications and enjoy a hassle-free tax compliance experience under the Income Tax Act, 1961.

CA Pulkit Goyal, is a fellow member of the Institute of Chartered Accountants of India (ICAI) having 10 years of experience in the profession of Chartered Accountancy and thorough understanding of the corporate as well as non-corporate entities taxation system. His core area of practice is foreign company taxation which has given him an edge in analytical thinking & executing assignments with a unique perspective. He has worked as a consultant with professionally managed corporates. He has experience of writing in different areas and keep at pace with the latest changes and analyze the different implications of various provisions of the act.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (90)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (118)

- Hallmark Registration (1)

- Income Tax (200)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (21)

- Startup/ Registration (128)

- Trademark Registration/IPR (40)

Recent Posts

- Post incorporation compliances for companies in India April 30, 2024

- Startup’s Guide to Employee Stock Ownership Plans April 29, 2024

- Master Secretarial Audit: A Complete Compliance Guide April 27, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.