All you need to know about the procedure of Conversion of Sole Proprietorship Firm into Private Company

- August 24, 2023

- Change in Business

A sole proprietorship is one of the simplest forms of business entities, where an individual owns and manages the entire business. However, as the business grows and the need for scalability, limited liability, and enhanced credibility arises, many sole proprietors contemplate converting their firms into private limited companies. The Companies Act, 2013, provides a legal framework for such conversions, allowing entrepreneurs to enjoy the benefits of a corporate structure while retaining the existing business. In this article we will discuss the process of conversion of Sole Proprietorship Firm into Private Company.

Before we move on to discuss conversion of a proprietorship to a company, let us move on to discuss about Sole Proprietorship and Private Limited Company respectively.

Understanding Sole Proprietorship

The simplest type of business entity is a sole proprietorship, in which one person owns and runs the company. There is no legal distinction in this arrangement between the owner and the company. The proprietor has all authority over decision-making and accepts all risks, obligations, and rewards related to the functioning of the company.

According to the Companies Act, 2013, a sole proprietorship is not defined explicitly. However, it is understood as a business carried on by a single individual, who is both the owner and manager of the business. This individual has full control and authority over the business’s operations, decision-making, and assets.

Meaning of Private Limited Company

The Companies Act, 2013, governs a Private Limited Company, which is a separate legal entity. Due to its adaptable form, restricted liability, and simplicity of use, it is a well-liked option among business owners and small corporations.

A Private Limited Company is a type of business organization that is legally separate from its owners, offering limited liability protection to its shareholders. The term ‘private’ signifies that the company’s shares are held by a closely-knit group of individuals, limiting the transferability of shares and retaining a level of control within the company’s management. The Companies Act, 2013, in India, lays down specific provisions and regulations that govern the functioning and structure of private limited companies.

Conversion of Sole Proprietorship Firm into Private Company

The Indian Parliament passed the Companies Act, 2013, which offers a thorough legal framework for the operation and regulation of companies in India. The procedure of converting a proprietorship to private limited company is one of the many requirements included in the Act.

In order to permit public trading of the company’s shares on a recognized stock market, a proprietorship must be converted to a private limited company. This transformation has a number of advantages, including better credibility, more market presence, and easier access to funding.

However, the conversion procedure necessitates strict adherence to legal and regulatory duties, including the creation and submission of appropriate documents, the receipt of approvals, and the fulfillment of disclosure obligations.

Reasons for conversion of Sole Proprietorship Firm into Private Company

The reasons for converting a proprietorship to Private Limited Company are as follows:

- Limited Liability Protection: One of the primary reasons for converting a sole proprietorship into a private company is the enhanced limited liability protection that comes with the latter. In a sole proprietorship, the owner’s personal assets are inseparable from the business liabilities. However, when transformed into a private company, the business becomes a separate legal entity. This means that the shareholders’ liability is limited to their share capital, providing a crucial safeguard for personal assets in case of business debts or legal issues.

- Access to Capital: Private companies often have greater access to various sources of capital compared to sole proprietorships. By converting, a business gains the ability to issue shares and attract investments from outside parties, such as venture capitalists, angel investors, or institutional investors. This injection of capital can fuel business expansion, product development, and innovation, helping the company realizes its growth potential.

- Perpetual Existence: A sole proprietorship’s existence is often tied to the owner’s lifespan or decision to discontinue operations. In contrast, a private company enjoys perpetual existence, independent of changes in ownership or management. This stability and continuity make it an attractive option for entrepreneurs looking to build a lasting legacy and ensure the business’s sustainability over the long term.

- Improved Credibility: The conversion to a private company enhances the business’s credibility and reputation in the eyes of stakeholders, including customers, suppliers, and partners. Private companies are subject to stricter regulatory and compliance requirements, which can inspire trust and confidence among potential clients and collaborators. This newfound credibility can lead to better business opportunities and partnerships.

- Enhanced Management Structure: Private companies typically have a more structured and organized management hierarchy compared to sole proprietorships. Converting to a private company allows for the creation of a board of directors and formal corporate governance practices, which can contribute to better decision-making, increased accountability, and improved operational efficiency.

- Employee Incentives: As a private company, offering employee stock options (ESOPs) becomes a viable option for incentivizing and retaining talented employees. ESOPs provide employees with a stake in the company’s success, aligning their interests with the business’s growth objectives. This can lead to higher employee morale, increased productivity, and a sense of ownership in the company’s achievements.

Benefits of conversion of Sole Proprietorship Firm into Private Company

The following are the benefits of conversion of Sole Proprietorship Firm into Private Company:

- Limited Liability Protection: One of the most significant advantages of converting a sole proprietorship firm into a private company is the shift from unlimited liability to limited liability. As a sole proprietor, the business owner is personally responsible for all debts and obligations of the business. However, upon conversion to a private company, the liability of the shareholders is limited to the extent of their shareholding in the company. This offers a safeguard to the personal assets of the entrepreneur, reducing the financial risk associated with business operations.

- Separate Legal Entity: A private company is a distinct legal entity separate from its shareholders. This separation ensures continuity even in the event of the demise or exit of the founder. The company’s existence is not dependent on the proprietor, and it can continue its operations seamlessly. This aspect contributes to enhanced credibility and longevity of the business.

- Easier Access to Capital: Private companies have better access to capital compared to sole proprietorship firms. They can raise funds through equity shares, debentures, and other financial instruments. This infusion of capital can be instrumental in expanding the business, investing in new opportunities, and upgrading infrastructure. Additionally, the private company structure may attract potential investors and venture capitalists that are more inclined to invest in organized corporate entities.

- Transferability of Shares: Shares in a private company are freely transferable, subject to certain restrictions as per the Articles of Association. This feature allows the entrepreneur to bring in additional shareholders, facilitate ownership succession, and incentivize key employees through the issuance of shares. The ease of transferring ownership can also be an attractive proposition for potential investors.

- Tax Benefits: Private companies often enjoy certain tax benefits and incentives that are not available to sole proprietorships. These may include deductions and exemptions under various sections of the Income Tax Act, 1961. Additionally, the corporate tax rate for private companies may be lower than the individual income tax rate, resulting in potential tax savings.

- Enhanced Credibility and Brand Image: The conversion of a sole proprietorship firm into a private company enhances the company’s credibility and brand image. Private companies are subject to greater regulatory scrutiny and compliance, which can foster trust among stakeholders, including customers, suppliers, and financial institutions. A robust corporate governance framework associated with private companies can contribute to a positive perception in the market.

- Scale and Expansion Opportunities: Private companies have a better structure for scaling up and expanding their operations. With a formalized organizational structure, streamlined decision-making processes, and access to capital, private companies are better positioned to seize growth opportunities, enter new markets, and diversify their product or service offerings.

Conditions for conversion of Sole Proprietorship Firm into Private Company

The following are the conditions for conversion of a proprietorship to a company:

- It is necessary for the sole proprietor and the company to sign a takeover or sale agreement.

- The phrase “The takeover of a sole proprietorship” must be in the Memorandum of Association (MOA).

- The company must get ownership of all of the sole proprietorship’s assets and liabilities.

- The proprietor must have a minimum of 50% of the voting power and must maintain such ownership for a minimum of 5 years.

- Except for the amount of shares held, the proprietor does not obtain any further advantages, either directly or indirectly.

Documents necessary for conversion of Sole Proprietorship Firm into Private Company

The followings are the documents necessary for the conversion of Sole Proprietorship Firm into Private Company:

- PAN card copies for each director serve as identification.

- Aadhar card copy or voter ID (proof of address).

- Passport-size images of the directors.

- Proof of business location ownership, if applicable.

- If rented, a rental agreement.

- Landlord’s No Objection Certificate (NOC).

- Water or Electricity charge.

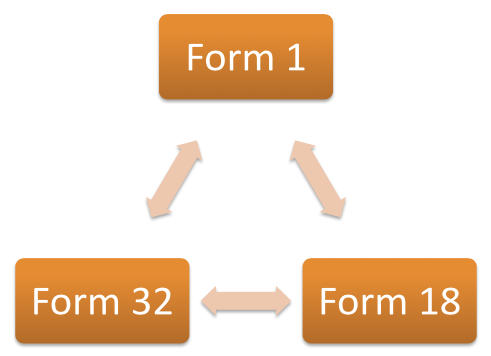

The following forms must be submitted to the MCA:

- Along with the MOA, AOA, and other documents, Form 1 must be filed.

- The specifics of the registered office are detailed in Form 18.

- Details of the directors’ information are contained in Form 32.

Procedure for conversion of Sole Proprietorship Firm into Private Company

The following are the procedure for conversion of Sole Proprietorship Firm into Private Company:

- The proprietor must finish the slump selling procedures.

- All directors must get a Director Identification Number (DIN) and a Digital Signature Certificate (DSC).

- The proprietor must submit Form 1 to request the availability of the name.

- Create the company’s Memorandum of Association (MOA) and Articles of Association (AOA), which should contain the company’s goals and regulations.

- Send a request for the company’s incorporation to the Ministry of Corporate Affairs (MCA).

- Send in all the required documentation.

- The Certificate of Incorporation should be obtained.

- Get a new PAN and TAN by applying.

- Change the bank information to reflect the conversion.

Challenges and Considerations converting a Proprietorship to Private Limited Company

While converting a proprietorship to private limited company offers numerous benefits, entrepreneurs should be aware of the challenges and considerations involved:

- Cost and Complexity: The conversion process involves legal, regulatory, and administrative complexities, which may lead to increased costs and time-consuming procedures.

- Compliance Burden: Private companies have stringent compliance requirements, including mandatory filings, disclosures, and meetings. Entrepreneurs must be prepared to adhere to these obligations.

- Shareholding and Management: The ownership and management structure of a private company may differ significantly from that of a sole proprietorship. Decision-making and control dynamics may also change.

- Valuation Discrepancies: Valuing assets accurately during the conversion process can sometimes lead to disagreements between parties involved.

- Employee Considerations: The conversion may impact employees, affecting their roles, compensation, and benefits.

Takeaway

The conversion of a sole proprietorship firm into a private company as per the Companies Act, 2013, is a strategic move that offers significant advantages in terms of limited liability, credibility, fundraising opportunities, and more. However, entrepreneurs must carefully weigh these benefits against the challenges and complexities associated with the conversion process. Seeking legal and financial advice is crucial to ensure a smooth transition and to make informed decisions that align with the long-term goals of the business.

Connect to the experts of Legal Window in case you need any assistance regarding the Conversion of Sole Proprietorship Firm into Private Company.

Neelansh Gupta is a dedicated Lawyer and professional having flair for reading & writing to keep himself updated with the latest economical developments. In a short span of 2 years as a professional he has worked on projects related to Drafting, IPR & Corporate laws which have given him diversity in work and a chance to blend his subject knowledge with its real time implementation, thus enhancing his skills.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (90)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (119)

- Hallmark Registration (1)

- Income Tax (201)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (21)

- Startup/ Registration (130)

- Trademark Registration/IPR (40)

Recent Posts

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.