Life insurance is an important financial tool that protects individuals and their families against unexpected calamities. Life insurance plans in India provide different tax benefits to policyholders in addition to their basic function of risk coverage. These tax breaks are intended to relieve financial burdens on individuals while also emphasizing the significance of insurance coverage. This article will look into the tax advantages of life insurance plans in India, covering pertinent provisions in the IT Act, 1961, and sections such as section 80C, section 10(10D), and section 80D.

Contents

Life Insurance Tax Exemption: An Overview

Under the Income Tax Act, 1961 life insurance policies in India provide multiple tax exemptions. Section 10(10D) of the Income Tax Act, 1961, grants tax exemption on the maturity amount or death benefit received from a life insurance policy. This exemption applies to all types of life insurance policies, including term insurance, endowment policies, and unit-linked insurance plans (ULIPs). This provision encourages individuals to invest in life insurance plans for financial protection while enjoying tax benefits.

Life Insurance Tax Benefits in India

In India, the tax benefits offered by life insurance policies make them an attractive investment option for individuals. These benefits provide financial protection, savings, and tax breaks simultaneously. The government supports life insurance investments by providing tax breaks on premiums paid, tax-free maturity amounts, and tax-free death payouts. These tax deductions help individuals and their families overall financial well-being.

In most circumstances, life insurance policies are tax-free. Premiums paid for life insurance coverage are normally tax-free under section 80C. However, there may be situations when the tax advantages depend on the premium payment amount and the person’s tax bracket. Consult a tax professional or the Income Tax Act for specific information on the taxable elements of life insurance plans.

| Parameter | Tax Benefit Under IT Act, 1961 |

|---|---|

| Premium Payment | Deduction under Section 80C of the Income Tax Act |

| Maturity Proceeds | Exempt under Section 10(10D) of Income Tax Act |

| Bonus or Loyalty Additions | Exempt under Section 10(10D) of Income Tax Act |

| Death Benefits | Exempt under Section 10(10D) of Income Tax Act |

| Health-related Riders (if applicable) | Deduction under Section 80D of the Income Tax Act |

| Policy Surrender Value/Partial Withdrawals | Taxability depends on the duration of the policy |

Also, read: Life Insurance Tax Benefits: Life Insurance Tax Benefit in Assessment Year 2024-25

Term Plan Tax Benefit

Term insurance policies offer pure risk coverage and are an affordable form of life insurance. Individuals can claim tax deductions on premiums paid for term insurance policies under section 80C, subject to a maximum limit of Rs. 1.5 lakh per appropriate fiscal year. Term plan tax benefits provide a dual advantage of financial protection and tax savings, making it a preferred choice for many individuals.

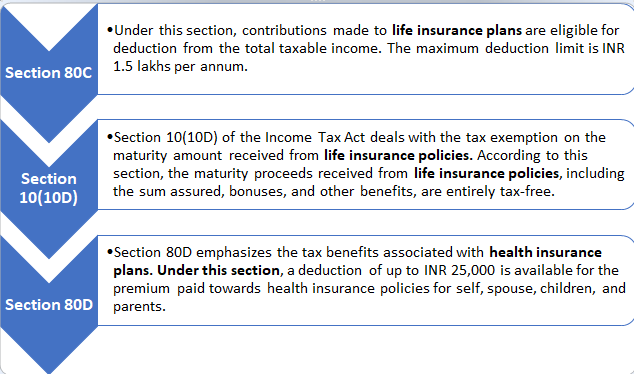

Life Insurance Premium Tax Deduction under Section 80C

Section 80C of the Income Tax Act allows taxpayers to claim deductions on various investments and expenses, including life insurance premiums. The premium paid towards life insurance policies, such as endowment plans and ULIPs, is eligible for deductions. Individuals can claim deductions of up to Rs. 1.5 lakh per appropriate fiscal year under section 80C, making life insurance policies an attractive investment option.

Also, read: Exploring Tax Saving Options Other than Section 80C of the Income Tax Act, 1961

Term Insurance Tax Benefit under Section 80D

Apart from section 80C, term insurance policies also offer tax benefits under section 80D. This section deals with deductions on health insurance premiums paid. Since term insurance policies provide pure risk coverage without any savings component, they fall under the category of health insurance policies. Taxpayers can claim exemptions up to Rs. 25,000 on premiums paid for term insurance policies under section 80D, subject to certain conditions.

Health Insurance Tax Benefit under Section 80D

Life insurance policies that provide health coverage, commonly known as health insurance plans, offer tax benefits under section 80D. Individuals can claim deductions on premiums paid for health insurance policies, including family floater plans, critical illness insurance, and individual health insurance policies. The maximum deduction limit under section 80D varies based on the age and family composition of the insured.

Life Insurance Policy- Tax-Deduction

Certain life insurance policies, such as pension plans and annuities, serve the purpose of long-term savings and income generation after retirement. The premium paid towards these policies is eligible for deductions under section 80CCC. This section allows taxpayers to claim deductions of up to Rs. 1.5 lakh per fiscal year on premium payments, reducing their overall tax liability.

Important Provisions in Nut Shell

Winding Up Note

The Indian government recognizes the significance of life insurance as a financial instrument and encourages individuals to avail of life insurance coverage through various tax benefits. The provisions under section 80C, section 10(10D), and section 80D provide policyholders with deductions, exemptions, and tax-free proceeds, reducing their tax liabilities. Such tax benefits not only promote life and health insurance coverage but also contribute to an individual’s financial well-being and encourage long-term savings.

In case of any query regarding the Tax Benefits with Life Insurance Plans in India, feel free to connect with our legal experts at Legal Window at 72407-51000.

CA Pulkit Goyal, is a fellow member of the Institute of Chartered Accountants of India (ICAI) having 10 years of experience in the profession of Chartered Accountancy and thorough understanding of the corporate as well as non-corporate entities taxation system. His core area of practice is foreign company taxation which has given him an edge in analytical thinking & executing assignments with a unique perspective. He has worked as a consultant with professionally managed corporates. He has experience of writing in different areas and keep at pace with the latest changes and analyze the different implications of various provisions of the act.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (90)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (118)

- Hallmark Registration (1)

- Income Tax (200)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (21)

- Startup/ Registration (128)

- Trademark Registration/IPR (40)

Recent Posts

- Post incorporation compliances for companies in India April 30, 2024

- Startup’s Guide to Employee Stock Ownership Plans April 29, 2024

- Master Secretarial Audit: A Complete Compliance Guide April 27, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.