Life Insurance Tax Benefits: Life Insurance Tax Benefit in Assessment Year 2024-25

- September 12, 2023

- Finance Company

Life is unpredictable, and one of the most important significance of future planning is ensuring the financial security of your loved ones in case of any uncertain event. This is where life insurance plays an important role. Life insurance is a contract between an individual and an insurance company, where the individual pays premiums in return for an amount of money that is payable to the beneficiaries upon the individual’s demise. In India, life insurance is of utmost importance due to the social and economic structure of the nation. In India, we will discuss some Life Insurance Tax Benefits along with the changes prescribed by CBDT in Life Insurance Tax Benefits for the Assessment Year 2024-25.

Understanding Life Insurance

Life insurance acts as a safety gauge that offers financial security to the policyholder and their dependents in the event of their death. It helps the policyholder’s beneficiary to alleviate the financial burden that may arise due to the sudden loss of the primary Earning member of the House. Life insurance policies are of various types, such as term insurance, whole life insurance, endowment policies, and Unit-Linked Insurance Plans (ULIPs), each providing needs and preferences as per their usage.

Importance of Life Insurance in India

The following are the importance of Life Insurance in India:

- Financial Security for Dependents: In a country like India, where the family structure commonly exists Joint Family Structure, the sudden death of a head of the family can leave the family with financial hardships.

Life insurance makes sure that even in the absence of the head of the family earner, the family can maintain its financial stability, and pay for expenses, education, and other needs.

- Debt Repayment: Many individuals in India have loans, mortgages, and other financial obligations. In case of their uncertain death, these debts can become a financial burden on their family. Life insurance can provide the required funds to clear debts and prevent financial obligations.

- Education and Future Goals: Every parent wants to provide the best education for their children. Life insurance acts as a tool to make sure that even in the absence of parents, their children’s education is not compromised due to lack of finances.

- Retirement Planning: Life insurance not only is helpful in the immediate future; it can also play a role in long-term planning. Policies such as endowment plans or ULIPs provide for a savings aspect, allowing individuals to build a corpus that can be used during their retirement years.

- Tax Benefits: Life insurance policies attract various tax benefits. The payment of premiums paid towards life insurance policies is eligible for deductions under Section 80C of the Income Tax Act, 1961. Also, it helps in reducing the policyholder’s taxable income. Additionally, the payout received by the beneficiaries is generally tax-free under Section 10(10D).

- Peace of Mind: Knowing that your family and your loved ones are financially secure even after your death provides policyholders with peace of mind. This emotional assurance is invaluable, especially in times of personal crisis.

- Promotion of Savings and Financial Discipline: Life insurance motivates policyholders to regular savings, as policyholders need to pay premiums at regular intervals. This promotes financial discipline and a habit of saving for the future.

Also read our Article: 7 Helpful Tips to Select the Best Health Insurance Plan

Types of Life Insurance in India

In India, there are several types of life insurance policies catering to diverse needs. Some of the common ones include:

- Term Insurance: This is one of the most simplest and affordable forms of life insurance. It covers the policyholder for a specific period (the term), and if the insured person passes away during the term, the beneficiaries will receive the death benefit. It offers standard protection without any savings component. It is one of the most significant term insurance tax benefits.

- Whole Life Insurance: As the name suggests, this type of insurance covers the entire life of the insured. Premiums are generally higher for this type of insurance, but a portion of the premium is utilized in building cash value over time, which can be borrowed against or withdrawn.

- Endowment Policy: These policies mix the life coverage with a savings or investment component. They pay out lump sum money either on the death of the insured or at the end of a specified term. It’s a way to secure protection and also to some savings.

- Unit Linked Insurance Plans (ULIPs): ULIPs combines the characteristic of insurance with investment. A portion of the premium of ULIPs goes towards life coverage, while the rest is utilized in various funds as per the policyholder’s choice. ULIPs offer flexibility and higher returns but also have certain investment risks.

- Money Back Policy: These policies provide regular payouts during the policy term, which can be useful in achieving financial goals at various life stages. In case the insured survives the policy term, then they receive the survival benefits, however, in case of death, the death benefit is paid to the beneficiaries.

Life Insurance Tax Benefits: Benefits of Life Insurance in India

The following are the Life Insurance Tax Benefits:

- Financial Security for Dependents: The most important benefit of life insurance is financial security, which life insurance provides to the policyholder’s dependents in case of their early demise. The death benefit can be used to cover life expenses, clearing debts, education, and other financial burdens.

- Tax Benefits: Life insurance policies offer tax benefits under Section 80C and Section 10(10D) of the Income Tax Act, 1961. The premiums paid by the policyholder and the maturity/death benefits received by him or by his family members after his death are eligible for tax deductions, making it a lucrative investment from the perspective of tax planning.

- Loan Facility: Various types of life insurance policies, such as whole life and ULIPs, allow the policyholders to take loans against the accumulated cash value, which proves to be beneficial during emergencies or to fulfil financial needs.

- Wealth Creation and Savings: Policies like endowment plans and ULIPs include an investment aspect that makes policyholders eligible to accumulate savings over time. This can be beneficial for achieving long-term financial goals, like purchasing a house, funds for a child’s education, or retirement planning.

- Encourages Regular Savings: Paying premiums for a life insurance policy by a policyholder enforces a regular saving habit. This act can have a positive impact on an individual’s entire financial planning.

Taxation of Life Insurance in India

In India, life insurance policies offer various tax benefits under the provisions of the Income Tax Act, of 1961. These benefits may rely on the type of policy and the premium amount. Here’s a look at the tax implications related to life insurance:

- Tax Deductions under Section 80C: Premiums paid by policyholders towards life insurance policies are eligible for deductions under Section 80C of the Income Tax Act, 1961. The maximum amount that can be deductible is ₹1.5 lakh per financial year.

This life insurance deduction in income tax is applied to policies owned by the individual, their spouse, or their children. However, for policies that are issued on or after April 1, 2012, the premium paid by the policyholder must not exceed 10% of the sum assured to qualify for this deduction.

- Tax Exemption on Death Benefit: The death benefit from the life insurance policy received by the nominees or beneficiaries is not taxable under Section 10(10D) of the Income Tax Act. This exemption covers to the entire amount received as a death benefit, including any bonuses.

- Maturity Benefit Taxation: The maturity benefit received, includes endowment and money-back policies, and is also not taxable under Section 10 (10D) of the Income Tax Act. This applies to policies issued on or after April 1, 2003.

However, this exemption is subject to the condition, which states that the premium paid by the policyholder during the policy term should not exceed the limit of 10% of the sum assured for policies issued after April 1, 2012.

- Tax Treatment of ULIPs: ULIPs confer the EEE (Exempt-Exempt-Exempt) status. This means that the premium paid by the policyholder, the returns generated by him, and the maturity amount received by the policyholder are all tax-free. However, the policies issued after February 1, 2021, with an annual premium exceeding the limit of ₹2.5 lakh, will have a taxable maturity amount.

Taxation of Life Insurance in India: Life Insurance Tax Benefits

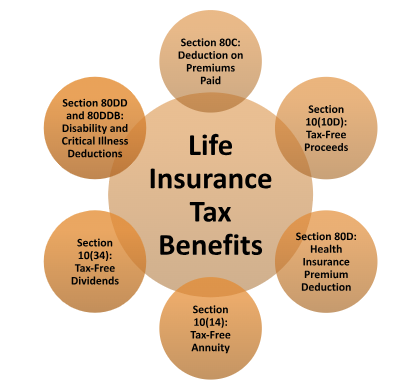

The following are the Life Insurance Tax Benefits under the Income Tax Act, of 1961:

- Section 80C: Deduction on Premiums Paid: One of the most important tax benefits offered by life insurance policies in India is the deduction available under Section 80C of the Income Tax Act, 1961, which the policyholder receives. Under this provision, individuals, with policy holder is eligible to claim a deduction of Rupees up to ₹1.5 lakh from their gross total income for premiums paid towards life insurance policies.

This covers the policies taken out for one’s own life, spouse’s life, or children’s lives. It’s pertinent to note that this deduction is available for these types of policies with a sum assured of at least 10 times the annual premium amount.

- Section 10(10D): Tax-Free Proceeds: Another important tax benefit that a life insurance policy provides is the exemption of the maturity amount and the death benefit as per Section 10(10D) of the Income Tax Act. This means that the amount that the policyholder received upon maturity of the policy or as a death benefit to the nominee is not taxable at all.

However, this exemption applies, only if the premium paid by the policyholder annually is not more than the limit of 10% of the sum assured.

- Section 80D: Health Insurance Premium Deduction: Health insurance policies are also an essential part of financial planning; even if they are not in direct relation to life insurance. Premiums paid by policyholders towards health insurance policies for self, spouse, children, or parents are subject to deduction under Section 80D.

This deduction is separate from the deduction available in Section 80C limit and provides additional benefit to taxpayers.

- Section 10(14): Tax-Free Annuity: Annuity policies are a form of life insurance that provides regular payments to the policyholder after their retirement, it also offers tax benefits. Under Section 10(14) of the Income Tax Act, 1961 the annuity received from policies is subject to partial exemption from taxation.

Only a certain percentage of the amount of the annuity received is considered taxable income, which reduces the tax obligation for retirees.

- Section 10(34): Tax-Free Dividends: Taking life insurance policies that furnish dividends to policyholders are also subject to tax exemptions under Section 10(34). The dividends received from such life insurance policies are not taxable on the part of the policyholder, providing an additional incentive for investing.

- Section 80DD and 80DDB: Disability and Critical Illness Deductions: Section 80DD and 80DDB were not exclusive to life insurance policies, however, these sections offer deductions for premiums paid by policyholders for policies covering disabilities and illnesses.

Under the purview of Section 80DD, individuals are allowed to claim a deduction for premiums paid by them for the maintenance of a disabled dependent or family member, while Section 80DDB provides deductions that are related to medical expenses incurred on specified critical illnesses.

Life Insurance Tax Benefit in Assessment Year 2024-25

The Ministry of Finance by Notification No. 61/2023, on August 16, 2023, notifies of an amendment to the Income Tax Rules, 1962. This is the Sixteenth Amendment which focuses on the calculation of taxable income from money yield under life insurance plans. When the total annual premium exceeds the limit of Rs. 5 lakh, these instructions lay down the process for calculating income from life insurance plans.

In the Income Tax Amendment (Sixteenth Amendment) Rules, 2023, the CBDT has incorporated Rule 11UACA to govern the calculation of income concerned with the maturity proceeds of life insurance plans issued after 1 April 2023, where the premiums paid exceed the limit of Rs. 5 lakh.

The guidelines that the computation under Rule 11UACA differs, depending on the condition that whether the money is received for the first time or in consecutive years under the life insurance policy. The announcement describes the change, which explains the procedure for calculating the income subject to tax under clause (xiii) of sub-section (2) of section 56 of the Income Tax Act, 1961.

The new regulations also provide that as long as the total annual premium paid does not exceed the limit of Rs. 5 lacks, life insurance plans issued after 1 April 2023 will be allowed for tax exemption on maturity benefits as per Section 10(10D) of the Income Tax Act, 1961.

The maturity proceeds, however, will be added to the individual’s income and subject to the appropriate income tax rates for policies with premiums above the limit of Rs. 5 lakh. The Union Budget for the fiscal year 2023–2024 proposed this change in the tax treatment of life insurance policies, excluding Unit Linked Insurance Policies (ULIPs).

According to the CBDT notification, under certain circumstances, the amount received from a life insurance policy, including bonus allocations, is now removed from income tax under Section 10(10D) of the Income Tax Act.

If the total premium paid in any prior year throughout the policy term exceeds Rs. 5,00,000, money received from life insurance policies issued after 1 April 2023 (except ULIPs) will not be excluded under Section 10(10D) of the Income Tax Act, 1961 for the assessment year 2024–2025.

The Bottom Line

Life insurance is not only a means of securing your family’s financial future but also offers attractive tax benefits in India. The deductions available in Section 80C, along with the tax-free status of death and maturity benefits, make life insurance a lucrative investment option. However, it’s important to carefully understand your insurance needs, policy terms, and tax implications before making a decision.

Consulting a financial advisor can be helpful for you. With proper guidance, you will be able to make the right decision whether to opt for a Life Insurance Policy and to take the Life Insurance Tax Benefits or not. Connect with our Experts at Legal Window in case you need any assistance regarding the understanding of the Life Insurance Tax Benefits.

CA Pulkit Goyal, is a fellow member of the Institute of Chartered Accountants of India (ICAI) having 10 years of experience in the profession of Chartered Accountancy and thorough understanding of the corporate as well as non-corporate entities taxation system. His core area of practice is foreign company taxation which has given him an edge in analytical thinking & executing assignments with a unique perspective. He has worked as a consultant with professionally managed corporates. He has experience of writing in different areas and keep at pace with the latest changes and analyze the different implications of various provisions of the act.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (89)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (118)

- Hallmark Registration (1)

- Income Tax (199)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (21)

- Startup/ Registration (128)

- Trademark Registration/IPR (40)

Recent Posts

- Startup’s Guide to Employee Stock Ownership Plans April 29, 2024

- Master Secretarial Audit: A Complete Compliance Guide April 27, 2024

- Farmer Producer Companies-Major provisions under Companies Act April 26, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.