All you need to about Issue of Bonus Shares under Companies Act, 2013

- July 29, 2023

- Company Law

The Issue of Bonus Shares is a significant aspect of corporate finance and is governed by the provisions of the Companies Act, 2013 in India. Bonus shares, also known as scrip dividends or capitalization shares, are additional shares issued by a company to its existing shareholders as a form of reward or incentive. This article delves into the key aspects of bonus shares under the Companies Act, 2013 and explores the implications for both companies and shareholders.

However, before we move on to discuss about Issue of Bonus Shares, let us first understand the meaning of Bonus Share.

Meaning of Bonus Share

Despite having a profit, companies can struggle to pay dividends in cash due to a lack of resources. Instead of delivering the Dividend in cash to the shareholders in this circumstance, the Companies issue Bonus shares to current shareholders. Bonus shares are distributed in proportion to the number of shares without incurring any costs.

Before, there were no particular regulations governing Bonus shares under the Companies Act, 1956. When SEBI became a regulator, the Controller of the Capital Issues, who had previously issued certain regulations, was also abolished.

Bonus shares are distributed to shareholders as additional shares based on the number of shares they own in the company. A company’s accrued earnings are occasionally dispersed as Bonus shares rather than dividends. These shares are distributed to present shareholders for no monetary consideration. Bonus shares improve the Company’s marketability. The primary goal of the Bonus Issue is to align the Company’s nominal capital with its assets.

Issue of Bonus shares under Companies Act, 2013

The Issue of Bonus shares is a typical occurrence in the corporate sector. When the company has a substantial profit surplus and intends to convert it into share capital, it might issue bonus shares to its owners in proportion to their respective holdings.

Bonus shares are issued to capitalize the Company’s profits or reserves. It is also commonly referred to as “Capitalization Shares” because these shares are issued upon the capitalization of profits or reserves. The primary goal is to increase the Company’s share capital. The issuance of bonus shares results in no cash outflow.

When reading with Rule 14 (Companies Share Capital and Debenture) Rules, 2014, in the new Companies Act, 2013, Section 63, it says for the Issue of Bonus shares to the shareholders.

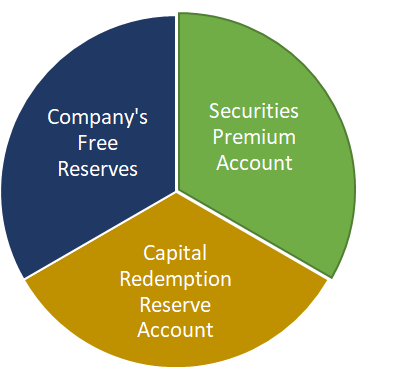

Section 63 of the Companies Act, 2013 allows for the issuance of bonus shares of fully paid-up equity shares as follows:

- Through the Company’s Free Reserves;

- Through the Securities Premium Account; and

- Through the Capital Redemption Reserve Account.

Advantages of Issue of Bonus shares

The following are the advantages of Issue of Bonus shares:

- Increase the company’s share base through encouraging retail participation.

- The price per share falls as the number of shares issued increases due to the bonus issuance. It becomes simple for an investor to purchase stock in that company.

- Bonus shares in India are a sign that the company is in good health. It indicates that the company is ready to service its increased equity.

- The investor is not required to pay any taxes upon receipt of the bonus shares in India.

- The issuance of new shares and the use of funds for the Company’s business growth build investor confidence in the Company’s operation.

- The bonus issuance allows the organization to save money for reinvestment in the business.

- The issuance of bonus shares increases the number of outstanding shares and the participation of smaller investors in the Company’s shares, so improving liquidity.

- The perception of the company’s size grows as its issued share capital grows.

Conditions and Checks for Issue of Bonus shares

The following are the conditions and checks for Issue of Bonus shares:

Conditions for the Issue of Bonus shares

The following are the conditions for the Issue of Bonus shares:

- According to Section 63 of the Companies Act, 2013, the Articles must include provisions for the issuance of bonus shares.

- The members should authorize the issuance of bonus shares based on the Board’s recommendation.

- The Company should make no payment defaults on fixed deposits or debt securities.

These are some of the conditions that a Company must keep in mind while issuing Issue of Bonus shares

Checks for Issue of Bonus shares

The following are the checks for the Issue of Bonus shares:

- Check that the authorized capital is sufficient to issue Bonus shares. If the capital is sufficient, the company can proceed with the share issue. If the capital is insufficient, the capital clause in the Memorandum of Association (MoA) should be changed.

- Check the Articles of Association (AoA) to see if they allow for the issuance of bonus shares. If the AoA permits, the Company may proceed with the Issue; however, if the AoA does not permit, the AoA must be altered.

- The availability of resources will be examined.

- The number of bonus shares will be determined.

Some Mandatory Requirements regarding Issue of Bonus shares

The following are some mandatory requirements regarding Issue of Bonus shares:

- Subject to the following (Section 63(2) and Regulation 293), the company shall capitalize its profits or reserves for the purpose of distributing fully paid-up bonus shares:

- Articles of Association Authorization

- Approval of its Shareholders/Members through a special resolution passed at a duly constituted general meeting on the basis of the Board’s recommendations.

- There has been no default in the payment of interest or principal on fixed deposits or debt instruments issued in this manner.

- There is no default in the payment of employees’ statutory dues, such as provident fund contributions, gratuities, and bonuses.

- Make all outstanding partially paid-up shares as fully paid-up on the day of allotment.

- None of its promoters or directors is fugitives from justice.

- If a bonus issue has been announced, the company must refrain from withdrawing from the Board’s recommendation. (Rule 14)

- The bonus issue will be implemented by the Issuer Company as follows:

- Within fifteen days of the date of the board meeting at which shareholders’ approval is not necessary for the capitalization of profits or reserves in order to make the bonus issue.

- Within two months of the date of the board meeting at which shareholders’ approval is required for the capitalization of profits or reserves in order to make the bonus issue. (Regulation 295)

SEBI Guidelines for the Issue of Bonus shares

The Securities and Exchange Board of India (SEBI) major guidelines for the Issue of Bonus shares are as follows:

- The Bonus shares do not dilute other offerings.

- The Bonus shares will be issued only from the Free Reserves.

- The Reserve created by an asset revaluation cannot be capitalized for Bonus shares.

- The Bonus shares cannot be granted in place of the Dividend.

- After obtaining Company Registration, the company must implement the Bonus shares plan within 6 months following the proposal’s approval in the Board Meeting.

- The Company cannot withdraw the Bonus shares proposal after it has been made.

- There should be no default in the payment of the Company issuing Bonus shares‘ interests.

- Bonuses should not be issued within 12 months of the public offering.

- The Articles of Association (AoA) should include a provision for the capitalization of reserves. If no provision exists, modify the AoA accordingly.

- If necessary, the Company’s authorized capital can be increased to allow the Bonus Share proposal.

The Procedure for Issue of Bonus shares as per Companies Act, 2013

The following is the procedure to be followed by a Company for Issue of Bonus shares as per Companies Act, 2013:

Call for a Board Meeting

Give members of the board at least seven days’ notice before the meeting.

Conduct a Board Meeting

The following issues should be discussed at the board meeting:

- According to Section 174(1), the board meeting must have a quorum of one-third of the board’s membership.

- It is necessary to choose the ratio of Bonus shares to be issued.

- Approve the Board Meeting Resolution.

- Make a decision regarding the EGM’s location, date, and time.

- Set a date for the EGM. Complete information about the EGM as well as the director’s authorization for the right Issue will be included in the notice of EGM.

- According to Section 101 of the Companies Act, 2013, the EGM notice must be sent at least 21 days prior to the scheduled date.

Submit Form MGT-14

E-form MGT-14 must be submitted within 30 days of the Board Resolution for the Issue of Bonus shares being approved. The MGT-14 Form should be accompanied by the Resolution adopted for the Issue of Shares.

Hold EGM

The following should be looked for by the EGM:

- Check the meeting’s quorum.

- Check to see if the auditor is in the room. If the person is absent, determine whether or not a Leave of Absence has been issued in accordance with Section 146 of the Companies Act, 2013.

- Pass the Bonus shares Issue Resolution.

- Accept the resolution for the bonus share allocation.

E-Form Submission

After the EGM, file Form PAS-3 with the Resolution for Bonus shares Issues. The following requirements should be included with the Form PAS-3:

- Resolution for Bonus shares Allotment

- Resolution for Bonus shares Issue

- List of the Allottees, including each person’s name, address, profession, and the quantity of securities assigned to them.

Issuance of Bonus Share Certificate

The Company must distribute share certificates to all shareholders within two months of the completion of the share allotment.

Takeaway

The Issue of Bonus shares to shareholders is regulated by the Companies Act, 2013. The AoA should give permission for the Issue. Once recommended, the Company cannot stop issuing bonus shares. The Bonus shares Issue process takes a lot of time and effort. You can also connect with our Experts at Legal Window in case you need assistance regarding the procedure. Our Experts may assist in timely delivery of your work in smooth manner.

Neelansh Gupta is a dedicated Lawyer and professional having flair for reading & writing to keep himself updated with the latest economical developments. In a short span of 2 years as a professional he has worked on projects related to Drafting, IPR & Corporate laws which have given him diversity in work and a chance to blend his subject knowledge with its real time implementation, thus enhancing his skills.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (90)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (119)

- Hallmark Registration (1)

- Income Tax (201)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (21)

- Startup/ Registration (130)

- Trademark Registration/IPR (40)

Recent Posts

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.