Everything you need to know about Income Tax Return for Freelancers

- August 11, 2023

- Income Tax

As the gig economy continues to thrive, the number of freelancers in India has been steadily rising. While freelancing offers flexibility and independence, it also comes with the responsibility of managing one’s own taxes. Income tax filing is an essential aspect that every freelancer in India must comply with, as per the provisions of the Income Tax Act, 1961. In this article, we will explore the key aspects of income tax filing for freelancers in India, and also, we will look into the procedure for filing Income Tax Return for Freelancers.

Who is a Freelancer?

A freelancer, often referred to as an independent contractor, is a self-employed professional who operates as a sole proprietor of their business. These individuals can be found across various industries, such as writing, graphic design, web development, marketing, photography, consulting, and more. The defining feature of freelancing is the absence of a long-term commitment to a single employer, allowing freelancers to work on multiple projects and for different clients simultaneously.

Are you also a freelancer and looking for Income Tax Return for Freelancers? Connect with our Tax Experts at Legal Window; they will assist you through the ITR Filing for Freelancers.

Understanding Freelancing Income

According to the Income Tax Act, 1961, income earned by freelancers is treated as ‘Income from Business and Profession.’ This classification includes individuals who provide professional services like graphic designing, content writing, software development, digital marketing, consulting, and various other skills-based services to clients. The act considers freelancers as sole proprietors of their business, and their earnings are subject to income tax under the provisions applicable to businesses.

Applicable Freelance Tax Form as per Income Tax Act, 1961

Freelancers in India can file their income tax returns using different forms based on the nature of their income and the manner of maintenance of their accounts. The most commonly Freelance Tax Form is:

- ITR-3: This form is applicable to freelancers who have income from carrying out a profession or being part of a partnership firm. It is mandatory for those with a total income exceeding Rs. 50 lakhs or if they have earned income from presumptive business under Section 44AD, 44ADA, or 44AE.

- ITR-4: Also known as Sugam, this form is suitable for freelancers who have opted for the presumptive taxation scheme under Section 44ADA and have total income below Rs. 50 lakhs. Under this scheme, a fixed percentage of the total receipts are considered as taxable income, and detailed maintenance of accounts is not required.

Applicable and Freelancer Tax Filing

In India, freelancers are subject to Income Tax and GST (Goods and Services Tax). If a freelancer’s total annual turnover exceeds Rs. 20 lakhs (Rs. 10 lakhs for North Eastern and Hill states), he must register for GST. The GST rate for the majority of services is 18%. The GST rate may differ depending on the goods and services provided by the freelancer.

Freelancers are required to pay income tax at the applicable rates. Freelancers can also claim deductions based on the tax system they choose. They can also file tax under Section 44ADA of the Income Tax Act, 1961 under the Presumptive Taxation Scheme. They can pay tax on freelancing income on only half of their gross annual income if they choose a presumptive taxation scheme and their total income for the year is less than Rs. 50 lakhs.

The deadline for submitting income tax returns for freelancers for FY 2022-23 (AY 2023-24) is July 31, 2023.

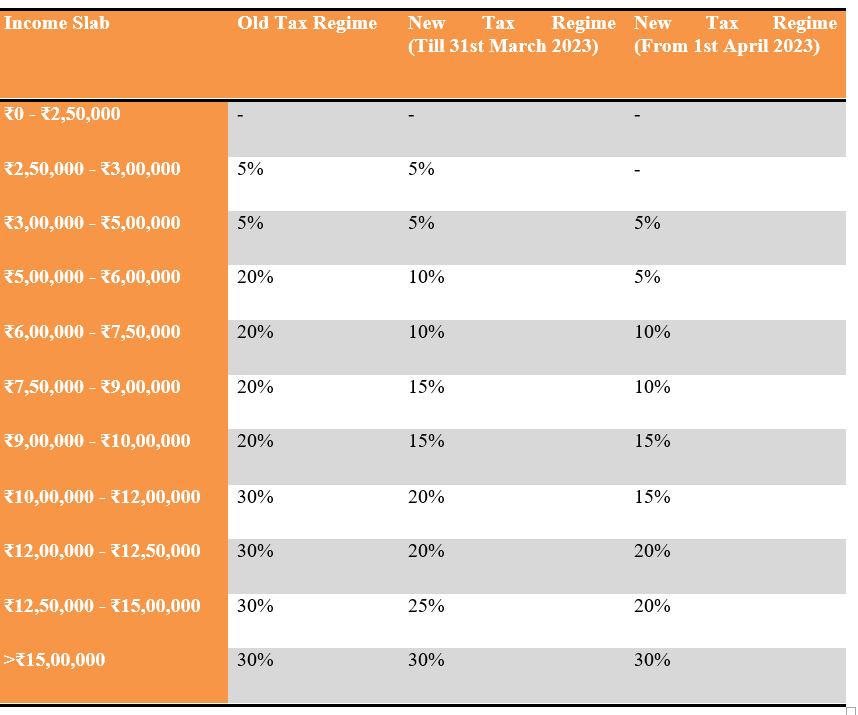

For the fiscal year 2023-24, the following tax rates will apply to freelancers under the age of 60:

Applicable TDS Provisions for Freelancers

The Income Tax Act mandates Tax Deducted at Source (TDS) on certain payments made to freelancers. Clients who engage freelancers are required to deduct TDS at prescribed rates before making payments. The applicable TDS rates for freelancers can vary depending on the nature of the payment and the PAN (Permanent Account Number) status of the recipient:

The following are some key points to consider regarding TDS for freelancers:

- TDS on Salary: If a freelancer is engaged under an employment-like relationship and receives a regular salary, the client is responsible for deducting TDS as per the individual’s income tax slab rates.

- TDS on Professional Fees: Payments made to freelancers for professional or technical services are subject to TDS under Section 194J. The current TDS rate for such payments is 10% of the gross amount. However, if the PAN is not furnished by the freelancer, the TDS rate increases to 20%.

- TDS on Rent: In cases where a freelancer receives rental income, the client making the payment is required to deduct TDS at 10% under Section 194-I.

- TDS on Other Payments: There might be various other payments made to freelancers that attract TDS under different sections of the Income Tax Act. Clients should carefully assess the nature of payment and the applicable TDS rate.

Advance Tax for Freelancers

The concept of Advance Tax is crucial for freelancers, as they do not receive a regular salary and may not have tax deducted at source on most of their income. Advance Tax is a system where taxpayers are required to pay their tax liability in installments over the financial year, rather than paying it all at once at the end of the year.

Key points to consider for Advance Tax:

- Installments: Freelancers are liable to pay Advance Tax if their total tax liability for the financial year is INR 10,000 or more. The Advance Tax is paid in four installments – 15% by June 15, 45% by September 15, 75% by December 15, and 100% by March 15.

- Calculation: To calculate Advance Tax, freelancers need to estimate their total income for the year and calculate the tax payable on it. This estimation can be revised in subsequent installments if there are changes in income.

- Interest on Late Payment: Failure to pay Advance Tax or underestimating the tax liability can attract interest under Section 234B and Section 234C of the Income Tax Act, 1961. It is essential to pay the correct amount of Advance Tax to avoid interest penalties.

Deductions and Exemptions Available for Freelancers

The Income Tax Act, 1961 provides certain deductions and exemptions that can significantly reduce the taxable income for freelancers. Here are some of the key ones:

- Business Expenses: Freelancers can claim deductions for business-related expenses, such as internet charges, phone bills, office rent, travel expenses, professional fees paid, etc. It is essential to keep proper records and receipts to support these claims.

- Section 80C Deductions: Under Section 80C, freelancers can claim deductions up to Rs. 1.5 lakh on investments made in specified financial instruments such as Public Provident Fund (PPF), Employees’ Provident Fund (EPF), National Savings Certificate (NSC), tax-saving fixed deposits, and equity-linked savings schemes (ELSS).

- Section 80D Deductions: Freelancers can avail deductions for premiums paid for health insurance policies for themselves, their families, and parents, subject to specified limits.

- Section 80G Deductions: Donations made to eligible charitable institutions and funds are eligible for deductions under Section 80G.

- Section 80TTA Deductions: Freelancers can claim deductions of up to Rs. 10,000 on interest earned from savings accounts.

- Section 44ADA Presumptive Taxation Scheme: Freelancers whose total gross receipts do not exceed Rs. 50 lakhs can opt for the presumptive taxation scheme. Under this scheme, 50% of the gross receipts are considered as income, and no further deductions are allowed.

- Section 10(14) Allowances: Certain allowances like the House Rent Allowance (HRA), Conveyance Allowance, etc., are exempted up to specified limits.

- Section 80E Deductions: Freelancers can claim deductions on the interest paid on educational loans for higher studies.

Procedure for filing Income Tax Return for Freelancers

Freelancers fall under the category of self-employed individuals, and their income is generally considered as “Income from Business or Profession.” As per the Income Tax Act, freelancers are required to file their income tax returns if their total income exceeds the threshold limit prescribed for the relevant financial year.

The process of filing income tax returns for freelancers involves the following steps:

- Determine the Appropriate ITR Form: Freelancers must choose the correct Income Tax Return (ITR) form based on the nature of their income and the type of business they are engaged in. For most freelancers, the ITR-3 or ITR-4 form is commonly applicable.

- Gather Income and Expense Details: Freelancers should compile all income sources earned during the financial year, such as freelance project earnings, consultation fees, royalties, etc. Additionally, they should maintain records of business-related expenses, as these can be deducted from the total income to arrive at the taxable income.

- Calculate Taxable Income: After deducting eligible business expenses from the total income, freelancers arrive at their taxable income.

- Pay Advance Tax (if applicable): Freelancers are required to pay advance tax if their total tax liability exceeds Rs. 10,000 in a financial year. Advance tax should be paid in installments before specific due dates to avoid penalties.

- File Income Tax Return: Once all the necessary calculations are made, freelancers can file their income tax return online on the Income Tax Department’s official website (incometaxindiaefiling.gov.in) using their digital signature or electronic verification code (EVC).

- Verify ITR-V: If the ITR is filed using EVC, the ITR-V (Acknowledgment) should be e-verified within 120 days of filing the return.

To Sum Up

In conclusion, freelancers in India are subject to income tax and are required to file their income tax returns if their total income exceeds the prescribed threshold limit. By diligently maintaining records of income and expenses and taking advantage of the available deductions and exemptions, freelancers can optimize their tax liability and ensure a smooth tax filing process. Remember, tax compliance is not just a legal obligation but a responsible contribution to the nation’s progress and development.

CA Pulkit Goyal, is a fellow member of the Institute of Chartered Accountants of India (ICAI) having 10 years of experience in the profession of Chartered Accountancy and thorough understanding of the corporate as well as non-corporate entities taxation system. His core area of practice is foreign company taxation which has given him an edge in analytical thinking & executing assignments with a unique perspective. He has worked as a consultant with professionally managed corporates. He has experience of writing in different areas and keep at pace with the latest changes and analyze the different implications of various provisions of the act.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (90)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (118)

- Hallmark Registration (1)

- Income Tax (200)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (21)

- Startup/ Registration (128)

- Trademark Registration/IPR (40)

Recent Posts

- Post incorporation compliances for companies in India April 30, 2024

- Startup’s Guide to Employee Stock Ownership Plans April 29, 2024

- Master Secretarial Audit: A Complete Compliance Guide April 27, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.