Interested in starting your own Full-Fledged money changer (FFMC) business? Look no further, as we have all the guidelines you need to get your FFMC license. Whether you’re a budding entrepreneur or a seasoned professional, our comprehensive guidelines will guide you through the process step by step and make it easier for you to navigate the world of foreign exchange. So get ready for a new journey in the exciting realm of FFMC and unlock endless possibilities in the financial industry. In this article we are going to study briefly about the guidelines for FFMC Licence.

Overview

Most people travel abroad for various purposes. Be it the purpose of a business meeting, vacation, study, onshore opportunities, and many more A significant part of this is made up of business travellers. So how do they manage despite having their own currency? All you need to do is consult a company that will convert your currency to the currency of the country you are visiting. But what are the things that you cannot overlook at any cost? A company operating a foreign exchange in India must be licenced by the FFMC.

What is FFMC Licence?

RBI has to authorize the entities or companies that carry out the business of money exchange under Section 10 of the Foreign Exchange Management Act (FEMA), 1999. Once the licence is approved, these companies will be considered authorized money changers (AMC). Any business entity operating a currency exchange business without a valid FFMC licence is subject to a heavy fine under the FEMA Act. The objective of a business entity obtaining a FFMC licence is to help residents and tourists easily access foreign exchange facilities.

What is AMC??

AMC is Authorised Money Changer. There are 3 styles of AMC: authorized dealer class I banks, authorised dealer category II banks, and full-fledged money changers (FFMCs). The primary goal of adding one greater AMC is to widen the right of entry to foreign exchange centres for citizens and travellers and ensure efficient customer service via competition.

Any person who wants to begin a money trade enterprise shall keep a valid licence issued with the aid of the Reserve Bank. Any individual without a legitimate licence, including a commercial enterprise, will face heavy consequences.

Benefits of FFMC Licence

Following are the benefits of FFMC Licence:

- An AMC licensee has the ability to provide sales facilities and services for foreign exchange.

- In the case of travellers’ checks and foreign currency notes from non-residents and residents, the FFMC licensee can give certificates of encashment.

- FFMC licensees can conduct foreign exchange activities for foreign tourists visiting India.

- AMC licensees can settle coin, traveller’s checks, and foreign currency transactions at prevailing exchange rates.

Guidelines for FFMC License

Guidelines to be fulfilled laid by RBI for issuing FFMC licence are:

- The applying company should be registered under the Companies Act, 1956.

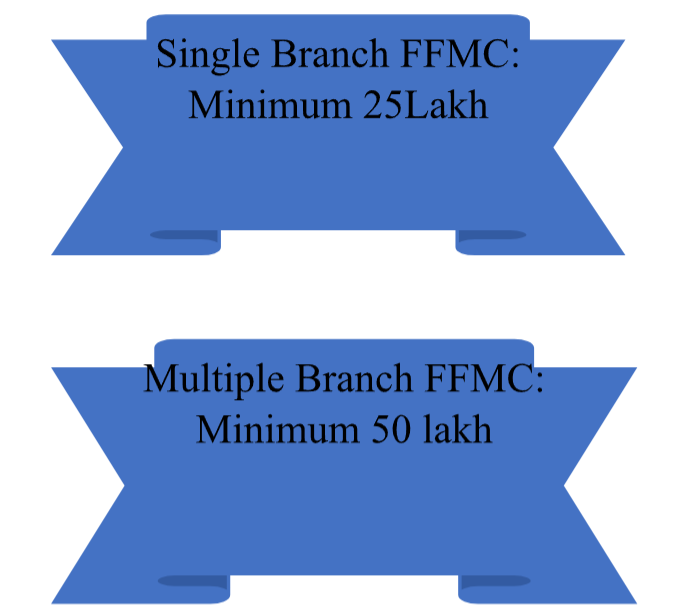

- The net fund held by the company should be as follows:

In the above case, the net owned fund is equal to the own fund minus the number of investments in the shares of its subsidiaries, companies in the same group, and all other non-bank financial companies, as well as the book value of bonds, debentures, outstanding loans and advances provided, and deposits with its subsidiaries and companies in the same group exceeding 10 percent of its own resources.

Wherein the owned fund is equal to the paid-up capital plus the free reserve plus the credit balance in the profit and loss account minus the accumulated loss balance.

Additional Branches of FFMC

FFMC can set up multiple corporations in different places after obtaining approval for each branch.

Franchise by FFMC

The Reserve Bank of India has permitted FFMCs to enter into franchise agreements, which may refer to agency agreements for the prohibited money-changing business, i.e., conversion of foreign currency notes, coins, or traveler’s checks into Indian rupees.

Condition for Franchise:

- The entity must have a place of business.

- The entity should have a minimum net owned fund of 10 lakhs.

- A franchisee may only conduct restricted money-changing business.

A franchise agreement should have the following features:

- Name of franchisors, exchange rates, and must be authorized to purchase foreign currency in their office.

- The exchange rate for converting foreign currency into rupees should be equal to or close to the daily exchange rate charged by FFMC.

- The franchisee shall surrender to the franchisor all foreign currency purchased by the franchisee within 7 working days from the date of purchase.

- The franchisee must maintain proper records of transactions.

- An on-site inspection of the franchise by the franchisor shall be conducted at least once a year.

Documents required for FFMC licence

The following are the documents required during applying for FFMC licence:

- Certificate of Incorporation of a Company or Entity

- Memorandum of Association (MOA) and Articles of Association (AOA) of the company. A company’s AOA must include provisions on exchange business.

- A copy of the latest audited financial statements together with the NOF (Net Owned Funds) certificate as of the date of application from the statutory auditors

- A copy of the company’s profit and loss statement and audited balance sheet for the last three years

- Applicant (Company or Entity) Confidential Banker’s Message

- Declaration that no proceedings have been initiated or are pending with any authority.

- Certified resolution of the board of directors for the money exchange business.

What are the powers given to FFMC by RBI?

Following are the powers give to FFMC by RBI:

- FFMCs have the authority to deal in foreign exchange and can extend access to foreign exchange facilities for residents and tourists.

- They have authority to purchase foreign exchange from residents and non-residents of India.

- The FMC should maintain a register containing the purchase of foreign currency, such as a traveller’s check ledger or a daily summary and coins.

- Full-fledged money changers submit consolidated statements of purchases or sales of foreign currency notes to the Reserve Bank every month.

- There must be an appropriate system for concurrent auditing of FFMC transactions.

- The proposed company should have net owned funds (NOF) of at least INR 25 million for a single branch licence and INR 50 million for a multi-branch licence.

Application process for FFMC licence

The Guidelines for FFMC Licence process includes the following steps:

- Application Submission: The applicant must submit a detailed application form along with necessary documents such as company incorporation documents, financial statements, and a business plan.

- Due Diligence: The Regulatory Authority carries out a thorough due diligence process, which includes checking the applicant’s documents, verifying the information provided, and assessing the applicant’s financial stability.

- Background Checks: Company directors and shareholders are subject to background checks to ensure their suitability to hold an FFMC licence.

- Capital Requirement: The applicant must meet the prescribed minimum capital requirement set by the regulatory authority.

- Infrastructure and Compliance: The applicant must have a robust infrastructure in place, including adequate office layout, trained staff, and compliance mechanisms to ensure compliance with regulatory guidelines.

- Grant of Licence: Once the application is approved and all requirements are met, the regulatory authority will grant the licence to FFMC.

Compliance requirements for FFMC

After obtaining an FFMC licence, the licensee must comply with various compliance & guidelines for FFMC Licence such as:

- Reporting: FFMCs are required to submit regular reports to the regulatory authority detailing their foreign exchange transactions, customer data, and financial statements.

- Risk Management: FFMC must implement robust risk management systems to mitigate currency risks and ensure the security of customer transactions.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Policies: FFMC must have strict AML and KYC policies in place to prevent money laundering, terrorist financing, and identity theft.

- Customer Protection: Licensees should prioritise customer protection by ensuring transparent pricing, fair exchange rates, and effective grievance redressal mechanisms.

- Record Keeping: FFMCs are required to maintain accurate and up-to-date records of their transactions, customer details, and compliance documentation.

Conclusion

Final thoughts suggest that obtaining an FFMC licence is a must if you wish to operate a foreign exchange business in India. And from an individual’s point of view, you need to cross-check whether the company is licenced by FFMC or not. FFMC, authorised by the Reserve Bank of India, deals in foreign currency for a specified purpose, such as the purchase of foreign exchange from residents and non-residents visiting our country. Once licenced by FFMC, you must also comply with submission and compliance requirements.

In case of any query regarding the FFMC Licence a team of expert advisors from Legal Window is here to assist you at every step. Feel free to reach us at admin@legalwindow.in.

CS Urvashi Jain is an associate member of the Institute of Company Secretaries of India. Her expertise, inter-alia, is in regulatory approvals, licenses, registrations for any organization set up in India. She posse’s good exposure to compliance management system, legal due diligence, drafting and vetting of various legal agreements. She has good command in drafting manuals, blogs, guides, interpretations and providing opinions on the different core areas of companies act, intellectual properties and taxation.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (90)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (119)

- Hallmark Registration (1)

- Income Tax (201)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (21)

- Startup/ Registration (130)

- Trademark Registration/IPR (40)

Recent Posts

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.