Fraud Risk Management Solutions in India: Safeguarding Businesses in a Digital Age

- September 5, 2023

- Miscellaneous

In this era where technology is interacted in every aspect of business operations, the risk of fraud activities has become a common concern for companies and businesses across the globe. India, as a growing economy with an ever-expanding digital landscape, is no exception to this issue. The need for quick and effective risk and fraud management solutions has proved to be most important, and businesses are now moving towards innovative strategies to safeguard their assets, respect and reputation, and customer trust. In this article, we will discuss about Fraud Risk Management Solutions in India.

Rising Threat of Fraud

Fraudulent activities have been an imminent concern for businesses for a very long, however, the digital world has given rise to a new form of fraud in which exploitation takes place in technological procedures. This unique challenge has been presented by the online or digital landscape, which is in demand for equally innovative and agile solutions. In India, as more transactions and interactions have moved towards digital platforms, the risk of cyber attacks, identity theft, payment fraud, and other forms of electronic crime has evolved significantly.

Fraud Risk Management Solutions in India: Early Warning System (EWS) by RBI

In this digital world, where financial transactions are conducted with just the clicking of a button, the risk of fraudulent acts has been rising to the fullest. To tackle this threat and for the protection of the integrity of the financial system, regulatory bodies or higher authorities such as the Reserve Bank of India (RBI) have implemented various measures, including the Early Warning System (EWS). This system plays an important role in identifying, reduction, and preventing fraudulent activities taking place within India’s financial system.The Reserve Bank of India recognized the need for a quick and efficient mechanism to keep a check and detect suspicious transactions in real time. Due to this only the inception of the Early Warning System (EWS) in 2014 takes place. The primary objective of the EWS is to assist in the timely detection and reporting of potential fraud. It also enables the concerned authority to take preventive measures.

- Key Components and Functioning: The EWS is based on a basis of advanced data analytics and artificial intelligence (AI) methods. Further, it operates by analyzing transactions, account activities and behaviours, and different patterns to identify any problem that may indicate fraudulent behaviour. The following are the key components and functioning of the EWS:

- Data Collection and Aggregation: The EWS is responsible for collecting transactional data from various banks and financial institutions present in India. This data is aggregated and centralized for analysis for further check.

- Behavioral Analytics: The system uses behavioural analytics to build a profile regarding customer transactions. This also includes assessing factors such as frequency of transactions, amounts, locations etc,

- Anomaly Detection: The EWS takes the help of AI and machine learning algorithms to identify issues present in transaction patterns. Unusual activities or deviations from a customer’s normal behaviour are then marked as red flags for beyond investigation.

- Alert Generation: In case of detection of any suspicious activities, the EWS generates alerts that are then sent to the relevant banks or financial institutions across the nation.

- Collaboration: The EWS encourages the collaboration of financial institutions by sharing information regarding potential frauds. This ensures quick detection and prevention of the issue across the entire financial ecosystem.

- Preventive Measures: Depending upon the alerts generated by the EWS, banks and financial institutions can take swift actions to prevent the issue. This may include in blocking transactions, freezing deferred accounts, or connecting with the account holders for verification.

Fraud Risk Management Solutions in India: Red Flag Account

The Red Flag Account approach is one of the most innovative risk and fraud management solutions that primarily focus on the use of advanced data analytics, artificial intelligence, and machine learning algorithms to detect vicious patterns and behaviours within a financial transaction. This unique system continuously analyzes a multitude of variables, including transaction frequency, amounts, geographical locations, and transaction partners, to identify issues and red flags that may indicate prevalent fraudulent activity.

- Key Features and Benefits: The following are key features of the Red Flag Account Approach

- Real-time Monitoring: Red Flag Account solutions are important as they offer real-time monitoring of transactions. This enables the immediate detection of unusual activities, making eligible organizations take swift action to prevent potential financial fraud.

- Data-driven Analysis: By utilizing vast amounts of data and by applying sophisticated digital algorithms, these solutions are eligible to identify subtle patterns that may go unnoticed by using traditional methods.

- Customization: Red Flag Account systems can be used to be tailored use, to suit the depending needs of various organizations and industries.

- Reduced False Positives: By using machine learning and AI, the system learns from past data and analyzes its alerts, curbing false positives and ensuring that genuine transactions are not flagged needlessly.

- Compliance and Regulation: These solutions assist organizations in complying with regulatory requirements from the higher authority to enhance their fraud prevention measures and for maintaining a thorough audit trail.

Fraud Risk Management Solutions in India: Fraud Risk Intelligence

Fraud risk intelligence is one of the most critical aspects of any effective risk and fraud management strategy. It includes the collection, analysis, and interpretation of data available to identify potential fraudulent activities, predict emerging risks, and mitigate potential losses. With the advent of digital transactions, data points are now generated at an extremely high pace, offering valuable input that, when it is harnessed effectively, then, it can empower businesses to stay one step ahead of fraudsters.

Fraud Risk Management Solutions in India: Third-Party Fraud Risk

Third-party fraud risk are those fraudulent activities that are carried out by external entities, such as vendors, suppliers, partners, contractors, or any external individuals, against an organization etc. These activities may include unauthorized transactions, false representation, data breaches, data collusion, and other unlawful practices that may lead to financial losses, reputational damage, and legal liabilities to the user.

- The Role of RBI: The Reserve Bank of India (RBI) is the country’s central banking authority and regulatory authority. RBI plays an important role in ensuring the stability and protection of the financial system. RBI has been actively participating in the creation of guidelines to address the issues by recognizing the growing significance of third-party fraud risk in the digital era.

The RBI while using its authority has issued several directives and guidelines which are aimed at strengthening fraud risk management frameworks for banks and financial institutions prevailing in the country. These directives aim to improve due diligence practices, improve risk assessment methods, and for the promotion of information sharing and collaboration among institutions to tackle third-party fraud risks effectively. - RBI Guidelines on Third-Party Risk Management: The RBI’s guidelines implement efficient and robust third-party risk management frameworks. Key guidelines include:

- Risk Assessment: Financial institutions are under obligation to conduct thorough risk assessments to identify third-party fraud risks. This process involves in evaluating the nature of the relationship, the type of services provided to the user, and the associated vulnerabilities and lacunae.

- Due Diligence: Institutions are under obligation and must perform comprehensive due diligence on their third-party partners, which includes evaluating their financial stability, reputation, past track record, and adherence to regulatory and compliance.

- Contractual Arrangements: The RBI lays down the importance of well-defined contractual agreements present between financial institutions and their third-party partners. These contracts should briefly outline responsibilities, liabilities, and provisions regarding fraud prevention and response.

- Monitoring and Reporting: Regular monitoring of third-party activities is also crucial to identify any unusual or suspicious behavior present. Financial institutions are under obligation to establish mechanisms for reporting fraud incidents to the RBI.

Fraud Risk Management Solutions in India: CARO as per Ministry of Corporate Affairs

The Companies (Auditor’s Report) Order, is commonly known as CARO. CARO was first introduced by the Ministry of Corporate Affairs in 2015. CARO has the primary objective to ensure transparency and accountability in financial reporting and also to identify and reduce the risks of fraud within companies. CARO outlines specific reporting requirements, to which the auditors must adhere while conducting audits of companies.

- Enhancing Fraud Risk Management: CARO acts as a vital tool in enhancing fraud risk management solutions within India. By imposing stringent or harsh reporting requirements on auditors, CARO encourages them to conduct thorough audits. This, in turn, enables companies to strengthen their internal control systems and mechanisms and to adopt more transparent business practices in the corporate sector.

Some key provisions of CARO regarding fraud risk management solutions in India:

- Disclosure of Internal Control Systems: CARO makes it mandatory the disclosure details related to internal financial controls and also, their adequacy in preventing and detecting fraud. Companies are under obligation to report on their mechanisms to ensure that financial operations take place in a transparent, smooth and secure manner.

- Fraud Reporting: Auditors are under obligation to report on anything involving the company’s employees, management, or directors regarding fraud that has an impact on the company’s financial status. This provision focuses on the importance of identifying and reporting fraudulent activities.

- Related Party Transactions: Due to CARO, companies disclose their related party transactions, which involve transactions with entities closely interconnected to the company. Transparent reporting also helps mitigate the risk of conflicts of interest and fraudulent activities.

- Borrowings and Defaults: Companies must disclose all their default status in repayment of loans, borrowings, and other financial obligations that a company may have. This provision removes the scope of companies from engaging in fraudulent practices by hiding their financial obligation.

- Cash Transactions: Companies should report large cash transactions above a specified limit need. This helps in curbing the potential threat of money laundering and other financial irregularities.

Fraud Risk Management Solutions in India: SEBI and Risk Committee under SEBI

The Securities and Exchange Board of India (SEBI) is the supreme regulatory body for the Indian securities market. SEBI was established in 1992. The primary objective of SEBI is to protect the interests of investors, also to ensure the integrity of the market, and promote the healthy growth of the securities industry in India. As far as fraud risk management is concerned, the SEBI has introduced numerous guidelines and regulations to make sure that market participants are adhering to the best measures in detecting and preventing fraud.

- Risk Committee Mandate as per SEBI Guidelines: SEBI emphasizes fraud risk management and it has led to the introduction of guidelines that make it necessary to establish Risk Committees by listed entities. These Risk Committees are established to function as an important aspect of the corporate governance structure, having the responsibility for overseeing the organization’s risk management framework, including fraud-related risks.

Key features and responsibilities of the Risk Committee, as per SEBI guidelines, include: - Composition: The Risk Committee must include a majority of independent directors to ensure unbiased decision-making and implementation.

- Terms of Reference: The committee’s terms of reference are an outline of comprehensive guidelines which include formulating a risk management policy for the organization, determining risk tolerance levels, and ensuring the implementation of appropriate risk management strategies.

- Fraud Risk Assessment: The committee is under obligation and is tasked with identifying and assessing fraud risks particularly relating to the organization’s operations. This involves analyzing potential lacunae and gaps and developing strategies to reduce these risks.

- Oversight of Risk Management Framework: The Risk Committee keeps an eye on the implementation and effectiveness of the organization’s risk management framework. It undertakes to review risk management policies and practices to make sure they align with regulatory requirements.

- Reporting: The committee is under obligation to report directly to the board of directors, providing regular updates on risk-related matters, which shall also include fraud risk assessments, risk mitigation efforts, and emerging risk trends.

- Whistleblower Mechanism: The committee should ensure the establishment of a quick and efficient mechanism that enables employees and other stakeholders to report fraud or unethical behavior without fear.

- Training and Awareness: The committee should promote and be aware of the training programs for employees, which are related to fraud risk awareness, prevention, and reporting.

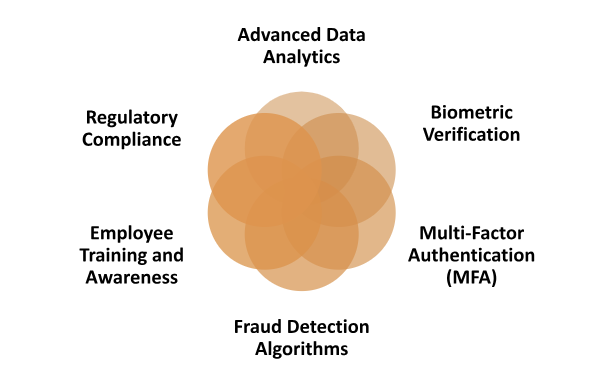

Fraud Risk Management Solutions in India

Fraud risk management solutions include a wide range of strategies, practices, and technological aspects to identify, prevent, and remove fraud. These solutions are particularly prevalent in a country like India, where the digital economy is on the rise.

- Advanced-Data Analytics: Fraud detection and prevention solutions rely on sophisticated data analytics techniques. By analyzing the vast amounts of transactional data, these systems can identify the various patterns that may indicate fraudulent activities. Machine learning and artificial intelligence algorithms also, play a pivotal role in increasing the accuracy of these analyses or results, enabling businesses to prevent fraud.

- Biometric Verification: Various Biometric authentication methods, such as fingerprint scanning and facial recognition, provide an additional layer of security to the user. These methods are difficult or almost impossible to replicate, making them effective instruments for tackling identity theft and unauthorized access.

- Multi-Factor Authentication (MFA): In MFA there is an obligation on users to provide multiple forms of verification before accessing an account or before completing a transaction. This process could involve a combination of (a password), a device (a mobile device), and the biometric data of the user.

- Fraud Detection Algorithms: Businesses can adopt real-time fraud detection algorithms that are capable of analyzing transactional behavior and flagging any suspicious activities. These algorithms can prevent any unauthorized transactions before their completion.

- Employee Training and Awareness: Comprehensive training programs can help educate employees about common fraud schemes and the importance of reporting suspicious fraudulent activities. A vigilant workforce can be used as the first line of defence against fraud.

- Regulatory Compliance: Compliance and Fraud Management guidelines regarding regulatory authority as the Reserve Bank of India’s guidelines on cyber security and fraud prevention are also important to tackle fraud. Businesses must make sure that they have the necessary policies, procedures, and technologies in place to meet these standards.

The Road Ahead

As India’s economy continues to expand the importance of robust fraud risk management solutions cannot be ignored. Businesses are in need to prioritize the protection of customer data, financial assets, and brand reputation beyond everything. By looking towards advanced technologies, employee training, and proactive strategies, companies or businesses can effectively safeguard their operations, simultaneously defending themselves from evolving fraud threats. Inter-relation between government bodies, regulatory agencies, and private companies is essential to establish a secure digital environment.Need Expert Opinion on this subject? Connect with our Expert on Legal Window and get your queries resolved.

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost. Our team offers expertise solutions in various fields that include Corporate Laws, Direct Taxations, GST Matters, IP Registrations and other Legal Affairs.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (90)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (120)

- Hallmark Registration (1)

- Income Tax (202)

- Latest News (34)

- Miscellaneous (165)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (21)

- Startup/ Registration (130)

- Trademark Registration/IPR (40)

Recent Posts

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.