Due diligence is an examination or audit conducted prior to a transaction, such as a purchase, investment, business partnership, or bank loan, to ensure compliance with financial, legal, and environmental reports. It is a requirement for firms registering in India. The results of each of these investigations and audits will be compiled into a report called Due Diligence. Due research on the business is crucial for Indian entrepreneurs seeking funding during this phase. We have compiled a list of company Due Diligence for Startups in India to ensure compliance.

| Table of Content |

Definition and Scope of due diligence

Due diligence is the name given to a thorough and detailed examination conducted by individuals or organizations before entering into any business arrangement. This process involves delving deeply into various aspects including operational, legal, financial, and compliance issues so as to assess the risks and prospects linked with these transactions. The degree of due diligence varies depending on the nature of transaction but it mainly includes fully examining relevant documents, contracts, financial statements, production processes, regulatory compliance and liabilities if any. Its main goal is risk mitigation and enhanced corporate transparency through gathering precise information, detecting possible risk signals and informed decision making.

Due Diligence for Startups in India

Before securing a bank loan, selling the business, or attracting private equity investment, corporations commonly undertake due diligence. Throughout this process, a thorough examination and documentation of the company’s financial, legal, and compliance aspects take place. Business due diligence for startup is typically carried out before an acquiring party or investor finalizes the purchase or investment. The corporation or share seller is in charge of providing the information and paperwork required for the buyer to carry out due diligence. By reducing uncertainty related to the purchase and enabling the buyer to make educated investment decisions, this diligence helps to limit risks associated with business transactions.

Types of due diligence relevant to startups

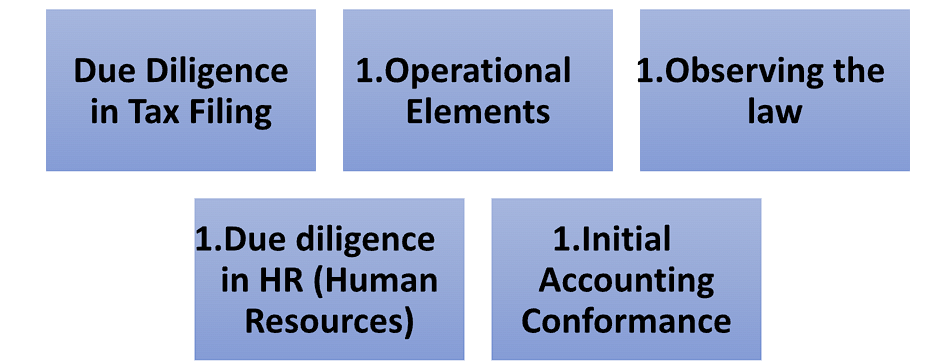

The kinds of due diligence that Indian entrepreneurs do include the following:

- Due Diligence in Tax Filing

When Filing Taxes In order to ensure that a firm doesn’t have any unforeseen tax liabilities in the future, the business’s taxation aspects need to be thoroughly studied throughout the due diligence phase. It is necessary to investigate the following areas of a company’s taxation: Submission of TDS Return ITR Submission of PF Returns and Submission of GST Returns for ESI Payment. - Operational Elements

During the due diligence process, it’s critical to gain a thorough grasp of the company’s strategy, business operations, and operational data. It is necessary to carefully review every aspect of the business, including site visits and personnel interviews.

The following has to be addressed and documented in the operational aspects evaluation:

- Number of Clients

- Organizational Structure

- Information about the vendor’s services

- Details on manufacturing

- Number of employees; specifics of machinery and equipment

- Observing the law

The purpose of this is to assess the legal and regulatory risks that the company faces. Following the law can often be the most difficult and time-consuming task. This is mostly the result of compliance with the Ministry of Corporate Affairs. It includes the analysis listed below:

- AOA and MOA Arrangement records pertinent to the finance arrangements of the business.

- Copies of any pending or previously filed lawsuits brought against the company.

- Large agreements, such those seen in joint ventures, partnerships, and other arrangements.

- There were signed equipment leases, if any.

- The company has contracts for real estate inked.

- Minutes of board meetings for the ensuing three fiscal years.

- Each register is owned by the company.

- Due diligence in HR (Human Resources)

When handling human resources HR must do due diligence by becoming familiar with the nation’s hiring contract system, labor laws, labor relations, regulatory frameworks, workplace culture, and industry standards. The human element of a corporation has both a cost and a value in terms of money.

- Payroll checklist

- Schedules for ESOPs and

- HR policies listed Employee contact information and additional details

- Initial Accounting Conformance

The Companies Act of 2013 requires all companies to keep a complete set of transaction records and a book of accounts. Consequently, in order to compare the company’s financial reports with the specific financial transaction data, an audit and verification are required. A few items to consider when performing financial due diligence on organizations are as follows:

- Verification of an accounting statement

- Each asset and liability must be assessed and verified.

- Confirmation of cash flow information is required.

- Every financial statement is compared with transactional data for analysis.

Legal Due Diligence

Legal due diligence is like a thorough checkup for businesses or investments. Its goal is to carefully examine a business’s legal situation and find any potential problems or responsibilities. This process involves looking at contracts, agreements, intellectual property, past legal issues, following rules, and other important legal documents.

The extent of this checkup depends on the specific situation, like partnerships, investments, or business mergers. The main purpose is to protect everyone involved from unexpected legal troubles and to make sure the business being examined follows all the laws and rules. It’s like making sure everything is in order before any important business deal happens.

Conclusion

To sum up, one essential component of the venture capital due diligence process is the due diligence that entrepreneurs undergo. Making educated investment selections requires carefully examining a startup’s operational, legal, and financial issues as described in the startup due diligence report. In order to inspire trust in potential investors, startups must emphasize due diligence as they negotiate the difficult business landscape. A key component of a successful startup investment is the startup due diligence process, which involves thorough investigation and transparency. Stakeholders strengthen their knowledge, reduce risks, and extend the lifespan of successful company endeavors when they participate in due diligence start-up projects.

CS Urvashi Jain is an associate member of the Institute of Company Secretaries of India. Her expertise, inter-alia, is in regulatory approvals, licenses, registrations for any organization set up in India. She posse’s good exposure to compliance management system, legal due diligence, drafting and vetting of various legal agreements. She has good command in drafting manuals, blogs, guides, interpretations and providing opinions on the different core areas of companies act, intellectual properties and taxation.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (89)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (118)

- Hallmark Registration (1)

- Income Tax (199)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (21)

- Startup/ Registration (127)

- Trademark Registration/IPR (40)

Recent Posts

- Master Secretarial Audit: A Complete Compliance Guide April 27, 2024

- Farmer Producer Companies-Major provisions under Companies Act April 26, 2024

- Detailed Analysis of Section 179 of the Companies Act, 2013 April 24, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.