Performing a first-time cost audit is a crucial step for any organization seeking to enhance financial efficiency, identify areas of overspending and optimize resource allocation. Below is a comprehensive guide to help you navigate through the Cost Records And Audit Rules process effectively.

| Contents |

Introduction

The Companies Act 2013 empowers the Central government to make rules regarding the maintenance of cost records and cost audits and hence, Companies (Cost Audit and Record) Rules was passed in 2014.

Cost Audit is compulsory for which companies?

Rule 3 of Companies (Cost Audit and Records) Rules 2014 states that both domestic and foreign companies either in regulated or non-regulated sector engaged in production of goods or providing services with overall turnover from its all goods and services of 35 crore rupees or more is required to get the cost audit done compulsorily.

Cost Audit Applicability

Cost audit was first introduced for companies engaged in manufacturing but with time its need has arisen in specified industries providing such goods and services. Rule 4 of Companies (Cost Audit and Records) Rules 2014 states the applicability of cost audit.

Cost Audit limits:

- For regulatory sector

Having overall annual turnover during immediately preceding financial year of Rs.50 crore or more for all goods and services and Rs.25 crore for individual goods and services.

- For non-regulatory sector

Having overall annual turnover during immediately preceding financial year of Rs.100 crore or more for all goods and services and Rs.35 crore for individual goods and services.

- The requirement for cost audit under these rules shall not apply to a company which is covered in rule 3; and

- Whose revenue from exports, in foreign exchange, exceeds seventy five per cent of its total revenue; or

- which is operating from a special economic zone;

- which is engaged in generation of electricity for captive consumption through Captive Generating Plant.

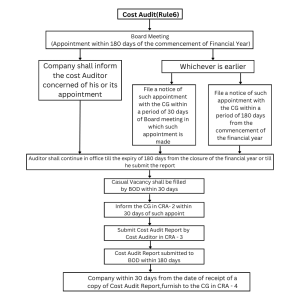

Cost Audit Procedure

- The category of companies specified in rule 3 and the thresholds limits laid down in rule 4, shall within one hundred and eighty days of the commencement of every financial year, appoint a cost auditor.

- The cost auditor so appointed shall submit a certificate that:

- (a) the individual or the firm so appointed is not disqualified for appointment under the Act

- (b) the individual or the firm satisfies the criteria provided in section 141 of the Act

- (c) the proposed appointment is within the limits laid down by or under the authority of the Act

- (d) the list of proceedings against the cost auditor or audit firm or any partner of the audit firm pending with respect to professional matters of conduct, as disclosed in the certificate, is true and correct.

- Every company shall inform the appointment of cost auditor to the Central Government within:

- a period of thirty days of the Board meeting in which such appointment is made or

- within a period of one hundred and eighty days of the commencement of the financial year, whichever is earlier In form CRA-2, along with the fee.

- Every cost auditor appointed as such shall continue in such capacity till the expiry of one hundred and eighty days from the closure of the financial year or till he submits the cost audit report.

- Any casual vacancy in the office of a cost auditor, whether due to resignation, death or removal, shall be filled by the Board of Directors within thirty days of occurrence of such vacancy and the company shall inform the Central Government in Form CRA-2 within thirty days of such appointment of cost auditor.

- Every cost auditor, who conducts an audit of the cost records of a company, shall submit the cost audit report in form CRA-3.

- Every cost auditor shall forward his duly signed report to the Board of Directors of the company within a period of one hundred and eighty days from the closure of the financial year.

- Every company covered under these rules shall, within a period of thirty days from the date of receipt of a copy of the cost audit report, furnish the Central Government with such report along with full information and explanation on every reservation or qualification contained therein, in Form CRA-4.

Conclusion

In essence, the implementation of cost audits is not merely a regulatory requirement but a strategic imperative for companies seeking to thrive in today’s dynamic business landscape. Therefore, companies falling under the specified sectors should get their cost audit done as per the cost audit rules. Through the rigorous procedures outlined in the rules, companies are compelled to adhere to strict standards of cost accounting and reporting, fostering greater trust among stakeholders and regulators. Stay updated with more such updates with team Legal Window and in case of queries feel free to reach us at admin@legalwindow.in

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost. Our team offers expertise solutions in various fields that include Corporate Laws, Direct Taxations, GST Matters, IP Registrations and other Legal Affairs.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (89)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (118)

- Hallmark Registration (1)

- Income Tax (199)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (21)

- Startup/ Registration (128)

- Trademark Registration/IPR (40)

Recent Posts

- Startup’s Guide to Employee Stock Ownership Plans April 29, 2024

- Master Secretarial Audit: A Complete Compliance Guide April 27, 2024

- Farmer Producer Companies-Major provisions under Companies Act April 26, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.