Different Committees and their Functioning as per Companies Act, 2013

- August 2, 2023

- Company Law

Do you know about the different committees and their functioning as per Companies Act, 2013? When it comes to running a company smoothly, committees are the unsung heroes. Under the Companies Act, 2013, these committees are like superheroes with specific powers, ensuring everything is in order. From financial checks to finding the right leaders, resolving stakeholder issues to making a positive impact on society, these committees have important tasks. Let us discuss the different committees and their functioning as per Companies Act, 2013.

Overview on Different Committees as per Companies Act, 2013

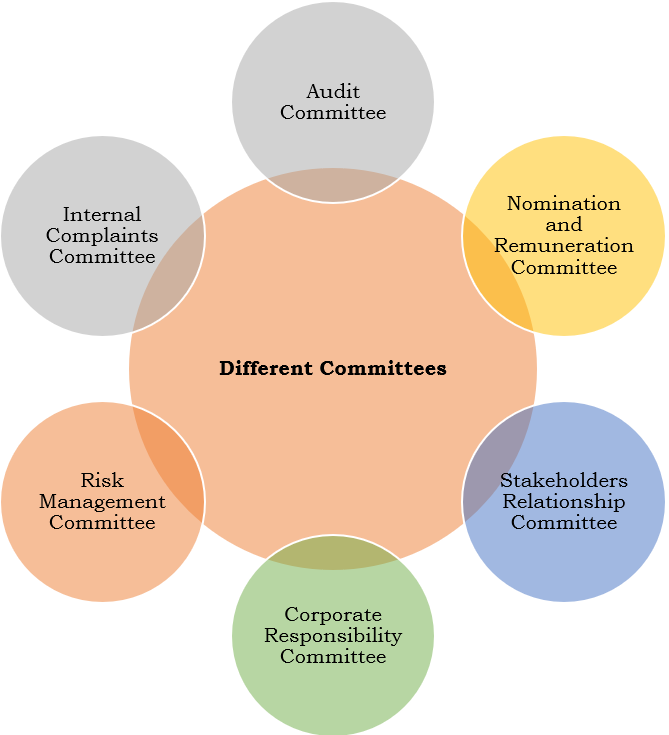

Different committees refer to the various committees that are required to be established by companies under the provisions of the Companies Act, 2013. These committees are mandated to ensure proper governance, accountability, and compliance with legal and regulatory requirements. The Companies Act, depending on the size and nature of the company, specifies the committees that need to be formed. Some common committees include the Audit Committee, Nomination and Remuneration Committee, Stakeholders Relationship Committee, Corporate Social Responsibility Committee, Risk Management Committee, and Internal Complaints Committee. Each committee has specific roles, responsibilities, and functions that contribute to the effective management and governance of the company.

Need of Different Committees as per Companies Act, 2013

The establishment of different committees under the Companies Act serves several crucial purposes in promoting effective corporate governance. Here are some key reasons highlighting the need for these committees:

- Enhancing Financial Integrity: The Audit Committee plays a pivotal role in ensuring financial integrity within a company. By overseeing financial reporting, internal controls, and audit processes, this committee safeguards against financial misconduct, fraud, and misrepresentation. It enhances the accuracy and transparency of financial statements, protecting the interests of shareholders and stakeholders.

- Ensuring Independent Decision-Making: The Nomination and Remuneration Committee ensures that the process of selecting and appointing directors and key managerial personnel remains unbias ed and independent. By setting transparent criteria for appointments, evaluating performance objectively, and recommending fair remuneration, this committee prevents nepotism and ensures the right individuals with the requisite qualifications are appointed.

- Safeguarding Stakeholder Interests: The Stakeholders Relationship Committee addresses grievances of shareholders, debenture holders, and other stakeholders, protecting their rights and interests. By providing a mechanism to address complaints and ensuring effective communication, this committee promotes transparency, trust, and accountability between the company and its stakeholders.

- Driving Corporate Social Responsibility: The CSR Committee ensures that companies fulfill their social and environmental responsibilities. By formulating CSR policies, identifying relevant initiatives, and monitoring their implementation and impact, this committee helps companies make a positive contribution to society. It ensures that businesses operate in a sustainable and socially responsible manner, aligning their actions with societal goals.

- Managing and Mitigating Risks: The Risk Management Committee identifies, assesses, and manages risks that may impact a company’s operations, reputation, and financial stability. By formulating risk management policies, developing mitigation strategies, and implementing risk control mechanisms, this committee helps companies proactively manage risks and make informed decisions, safeguarding their long-term viability.

- Ensuring Workplace Safety and Equality: The Internal Complaints Committee addresses workplace sexual harassment issues, providing a safe and respectful work environment for employees. By following a prescribed process for receiving and resolving complaints, this committee promotes gender equality, protects employees from harassment, and upholds their rights.

Therefore it is important to know the different committees and their functioning as per Companies Act, 2013.

Different Committees as per Companies Act, 2013

Different Committees and their Functioning as per Companies Act, 2013

The different Committees and their Functioning as per the Companies Act, 2013 are-

- Audit Committee: The Audit Committee is a crucial committee mandated by the Companies Act, 2013. It consists of a minimum of three directors, with a majority being independent directors. The committee’s primary objective is to oversee financial reporting, internal control systems, audit processes, and compliance with legal and regulatory requirements. The Audit Committee ensures the accuracy, integrity, and transparency of financial statements and the effectiveness of the company’s internal control mechanisms.

- Nomination and Remuneration Committee: The Nomination and Remuneration Committee, also known as the Nominations Committee, is responsible for selecting, appointing, and evaluating directors and key managerial personnel. This committee recommends their remuneration and formulates policies related to their appointment, qualifications, and performance evaluation. The goal is to ensure a transparent and objective process for identifying individuals suitable for leadership roles within the company.

- Stakeholders Relationship Committee: The Stakeholders Relationship Committee is established to address and resolve grievances of shareholders, debenture holders, and other stakeholders. This committee monitors and ensures the effective communication of the company’s policies and practices to its stakeholders. It also oversees the redressal of investor grievances, including issues related to share transfers, non-receipt of dividends, and other matters concerning shareholders’ interests.

- Corporate Social Responsibility Committee: Under the Companies Act, 2013, certain companies meeting specific criteria are required to establish a Corporate Social Responsibility (CSR) Committee. This committee formulates and monitors the implementation of the company’s CSR policy. It identifies and approves CSR activities, ensures adequate allocation of resources, and monitors their impact. The CSR Committee also reports on CSR activities in the company’s annual report.

- Risk Management Committee: Large companies or companies meeting specific criteria are mandated to establish a Risk Management Committee. This committee is responsible for identifying, assessing, and mitigating various risks that may impact the company’s operations, reputation, or financial stability. It formulates and reviews risk management policies, strategies, and frameworks. The committee also ensures the implementation of appropriate risk management systems throughout the organization.

- Internal Complaints Committee: To address issues related to workplace sexual harassment, the Companies Act, 2013, requires certain companies to establish an Internal Complaints Committee (ICC). The ICC is responsible for receiving and redressing complaints related to sexual harassment at the workplace. It follows a prescribed procedure to ensure a safe and supportive environment for employees.

Role of an Auditor in Corporate Governance

The role of auditor in corporate governance is crucial as they play a pivotal role in ensuring transparency, accountability, and integrity within organizations. Here are the key responsibilities and contributions of auditors in corporate governance:

- Financial Statement Verification: Auditors are responsible for verifying the accuracy and reliability of a company’s financial statements. They examine the financial records, transactions, and supporting documentation to ensure that the financial statements present a true and fair view of the company’s financial position and performance. This verification process helps stakeholders, including shareholders, investors, and creditors, make informed decisions based on reliable financial information.

- Internal Control Evaluation: Auditors evaluate the adequacy and effectiveness of internal control systems within organizations. They examine the design, implementation, and operation of internal controls, including financial reporting controls, compliance controls, and operational controls. This evaluation helps identify control weaknesses, potential fraud risks, and deficiencies that may impact the reliability of financial reporting. Auditors’ recommendations assist companies in strengthening their internal controls and safeguarding assets.

- Fraud Detection and Prevention: Auditors play a significant role in detecting and preventing fraud within organizations. They employ audit techniques and procedures to identify fraudulent activities, including misappropriation of assets, fraudulent financial reporting, and conflicts of interest. By scrutinizing financial transactions, conducting forensic examinations, and assessing internal controls, auditors act as a deterrent against fraudulent behavior. Their efforts contribute to maintaining ethical conduct and protecting the interests of shareholders and stakeholders.

- Compliance Assurance: Auditors ensure that organizations comply with applicable laws, regulations, and accounting standards. They assess whether financial statements are prepared in accordance with the Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). Additionally, auditors review the company’s adherence to legal and regulatory requirements, industry-specific regulations, and corporate governance guidelines. Their assurance on compliance enhances the credibility and trustworthiness of the organization.

- Independence and Objectivity: Maintaining independence and objectivity is a fundamental aspect of an auditor’s role in corporate governance. Auditors must remain unbiased and impartial in their assessments. They should be independent of the company and its management to avoid conflicts of interest. This independence ensures that auditors can provide objective opinions and recommendations based on their professional judgment and evaluation of evidence. Stakeholders rely on auditors’ objectivity to trust the reliability of their findings.

Responsibility of an External Auditor

The responsibility of an external auditor is to examine and provide an independent opinion on the financial statements of an organization. Here are some key responsibilities of an external auditor:

- Financial Statement Audit: The primary responsibility of an external auditor is to conduct a thorough examination of an organization’s financial statements. This involves reviewing the financial records, transactions, and supporting documentation to ensure that the financial statements are prepared in accordance with the applicable accounting standards and regulatory requirements.

- Independence and Objectivity: External auditors must maintain independence and objectivity throughout the audit process. They should be free from any conflicts of interest that could impair their ability to provide an unbiased opinion on the financial statements.

- Compliance Audit: External auditors may also be responsible for performing compliance audits to assess whether an organization is adhering to specific laws, regulations, or internal policies. These audits focus on evaluating the organization’s internal controls and processes to ensure compliance with legal and regulatory requirements.

- Risk Assessment: Auditors are expected to identify and assess the risks associated with the organization’s financial reporting. This involves understanding the internal control environment, identifying areas of potential fraud or error, and determining the extent of audit procedures needed to address those risks.

- Audit Planning and Execution: External auditors are responsible for developing an audit plan that outlines the scope, objectives, and procedures to be performed during the audit. They execute the audit plan by testing transactions, verifying account balances, and obtaining sufficient and appropriate audit evidence to support their findings.

Final words

The Companies Act, 2013, emphasizes the importance of committees in promoting good corporate governance and safeguarding the interests of stakeholders. These committees, such as the Audit Committee, Nomination and Remuneration Committee, Stakeholders Relationship Committee, CSR Committee, Risk Management Committee, and Internal Complaints Committee, each serve a specific purpose and contribute to the effective functioning of companies. By adhering to the guidelines provided by the Act, companies can ensure transparency, accountability, and responsible decision-making, ultimately fostering trust and confidence among stakeholders.

In case of any query regarding the different committees and their functioning as per Companies Act, 2013, a team of expert advisors from Legal Window is here to assist you at every step. Feel free to reach us at admin@legalwindow.in.

CS Urvashi Jain is an associate member of the Institute of Company Secretaries of India. Her expertise, inter-alia, is in regulatory approvals, licenses, registrations for any organization set up in India. She posse’s good exposure to compliance management system, legal due diligence, drafting and vetting of various legal agreements. She has good command in drafting manuals, blogs, guides, interpretations and providing opinions on the different core areas of companies act, intellectual properties and taxation.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (90)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (120)

- Hallmark Registration (1)

- Income Tax (202)

- Latest News (34)

- Miscellaneous (165)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (21)

- Startup/ Registration (130)

- Trademark Registration/IPR (40)

Recent Posts

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.