For Less Compliances and Low-Cost Incorporation – Convert your Company into LLP

- August 5, 2023

- Change in Business

Transforming your company into a Limited Liability Partnership (LLP) offers a fascinating proposition: fewer compliance obligations and a cost-effective incorporation process. Say goodbye to complex paperwork and become familiar to sim For Less Compliances and Low-Cost Incorporation – Convert your Company into LLP plified operations. Convert your company into an LLP for reduced administrative burdens and an efficient business structure. Experience the freedom of streamlined compliance and enjoy the benefits of limited liability with our low-cost conversion services. Let us discuss the conversion of company into LLP.

What is an LLP?

A Limited Liability Partnership (LLP) is a business structure that combines elements of both partnerships and Limited Liability Companies (LLCs). It provides the partners with limited personal liability for the debts and obligations of the partnership while allowing them to have a flexible management structure and retain the tax advantages of a partnership.

Benefits of the Conversion of Company into LLP

Some benefits of the conversion of company into LLP are-

- Limited Liability: One of the primary advantages of an LLP is the limited liability protection it offers to its partners. This means that the personal assets of partners are protected in case of any financial or legal liabilities faced by the LLP.

- Flexible Management Structure: LLPs allow for a flexible management structure, enabling partners to have more autonomy and make decisions collectively. It provides a balance between the interests of partners and the efficient functioning of the business.

- Tax Benefits: LLPs often enjoy favorable tax treatment, as they are taxed at the partnership level, avoiding the double taxation issue faced by traditional companies. Partners are taxed individually on their share of profits.

- Ease of Compliance: Compared to companies, LLPs typically have fewer compliance requirements. This translates into reduced administrative burdens, making it easier to focus on core business operations.

- Improved Credibility: Converting into an LLP can enhance the credibility and reputation of a business, especially in professional services sectors. The “LLP” tag signifies a commitment to transparency, governance, and adherence to legal and ethical standards.

What is the Eligibility criteria for Conversion of Company into LLP?

The eligibility criteria for conversion of Company into LLP are-

- The company should not have any security over any of its assets;

- There should be no pending electronic company forms;

- No open accusations should be made against the company;

- The shareholder of the company becomes the partners of the LLP;

- The converting company must file at least one balance sheet and annual statements.

What are the Documents required for Conversion of Company into LLP?

Here is a list of documents typically required for the conversion of a company into a Limited Liability Partnership (LLP):

- Board Resolution: Proposal and approval of the conversion by the company’s directors.

- Shareholders’ Consent: Written consent from all shareholders approving the conversion.

- LLP Agreement: Document outlining the rights, obligations, and management structure of the LLP.

- Statement of Assets and Liabilities: Report showing the company’s assets and liabilities during conversion.

- Statement of Shareholders: List of shareholders and their respective holdings.

- NOC from Creditors: No Objection Certificate from company creditors.

- PAN Card and Address Proof: PAN cards and address proofs of all LLP partners.

- Identity Proof: Identification documents (e.g., passport, driver’s license) of LLP partners.

- Registered Office Proof: Evidence of the LLP’s registered office address.

- Forms and Applications: Various forms and applications required by the relevant regulatory authority.

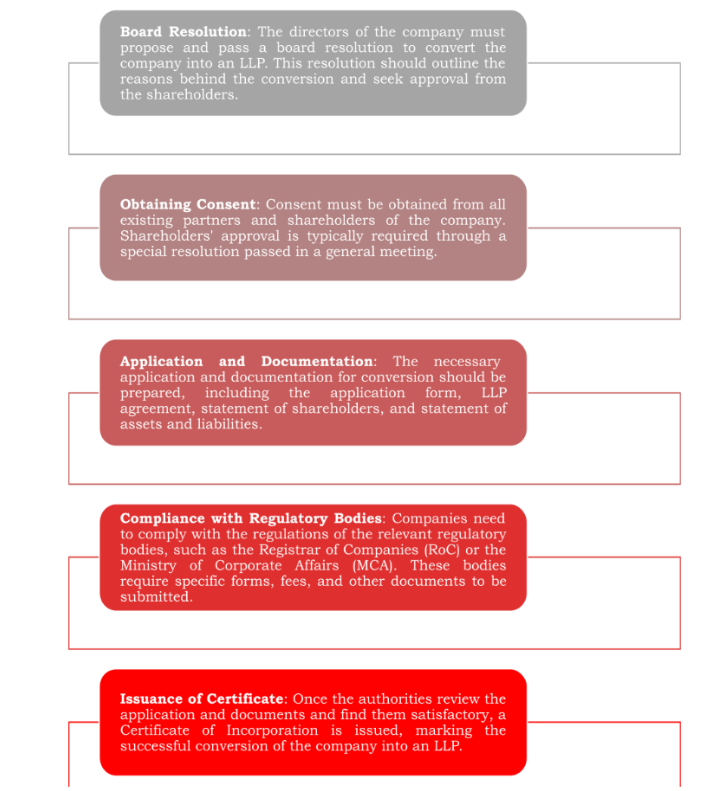

Procedure for Conversion of Company into LLP

Converting a company into an LLP involves a systematic process that requires compliance with legal regulations and specific steps. It is crucial to consult legal and financial professionals to ensure a smooth transition. Here are the general steps involved:

Effect of Conversion of Company into LLP

Some of the effects of converting a Company into an LLP are-

- The private company is dissolved after the conversion of private company into LLP.

- The conversion of a partnership firm into LLP involves a change in the legal structure and status of the business from a traditional partnership to an LLP.

- The registrar of companies shall remove the name of the limited liability company from the register.

- The conversion does not affect employment, current responsibilities, obligations, agreements and contracts.

The company must inform all relevant authorities about the conversion. In addition, it will make necessary changes to all registrations and licenses.

Key Considerations for the Conversion of Company into LLP

While the conversion to an LLP offers numerous advantages, there are certain considerations to keep in mind:

- Change in Legal Identity: Converting to an LLP involves a change in the legal identity of the entity. Contracts, licenses, permits, and agreements with other parties must be reviewed and amended accordingly.

- Valuation and Accounting: The assets and liabilities of the company need to be valued and transferred to the LLP. Proper accounting procedures must be followed to ensure accurate financial reporting.

- Intellectual Property Rights: Intellectual property owned by the company needs to be transferred to the LLP to maintain legal protection. Consultation with legal experts is crucial to ensure a smooth transfer of rights.

- Contracts and Agreements: Existing contracts and agreements, such as lease agreements, vendor contracts, and employment agreements, may need to be renegotiated or transferred to the LLP.

Final words

The conversion of a company into an LLP presents a compelling opportunity for businesses seeking enhanced flexibility, reduced liability, and improved governance structures. It is important to carefully navigate the conversion process, seeking professional advice to ensure compliance with legal requirements. By making a well-informed decision and leveraging the benefits of an LLP, businesses can position themselves for sustainable growth and success in today’s competitive landscape.

In case of any query regarding the conversion of company into LLP, a team of expert advisors from Legal Window is here to assist you at every step. Feel free to reach us at admin@legalwindow.in.

Neelansh Gupta is a dedicated Lawyer and professional having flair for reading & writing to keep himself updated with the latest economical developments. In a short span of 2 years as a professional he has worked on projects related to Drafting, IPR & Corporate laws which have given him diversity in work and a chance to blend his subject knowledge with its real time implementation, thus enhancing his skills.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (90)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (119)

- Hallmark Registration (1)

- Income Tax (201)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (21)

- Startup/ Registration (130)

- Trademark Registration/IPR (40)

Recent Posts

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.