The conversion of OPC to a private company is a transformative process that takes a small business entity and transforms it into a more sophisticated and dynamic enterprise. Imagine a one-person fishing boat that becomes a private vessel with a crew. This industrial oven is transformed into a private bakery or a solo performer, becoming a private artist with a loyal following. These transformations are just a few examples of the incredible journeys that can occur when a one-person company is converted into a private company. The process involves meticulous planning, careful execution, and expert guidance. So, if you’re ready to take your one-person company to the next level and experience the transformative power of the conversion of OPC to a private company, get ready to set sail, start baking, or take the stage with confidence. The adventure begins now.

What is a One-Person Company?

A one-person company is a legal entity with only one member or shareholder, who also serves as the director and decides on the company’s business. One-person companies are often established to limit liability and streamline business operations for solo entrepreneurs or small businesses. The advantages of a one-person company include flexibility, simplicity, and lower registration and compliance costs compared to traditional businesses. However, it is vital to point out that the advantages and disadvantages of a one-person company may vary depending on the specific context and jurisdiction.

What is a Private Company?

A private company is a legal entity not publicly traded on a stock exchange. Private companies are usually owned by a specific group of investors, such as founders, early employees, or venture capitalists. They do not need to disclose their financial information to the general public. Private companies are often preferred by early-stage startups or small businesses that want to maintain control over their operations and financial information. They may also access financing through venture capital firms or angel investors instead of relying on public markets.

What is the Conversion Process of OPC to a Private Company?

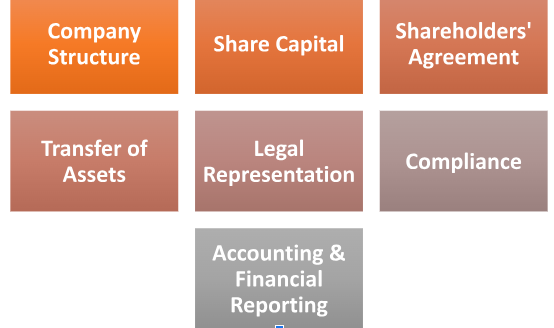

The conversion process of a one-person company to a private company typically involves several steps.

- Company Structure: Before converting, the one-person company needs to change its structure to reflect its new status as a private company. It may involve changing its articles of incorporation or similar documents and obtaining any necessary licensing or permits.

- Share Capital: A private company must have a minimum share capital, which varies by jurisdiction. To convert the one-person company to a private company, the founders must determine the necessary share capital and allocate it to themselves in proportion to their ownership interests.

- Shareholders’ Agreement: The shareholders of a private company must have a written shareholders’ agreement that describes their rights, obligations, and mechanisms for making decisions.

- Transfer of Assets: The private company will need to obtain the assets of the one-person company, which can be done through a transfer agreement or similar document.

- Legal Representation: The private company will need a legal representative(s) who can act on its behalf and be responsible for its legal obligations, such as filing tax returns or complying with regulations.

- Compliance: The private company will need to ensure that it complies with all applicable laws and regulations, such as labour laws, environmental regulations, and tax regulations.

- Accounting & Financial Reporting: The private company must also maintain accurate and timely financial records and follow the best accounting and financial reporting practices.

The above steps are general and may vary depending on the jurisdiction and situation. It is essential to seek legal and financial advice to ensure the conversion process is done correctly and in line with all legal requirements.

What Documents are Needed for the Conversion Process of a One-Person Company to a Private Company?

The documents needed for the conversion of OPC to a private company will vary depending on the specific jurisdiction and the requirements of the relevant government authorities. However, some of the standard documents required during the conversion process may include the following:

- Articles of Incorporation: These documents set out the company’s details, including its name, purpose, location, and share structure.

- Shareholders’ Agreement: A written agreement that details the company’s shareholders’ rights, obligations, and decision-making processes.

- Transfer Agreement: A document that outlines the terms and conditions of transferring the assets, resources, and intellectual property from the one-person company to the private company.

- Board of Directors Resolution: A resolution by the board of directors of the one-person company, consenting to the conversion and setting out the terms and conditions of the transfer.

- Company Registration Form: A form must be submitted to the relevant government authorities for the conversion process.

- Tax Registration Form: A form must be submitted to the tax authorities to register the private company.

- Partnership Agreement: If the converted company is a partnership, a partnership agreement setting out the rights and obligations of the partners will also be required.

It is critical to consult with an experienced corporate lawyer and accountancy firm that can provide guidance and support throughout the conversion process and ensure that all relevant documents are in order and correctly filed.

What are the Advantages and Disadvantages of the Process Conversion of an OPC to a Private Company?

The process of conversion of OPC to a private company has both advantages and disadvantages. Here are some of the important points to consider:

Advantages:

- Access to More Capital: A private company can tap into a larger pool of funding opportunities, such as venture capitalists, private equity firms, and institutional investors. It can help the company grow and expand faster.

- More Control: Private companies have fewer shareholders, making it easier to make business decisions and maintain control over their operations.

- Greater Flexibility: Private companies have greater flexibility in resolution-making, as they are not subject to similar scrutiny and disclosure requirements as public entities.

- Simplified Financial Reporting: Private companies are not required to meet the same level of financial disclosure as public companies, which can simplify financial reporting and allow managers to focus on long-term strategy.

Disadvantages:

- Limited Liquidity: Private companies’ stock is private, making it much hard for shareholders to sell their shares.

- Lack of Transparency: Private companies are subject to a different level of transparency and disclosure than public companies. It can make it hard for investors to access information and analyze the company’s performance.

- Increased Compliance Costs: Private companies have to comply with a wide range of rules related to tax, accounting, labour, and other legal requirements. These compliance costs can be significant and affect the company’s bottom line.

- Increased Liability: Private companies can be held personally liable for the company’s debts and misconduct, making it more difficult for founders and investors to limit their liability.

Considering these advantages and disadvantages is important when deciding whether to convert a one-person company to a private one. As with any business decision, consulting with legal and financial advisors is essential to ensure the conversion process is done correctly and in line with all relevant laws and regulations.

Conclusion

In conclusion, the conversion of OPC to a private company is a complex and legally-intensive process that requires careful planning and execution. It is essential to seek legal and financial advice throughout the process to ensure the conversion correctly complies with all relevant laws and regulations. The procedure can be overwhelming and time-consuming, but with actual assistance, it can be a valuable step in the growth and success of the company. Considering the conversion process’s pros and cons and each company’s specific circumstances and goals is essential. The conversion process is a significant milestone in the journey of a one-person company, and it marks the start of a new era of growth and success.

CS Urvashi Jain is an associate member of the Institute of Company Secretaries of India. Her expertise, inter-alia, is in regulatory approvals, licenses, registrations for any organization set up in India. She posse’s good exposure to compliance management system, legal due diligence, drafting and vetting of various legal agreements. She has good command in drafting manuals, blogs, guides, interpretations and providing opinions on the different core areas of companies act, intellectual properties and taxation.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (90)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (119)

- Hallmark Registration (1)

- Income Tax (201)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (21)

- Startup/ Registration (130)

- Trademark Registration/IPR (40)

Recent Posts

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.