Usually, we register a company with the idea of the business we wanted to do and for some reason, it does not work, we do not even start work. Also, there are times when we register a company for a future project and that is why those companies are not working yet. There are various rules that a person must meet after registering a company and it requires the cost to meet them. This article highlights the process of closing a company.

| Table of Contents- |

Process of Closing a Company

The winding-up is the liquidation of the Company’s assets that are collected and sold to pay off the debts incurred. When a company first completes its debts, costs, and expenses are paid and then distributed among shareholders.

Once the Company has been removed, it is officially dissolved and the Company no longer exists.

Winding up is the official way to close a company and stop all activities. After the Company concludes the Company’s existence comes to an end and the assets are guarded so that the parties are not disturbed.Company shareholders can start closing down a company at any time. If there are any unsecured debtors or employees listed, then all payments must be adjusted. After the settlement of the payments, it is necessary to close all the bank accounts of the Company. GST registration must also be granted in the event of the Company’s termination.

Once all the registration has been granted, an application for closure can be submitted to the Minister of Corporate Affairs.

Mandatory Winding-up

Any company registered under the Companies Act, 2013 committing an unlawful act, fraudulent act, or even if the company is involved in any kind of activity in certain fraudulent or illegal activities then that company will be liable for mandatory winding-up by the Tribunal.

Mandatory winding-up process-

- A petition will be filed by the company or any of the contributors to the company or registrar of companies or commercial lenders of the company or central or state government.

- All documents added to the complaints will be audited by the CA and the opinion given by the Auditor on the financial statements should be unqualified.

- The Petition must be advertised in the daily newspaper for at least 14 days in English and the local language of the area.

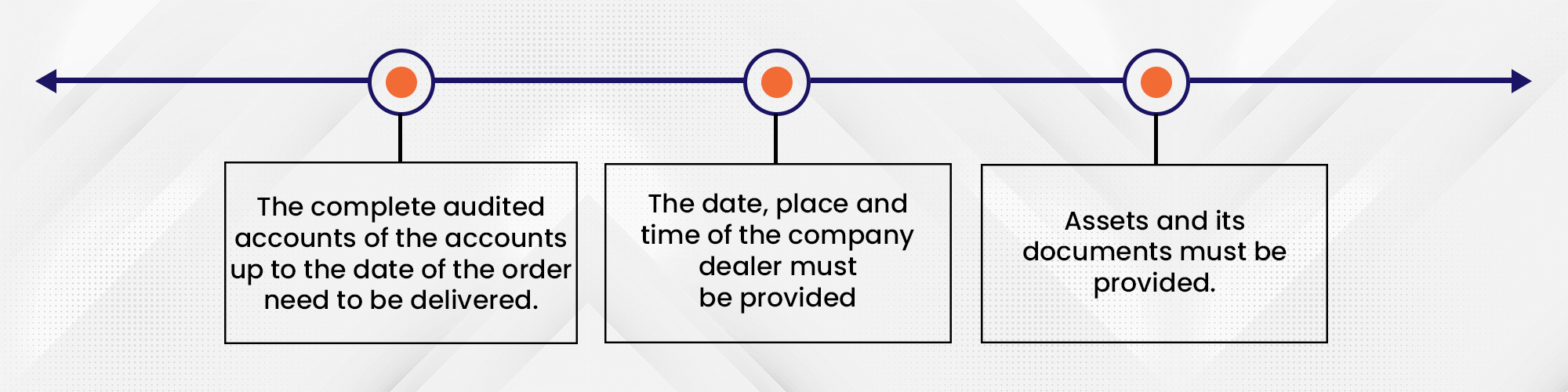

- Form 11 is required to liquidate the company. Form 11 must include-

If the court finds that all accounts are correct and all the necessary compliance has been fulfilled, the court will issue an order to dissolve the company within 60 days of receiving the claim. After the order is passed by the court, the registrar will issue a notice in the Official Gazette confirming that the company is liquidated.

Voluntary Winding-up

Voluntary closure of a private limited company requires compliance with a lengthy process that must be followed. Certain mandatory requirements must be met to close a company voluntarily.

Voluntary winding-up procedure-

- According to the Companies Act 2013, a Board Decision is required to voluntarily liquidate a company. However, the majority of the directors must agree to the termination.

- A special decision is required to liquidate a company where 3/4 of the total shareholders must vote to authorize the closure of the company.

- The approval of commercial creditors is also required to liquidate the company. Commercial Debtors must give their consent that they are not responsible if the company is in danger.

- A Payment Notice must be made by the company and the same must be accepted by the company’s creditors. The company integrity to the Declaration of Solvency must be demonstrated by the company.All of the above procedures will be introduced and installed properly and after the company has been completed and the company name will not be allowed for 2 years to be adopted by any other company.

Defunct Company Winding-up

According to the Companies Act, 2013, a defunct Company is a company that has acquired the status of a Sleeping or Dormant Company. The government gives relief to a company that no longer exists or no longer works because no money is made by dormant companies.

Procedure to close the defunct company-

A Dormant or Defunct Company may be closed with a preliminary process that requires the submission of an STK-2 form. Therefore, Form STK-2 is required to wind up such a company. Form STK-2 requires the completion of the Registrar of Companies and the same must be duly signed by the director of the company authorized by its board to do so.

Final words

We can conclude that by the above-mentioned process of closing a company if company owners or directors decide to terminate or close the business, they may consider closing options. When a closure is approved, the company name is removed from the register and as a result, it is not prevailing in the eyes of the law. The company must complete all compliance before proceeding with the strike application. The application is compliant with various documents and requires professional help.

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost. Our team offers expertise solutions in various fields that include Corporate Laws, Direct Taxations, GST Matters, IP Registrations and other Legal Affairs.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (90)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (118)

- Hallmark Registration (1)

- Income Tax (200)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (21)

- Startup/ Registration (128)

- Trademark Registration/IPR (40)

Recent Posts

- Post incorporation compliances for companies in India April 30, 2024

- Startup’s Guide to Employee Stock Ownership Plans April 29, 2024

- Master Secretarial Audit: A Complete Compliance Guide April 27, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.