If you want to save on your taxes, you’re in luck. In India, various investment plans are available to help you attain your financial goals while saving on taxes. These plans range from equity-based investments to debt-based investments, and they’re designed to suit a wide range of risk profiles. You have an investment plan, whether you are a conservative investor or a risk-taker. Whether looking for short-term tax savings or long-term wealth accumulation, these investment plans can help you. Let’s explore the world of tax-saving investment plans in India!

| Table of Contents |

Best Tax Saving Investment Plans in India: An Overview

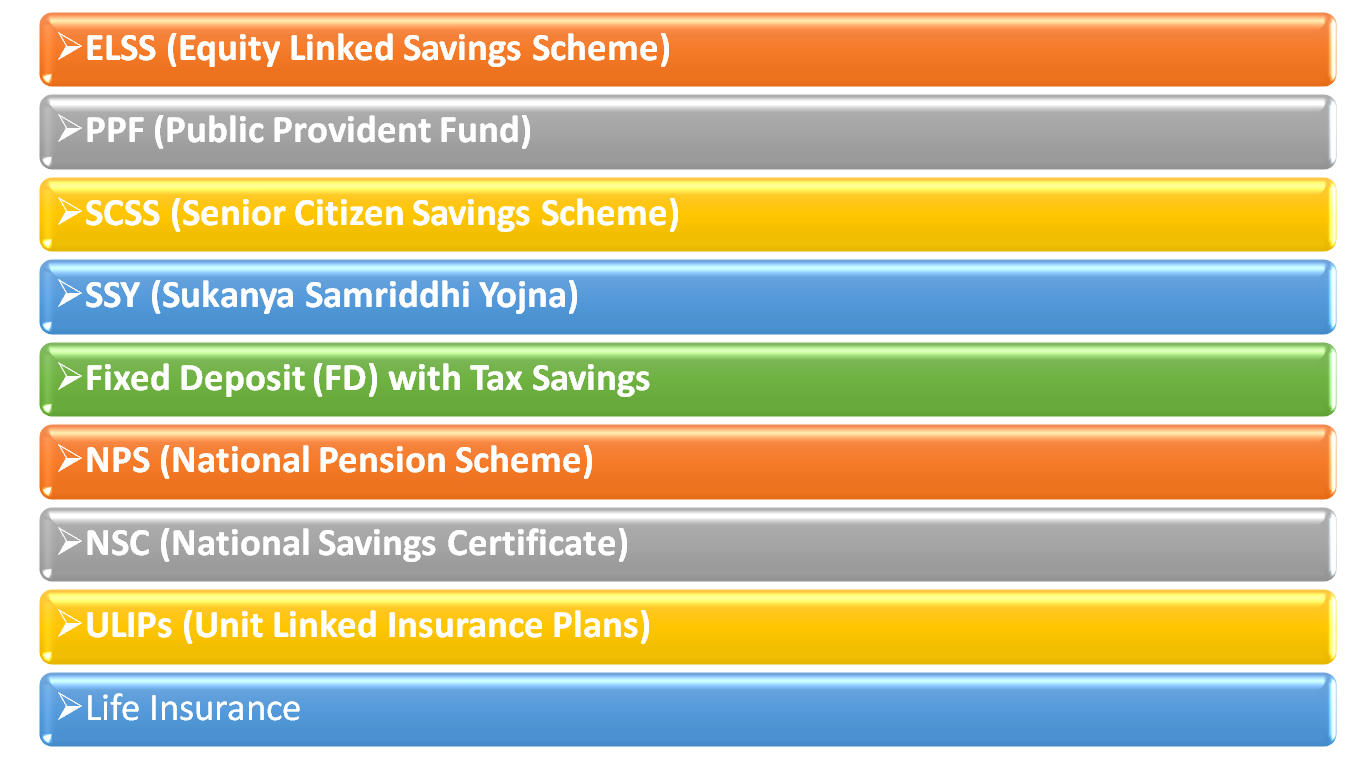

In India, several investment plans are specifically designed to help taxpayers save on their taxes. These investment plans fall under different categories: Equity-Linked Savings Schemes (ELSS), ULIPs, PPF, EPF, Mutual funds, and Insurance plans. These investment plans offer additional benefits, risks, and returns depending on the investor’s needs, risk profile, investment horizon, and financial goals.

With the introduction of Section 80C of the Income Tax Act 1961, the Indian government encouraged taxpayers to invest in tax-saving schemes by offering tax benefits on investments made in specified instruments. These tax-saving instruments help individuals reduce their tax liability while building long-term wealth.

Several investment options, such as ELSS, Tax Saving Mutual Funds, PPF, EPF, and Life Insurance plans, offer tax advantages under Section 80C of the Income Tax Act 1961.

The best tax-saving investment plan choice depends on an individual’s needs, risk profile, investment horizon, financial goals, and tax bracket. It is crucial to seek professional advice before finalizing an investment plan to help ensure it aligns with your financial goals and tax-saving requirements.

Applicability of Best Tax Saving Investment Plans in India

Many investors can apply tax-saving investment plans in India depending on their investment goals and risk-taking appetite. These plans cater to individuals looking to save taxes, make long-term investments, and generate wealth.

Generally, India’s best tax-saving investment plans are considered ELSS funds, PPF, EPF, ULIPs, and tax-saving mutual funds. These plans offer tax benefits under Section 80C, which allows investors to deduct up to INR 1.5 lakh from their taxable income.

Furthermore, these investment plans are designed to provide higher returns over a more extended period, making them suitable for investors with long-term investment plans. However, it is crucial to note that these investment plans carry certain risks, and investors should carefully evaluate their financial situation before investing in them.

Therefore, the applicability of India’s best tax-saving investment plans depends on an individual’s investment goals, risk tolerance, and tax situation. Investors should consult a financial adviser before deciding and research tax-saving investment options to make an informed investment decision.

Documents Required for the Best Tax Saving Investment Plans in India

The documents required for India’s best tax-saving investment plans may vary depending on your investment type. However, certain documents are generally required for all assets:

- Pan card: Permanent Account Number (PAN) is a 10-digit alphanumeric number that acts as a unique identifier for an investor for tax purposes. It is required for all financial dealings, such as opening a new bank account, investing in mutual funds, and filing income tax returns.

- Aadhar card: Aadhar card is a 12-digit unique identification number for proof issued by the Unique Identification Authority of India (UIDAI) to eligible Indian residents aged six years and above. It is required for opening a demat account, investing in mutual funds, and applying for several government schemes.

- Proof of Identity: You may be required to submit one of the following documents as proof of identity, such as an Aadhar Card, PAN card, passport, driver’s license, or voter ID card.

- Proof of Address: You may be required to give one of the following documents as address proof, such as an Aadhar card, passport, utility bill, or rent agreement.

- Bank Information: You must provide your bank details, such as account number, IFSC code, and bank branch.

- KYC form: You must fill out a KYC (Know Your Customer) form, which requires you to provide your details, such as name, address, and contact information.

Before investing, you must check with the investment company or financial advisor to ensure you have all the required documents. You must provide accurate and up-to-date information to avoid any issues during the investment process.

Also, Read ‘Income Tax Return Filing’ Click Here!

Best Tax-Saving Instruments and Their Returns

- ELSS (Equity Linked Savings Scheme)

Equity-linked savings schemes are one of the most popular market investment options among individuals looking to save money on taxes. It is one of the best strategies to minimize tax under Section 80C while earning significant returns through market advantage.

Tax breaks ELSS funds invest at least 80% of their total portfolio in equity securities, producing the most significant return of any comparable instrument on the market. This scheme requires a three-year lock-in period on the investment amount. Section 80C makes the following requirements to provide significant tax savings on money associated with the ELSS plan.

- The total principal amount invested in ELSS is tax-free if it is less than Rs. 1.5 lakh.

- Long-term capital gains tax is not levied on capital gains smaller than Rs. 1 lakh.

Tax-advantaged ELSS funds are highly liquid compared to other securities under the same umbrella.

- PPF (Public Provident Fund)

The government-sponsored public provident fund is one of the best tax-saving mechanisms under Section 80C. PPF, on the other hand, has a statutory lock-in duration of 15 years. It could jeopardize an investor’s liquidity needs.

The government announces the PPF interest rate earned on this tax-saving instrument every quarter, and it remains fixed for the specified duration. PPF is a fixed-return product because it offers guaranteed interest stated by the central government.

A maximum of Rs. 1.5 lakh can be invested in a PPF account in a single fiscal year as a lump payment or every month. The total sum can be tax-free, making it one of the top tax-saving investments under Section 80C. Any interest earned on an investment is likewise excluded from tax computations.

- SCSS (Senior Citizen Savings Scheme)

Senior Citizens Savings Scheme is also one of the top tax-saving investments under Section 80C since it allows you to deduct up to Rs. 1.5 lakh from your investment amount. However, the qualifying conditions for this scheme are stricter than those for other instruments. This investment tool is only available to those who meet the following criteria:

- Individuals over the age of 60

- Individuals over the age of 55 who take voluntary retirement

- Any person above the age of 50 who works in India’s defense industry

Rs. 15 lakhs can be invested in an SCSS policy. The Central Government of India determines the interest rate payable on an investment amount, resulting in a consistent return on investment.

- SSY (Sukanya Samriddhi Yojna)

Sukanya Samriddhi Yojna is one of the best tax-saving techniques under the Income Tax Act Section 80C. The SSY tax benefits are worth up to Rs. 1.5 lakh per year. However, an account under the Suaknya Samriddhi Yojna can only be opened by someone with a daughter under 10.

As part of the ‘Beti Bachao Beti Padhao’ strategy, the government provides a greater interest rate on this sum than on other government-mandated instruments such as the Public Provident Fund. Any investment that exceeds Rs. 1.5 lakh in a calendar year is not eligible for SSY tax benefits.

- Fixed Deposit (FD) with Tax Savings

Fixed deposits with a five-year lock-in maturity length qualify for Section 80C tax breaks. It is a popular investment strategy among risk-averse people since it guarantees guaranteed earnings at a fixed interest rate.

It should be noted, however, that any early withdrawals will negate any tax benefits from such investments. The interest collected through this program is taxed.

- NPS (National Pension Scheme)

The National Pension Scheme is a systematic investing policy offering retirees financial security. It is one of the top Section 80C tax-saving investments, with a claim deduction of up to Rs. 1.5 Lakh on the whole principal amount. The national pension program accepts payments from employers and employees

for salaried individuals.

Employees can make a tax-free investment of up to 10% of their wage under Section 80CCD (1). Section 80CCD (1B) allows self-employed individuals to claim an additional Rs—50,000 in NPS tax advantages.

Funds placed in an NPS account can be partially reinvested in equity schemes at an investor’s discretion.

- NSC (National Savings Certificate)

Individuals apprehensive of stock market movements should consider purchasing a national savings certificate. The tax benefits of this policy are enormous, with exemptions of up to Rs. 1.5 Lakh on both the principal and the reinvested interest sum. The maturity duration for this investment remains fixed at five and ten years, with the investor free to select between the two.

- ULIPs (Unit Linked Insurance Plans)

Unit-linked insurance plans are among the finest tax-saving options under Section 80C, with exclusions on investment and premium amounts payable.

Under this scheme, the share of money dedicated to the investment component is eligible for tax relief of Rs. 1.5 Lakh and 10% of the overall premium (given the value is less than Rs. 1.5 Lakh).

- Life Insurance

A premium paid on a life insurance policy is deductible under section 80C in income tax computations. To qualify for this tax break, the total amount spent on premium payments must exceed Rs. 1.5 lakh.

Also, Read ‘An Overall Assessment of Income Tax Notice’ Click Here!

Process for the Best Tax Saving Investment Plans in India

The process for India’s best tax-saving investment plans may vary depending on your investment type. However, here’s a general overview of the process:

- Research: The first step is to research and choose the tax-saving investment plans that best suit your financial needs. It is essential to explore all available options and consider factors such as the investment horizon, risk tolerance, and tax benefits before deciding.

- Open a Demat account: A dematerialized account, or demat account, is a digital account that allows you to invest in stocks, mutual funds, and other securities online. You must open a demat account with a reputed broker or a financial service provider.

- Invest: After opening a demat account, you can invest in ELSS, PPF, EPF, tax-saving mutual funds, or other eligible tax-saving investment plans. You can invest directly or opt for a monthly or lump sum investment plan through your broker or financial advisors.

- Monitor investments: It is essential to regularly monitor your investments to ensure that they align with your financial goals and risk tolerance. You can check the performance of your assets using online portals or by regularly reviewing your portfolio.

- Tax benefits: As you invest in tax-saving investment plans, it is essential to claim the tax benefits under Section 80C of the Income Tax Act, 1961. You can claim tax benefits by filing your income tax returns and providing proof of investment.

It’s essential to note that the process may vary depending on your investment type. It’s crucial to consult a financial advisor before investing to ensure that you fully understand the investment options available, the associated risks, and the potential returns. The advisor can also help you choose the best investment plan based on your financial goals and risk tolerance.

Also Read ‘Tax Consultant in Jaipur: Simplifying Your Taxation Needs’ Click Here!

Advantages of the Best Tax Saving Investment Plans in India

The best tax-saving investment plans in India offer several advantages to investors, including:

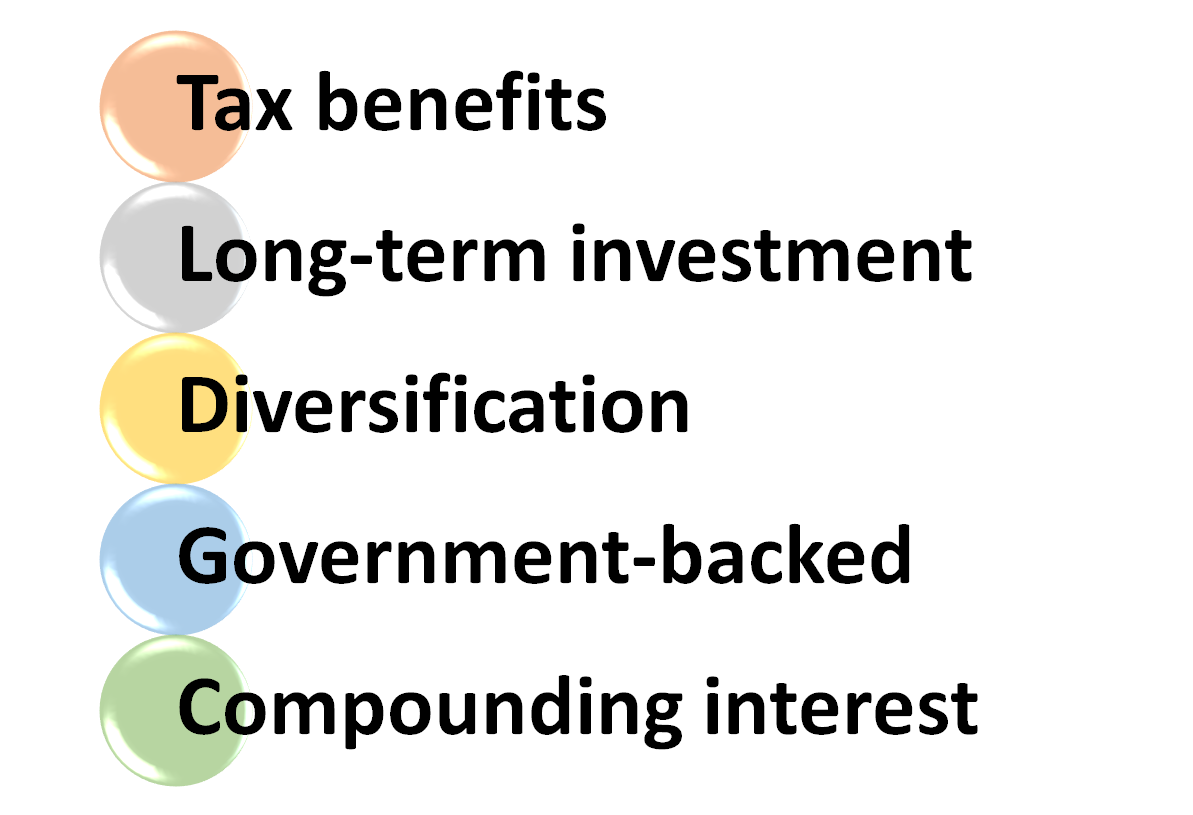

- Tax benefits: These investment plans offer tax benefits under Section 80C of the Income Tax Act, 1961. Investors can deduct up to INR 1.5 lakh from their taxable income by investing in these plans, resulting in lower tax liability and more effective savings.

- Long-term investment: The returns from these investment plans are accumulated over a period, which makes them suitable for long-term investment. Investors can benefit from compounding interest over a more extended period, accumulating significant wealth.

- Diversification: These investment plans allow investors to diversify and manage their risk by investing in a range of assets such as equity, debt, and other securities. This makes them suitable for investors with different risk profiles.

- Government-backed: Some investment plans, such as the Public Provident Fund (PPF) and Employee Provident Fund (EPF), are government-backed and provide investors with an added layer of security and protection.

- Compounding interest: Compounding interest is a decisive factor in wealth accumulation, and these investment plans offer the benefit of compounding interest over a long period. With regular investments and patience, investors can achieve their financial goals and reap the benefits of compounding interest.

Investors must carefully evaluate their financial goals, risk tolerance, and tax obligations before investing in tax-saving investment plans. It is essential to consult financial advisors and research tax-saving investment options to make an informed investment decision. These investment plans can help investors achieve their financial goals and save taxes simultaneously, making them an attractive option for investors with limited disposable income.

End Note

In summary, India’s best tax-saving investment plans are attractive for investors looking to save taxes while investing in their future. These investment plans offer tax benefits, long-term investment opportunities, diversification, government-backed security, compounding interest, and the potential for significant wealth accumulation over time. It is essential to carefully evaluate your financial goals and risk tolerance before investing in tax-saving investment plans. As with any investment, it is necessary to research and consult financial advisors to make an informed investment decision.

CA Pulkit Goyal, is a fellow member of the Institute of Chartered Accountants of India (ICAI) having 10 years of experience in the profession of Chartered Accountancy and thorough understanding of the corporate as well as non-corporate entities taxation system. His core area of practice is foreign company taxation which has given him an edge in analytical thinking & executing assignments with a unique perspective. He has worked as a consultant with professionally managed corporates. He has experience of writing in different areas and keep at pace with the latest changes and analyze the different implications of various provisions of the act.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (90)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (118)

- Hallmark Registration (1)

- Income Tax (200)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (21)

- Startup/ Registration (128)

- Trademark Registration/IPR (40)

Recent Posts

- Post incorporation compliances for companies in India April 30, 2024

- Startup’s Guide to Employee Stock Ownership Plans April 29, 2024

- Master Secretarial Audit: A Complete Compliance Guide April 27, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.