Do you own a computer? Do you use it for your personal use or for business purposes? Yes, if you own a computer, you should be awareof thedepreciationrate on Computer Accessories and Peripherals.So, if you are using it for business than while calculating taxable business income assessee can claim deduction of depreciation at 40% but it should fall under the expression “computer” as defined in Income Tax Act, 1961. In this blog we will cover the Rate of Depreciation on Computer Accessories and Peripherals in detail.

What exactly do you mean when you say the word “computer”?

The Income Tax Act of 1961, as well as the Income Tax Rules and General Clauses Act of 1987, don’t really define what constitutes the term “computer”. The interpretation of the phrase “computer” can be assessed utilizinglegal principles, whichimplies that the significance of the phrase “computer” must be assessed not only by reviewing a dictionary, but also by implementing a popular nomenclature or large scale common usage test and evaluating the legislature’s purpose in setting the maximum rate of depreciation.

Cases of historical significance

The opinion expressed by the panel in Ushodaya Enterprises Ltd. v. Assistant Commissioner of Income Tax, Circle-16 (2), and Hyderabad, is that the term “computer” is not specific solely in terms of central processing units (CPU). The Hon’ble Bench went on to say that while the function of a computer as a composite unit is to execute logical, arithmetical, or memory tasks, etc., the CPU is not the only piece of hardware which conducts these activities and may be called a “computer.”

- The ‘computer’ comprises both input and output devices such as that of the keyboards, cursor, printers, barcode, broadband, switchgear, adapters, cable management, and so forth.

- The bench put forward a test to identify whether the particular object can be a part in the ambit of same to get the depreciation.

- When any hardware of computer is used as the essential part to run the computer can be considered under the ambit defined.

- Whereas if any part s not used as a necessary accessory to the one that it is not entertain under the same.

What is the meaning of rate of Depreciation?

The rate of depreciation refers to the ratio beyond which the object drops in value throughout its approximate service life. It’s also known as the fraction of acorporation’s long time horizon. As it is an asset, it might be presumed as a stamp duty expense throughout the financial period. Each underlying asset does indeed have a different strategy.

Methods of calculation of Depreciation on Computer Accessories and Peripherals

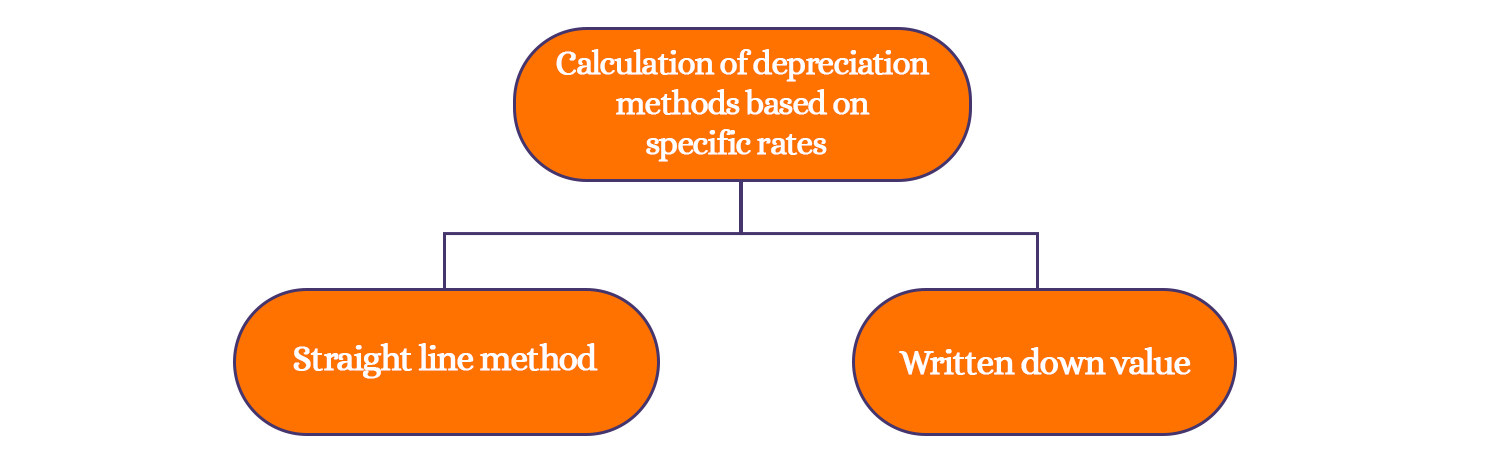

- Calculation of depreciation methods based on specific rates according to Companies Act, 1956

- Written down values

- Straight line method

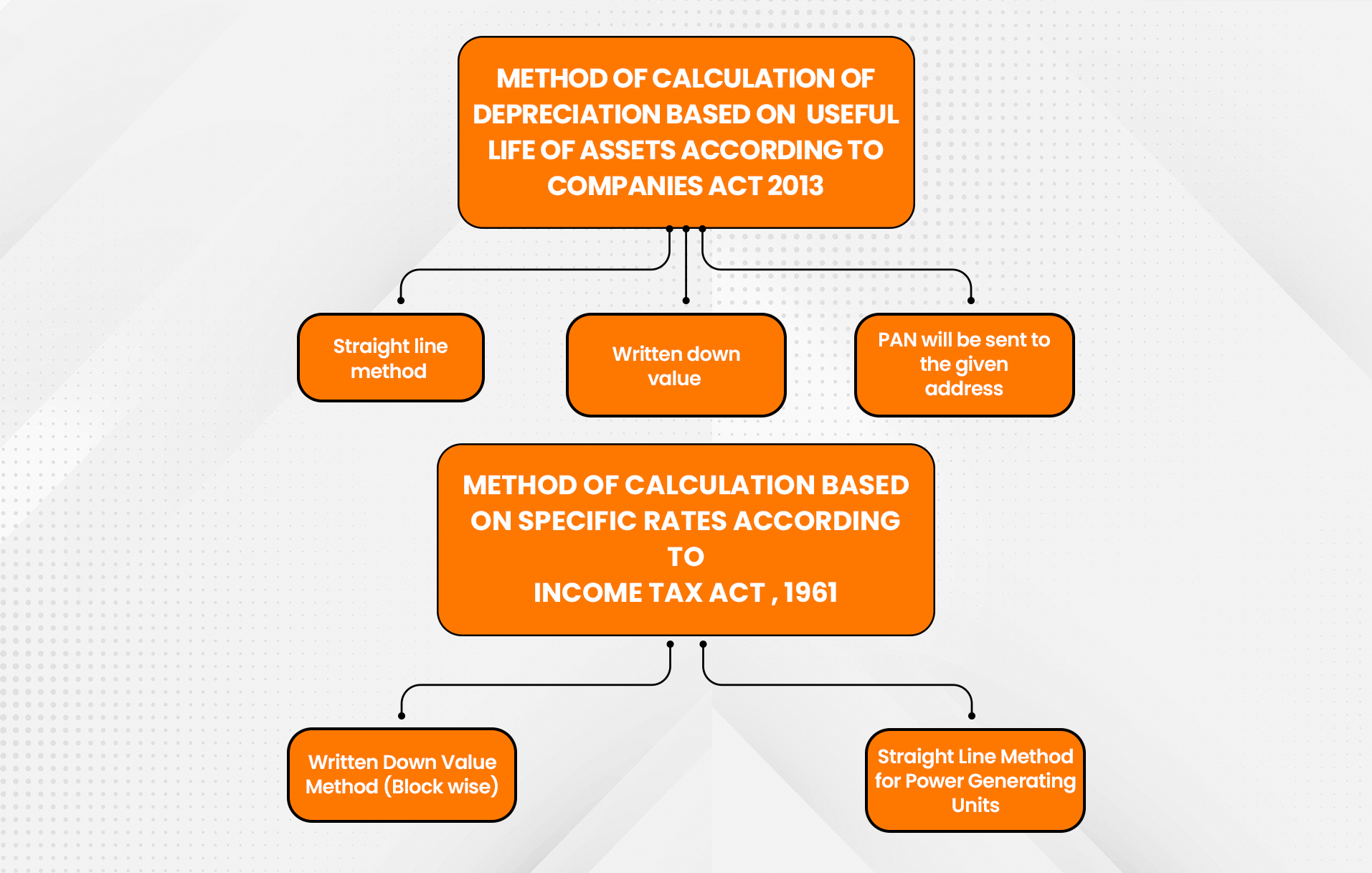

- Method of calculation of depreciation based on useful life of assets according to Companies Act, 2013

- Written down value

- Straight line method

- Unit of production

- Method of Calculation based on specific rates according to Income Tax Act , 1961

- Written Down Value Method (Block wise)

- Straight Line Method for Power Generating Units

Formula for the calculation of depreciation

Formula for calculation of rate of depreciation value:

- Depreciation Rate per year: 1/useful life of the asset

- Depreciation Value per year = (Cost of Asset – Salvage value of Asset)/ Depreciation Rate per Year

Depreciation list for various objects

In the above mentioned case law,the court defined which parts can be considered part and parcel of the expression “Computer”. Therefore, parts like keyboard, mouse, printer etc. can be used along with a computer and function as an integrated part. However, they are eligible for depreciation at 40% i.e. the prescribed depreciation applicable to computers.

- Router and switches –Router and switches as considered the part of Computer in Mumbai Bench -ITAT. However , they are eligible for depreciation at 40%

- Media Resource Board – The bench held that MRBs operates along with the servers and computers and are one of the important part of Computer system. However, MRBs are classified as computer and eligible for depreciation at 40%.

- ATM– ATM and computers work on different functions and are not considered as a part computer. However, they are not eligible for depreciation.

- Optical Fibers– Supreme court held that Optical Fiber cables are used for operating computers and are eligible for depreciation at 40%.

- EPABX and Mobile Phones – High court of Kerala held that are in the nature of communication equipment. They cannot be treated as computers and, hence, are not eligible for depreciation.

- IPad–iPad is also used as communicating and entertainment device with some additional feature of computers. Stores do not sell them in the arena of computers or laptops so they are not included in arena of depreciation.

Requirements for claiming Depreciation

- The belongings of the one should withhold, completely or moderately, by the tax payer.

- The belongings should be put to use for the enterprise or career of the taxpayer. Further, the property of one is completely withheld for the enterprise’s purpose. However, for different functions as well, the depreciationallowable might be proportionate to the discharge of enterprise purpose.

- The Income Tax Officer furthermore has the power to make a decision the proportionate a fraction of the depreciation lower than Section 38 of the Act.

- Co-proprietors can state depreciation to the quantity of the cost of the belongings owned with the aid of using each co-owner.

- You can’t declare depreciation at the value of land.

Conclusion

The rate of depreciation is generally used by the cooperating companies to determine the calculation of the property withheld by the cooperation. Further, Misleading in calculations may lead to disturbances in profit and loss statements. Moreover, this creates a problem in the balance sheet of the company. Meanwhile, understanding of the same is must for the proper functioning of the cooperation.

Furthermore, to know the Rate of Depreciation on different objects, reach our Experts

CA Pulkit Goyal, is a fellow member of the Institute of Chartered Accountants of India (ICAI) having 10 years of experience in the profession of Chartered Accountancy and thorough understanding of the corporate as well as non-corporate entities taxation system. His core area of practice is foreign company taxation which has given him an edge in analytical thinking & executing assignments with a unique perspective. He has worked as a consultant with professionally managed corporates. He has experience of writing in different areas and keep at pace with the latest changes and analyze the different implications of various provisions of the act.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (89)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (118)

- Hallmark Registration (1)

- Income Tax (199)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (20)

- Startup/ Registration (126)

- Trademark Registration/IPR (40)

Recent Posts

- Detailed Analysis of Section 179 of the Companies Act, 2013 April 24, 2024

- Maximise Your Tax Savings: Power of Form 12BB April 23, 2024

- Cryptocurrency startups and Regulatory compliance April 22, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.