Mastering Your Finances: Simplified Guide to Filling Income Tax Return in Jammu

- September 25, 2023

- Income Tax

Guide to Filling Income Tax Return in Jammu is vital just like any other part of India. It ensures Compliance with tax laws and facilitates proper tax assessment and collection. A clear understanding of the process is crucial for Jammu’s salaried individuals, self-employed professionals, and business owners to avoid penalties and legal issues. Let’s begin on this journey to overcome ITR Filing in Jammu, ensuring financial compliance and optimizing tax liabilities.

Table of Content

Meaning: ITR Return in Jammu

An Income Tax Return is a form for filing income and tax information with the Income Tax Department. It determined the taxpayer’s tax liability based on their income. If the ITR Return indicates excess tax payment, the individual can claim an income tax refund from the department. Maintaining financial transparency and accountability is the aim of the overall tax system, making ITR an essential part. Individuals and businesses must fulfil tax obligations and comply with applicable laws in Jammu. Every year, according to income tax laws, individuals and businesses must file a ITR Return if they earn any income. This income can come from various sources like salaries, business profits, properties, dividends, or interests.

Gather the Essential Documents: What you will need for ITR Filing

Smoothly file your Income Tax Return in Jammu by organizing essential documents, ensuring accuracy, compliance, and an efficient, stress-free process. To successfully file your Income tax return, you must actively gather the following essential documents:

- PAN Card

- Aadhar Card

- Form 16 or Salary Certificate

- Form 16A

- Form 26AS

- Bank Statement

- Investment Proof

- Rent Receipts

- Proof of Exemptions

- Previous Year’s Tax Return

The mentioned documents are crucial for ITR filing in Jammu. Keep them organized and updated for a hassle-free process. The expert of Legal Window can assist if needed. Get in touch with our team on 072407-51000 or email admin@legalwindow.in for Filling out your Income Tax Return in Jammu.

Choosing the Right ITR Return Form for Jammu

Selecting the right ITR Return form in Jammu is vital for accurate income reporting and claiming deductions. Consider income sources, residential status, and specific circumstances to make an informed choice. Here are the commonly used Guide to Filling Income Tax Return in Jammu.

- ITR-1: Suitable for individuals with income from salary, pension, one-house property, and other sources (excluding lottery winnings and income from horse racing).

- ITR-2: If you have income from multiple sources, including capital gains or foreign assets, or if you are a director in a company, you should use ITR-2 as the appropriate form.

- ITR-3: ITR-3 is applicable for individuals and Hindu Undivided Families (HUFs) with income from business or profession.

- ITR-4: It is eligible for the presumptive income scheme under Section 44AD, 44ADA, or 44AE, use ITR-4 to report your income.

- ITR-5: ITR-5 is for partnerships, Limited Liability Partnerships (LLPs), Association of Persons (AOPs), and Body of Individuals (BOIs).

- ITR-6: Companies, except those claiming exemption under Section 11, must file their returns using ITR-6.

Selecting the appropriate Guide to Filling Income Tax Return in Jammu is important for accurate reporting and minimizing errors.

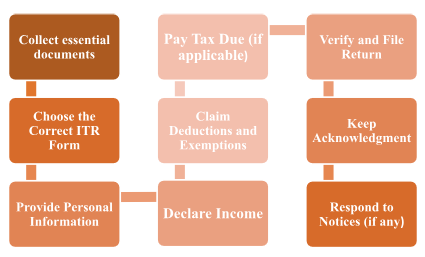

Step-by-Step walkthrough: ITR Return File in Jammu

- Collect essential documents: Form 16, bank statements, investment proofs, rent receipts, Form 26AS, Aadhaar Card/PAN Card, and proof of exemptions.

- Choose the Correct ITR Form: Select the right ITR form based on your income sources, residential status, and specific circumstances.

- Provide Personal Information: Fill in your name, address, PAN number, and contact information to provide personal details accurately.

- Declare Income: Report your income from different sources like salarysalary, business profits, house property, capital gains, and other earnings.

- Claim Deductions and Exemptions: Mention eligible deductions under different sections of the Income Tax Act, 1961 and provide supporting documents to claim exemptions.

- Pay Tax Due (if applicable): If there is any tax payable after considering TDSTDS and advance tax payments, ensure to pay the remaining tax amount before ITR filing.

- Verify and File Return: Double-check the information, verify using EVC or DSC, and submit the return online on the Income Tax Department’s e-filing portal.

- Keep Acknowledgment: After successfully filing, download and keep a copy of the acknowledgement receipt for future reference.

- Respond to Notices (if any): If you receive any communication or notice from the Income Tax Department, respond promptly and provide the necessary information.

Maximizing Deductions and Credits Jammu Residents

Consider these key strategies to minimize tax liability and maximize savings by utilizing deductions and credits available to Jammu residents.

- Claiming Deductions: Identify and claim deductions available under sections 80C, 80D, and 24(b) of the Income Tax Act for Jammu residents.

- Utilizing HRA Benefits: For Jammu residents in rented accommodation, claim HRA exemption by keeping rent receipts and necessary documents ready.

- Taking Advantage of Section 80G: Jammu residents can claim deductions under Section 80G of the Income Tax Act by donating to approved charitable institutions.

- Utilizing Education Loan Interest Deduction: Claim deductions on education loan interest paid under Section 80E by keeping track of loan statements and interest payments.

- Maximizing Benefits for Senior Citizens: Senior citizens in Jammu can maximize benefits through higher exemption limits, reduced tax rates, and deductions under Section 80D for medical insurance premiums.

- Capitalizing on Tax-Saving Investments: Explore tax-saving investments like National Pension System, Equity-Linked Savings and FDs to save taxes and generate potential returns in Jammu.

- Keeping Records and Documentation: Maintain organized records and documentation of transactions, investments, and expenses for deductions, aiding tax filing and addressing queries.

Maximizing deductions and credits allows Jammu residents to optimize their finances and take proactive steps towards financial optimization.

Submitting ITR Filing in Jammu: Online vs Offline Options

Consider convenience and accuracy while choosing between online and offline Income tax return filing methods in Jammu. The online method of filing Income Tax Returns is convenient, quick, and preferred by many taxpayers. But, if you cannot access the internet or prefer the traditional approach, offline filing is available for Income Tax Returns in Jammu.

Navigating Common Challenges: Troubleshooting ITR Return Issues

To troubleshoot Tax Return issues in Jammu, ensure accurate information, calculations, and document alignment. Select the correct filing status, address notices promptly, and ensure eligibility for deductions and tax credits. Seek professional help if needed and maintain accurate records for a smooth process.

Important Dates and Deadlines: Stay on Top of Tax Obligations in Jammu

Staying aware of important tax dates and deadlines in Jammu is crucial. Key dates include Income Tax Return filing, advance tax payments, TDS payments, GST return filing, and tax audit deadlines. Stay updated with any changes to ensure compliance and avoid penalties.

Tips for Future Tax Planning: Setting up for Success in Jammu

To optimize tax savings and ensure successful tax planning in Jammu, stay updated with tax laws and maintain accurate records. Utilize deductions, invest in tax-saving instruments, and plan for capital gains. Optimize salary structure, consider tax-saving insurance, and seek professional advice if necessary.

Takeaway

Failure to abide by the deadline results in the taxpayer having to pay a penalty. Don’t forget to meet your tax obligations! To effectively fill your ITR Return in Jammu, you should pay careful attention to details and stay informed about tax laws. Utilize deductions and exemptions and follow the provided simplified guide for confident and accurate filing. Streamline your tax filing experience, ensure timely filing, and maintain compliance with Jammu’s ITR Returns regulations.

CA Pulkit Goyal, is a fellow member of the Institute of Chartered Accountants of India (ICAI) having 10 years of experience in the profession of Chartered Accountancy and thorough understanding of the corporate as well as non-corporate entities taxation system. His core area of practice is foreign company taxation which has given him an edge in analytical thinking & executing assignments with a unique perspective. He has worked as a consultant with professionally managed corporates. He has experience of writing in different areas and keep at pace with the latest changes and analyze the different implications of various provisions of the act.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (90)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (118)

- Hallmark Registration (1)

- Income Tax (200)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (21)

- Startup/ Registration (128)

- Trademark Registration/IPR (40)

Recent Posts

- Post incorporation compliances for companies in India April 30, 2024

- Startup’s Guide to Employee Stock Ownership Plans April 29, 2024

- Master Secretarial Audit: A Complete Compliance Guide April 27, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.