In the Income Tax Act, 1961 sources of income are classified and talk about the five forms of income. Other sources of income are distinct from the other four sources of income such as salary, property, business or profession, and capital gains. This article deals with income from other sources, its types, and tax rates.

Table of Contents

Income from Other Sources Examples

Section 56 of the Income Tax Act gives a comprehensive list of the numerous incomes classified as “income from other sources.” The following are income from other source lists:

- Dividends from mutual funds, stocks, etc.

- Lotteries, horse racing, crossword puzzles, gaming and betting.

- Any sum received from an employee as a contribution to a provident fund, ESI, Superannuation fund, or other fund that is not deposited into the relevant fund by the due date.

- Interest earned on bank term deposits, corporate deposits, and so on.

- Amounts paid in advance or funds obtained during the negotiation or transfer of any capital asset.

- Payment earned by renting out machines, plants, etc. if such income is not considered as “Income from business or profession”.

- Gifts worth more than Rs. 50,000, unless received as a wedding or anniversary present.

- Profit from the selling of real estate.

Other Sources of Income- Tax Rates and Rules

The tax treatment of income from other sources varies depending on the type of income. Lottery wins, horse racing, and other sorts of betting, for example, are taxed at a fixed rate of 30% plus appropriate cess. In this scenario, the taxpayer’s income tax bracket has no bearing.

Dividend income from shares and/or mutual funds, on the other hand, is taxable according to the individual’s income tax slab rate for the applicable fiscal year. There are regulations for tax on income from other sources.

Also, read: Income From Other Sources- Do You Also Have?

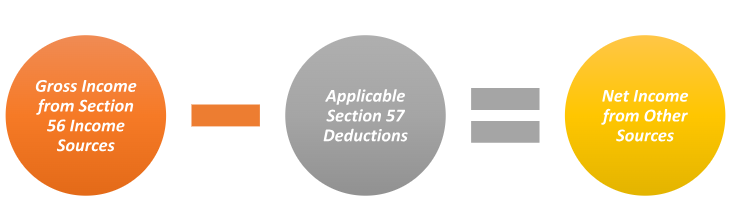

How are Net Earnings from Other Sources Calculated?

The income from other sources, net earnings are calculated like:

The other sources of income under this area will be taxed at different rates depending on the applicable sections and sub-sections of the Income Tax Act.

Taxation of Presents/Gifts

According to the Income Tax Act, gifts are money, property (movable or immovable), land, or any other sort of asset received without consideration, i.e. without any exchange of money, or for inadequate consideration, i.e. payment less than the fair market price.

Money/assets obtained as an inheritance through will, presents received on the occasion of marriage, gifts received from relatives, and so on are instances of tax-free gifts. We should know that, under current tax legislation, gifts with a fair market value of less than Rs. 50,000 are free from tax.

If a gift does not meet any of the exempt criteria, the net taxable amount is added to the taxpayer’s annual income under the heading income from other sources. It will be taxed at the appropriate income tax slab rate.

Income Tax on Real Estate Sales

Any property transaction, whether moveable or immovable, will be subject to taxation in addition to stamp duty. Land and property are both included in a property transaction. If an immovable property is given without consideration, the full stamp duty will be levied.

If the property is obtained after consideration and the stamp duty exceeds Rs. 50,000 or 10%, the stamp duty will now be payable as per the buyer’s income. TDS on property applies to these transactions as well.

Moveable property, such as gold, securities, shares, archaeological collections, sculptures, paintings, photos, bullion, artwork, and so on, falls under the tax slab when received without consideration or at a reduced price.

Also, read: What is Income and Different Sources of Income?

Tax Exemptions for Income from Other Sources

Other sources of income provide for deductions when filing income taxes. As a taxpayer, you can deduct a variety of expenses. The following are the deductions permitted for income from other sources:

- Commission or payment for realizing interest or dividends on securities.

- Repairs, depreciation on plant, fixtures, and machinery, and insurance premiums can all be deducted from the income generated.

- The standard deduction for family pension income.

- Interest in more remuneration or compensation. According to current guidelines, you can deduct up to 50% of the interest in such instances.

Winding Up Note

Income from other sources is clearly mentioned in Section 56 of the Income Tax Act, 1961. It includes various types of income not covered under other specific heads such as, monetary gifts, certain dividends, winnings from lottery or gambling, and rental income. The tax levied on income from other sources is calculated as per the provisions mentioned in this section. Capital gains and income from other sources are taxed under different provisions, but if capital gains do not qualify the prescribed criteria, they may fall under income from other sources.

In case of any query regarding Income from Other Sources- Its Types, Deductions, and Tax Rates, feel free to connect with our legal experts at Legal Window at 72407-51000.

CA Pulkit Goyal, is a fellow member of the Institute of Chartered Accountants of India (ICAI) having 10 years of experience in the profession of Chartered Accountancy and thorough understanding of the corporate as well as non-corporate entities taxation system. His core area of practice is foreign company taxation which has given him an edge in analytical thinking & executing assignments with a unique perspective. He has worked as a consultant with professionally managed corporates. He has experience of writing in different areas and keep at pace with the latest changes and analyze the different implications of various provisions of the act.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (90)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (118)

- Hallmark Registration (1)

- Income Tax (200)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (21)

- Startup/ Registration (128)

- Trademark Registration/IPR (40)

Recent Posts

- Post incorporation compliances for companies in India April 30, 2024

- Startup’s Guide to Employee Stock Ownership Plans April 29, 2024

- Master Secretarial Audit: A Complete Compliance Guide April 27, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.