Employers include a portion of employees’ salaries known as the House Rent Allowance (HRA) to help cover their rent bills. The Income Tax Act of 1961 allows for HRA tax deductions. To pay for your living expenses while renting a house, an individual can apply for House Rent Allowance. They are eligible to claim this exemption, which lowers or saves their taxes. Let’s discuss how to calculate HRA.

| Table of Contents |

What is HRA?

A working individual’s salary generally consists of several components such as basic pay, allowances for various purposes such as accommodation, travel, and health, and forced savings options such as gratuity and provident fund. Understanding the salary structure is essential not only for financial reasons but also to help with filing your tax return.

House Rent Allowance is an important component of your salary. All employers are required to provide HRA as reimbursement of house rental costs. We do not realize that we can save on taxes. The HRA is determined by the factors such as the actual salary, the employee’s pay structure, and the city of residence.

Eligibility for the HRA Tax Exemption

If the following qualifying requirements are satisfied, a portion of the HRA may be claimed as a tax deduction under Section 10(13A) of the Income Tax Act:

- HRA ought to be paid to you as a salary component.

- A salaried individual is a mandate.

- You should rent a house.

- In reality, you should pay the rent on the house; that is, rent receipts ought to be issued in your name.

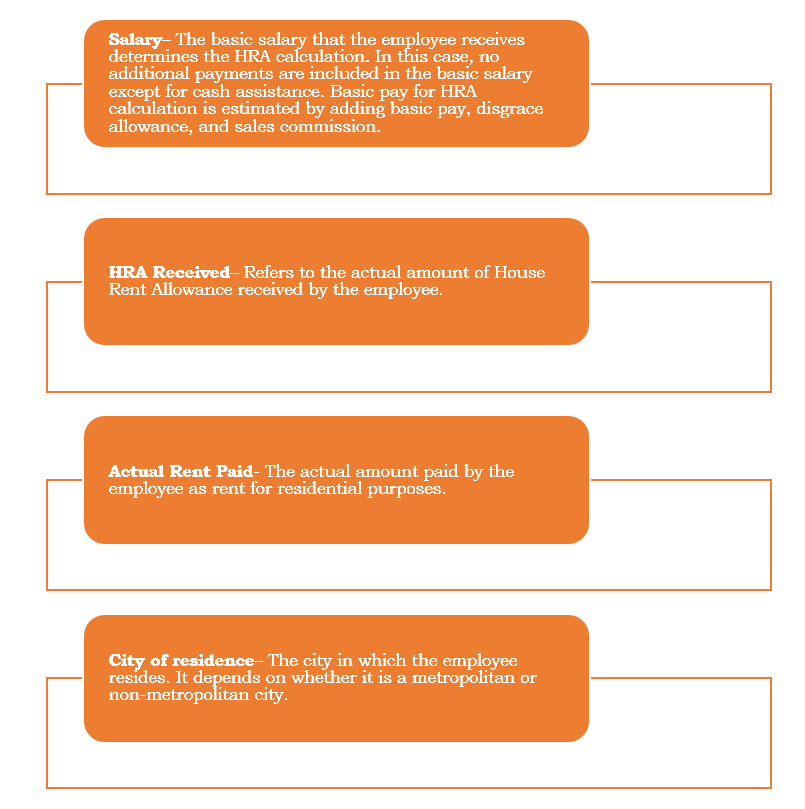

Factors Affecting HRA Calculation

Calculation of HRA

HRA exemption is calculated as per 2A of the Income Tax Rules. As per Rule 2A, at least of the below items are exempt from salary under Section 10(13A) and do not form part of taxable income.

- Actual HRA received from an employer

- For those living in metropolitan areas: 50% (basic salary + dearness allowance)

- For those living in non-metro cities: 40% (basic salary + dearness allowance)

- Actual rent paid minus 10% (basic salary + dearness allowance)

Example-

X lives in Delhi and has a basic salary of Rs. 50,000 per month and pays a rent of Rs. 15,000 per month. He will receive HRA Rs. 20,000 from your employer. Calculate your HRA exemption.

Actual HRA received- Rs. 20,000

Actual Rent Payment – 10% of Salary= 15000 – 10% (50000) = 10,000

50% of basic salary (metropolitan city) = 50% (50,000) = 25,000

Least of above- 10,000

Therefore, X can claim Rs. 10,000 per month as a deduction from his taxable salary which was derived from the above calculation of HRA.

There are HRA exemption calculator too where you can prefill the details and calculate the HRA exemption with one click.

How to apply for HRA Benefits?

Rental agreement receipts allow you to claim income tax exemption on HRAs without having to pay an excessive amount of tax at source through your employer. Should the annual rent payment surpass ₹ 1,00,000, you will furthermore be required to disclose the landlord’s PAN information.

You can still claim the HRA deduction when you file your IT returns even if you choose not to disclose this information to your employer. You will have to submit proof to support your claim if the tax authorities want it.

Section 80GG Calculation

Deduction under Section 80GG applies to workers and self-employed professionals. Therefore, if an individual is the owner of the business, he will be entitled to tax deductions under this section. Persons living on their parents’ property, which they own, are also entitled to benefits under Section 80GG.

Deduction under Section 80GG is provided at least from the following:

- Total rent paid minus 10% of basic salary.

- Rs 60,000 per annum (Rs 5,000 per month).

- 25% of adjusted gross total income.

Takeaway

HRA tax benefits can be claimed by an individual if they pay rent for accommodation. To avail of tax benefits from home loan and HRA at the same time, an individual must have his house rented and live in a rented place himself. Ever wondered what if your owned house is located in the same city as your rental property? You are not eligible to claim tax exemptions for both. However, if an individual can prove that they have rented a house because their property is far from their place of employment, they can claim the tax exemption on both the home loan and the HRA.

In case of any query regarding how to calculate HRA, a team of expert advisors from Legal Window is here to assist you at every step. Feel free to reach us at admin@legalwindow.in.

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost. Our team offers expertise solutions in various fields that include Corporate Laws, Direct Taxations, GST Matters, IP Registrations and other Legal Affairs.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (90)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (118)

- Hallmark Registration (1)

- Income Tax (200)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (21)

- Startup/ Registration (128)

- Trademark Registration/IPR (40)

Recent Posts

- Post incorporation compliances for companies in India April 30, 2024

- Startup’s Guide to Employee Stock Ownership Plans April 29, 2024

- Master Secretarial Audit: A Complete Compliance Guide April 27, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.