Haven’t Filed Your Income Tax Returns Yet? Here’s why you should!

- August 22, 2023

- Income Tax

As the saying goes, “In this world, nothing is certain except death and taxes.” While tax season might not be the most exciting time of the year, it’s a crucial responsibility for all eligible citizens. Filing your Income Tax Returns isn’t just a legal obligation; it’s a financial decision that can have a significant impact on your present and future well-being. In this article, we will guide you through why you should file ITR. So if you are the one who didn’t file your ITR yet or didn’t file your ITR on time, then stick to this write-up.

But let us before discuss about Income Tax Return first and also, we will look into Penalty for not filing ITR and last date to file ITR 2022-23 and we will also go through some FAQ’s related to the topic.

An overview of Income Tax Return

An income tax return is a form or document that both people and entities must submit to the Income Tax Department in order to provide information about the money they made over the course of a given fiscal year. It contains details on different income sources, requested tax deductions, and actual tax payments.

Who should file Income Tax Return as per Income Tax Department?

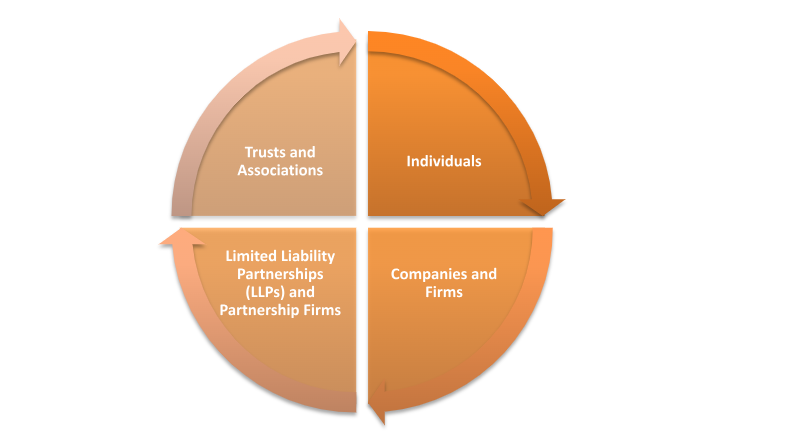

According to the Income Tax Act, 1961, anyone who falls under the following categories of individuals or companies must file an ITR Return:

- Individuals: ITR filing is compulsory for all persons whose combined income above the basic exemption ceiling, which is presently INR 2.5 lakh for those under the age of 60. Salary workers, independent contractors, freelancers, and others are all affected by this.

- Companies and Firms: Regardless of their profit or loss, all registered companies and enterprises are obligated to submit ITR.

- Limited Liability Partnerships (LLPs) and Partnership Firms: Both of these entities i.e., Limited Liability Partnerships (LLPs) and Partnership Firms must submit an ITR.

- Trusts and Associations: Trusts, Non-Governmental Organisations (NGOs), Charitable Organisations, and other organisations with income above the exemption level must file an ITR Return.

Significance of ITR Filing

The following are the significance of ITR Filing:

- Legal Obligation – Filing an income tax return is a legal requirement in most countries. Tax laws mandate that individuals and entities earning above a certain threshold must declare their income and pay taxes accordingly. Non-compliance can lead to penalties, fines, and even legal actions. By filing an income tax return, you demonstrate your commitment to upholding the laws of the land and participating in the nation’s financial system.

- Revenue Generation – Governments rely heavily on tax revenue to finance public infrastructure, social programs, education, healthcare, and other essential services. Income tax is a primary source of government revenue, and it plays a pivotal role in funding projects that contribute to the overall development and well-being of society. By fulfilling your tax obligations, you are directly contributing to the betterment of your community and country.

- Wealth Redistribution – Income tax serves as a tool for wealth redistribution. Through progressive tax systems, individuals with higher incomes are required to pay a larger portion of their earnings in taxes. The revenue generated from income tax helps reduce economic disparities by funding programs that support the less fortunate, such as social welfare initiatives, unemployment benefits, and public assistance programs. Filing an income tax return helps ensure a fairer distribution of resources and promotes social equality.

- Infrastructure and Public Services – The taxes collected from income tax filings play a pivotal role in building and maintaining crucial infrastructure. Roads, bridges, public transportation, schools, hospitals, and other essential facilities are funded through tax revenue. By fulfilling your tax obligations, you are contributing to the creation and upkeep of infrastructure that enhances the quality of life for everyone in the community.

- National Development – Income tax revenue is a driving force behind economic growth and development. It enables governments to invest in various sectors such as education, healthcare, technology, and research, which, in turn, stimulates economic progress. A well-funded government can implement policies that foster innovation, attract investments, and create a conducive environment for businesses to thrive.

- Avoiding Legal Consequences – Filing an income tax return on time helps you avoid legal complications. Late or incorrect filings can result in penalties and interest charges. By fulfilling your tax obligations promptly and accurately, you can prevent unnecessary financial burdens and legal hassles.

- Access to Financial Services – Filing income tax returns is often a prerequisite for accessing financial services such as loans, mortgages, and credit facilities. Financial institutions use tax returns as a measure of an individual’s or entity’s financial stability and credibility. Regular tax filings can enhance your financial profile and improve your chances of securing favorable terms from lenders.

Benefits of filing of an Income Tax Return

- Filing an Income Tax Return (ITR) offers a range of advantages for individuals and businesses. Firstly, it ensures compliance with tax regulations, avoiding potential penalties or legal issues. Moreover, filing ITR facilitates financial transparency and credibility, crucial for obtaining loans or visas.

- Secondly, ITR filing enables individuals to claim tax deductions and benefits. By accurately reporting income and investments, taxpayers can avail themselves of deductions under various sections of the tax code, reducing their overall tax liability.

- Thirdly, filing ITR is essential for those seeking to carry forward losses. Losses incurred in a financial year can be offset against future profits, reducing taxable income in subsequent years.

- Fourthly, a filed ITR serves as proof of income, which is often required for transactions such as property purchases or applying for government tenders.

- Lastly, consistent ITR filing over the years contributes to a person’s financial history. This history can be influential in achieving financial goals, such as securing better insurance coverage or demonstrating creditworthiness.

- In conclusion, filing an Income Tax Return is not just a legal obligation, but a strategic step towards financial stability and growth, offering advantages like compliance, tax benefits, loss carry forwards, proof of income, and improved financial history.

Documents required for Income Tax Return Filing

Filing your Income Tax Return (ITR) is a crucial annual task, and ensuring you have the right documents in order is essential for a smooth process. Here’s a checklist of documents required for ITR filing:

- Form 16/16A: Provided by your employer, these documents detail your salary, allowances, and tax deductions.

- Form 26AS: A consolidated tax statement reflecting taxes paid, TDS (Tax Deducted at Source), and other financial transactions.

- Bank Statements: Gather statements for all your bank accounts to track interest income and transactions.

- Investment Proofs: Including details of fixed deposits, mutual funds, stocks, and other investments.

- Property Documents: If you own property, keep records of purchase/sale, home loan details, and rental income.

- Rent Agreements: Required if you’re claiming House Rent Allowance (HRA).

- PAN and Aadhaar: Ensure your PAN card is updated and linked with Aadhaar.

- Charitable Donations: Keep receipts of donations made for tax-exempt deductions.

Procedure for Income Tax Return Filing in India

The following is the procedure for Income Tax Return Filing in India:

- Gather Documents: Collect essential documents such as Form 16 (provided by your employer), details of other income sources, investment proofs, and bank statements.

- Select the Appropriate Form: Choose the correct ITR form based on your income sources and category. Individuals, Hindu Undivided Families (HUFs), and businesses have different forms to choose from.

- Online Registration: Create an account on the Income Tax Department’s e-filing portal (incometaxindiaefiling.gov.in) if not done already.

- Fill in Details: Log in and select the relevant ITR form. Fill in personal details, income details, deductions, and tax payable.

- Verify and Calculate Tax: Review the information entered and calculate the tax payable using the online calculator.

- Claim Deductions: Enter details of deductions under various sections like 80C, 80D, etc., to reduce your taxable income.

- Upload Documents: Attach required documents as per the ITR form’s instructions.

- Verify and Submit: Verify your details, either through Aadhaar-based OTP, net banking, or sending a signed physical ITR-V form. Submit the return.

- Acknowledgment: Once submitted, an acknowledgment (ITR-V) is generated. E-verify the return or send the signed ITR-V to the Centralized Processing Center within 120 days.

- Verification Completion: On successful verification, the return process is complete. The Income Tax Department will process the return and issue any applicable refunds.

With regard to filing a Personal ITR and other compliances, Legal Window will provide you with all essential services and legal support. Please get in touch with us at 072407-51000 or admin@legalwindow.in for your Personal ITR filing.

Penalty for not filing ITR as per Income Tax Act, 1961

Under the Income Tax Act, 1961, the timely filing of Income Tax Returns (ITR) is a legal obligation for eligible taxpayers. Failure to comply with this requirement can result in penalties and consequences. Section 234F of the Act stipulates the penalty for late filing.

According to the provisions, if an individual fails to file their ITR by the due date, they may be liable to pay a penalty of up to Rs. 10,000. The severity of the penalty depends on the time of filing. For those who file after the due date but before December 31 of the assessment year, the penalty may be limited to Rs. 5,000. However, for filings made after December 31, the penalty can extend to Rs. 10,000.

It’s important to note that the penalty amount is subject to certain conditions and exceptions, primarily aimed at providing relief to small taxpayers. Individuals with an annual income below a certain threshold might face lower penalties. Additionally, if the total income tax payable is less than the penalty amount, the penalty will be restricted to the amount of tax payable.

To avoid Penalty for not filing ITR, taxpayers are advised to ensure timely filing of their ITRs. The Income Tax Act’s provisions and penalty structure underscore the significance of fulfilling tax obligations promptly, contributing to efficient tax administration and compliance.

FAQ’s

Question 1: I have not filed income tax return for last 5 years. Can I file it in this Year?

According to the Income Tax Act, 1961, taxpayers can file belated income tax returns within a certain period after the original due date. You can file belated returns for up to two years from the end of the relevant financial year. For example, if you want to file a return for the financial year 2019-20 (Assessment Year 2020-21), you may have been able to file it until the end of the assessment year 2022-23. Hence, you cannot file your income tax return for last 5 years.

Question 2: What was the last date to file ITR 2022-23?

The last date to file ITR 2022-23 are as follows:

| Sr. No. | Category of the Tax Payer | Income Tax Filing deadlines for the FY 2022-23 (AY 2023-24) |

| 1. | Individual / HUF / AOP / BOI (no need for audited books of accounts) | 31st July 2023 |

| 2. | Businesses (With Audit) | 31st October 2023 |

| 3. | Businesses that require transfer pricing reports (for international/specified domestic transactions) | 30th November 2023 |

| 4. | Return Revised | 31 December 2023 |

| 5. | Late Return | 31 December 2023 |

Question 3: What happens if you don’t file ITR India?

The immediate consequence of not filing ITR is the imposition of a penalty. As per the Income Tax Act, if a taxpayer doesn’t file their return by the due date, they may face a penalty of up to Rs. 10,000, depending on the delay period and the taxpayer’s total income.

In more severe cases, the Income Tax Department may initiate legal actions, including prosecution, for willful non-compliance. This can result in fines and even imprisonment, ranging from rigorous imprisonment of three months to two years.

Question 4: Can I file ITR for last 3 years now?

No, you are unable to submit an ITR for the previous three years at once.

This is not allowed by Income Tax Department; hence taxpayer should be more vigilant and aware while submitting their ITR Return.

Question 5: Why you should file your ITR on Time?

Filing your Income Tax Returns (ITR) in accordance with the Income Tax Act, 1961 is not just a legal obligation, but a smart financial move. It ensures compliance, avoids penalties, and maintains a transparent financial record. Moreover, filing ITR on time can lead to quicker loan approvals and hassle-free visa applications. By adhering to this law, you contribute to the nation’s development while gaining financial security and opportunities. Don’t miss out on the benefits – file your ITR as per the Income Tax Act, 1961.

Takeaway

Filing your income tax returns is not just an administrative chore; it’s a fundamental aspect of responsible citizenship and financial planning. Beyond fulfilling your legal obligations, filing your taxes can lead to numerous benefits – from potential refunds and accessing government programs to building a solid financial history and contributing to your retirement savings. By recognizing the importance of filing your income tax returns, you take a proactive step towards securing your financial well-being and contributing to the greater good of society.

CA Pulkit Goyal, is a fellow member of the Institute of Chartered Accountants of India (ICAI) having 10 years of experience in the profession of Chartered Accountancy and thorough understanding of the corporate as well as non-corporate entities taxation system. His core area of practice is foreign company taxation which has given him an edge in analytical thinking & executing assignments with a unique perspective. He has worked as a consultant with professionally managed corporates. He has experience of writing in different areas and keep at pace with the latest changes and analyze the different implications of various provisions of the act.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (90)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (118)

- Hallmark Registration (1)

- Income Tax (200)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (21)

- Startup/ Registration (128)

- Trademark Registration/IPR (40)

Recent Posts

- Post incorporation compliances for companies in India April 30, 2024

- Startup’s Guide to Employee Stock Ownership Plans April 29, 2024

- Master Secretarial Audit: A Complete Compliance Guide April 27, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.