Avoid First-Time Home Buying Mistakes in India: Solutions and Strategies

- September 13, 2023

- Finance Company

Many individual or person considers purchasing a home to be a significant milestone in India. However, becoming a homeowner in India, and especially for first-time buyers, can be challenging. In the enthusiasm and excitement of purchasing a property, most people usually make common mistakes that can hamper their budget or finances and well-being. In this article, we will try to shed light on First-Time Home Buyer’s Mistakes in India and common home-buying mistakes that one may make while buying a Home for the first time. We will also, go through insights on how to avoid common mistakes when buying a house.

| Table of Content |

First-Time Home Buyers Mistakes: Most Common Home Buying Mistakes

Purchasing a home for the first time in India is an enthusiastic and yet very complex task. , avoiding mistakes when buying a house can help first-time buyers to analyze the real estate market more keenly and make informed decisions that fit with their financial goals and long-term aspirations. By doing careful planning, thorough research, and taking professional guidance, first-time buyers can fulfil their dream of purchasing a Home.

The following are some common home-buying mistakes that first-time buyers should avoid:

- Lack of Research: One of the most common mistakes that first-time home buyers commit is by not conducting proper research. Buyers need to research not only the property but also the locality as well as the builder’s reputation, and the applicable property prices in that area. With the help of the internet, potential buyers have access to information that can help them in making informed decisions.

- Ignoring the Budget: It is a common mistake to get carried away by the dream of purchasing a house that may not fit your budget. So it is important for the buyer that before he or she starts the home buying process, He or she should first determine a realistic budget. This budget should be made by considering the financial situation, down payment, home loan interest rates, and maintenance costs. Overstretching your budget can lead to stress and financial strain in the long run.

- Not Factoring in Hidden Costs: It is common for First-time home buyers to focus only on the property’s purchase price and ignore other various hidden costs like registration fees, stamp duty, property taxes, maintenance charges, and legal fees. It is important to keep these things in mind so that your budget does not exceed.

- Ignoring Location: Location also plays an important role in determining the value of the property and for the long-term appreciation of your property. It is essential to opt for a location that suits your lifestyle. And also is well-connected to essential locations such as hospitals, Banks, Schools etc.

- Neglecting Legal Due Diligence: Failing to conduct proper legal due diligence is a grave mistake that a first-time home buyer may commit and as a consequence, they may find themselves in big trouble. So it’s important to ensure that the property has a clear title, is free from any legal disputes, and also that it complies with all regulatory requirements. This step can save first-time home buyers from potential legal disputes in the future.

- Skipping Home Loan Research: While home loans help the buyer purchase the home efficiently, many first-time buyers rush into taking Home Loans without doing proper research on the various home loan options available. Home Buyers could get benefits by comparing interest rates, loan tenures, processing fees, and prepayment penalties from different banks or financial institutions.

- Emotionally Driven Decisions: Buying a home is an emotional moment for many home buyers; however, being driven by emotions can affect your decision-making and can lead to poor choices. So home buyers should make informed decisions by considering all the relevant factors.

- Rushing the Decision: Transactions about Real estate require careful consideration. Rushing into deciding without thorough due diligence can lead to poor decisions. So it is advisable to Take your time, consult with experts, and consider all the pros and cons before you finalise any purchase.

First-Time Home Buyers Mistakes: Potential Solution to Avoid Home Buying Mistakes

The following are the potential solutions that help you to avoid committing common home-buying mistakes:

- Solution for Lack of Research: Start by conducting proper research related to the property market in your desired location. Keenly observe the property prices, recent sales trends, and the future growth prospects of the property. Additionally, you should also research the builder’s reputation, construction quality, and track record if any. You can also Engage with a local real estate agent. It is advisable to visit the neighbourhood several times a day and gather information as much as possible before you make a decision.

- Solution for Ignoring the Budget:: Set a budget that aligns with your financial situation and you should also avoid exceeding it. Also, calculate your monthly mortgage payments, which may include all your associated costs, and please ensure that they are lying within your budget. It is always better to buy a property that aligns with your financial stability.

- Solution for Not Factoring in Hidden Costs: Create an enhanced and comprehensive budget that includes all the possible expenses that could arise while buying a home. Consult with your professional to get a clear picture of the various fees associated with it. This will help you make a more accurate estimation of the total cost incurred and avoid any of the unexpected financial burdens.

- Solution for Ignoring Location: You should not only consider your current financial needs but you should also consider your plans;, Will the property be able to accommodate a growing family? Whether the location of the property is convenient for work, schools, and other amenities? You should think for the long-term while making this significant investment.

- Solution for Legal Due Diligence: You should engage a legal expert to make sure that all the necessary documentation, clearances, and titles are in the required order. You should also verify the legitimacy of the property and its ownership by way of a due diligence process. It may seem time-consuming, but it is very important for a secure and trouble-free property purchase.

- Solution for Home Loan Research: You should conduct proper research and compare the various home loan options from various banks and financial institutions. You should also consider various factors such as interest rates, processing fees, and repayment terms.

Also, it is essential to go through read and understand all the terms and conditions applicable to the home loan. It is pertinent to be aware of any hidden charges or penalties.

Also, read our Article on the Concept of Housing Loans & EMI Business in India

- Solution for Emotionally Driven Decisions: While emotional attachment to buying a home for the first time is natural it is also important to make sure to balance it with practical considerations. You should evaluate the property based on its features, location, price, and potential for appreciation and not solely on personal sentiments.

- Solution for Rushing the Decision: You should take your time to explore the multiple properties, and you should also compare prices and evaluate the pros and cons regarding them. You should avoid taking pressure from sellers or agents to make haste decisions.

Taxation aspect regarding First- Time Home Buyers

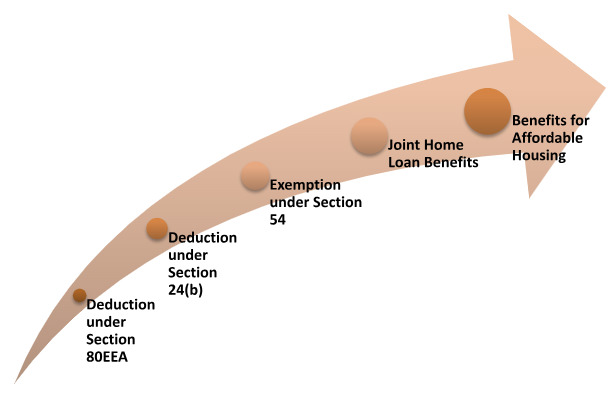

The Income Tax Act, of 1961 (hereinafter referred to as “Income Tax Act”), understands the importance of buying a Home for the first time and tends to offer certain provisions and benefits to lower the financial burden on first-time home buyers. The provision in the Income Tax Act aims to encourage home ownership and also to stimulate the real estate sector, and provide relief to individuals having limited financial resources. Some of these provisions are:

- Deduction under Section 80EEA: The provision of Section 80EEA offers a deduction of up to ₹1.5 lakh on interest paid towards a home loan. To claim this deduction, certain conditions need to be fulfilled:

- The home loan must receive a sanction between 1st April 2019 and 31st March 2022.

- The value of stamp duty of the property must not exceed the amount of ₹45 lakh.

- The individual should not be the owner of any other residential property on the date of loan sanction.

The provision of Section 80EEA acts as a helping hand to those aspiring home buyers to own their first home by way of reducing their taxable income and thereby lowering their tax liability.

- Deduction under Section 24(b): As per Section 24(b) of the Income Tax Act, the interest paid on the home loan is eligible for deduction up to ₹2 lakh per financial year in case of a self-occupied property. On the other hand if in a case the property is not self-occupied or it is rented out, then in that case there is no upper limit on the deduction for interest paid on the home loan. The provision of Section 24(b) encourages individuals to invest in the real estate market, as the interest on the home loan can significantly impact the overall tax liability.

- Exemption under Section 54: First-time home buyers can claim an exemption under Section 54 of the Income Tax Act, 1961 from the capital gains tax, in the case, if the funds or money yield from the sale of a residential property (other than agricultural land) are again reinvested in buying or constructing another residential property. The provision of Section 54 is beneficial for first-time home buyers who are looking to upgrade their living arrangements and simultaneously save on the tax implications of the capital gains.

- Joint Home Loan Benefits: First-time home buyers are also eligible to avail of the benefit from availing a joint home loan with a family member, especially a spouse. In this case, both individuals are eligible to claim deductions for the principal repayment and for the interest payment under Section 80C and Section 24(b), respectively. This joint financial responsibility not only makes loan repayment manageable but also enhances the tax benefits available.

Also read our article on Various Tax benefits on Home Loan as per the Income Tax Act, 1961 (With FAQ)

- Benefits of Affordable Housing: Many Indian government initiatives aim to promote affordable housing. For example, schemes like “Pradhan Mantri Awas Yojana” commit to offering additional incentives for first-time home buyers. These schemes have the main objective of providing affordable housing options to individuals who belong to the Economically Weaker Sections (EWS) and Low-Income Groups (LIG). With the help of these schemes, the beneficiaries are eligible to avail of credit-linked subsidies which make homeownership more accessible.

End Note

The procedure of purchasing a home for the first time in India is important and maybe a complex task for many that may require careful planning, research, and consideration. Avoiding the above-mentioned common mistakes can help first-time buyers to explore the real estate landscape with confidence, and to secure a successful homeownership experience.

Connect with our Experts at Legal Window because it is essential to be patient, seek expert advice, and prioritize long-term financial well-being before you make this important decision and they are eligible to guide you well regarding this.

CA Pulkit Goyal, is a fellow member of the Institute of Chartered Accountants of India (ICAI) having 10 years of experience in the profession of Chartered Accountancy and thorough understanding of the corporate as well as non-corporate entities taxation system. His core area of practice is foreign company taxation which has given him an edge in analytical thinking & executing assignments with a unique perspective. He has worked as a consultant with professionally managed corporates. He has experience of writing in different areas and keep at pace with the latest changes and analyze the different implications of various provisions of the act.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (89)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (118)

- Hallmark Registration (1)

- Income Tax (199)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (21)

- Startup/ Registration (127)

- Trademark Registration/IPR (40)

Recent Posts

- Master Secretarial Audit: A Complete Compliance Guide April 27, 2024

- Farmer Producer Companies-Major provisions under Companies Act April 26, 2024

- Detailed Analysis of Section 179 of the Companies Act, 2013 April 24, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.