Planning your finances is crucial for achieving your life goals and ensuring a secure future, especially in India’s rapidly growing economy. With its diverse population and ever-changing economic conditions, Financial Planning has become increasingly important. To navigate the multitude of investment options and tax regulations, creating a strong financial plan is essential for individuals and families to attain financial security and fulfill their aspirations. In this article we will discuss about concept of Financial Planning, its importance and benefits. We will also cover some exciting tips on Financial Planning in India .

| Table of Content |

Meaning of Financial Planning

Financial Planning encompasses an approach, to evaluating ones financial status establishing attainable financial objectives and formulating plans to accomplish those objectives. It involves facets of finance such as budgeting, saving, investment strategies, retirement planning, tax optimization, risk management and estate planning. An effective financial plan not focuses on wealth accumulation. Also emphasizes the management and safeguarding of assets, over the long term.

Importance of Financial Planning in India

India has experienced changes, in its economy over the few decades. The emergence of a class, rapid urbanization and higher income levels has given rise to both opportunities and challenges when it comes to personal finance. With the shift from joint family setups to nuclear families individuals is now taking on greater responsibility, for their own financial well being.

Furthermore the demographic advantage India possesses thanks, to its expanding population emphasizes the Importance of Financial Planning, for a secure future and a comfortable retirement. In light of increasing inflation rates and rising healthcare expenses prudent Financial Planning can assist individuals in minimizing the effects of these factors on their well being.

Key Components of Financial Planning

Key components of Financial Planning are as follows:

- Setting Financial Goals: Financial Planning initiates with setting precise and achievable short and long-term financial objective. These goals may be buying a home, for education, for retirement plan, and many more.

- Budgeting and Saving: Creating and adhering to a budget is essential. Adhering to a budget ensures that expenses are effectively managed and there’s scope for savings and investments. Setting aside a part of income for emergency condition and unexpected expenditure is also important.

- Investment Planning: Identification of right investment plan based on risk tolerance, time, and financial objective is important aspect of Financial Planning in India. Options may range from equities and mutual funds to real estate and fixed deposits.

- Tax Planning: Knowing the tax implications of financial decision and using tax-saving options can reduce the tax liability while filing returns.

- Retirement Planning: Planning for retirement includes estimation of future expenditure, inflation, etc., and creating a retirement scheme through systematic investments.

Benefits of Financial Planning in India

The following are the benefits of Financial Planning A path towards your Wealth Growth in India:

- Achievement of Financial Goal: Financial Planning helps individuals and families to define and attain their life goals. Whether it is purchasing a home, funding education, starting a business, retirement planning, etc., Financial Planning provides a definite approach to divide resources and investments to achieve these goals.

- Risk Management: In a country with a variety of risks, ranging from health issues to natural calamities, having a financial plan is important for avoiding unexpected financial loss. Insurance, emergency funds, and contingency plans are some integral components of Financial Planning that can protect individuals and families from unwanted circumstances.

- Tax Efficiency: The Indian Taxation System is very much wide, with a variety of tax-saving instruments and provisions. Financial Planning helps individuals reduce their tax liabilities by strategically applying tax deductions, exemptions, and investments such as mutual funds, Public Provident Fund (PPF), and National Pension Scheme (NPS).

- Wealth Accumulation: India’s economic growth potential is important; making wealth accumulation is a priority for many. Financial Planning helps in identifying investment opportunities relates with individual need and long-term objectives. Investments in form of stocks, mutual funds, real estate, and fixed deposits can be used to suit individual financial goals.

- Retirement Planning: As the concept of a traditional joint family converted into nuclear families, ensuring a peaceful retirement has become more important. Financial Planning assists individuals think of their post-retirement financial needs and develop a retirement plan through investments like Employee Provident Fund (EPF), PPF, and retirement options.

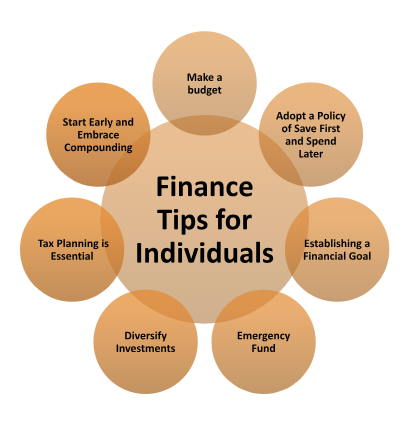

Financial Planning: Personal Finance Tips for Individuals

Financial Planning is an important pathway of attaining financial stability and success. Whether you have just begun with your career or are on a verge of retirement, having a financial plan with you can help you tackle life’s difficulties. Here is some Best Financial Advice:

- Make a budget: The first and most essential step in financial management is to create a budget. To make a budget, get an idea of how much money you need to spend on monthly bases as per your income, lifestyle, and desires. Having such an idea will allow you to have better control over your money. You can track and achieve your financial aim more effectively without sacrificing your lifestyle if you have more control and idea over your spending patterns.

- Adopt a Policy of Save First and Spend Later: When you adopt a policy of save first and Spend Later, you yourself contribute towards your wealth generation. This proves to be one of the most essential instruments that you can use to save your money.

- Establishing a Financial Goal: Setting a financial goal is much more important than have a financial plan, and also it forms an essential part of Financial Planning. Keep in mind to create a realistic and comprehensive goal, it will not only keep you motivated but also it will ensure that your money is well spent.

- Emergency Fund: Building an emergency fund is of utmost importance. You should aim to set 3-6 months’ worth of living expenditure in a liquid money and easily accessible account. This fund acts as a safety gauge during unexpected circumstances, like medical emergencies or job loss etc.

- Diversify Investments: Indians have biasness towards traditional investments like gold and real estate. While these investments have their merits, diversifying your investment across asset classes like stocks, mutual funds, and bonds can reduce risk and potentially yield much returns over the long term.

- Tax Planning is Essential: You should explore tax-saving investment options like Equity-Linked Savings Schemes (ELSS), Public Provident Fund (PPF), National Pension Scheme (NPS). These investments not only help you reduce your tax liabilities but also help in wealth accumulation.

Also read our Article on: Tax Planning for Individuals under Income Tax Act, 1961

- Start Early and Embrace Compounding: Time is a friend in wealth creation. Start saving and investing as soon as you can. The power of compounding can amplify your savings with time. Whether it is a fund for retirement, children’s education, or buying a home, early investments can help you achieve your financial goals with more ease.

The Bottom Line

Successful Financial Planning A path towards your Wealth Growth depends on setting clear goals, creating budget, saving of emergency fund, and diversifying investments. By following these personal finance tips, you can through the financial landscape, secure your future, and achieve your Dreams in Life.

It is recommended to consult with Finance Advisor before you move on to invest your money into any Scheme or Option. You can connect with our experts at Legal Window in case you need any assistance regarding managing your finances.

Neelansh Gupta is a dedicated Lawyer and professional having flair for reading & writing to keep himself updated with the latest economical developments. In a short span of 2 years as a professional he has worked on projects related to Drafting, IPR & Corporate laws which have given him diversity in work and a chance to blend his subject knowledge with its real time implementation, thus enhancing his skills.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (89)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (118)

- Hallmark Registration (1)

- Income Tax (199)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (21)

- Startup/ Registration (128)

- Trademark Registration/IPR (40)

Recent Posts

- Startup’s Guide to Employee Stock Ownership Plans April 29, 2024

- Master Secretarial Audit: A Complete Compliance Guide April 27, 2024

- Farmer Producer Companies-Major provisions under Companies Act April 26, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.