Capital Gains Tax for NRIs: An Important Investment Aspect for NRI

- September 19, 2023

- Income Tax

Capital Gain Tax is a type of tax structure under which an individual has to pay on the sum amount of money earned by him when he sold any of his assets. This form of tax applies to both Indian Nationals and Non-Resident Indians (NRIs). For Indian Nationals and NRIs, understanding capital gains tax is crucial in efficiently managing their investments. In brief, this article will delve into the concept of Capital Gains Tax for NRIs in India.

Let’s not mix things up and let’s talk about Capital gains Tax first. Then, we’ll delve into the topic of Capital Gains Tax for NRIs in India. Lastly, we’ll touch upon the subject of NRI Capital Gains Tax on property.

Understanding Capital Gains Tax in India

Tax on the gain an individual receives from selling their assets is known as Capital Gain Tax. In simpler words, Capital Gain Tax is a type of tax structure under which an individual has to pay on the sum or amount of money earned by him, when he sold some of his assets. The assets subject to this tax cover a variety of properties such as stocks, real estate or precious metals. Selling a capital asset that brings profit in capital gain, but a capital loss is incurred if the sale results in a loss.

Classification of Capital Gains

The Income Tax Act, of 1961 India deals with the concept of Capital Gain Tax in India. It is divided into two main categories:

- Short-Term Capital Gains (STCG): If a capital asset or property is held by the owner for 36 months or less before its sale, then the resulting gain falls under the category of Short-Term Capital Gain. However, for many assets like immovable property and unlisted shares, this holding period is reduced to 24 months.

- Long-Term Capital Gains (LTCG): When a capital asset or property is held by the owner for more than the prescribed holding period (usually 36 months), then in that case any gain arising from the sale of the asset lies in the category of long-term capital gain.

The holding period for certain assets like immovable property and unlisted shares is 2 Years.

Also read our Article on: How to Calculate Capital Gain Tax in India?

Capital Gains Tax Guide for NRIs

NRIs are subject to pay the Capital Gain Tax who are willing to sell their property in India. The respected tax paid by them on capital gains is calculated after determining their status whether the capital gains applicable is a short-term gain or a long-term gain.

When any residential property is sold by NRI having a holding period of more than 12 Months or after two years, then the gain yield is long-term capital gain. On the other hand, it is a short-term capital gain if it is sold for less than two years. NRIs have tax implications as well in the case of inherited property.

Note: In the case of Long-term Capital Gain Tax the term is reduced from 3 Years to 2 Years under the aegis of Budget 2017.

In the case of an inherited property please keep this thing in mind to account for the original owner’s date of purchase while determining the property for whether its capital gain is for the long or short term. In such a circumstance, the property’s cost must be the cost to the prior owner.

Long-term capital is taxed at the rate of 20%. Where the short-term gains are taxed at the applicable income tax slab rates for NRIs which is based on total income taxable in India.

NRIs can claim income tax exemptions under the aegis of Sections 54 and 54EC upon long-term capital gains on selling residential property in India.

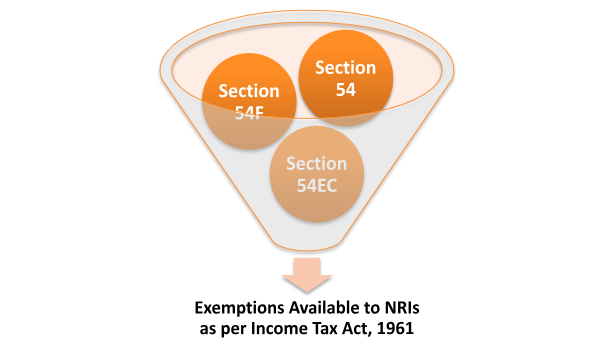

Capital Gains Tax for NRIs: Exemptions Available to NRIs as per Income Tax Act, 1961

The Income Tax Act, of 1961 provided for certain exemptions to NRIs that apply to capital gains under specific circumstances. These exemptions can assist in reducing the tax obligation for NRIs. Some of the exemptions are as follows:

- Section 54: Under Section 54, an NRI who sells a residential property is eligible to claim an exemption. If these capital gains are reinvested by them in purchasing another residential property within the specified period. The applicable exemption amount is limited to the amount of capital gains which was utilized for the purchase of new properties.

- Section 54F: This section provides for an exemption to NRIs who sell non-residential property (such as land, or commercial property) and reinvest this income in the purchase or the construction of a residential property.

- Section 54EC: NRIs can invest their yielded capital gains from the sale of any long-term asset into specified bonds that were issued by the National Highways Authority of India (NHAI) or Rural Electrification Corporation (REC) to claim exemption under this provision. The investment made should be completed within six months from the date of the sale of the asset.

These are some of the exemptions that are applicable as per the Income Tax Act, 1961 regarding NRI capital gains tax on property.

Capital Gains Tax for NRIs: Tax Deducted at Source (TDS) for NRIs as per Income Tax Act, 1961

The buyer is under obligation to deduct TDS at the rate of 20% when an NRI sells a Property. A TDS will be applicable at the rate of 30% if the property is sold within two years (reduced from the date of acquisition).

- How deduction of TDS take place?

The buyer is under the obligation to deduct the TDS from the selling proceeds when transferring the sale profits to the NRI seller. To deduct the TDS, the buyer of a property must have a TAN and in case he does not have one, he must apply for and get a TAN (Tax Deduction Account).

In case two or more people purchase a house jointly and invest money from their funds or by way of joint financing, then they must get TAN. When making a payment by the buyer to an NRI, the buyer must deduct the TDS amount after the attainment of TAN.

The buyer must submit the deducted TDS to the Income Tax Department by way of e-challan by the end of the 7th day of the month following the month in which the seller was paid by the buyer. The buyer must file the TDS return within three months of submitting the TDS payment. The buyer can print Form 16A and deliver it to the NRI seller after the filing of the TDS Return.

- Saving on a TDS Payment

The buyer must deduct TDS at the required rates, before transferring the funds from the purchase to the NRI seller. On the other hand, the seller may receive a NIL/lower deduction certificate from the Income Tax Department. In this case, the buyer will deduct TDS at the rate as specified in the NIL/reduced deduction certificate.

When the TDS exceeds the seller’s tax burden, the NRI seller may apply to the Income Tax Department for an NIL/lower deduction certificate. However, the seller must receive the NIL/lower deduction certificate before the completion of the property sale agreement.

After the determination of the capital gains by the assessing officer, the assessing officer will calculate the TDS. When the seller does not have any NIL/lower deduction certificate, he or she becomes eligible to demand a refund on the TDS deducted if the TDS is more than the tax due.

- Penalty for non-filing of TDS by NRI

Sometimes the buyer may pay TDS at the rate applicable to citizens rather than NRIs, or the buyer may fail to deduct TDS for any reason. In such events, the customer will have to face negative effects. The buyer is under legal obligation to deduct and submit the TDS at the applicable TDS rate for the NRI seller or at the rate which is prescribed in the Income Tax Department’s NIL/lower deduction certificate.

If the buyer fails or forgets to deduct TDS at the applicable statutory rates, he or she will end up paying a penalty equal to the amount of TDS that he has not deducted. Additionally, the buyer is under obligation to pay interest on the default sum.

Furthermore, it is pertinent to note that in case the TDS is not deducted, the seller is not allowed to transfer the sale earnings to his or her foreign bank account/NRE account. Also, in case the Income Tax Department gets to know about this transaction, the seller may be subject to penal punishment for falsifying information regarding his or her tax residence.

Capital Gains Tax for NRIs: Important Points to Remember

The following are the important points that NRIs should keep in mind:

- Taxation of Short-Term Capital Gains: NRI Short Term Capital Gain Tax is subject to taxation at the rate of 30% in addition to applicable surcharge and education cess. The NRI cannot avail of the benefit of the concessional tax rates on the other hand an Indian resident may avail of those benefits.

- Taxation of Long-Term Capital Gains: LTCG for NRI on the selling of the listed securities (like stocks and equity-oriented mutual funds) which are exceeding INR 1 lakh are subject to taxation at the rate of 10%, without receiving any indexation benefits. If the NRI chooses to opt to calculate tax with indexation, then the tax rate is 20%.

- Indexation Benefit: Indexation is a type of method that takes care of or adjusts the purchase price or the market value of the asset for inflation. This is beneficial for the taxpayer as it reduces the taxable liability because of the increase in the indexed cost of acquisition. NRIs are allowed to opt for indexation while simultaneously calculating LTCG tax this helps in a significant reduction of the tax burden.

- Exemptions and Deductions: NRIs are eligible to avail of certain exemptions and deductions under the Income Tax Act, of 1961 such as the advantages of the basic exemption limit and deductions under Section 80C (investment in specified financial instruments). However, on the other hand, these exemptions and deductions apply only to income which is taxable in India.

- TDS (Tax Deducted at Source): In the case of NRIs selling property in India the buyers who were purchasing that property are under obligation to deduct TDS at a specified rate before they make the payment to the NRI seller. This mechanism takes place to ensure that the tax liability on the capital gains is upon the NRI. Also, Proper documentation and compliance with TDS provisions are very much essential to prevent any legal repercussions or issues.

- Avoiding Double Taxation: NRIs may be liable to pay dual taxation in both India and their country of residence. To tackle this problem the NRIs can take advantage of Double Taxation Avoidance Agreements (DTAAs) that India has entered into with several countries. These agreements provide various methods to avoid double taxation which helps the NRIs to avoid paying tax twice on the same income.

- Repatriation of Funds: NRIs can repatriate the sale proceeds after paying their applicable taxes but this is subject to certain conditions and limits applicable. This is done with the help of a designated banking channel, and also there is the need for proper maintenance of proper documentation.

- Consultation with Experts: NRIS should seek professional advice from Tax Consultant or Chartered Accountants to tackle the complex tax structure prevailing in the country. This can also help them to navigate through the complexities of capital gains tax and it also ensures them that they are in adherence with the law.

Final Words

NRIs should closely observe the capital gains tax regulations of both their home country and the foreign country where they hold any form of investments. Compliance with these regulations is very important to avoid any legal issues or penalties and it also helps to optimize their investment strategies.

Seeking professional advice from tax experts can be highly effective while tackling the complexities of international tax laws and ensuring tax efficiency in investment decisions. You can connect with our Tax Experts at Legal Window for any clarifications regarding Capital Gains Tax for NRIs.

CA Pulkit Goyal, is a fellow member of the Institute of Chartered Accountants of India (ICAI) having 10 years of experience in the profession of Chartered Accountancy and thorough understanding of the corporate as well as non-corporate entities taxation system. His core area of practice is foreign company taxation which has given him an edge in analytical thinking & executing assignments with a unique perspective. He has worked as a consultant with professionally managed corporates. He has experience of writing in different areas and keep at pace with the latest changes and analyze the different implications of various provisions of the act.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (90)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (118)

- Hallmark Registration (1)

- Income Tax (200)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (21)

- Startup/ Registration (128)

- Trademark Registration/IPR (40)

Recent Posts

- Post incorporation compliances for companies in India April 30, 2024

- Startup’s Guide to Employee Stock Ownership Plans April 29, 2024

- Master Secretarial Audit: A Complete Compliance Guide April 27, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.