All you need to know about Prime Minister Employment Generation Programme

- November 25, 2020

- Miscellaneous

Prime Minister’s Employment Generation Programme (PMEGP) is a credit-linked subsidy programme launched by the government of India in 2008. It is a merger of two schemes, namely, Prime Minister’s Rojgar Yojna and Rural Employment Generation Programme. The program focuses on generative self-employment chance via micro-enterprise start in the non-farm sector by helping unemployed youth and traditional artisans.

The PMEGP Scheme is being implemented by Khadi and Village Industries Commission (KVIC) at the national level and at the State level, the Scheme is being implemented through State Khadi and Village Industries Commission Directorates.

Objectives of Prime Minister’s Employment Generation Programme

- Generation of sustainable and uninterrupted self-employment opportunities in urban and rural areas of the country.

- Providing sustainable and uninterrupted employment to a large segment of rural and urban unemployed youth, traditional and prospective artisans through the establishment of micro-enterprises.

- Facilitating the financial institution’s partaking for higher credit influx to the micro sector.

Eligibility

- Individuals with age of 18 years or more.

- VIII passed candidate is required for a project above Rs 5 lakh in the service sector and above Rs 10 lakh in the manufacturing sector.

- Institutions registered under Societies Registration Act- 1860.

- Production based co-operative societies.

- Self-help groups and charitable trust.

Areas of Operation

The area included in any village and includes the area included in any town. Population should not more than twenty thousand or such other figure as the Central Government may specify from time to time. For the the urban area, only District Industries Centres (DIC) are included.

Negative list of activities

- Businesses/ Industries linked with sericulture, cultivation, floriculture, horticulture.

- Manufacture of containers of recycled plastic/polythene carry bags of less than 20 microns

- Rural transport (except houseboat, shikara, tourist boat in Andaman & Nicobar Islands and in Jammu & Kashmir, auto rickshaw and cycle rickshaw.)

CNG auto rickshaw will be allowed only in Andaman & Nicobar Islands and North Eastern Region of the country with the prior approval of Chief Secretary of the State on merit.

Margin

The margin money share is 5% of the cost of the project for special category borrowers and 10% for General category borrowers.

Illustration: Suppose Miss Ananya applies to XYZ bank for Rs 10 lakh loan, the bank might finance only 80% of the loan amount (ie Rs 8,00,000/-). The balance 20% (ie Rs 2,00,000/-) is called as margin money and Ananya has to make arrangements for the same.

Subsidy

- For General Category eligible subsidy is 25% of the cost of the project in rural areas and 15% in urban areas.

- For Special Category eligible subsidy is 35% of the cost of the project in rural areas and 25% in urban areas.

Quantum of margin money subsidy

| Categories of beneficiaries | Beneficiary’s personal contribution (of project cost) | % of Subsidy | |

| Urban | Rural | ||

| For General Category | 10% | 15% | 25% |

| For Special Category (including SC/ST/OBC /Minorities/ Women, Ex-Servicemen, Physically handicapped, NER, Hill, and Border areas etc) | 5% | 25% | 35% |

How does this scheme work?

Let’s assume Mr. Brown, a young new entrepreneur from Bangalore Urban, wants to apply for the PMEGP scheme.

Estimated Project Cost – Rs 10 lakh

Mr. Brown’s Contribution (Mandatory as per PMEGP) – Rs 1 lakh (10% of Rs 10 lakh)

Amount Received By Mr. Brown – Rs 9 lakh

Note: The margin money (ie 15% of the Project Cost – Rs 1,50,000/-) commonly withheld by the bank will be repay to the bank by KVIC within 24 hours of assent of the PMEGP application. Hence, entrepreneurs like Mr. Brown can get the expected capital to proceed with their venture very easily.

The rate of Interest and Repayment Schedule:

The normal interest rate is exercisable to the enterprise from time to time. The Loan Repayment Schedule ranges from 3 -7 years.

Security:

No auxiliary security nor any third party guarantee is maintain here and any assets created from the bank loan should be hypothecated to Bank.

Training

Two weeks training is mandatory for all the beneficiaries.Process for applying at PMEGP e-portal

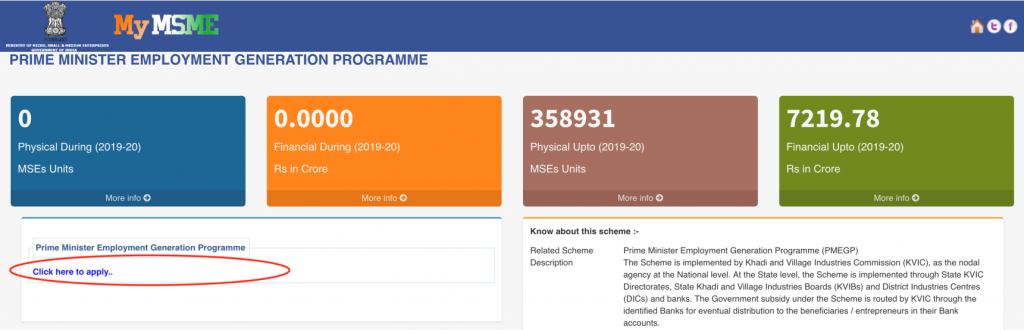

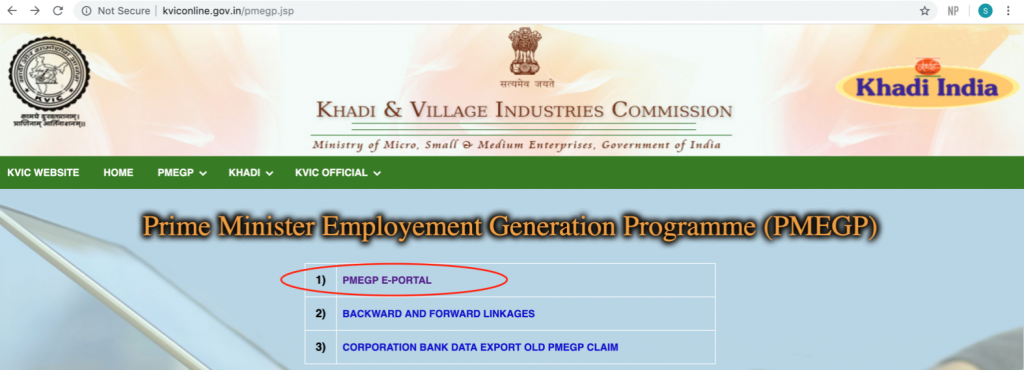

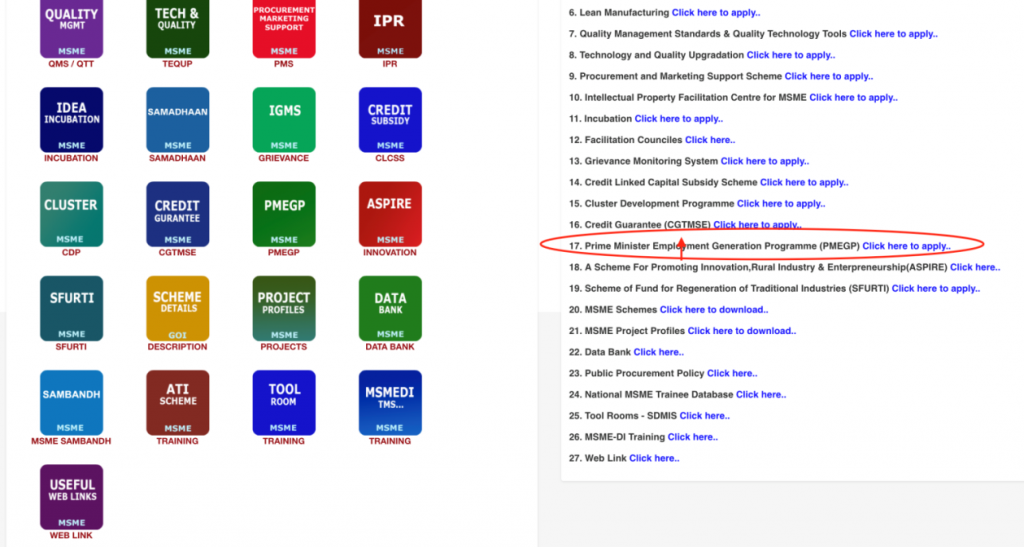

Firstly, visit the website my.msme.gov.in or kviconline.gov.in

Click the link ”Prime Minister Employment Generation Programme” or “PMEGP ePortal”

Now, click on “Online Application Form For Individual” to fill the application form.

Then PMEGP Application Form will be then visible here.

Guidelines for filling the Online PMEGP Application for an Individual Applicant

| 1 | Aadhaar Number -12 digit Aadhaar number of the applicant |

| 2 | Name of Applicant – As per Aadhar Card |

| 3 | Sponsoring Agency – Agency where the application is to be submitted |

| 4 | State and District |

| 5 | Sponsoring Office |

| 6 | Gender and Date of Birth (DD-MM-YYYY) |

| 7 | Select whether Social Category (General Category) / Special Category |

| 8 | Educational Qualification : |

| ( 8th Pass, Under 8th, 10th Pass, 12th Pass, Graduate, Post Graduate, Ph.D., Diploma) | |

| 9 | Address for Communication: The Applicant should fill the complete postal address of the applicant including State, District, Pin Code, Mobile No., Email and PAN No. |

| 10 | Unit Location : Select Unit Location (i.e. Rural OR Urban) |

| 11 | Proposed Unit Address : The Applicant should fill the complete Unit address of the unit including Taluka, District, Pin Code |

| 12 | Type of Activity: Select from the activity list (i.e. Service or Manufacturing) |

| 13 | Name of the Activity : |

| 1. Industry: Select Industry from the List of Industry | |

| 2. Product Description: Type the specific product description. | |

| 14 | Whether EDP Training Undergone : Select Yes Or No from the List |

| 15 | Training Institute’s Name: If EDP Training Undergone YES, enter Training Institute Name in detail. |

| 16 | Loan Required : |

| 1. Capital Expenditure: Enter CE loan in rupees. | |

| 2. Working Capital : Enter WC loan in rupees. | |

| 3. Total Loan: The total loan will be calculated by the system automatically. | |

| 17 | Bank Details: Enter IFSC code |

| 18 | After entering the required information, click on “Save Applicant Data” |

| 19 | Upload the documents for final submission |

| 20 | After final submission, applicant ID and Password will be sent to the Registered Mobile No |

Applicants seeking for registration have to fill all the required information and click the “Submit” button to complete the registration process.

At last, the registered candidates can login to the “PMEGP portal” and can fill the remaining form to complete the application process.

CA Pulkit Goyal, is a fellow member of the Institute of Chartered Accountants of India (ICAI) having 10 years of experience in the profession of Chartered Accountancy and thorough understanding of the corporate as well as non-corporate entities taxation system. His core area of practice is foreign company taxation which has given him an edge in analytical thinking & executing assignments with a unique perspective. He has worked as a consultant with professionally managed corporates. He has experience of writing in different areas and keep at pace with the latest changes and analyze the different implications of various provisions of the act.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (89)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (118)

- Hallmark Registration (1)

- Income Tax (199)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (20)

- Startup/ Registration (126)

- Trademark Registration/IPR (40)

Recent Posts

- Detailed Analysis of Section 179 of the Companies Act, 2013 April 24, 2024

- Maximise Your Tax Savings: Power of Form 12BB April 23, 2024

- Cryptocurrency startups and Regulatory compliance April 22, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.